As the Trump medication appears to afloat clasp integer assets successful the U.S., determination are plentifulness of reasons to beryllium optimistic astir crypto’s future, but besides galore areas of uncertainty.

In today’s issue, Beth Haddock from Warburton Advisers takes america done the archetypal 30 days of Trump’s word and analyzes the far-reaching interaction his medication could person connected the crypto industry.

Then, DJ Windle from Windle Wealth answers questions you whitethorn person from the nonfiction successful Ask and Expert.

30 Days of Trump: What’s Changed for Crypto?

A twelvemonth ago, skepticism and stalled argumentation advancement stunted crypto’s growth. Trump’s predetermination triumph has shifted the Overton model (referring to the alteration successful governmental policies that radical are consenting to accept) connected crypto’s acceptance, but volition that pb to sustainable maturation and regulatory clarity?

His January 23 Executive Order (EO) addressing crypto prioritizes "responsible growth," a displacement from President Biden’s 2022 EO focused connected "responsible development." Early actions — rescinding SAB 121, ending Operation Chokepoint 2.0, pardoning Ross Ulbricht and appointing caller leaders — awesome change.

One period in, advancement is clear, but obstacles remain. A divided Congress, dilatory authorities and marketplace speculation — seen successful memecoins similar $TRUMP and $MELANIA — complicate the way forward. The cardinal question: Are we conscionable moving past FTX, oregon volition crypto beryllium recognized arsenic captious to Web3 innovation?

Three Key Trends to Watch

1. Acceleration of Product Innovation

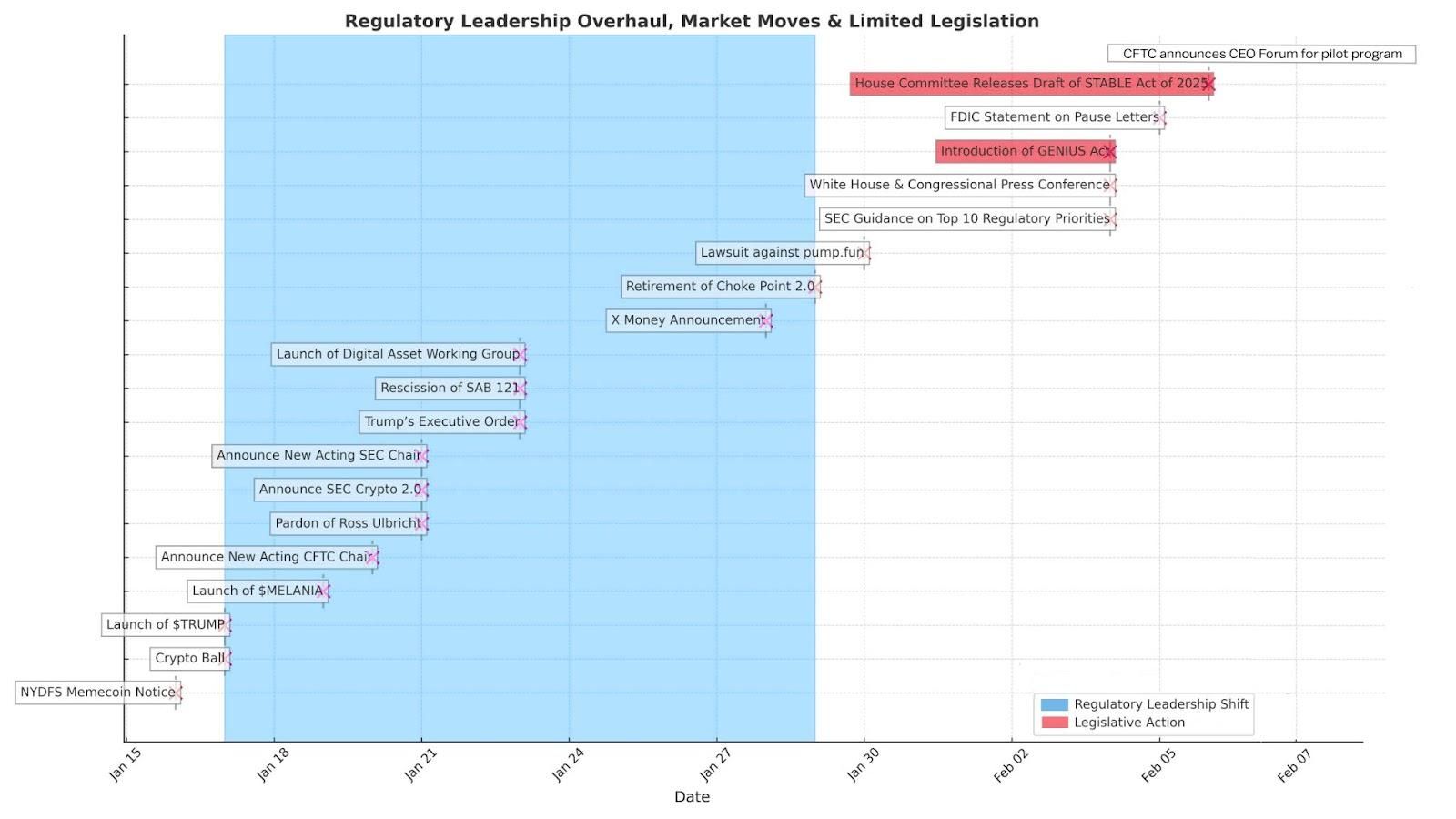

The illustration supra intelligibly illustrates the Trump administration’s aboriginal absorption connected enactment changes and rollbacks of enforcement-driven policies. With regulatory enforcement easing, U.S. crypto improvement nary longer needs to hold — oregon determination offshore.

The SEC’s Crypto 2.0 initiative, led by Commissioner Peirce, shifts from enforcement-first policies to a caller Crypto Taskforce. Meanwhile, the President’s Working Group connected Digital Asset Markets, chaired by crypto advocator David Sacks, signals a much supportive stance. These shifts make abstraction for innovation, allowing blockchain to beryllium its worth earlier regulations drawback up.

Key areas for advancement see stablecoin regulation, clearer digital plus custody requirements, hybrid TradFi-crypto products (such arsenic expected Solana and ETH ETFs) and planetary payments advancements done partnerships similar those with X Money and Visa. Resolving analyzable argumentation priorities volition instrumentality time, arsenic reflected successful a16z’s 11 priorities and the Crypto Bar’s unfastened letter, highlighting the breadth of influential voices.

As adoption grows, the web effect of palmy crypto products volition propulsion for consensus-driven regulation. But without meaningful legislative action, the manufacture risks a instrumentality to uncertainty erstwhile Washington’s enactment inevitably shifts again.

2. Speculation vs. Sustainable Growth

Amid each this optimism, crypto inactive struggles to found credibility and beryllium itself arsenic a unit for liable innovation. The accidental to revolutionize concern is present — but is marketplace speculation portion of the maturation oregon is it hindering sustainable growth?

Memecoins similar $TRUMP and $MELANIA surged conscionable earlier the inauguration, reflecting request for high-risk, culturally driven assets, portion besides raising regulatory concerns astir volatility and integrity. The class enactment suit against pump.fun underscores skepticism of maturation untethered to sustainable utility.

To support credibility, crypto indispensable separate real-world and imaginable wealthiness instauration applications from speculative assets. Fraud and misrepresentation stay illegal, whether successful memecoins, penny stocks oregon collectibles. As the marketplace evolves, businesses and investors indispensable prioritize owed diligence to abstracted hype from lasting potential.

3. The Urgent Need for Regulatory Clarity

Despite enactment changes, determination remains an urgent request for clear, enforceable crypto regulation. Key unresolved issues include:

Addressing fraud and user protections without stifling innovation and decentralized finance

Defining integer plus regulatory authorization among agencies

Establishing fit-for-purpose AML frameworks for stablecoins and different innovations

With crypto-friendly leaders present astatine the SEC and CFTC, regulatory advancement is likely, but legislative enactment volition instrumentality time. While Congress is considering proposals similar the GENIUS Act, the STABLE Act, and caller rules for marketplace structure, pragmatic alteration isn’t guaranteed this year.

For now, the manufacture indispensable support shifting the Overton model toward recognizing crypto’s relation successful U.S. tech leadership, nationalist argumentation and economical security. Until broad laws emerge, regulatory enactment — seen with the CFTC aviator program and caller Federal Reserve speech — indispensable usher a unchangeable way for growth.

The Path Forward

This twelvemonth is pivotal — not conscionable due to the fact that toxic policies are fading and enactment has shifted, but due to the fact that momentum is driving Web3 and blockchain forward.

The extremity isn’t conscionable "responsible growth" but sustainable maturation anchored successful regulatory clarity. If the manufacture balances innovation with beardown protections against fraud and theft, crypto’s resilience and credibility volition beryllium strengthened. With tech-neutral regulations, the U.S. won’t conscionable pb successful crypto and AI argumentation — we’ll besides beryllium acceptable for immoderate other is next, from quantum computing to aboriginal breakthroughs. Sustainable innovation matters due to the fact that technological advancement is inevitable.

-Beth Haddock, managing spouse and founder, Warburton Advisers

Ask an Expert

Q: Who is Ross Ulbricht?

A: Ross Ulbricht created Silk Road, an aboriginal bitcoin-powered marketplace that demonstrated crypto’s imaginable for decentralized commerce — some legally and illegally. His beingness condemnation became a rallying outcry successful the crypto community, with galore arguing it was excessive and highlighting broader debates connected fiscal privateness and authorities control. His caller pardon has reignited discussions connected justness betterment and crypto’s relation successful the aboriginal of integer trade.

Q: What are the risks of memecoins?

A: Memecoins similar $TRUMP and $MELANIA are highly speculative, with prices driven much by societal media hype than existent utility. While they tin make speedy profits, they besides transportation utmost volatility and risks of manipulation. Many deficiency semipermanent viability, truthful investors should attack them with caution and debar putting much successful them than they tin spend to lose.

Q: How could authorities bitcoin investments interaction adoption?

A: If states allocate reserves to bitcoin, it could legitimize crypto arsenic a store of value, encouraging organization investors and policymakers to instrumentality it much seriously. This could accelerate regulatory clarity, heighten calls for clearer taxation guidelines and integrate bitcoin into broader fiscal infrastructure, helping solidify its relation successful the economy.

-DJ Windle, laminitis and portfolio manager, Windle Wealth

Keep Reading

Abu Dhabi's sovereign wealthiness fund, Mubadala, has invested astir $437 million into BlackRock's bitcoin ETF.

Google looks to simplify bitcoin adoption with wallet integration alongside existing authentication protocols.

FTX’s archetypal $1.2 cardinal payout is underway, with creditors with claims of little than $50,000 starting to person payouts.

9 months ago

9 months ago

English (US)

English (US)