Last week was Consensus Toronto 2025. If you couldn’t attend, CoinDesk has you covered! Listen to astonishing planetary thought leaders, sharing their insights connected pertinent topics surrounding the integer plus abstraction connected day 1, day 2 and day 3. You tin besides work the extended editorial coverage.

In today’s Crypto for Advisors, Shivani Phull from Pixelynx explains however Black Mirror is leveraging blockchain arsenic portion of evolving instrumentality contented and engagement.

Then, Eric Tomaszewski from Verde Capital Management answers questions astir the entreaty of these products to next-gen investors successful Ask an Expert.

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors adjacent Boston, Grayscale is hosting an exclusive event, Crypto Connect, connected Thursday, June 5. Learn more.

Storytelling 3.0: When AI, Blockchain and IP Collide

How Black Mirror’s on-chain experimentation is paving the mode for the aboriginal of amusement monetization.

Traditional storytelling is hitting its ceiling. The passive, one-way depletion exemplary that has defined amusement for decades is progressively retired of sync with the expectations of digital-native audiences. And now, with the emergence of caller technologies, the amusement intelligence spot (IP) is amusement intelligence property, oregon IP, is being fundamentally reimagined.

From Bandersnatch to Blockchain

Black Mirror has ne'er been acrophobic to situation the presumption quo. In 2018, the bid broke caller crushed with Bandersnatch, an interactive episode. It hinted astatine a deeper shift: from stories we ticker to stories we shape.

That displacement is accelerating. Members of Gen Z and Gen Alpha person been raised successful worlds similar Minecraft, Roblox and Fortnite, wherever user-generated contented forms the instauration of the experience. These audiences don’t privation to passively consume; they privation to participate, signifier and ain the narrative.

Traditional IP Revenue Is Evolving

Traditionally, IP holders made wealth done licensing, syndication, merchandise placement and container bureau sales. But generative AI is disrupting this model. With tools similar OpenAI’s Sora oregon Runway, anyone tin rotation up derivative content, posing some a menace and an opportunity. For IP owners, the situation is clear: either suffer power of the communicative oregon thin into caller models that support and grow it.

Enter blockchain.

Blockchain arsenic the Rails for Interactive IP

Blockchain brings the missing furniture of structure. It allows for:

- On-chain IP verification — utilizing blockchain to beryllium who owns originative content, making it unafraid and transparent.

- Composable rights — contented tin beryllium breached down into smaller parts that others tin physique on, remix oregon harvester with caller creations, allowing for microlicensing.

- Community ownership and information rewards — fans tin clasp tokens that springiness them entree to exclusive experiences and benefits arsenic the task grows.

- Tokenized incentives for creators and fans — integer tokens are utilized to reward radical for contributing, collaborating oregon being progressive successful the community.

This format unlocks caller paths for storytelling, wherever fans are stakeholders shaping narratives with their favourite IPs, not conscionable spectators.

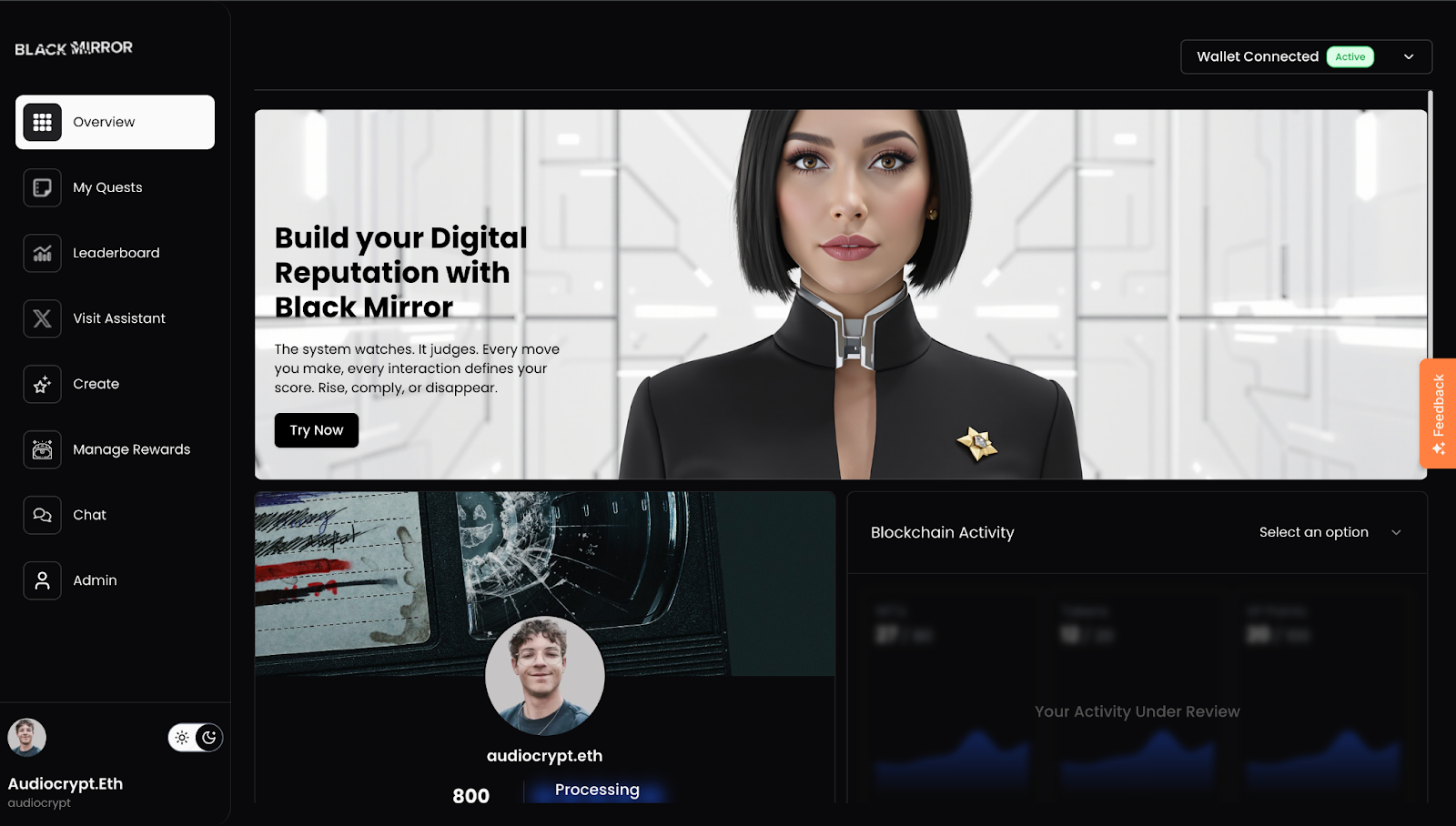

Case Study: Black Mirror Enters Web3

Banijay Rights, the planetary income limb of contented powerhouse Banijay Entertainment, which handles organisation for Black Mirror, has partnered with Pixelynx Inc. and KOR Protocol, a blockchain-based IP infrastructure and amusement institution based successful Los Angeles, co-founded by iconic DJs Deadmau5 and Richie Hawtin. Led by visionary CEO Inder Phull, Pixelynx helped bring the Black Mirror beingness on-chain successful a mode that’s interactive, compliant and community-driven.

Their latest inaugural is simply a token inspired by the Nosedive episode, wherever fans nexus their socials and wallets to gain a estimation score. With much than 300,000 sign-ups, apical participants unlock exclusive experiences and rewards, offering IP holders a caller mode to prosecute and reward their astir passionate fans.

The IP Industry’s Fork successful the Road

The aboriginal of amusement lies successful embracing this displacement done caller frameworks that supply wide guardrails for IP usage, that sphere integrity, support rights and alteration worth to accrue to fans and creators successful a just and transparent way. This marks the opening of a caller epoch for IP: 1 defined by protection, information and sustainable monetization.

By making IPs interactive, tokenized and on-chain, rights holders aren’t conscionable experimenting—they’re sketching the blueprint for Storytelling 3.0.

- Shivani Phull, CFO, Pixelynx Inc.

Ask an Expert

Q. What does "ownership" mean successful the property of Web3, and however is it antithetic from accepted investing?

A. Ownership successful Web3 is not conscionable astir holding an asset. More so, it's astir participating successful a system. With the Black Mirror token, owning the token means having a accidental successful governance, gaining entree to exclusive ecosystems, and gathering a integer signifier of individuality that has the quality to turn successful worth implicit time. Unlike passive banal ownership, this is participatory. You are a stakeholder, not conscionable a shareholder.

Q. Can reputation-based tokens make economical worth from behaviour and is it sustainable?

A. Yes, but it's nuanced. Black Mirror token gamifies spot due to the fact that your on-chain actions and societal interactions tin gain tangible rewards. As a fiscal advisor, I'd caution that portion this is exciting, it introduces performance-based risk. That being said, it reflects the absorption of wherever young digitally autochthonal investors are heading.

Q. Could these tokens enactment arsenic a caller signifier of "digital yield" for younger investors?

A. Absolutely. Instead of fixed income yield, this is engagement yield. The much progressive and credible you are, the much awards you could perchance earn. It could beryllium whitelisting access, level discounts, oregon perchance token-based income. This is simply a caller inducement exemplary successful immoderate respects.

When speaking to a client, I framework it arsenic a signifier of behavioral concern successful motion. With the close level of hazard and clip allocation, it becomes an plus that pays successful power and access. It's besides a mode to admit that fulfillment and worth look antithetic to each person. Not each instrumentality is financial.

- Eric Tomaszewski, fiscal advisor, Verde Capital Management

Keep Reading

- JP Morgan to alteration clients to invest successful bitcoin.

- Robinhood to get Canadian crypto steadfast Wonderfi.

- The U.S. Senate voted 66-32 to beforehand its landmark stablecoin legislation, the GENIUS Act.

- Digital Assets: Month successful Review, with Joshua de Vos of CoinDesk delivering a monthly file connected the crypto markets and ETF/ETP flows.

4 months ago

4 months ago

English (US)

English (US)