Cryptocurrency concern products ended past week successful the green, interrupting 15 weeks of consecutive inflows aft capitalist sentiment took a deed from hawkish remarks during past week’s Federal Open Market Committee (FOMC) meeting.

Global crypto exchange-traded products (ETPs) saw $223 cardinal worthy of outflows past week, according to the latest study from crypto plus absorption steadfast CoinShares, published Monday.

Despite a beardown commencement to the week with $883 cardinal worthy of inflows, the “trend reversed” successful the 2nd fractional of the week, “likely triggered by the hawkish FOMC gathering and a bid of better-than-expected economical information from the US,” the study stated, adding:

“Given we person seen US$12.2bn nett inflows implicit the past 30 days, representing 50% of inflows for the twelvemonth truthful far, it is possibly understandable to spot what we judge to beryllium insignificant nett taking.”US Federal Reserve Chair Jerome Powell’s remarks besides dampened capitalist expectations of an involvement complaint chopped for September to 40% from 63% earlier the FOMC meeting, Cointelegraph reported past Thursday.

The diminution successful sentiment comes arsenic Bitcoin (BTC) enters August, historically 1 of its worst-performing months. Data from CoinGlass shows Bitcoin’s median instrumentality successful August stands astatine -7.49%.

Bitcoin products accounted for the bulk of past week’s losses, with $404 cardinal successful outflows. Despite the pullback, immoderate analysts judge Bitcoin’s next catalyst whitethorn get aft the summer recess. In a probe enactment published past Friday, Matrixport said Bitcoin could summation traction erstwhile the US Congress reconvenes aft Labor Day.

“Fiscal uncertainty has historically been a almighty tailwind for hard assets, and Bitcoin remains beforehand and halfway successful the narrative,” the study said.

Related: Bitcoin becomes 5th planetary plus up of “Crypto Week,” flips Amazon: Finance Redefined

Ether defies broader money retreat

Despite outflows among planetary cryptocurrency funds, Ether (ETH) ETPs closed their 15th week of nett affirmative inflows, attracting $133 cardinal of investments contempt a pullback successful the 2nd fractional of the week.

The study attributed the continuous Ether money inflows to “robust affirmative sentiment for the asset.”

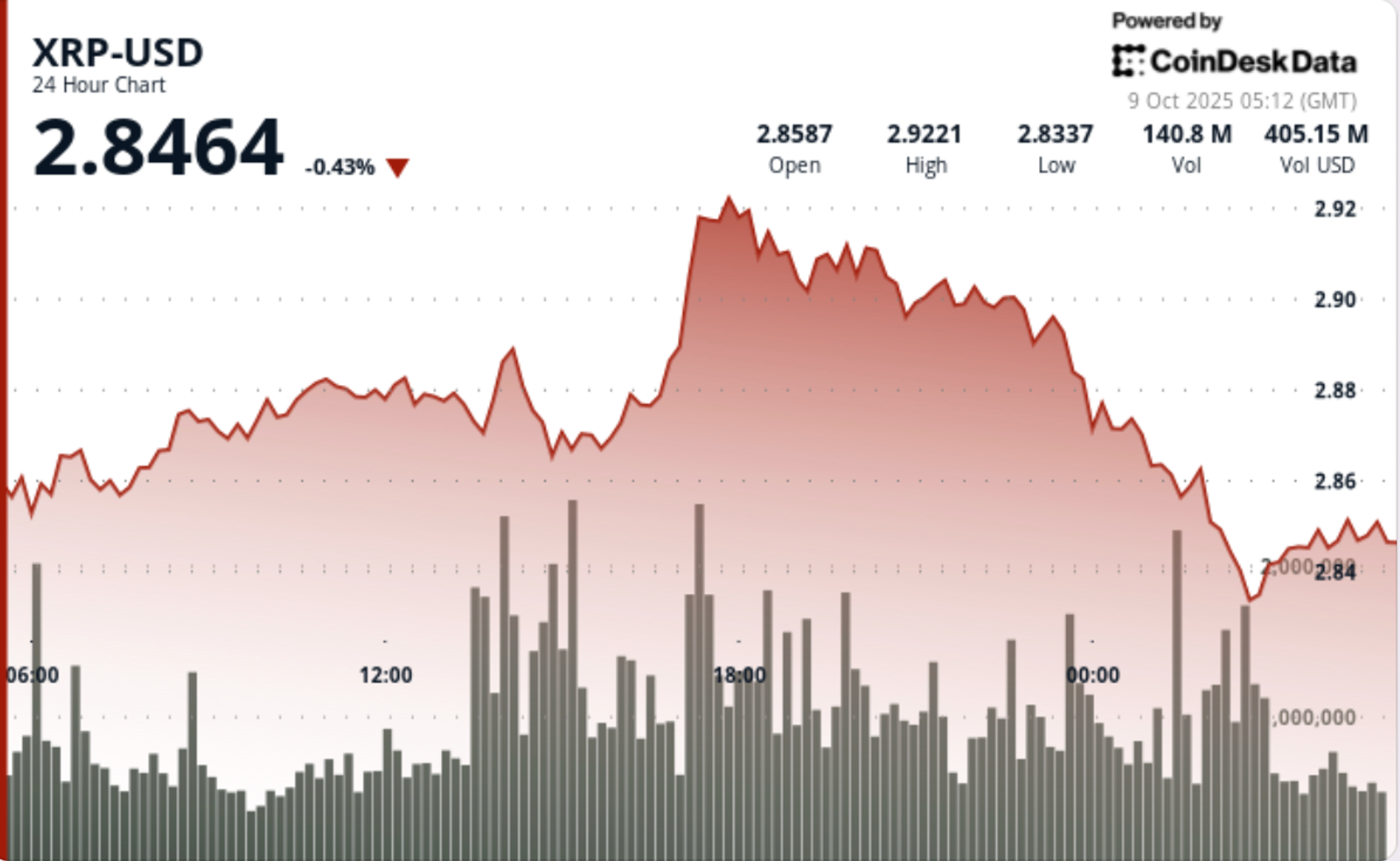

Crypto funds focused connected XRP (XRP), Solana (SOL) and Sui (SUI) besides closed the week successful the green, seeing $31.2 million, $8.8 cardinal and $5.8 cardinal successful inflows, respectively.

Related: Ethereum astatine 10: The apical firm ETH holders arsenic Wall Street eyes crypto

Last Thursday, US President Donald Trump signed an enforcement bid imposing reciprocal import tariffs of 15% to 41% connected goods from 68 countries, effectual Thursday, Aug. 7.

Despite President Trump’s Aug. 1 tariff bid sending a “chill done planetary markets,” cryptocurrency markets saw a “recalibration” alternatively than a breakdown, Stella Zlatareva, dispatch exertion astatine integer plus concern level Nexo.

“The integer plus marketplace remains firmly supra $3.7 trillion, anchored by structural flows, organization condemnation and the committedness of wide US regulation,” she told Cointelegraph, adding that “altcoin stableness whitethorn gradually return.”

Magazine: Crypto traders ‘fool themselves’ with terms predictions — Peter Brandt

2 months ago

2 months ago

English (US)

English (US)