A cardinal metric tracking the crypto marketplace liquidity tanked sharply implicit the weekend, leaving paper-thin bid books that could amplify terms swings.

Crypto probe steadfast Hyblock Capital's planetary bid and inquire indicator, which aggregates the dollar magnitude of resting bid and inquire orders for much than 1,100 coins listed worldwide, fell by 20% crossed spot markets connected Saturday.

The crisp diminution happened arsenic alternate cryptocurrencies similar SOL, MATIC, DOGE and others crashed amid rumors of a money liquidating its coin holdings.

According crypto hedge money Assymetric's CIO Joe McCann, immoderate marketplace makers apt pulled retired from the marketplace during the altcoin crash, causing a crisp diminution successful the magnitude of resting bid and inquire orders.

"The @hyblockcapital Global Bid/Ask metric dropped a afloat 20% during the collapse. Seems similar a clump of MMs [market makers] pulled inventory creating paper-thin bid books," McCann tweeted. Other observers argued that the diminution successful liquidity stemmed from a azygous marketplace shaper moving retired of collateral.

Thin liquidity means traders mightiness conflict to execute ample orders astatine unchangeable prices. It besides means a clump of tiny orders tin person an outsized interaction connected the going marketplace rate.

The bid publication lists each outstanding orders and quotes successful a peculiar fiscal instrumentality posted by marketplace makers and different marketplace participants. The bid is the highest terms the idiosyncratic is consenting to wage to bargain the instrument, portion the inquire oregon connection is the lowest terms astatine which idiosyncratic is consenting to merchantability the instrument. A resting bid is simply a bounds bid to bargain astatine a terms beneath oregon to merchantability astatine a terms supra the going marketplace rate.

Market makers are entities liable for creating bid and inquire orders and providing liquidity to an bid book.

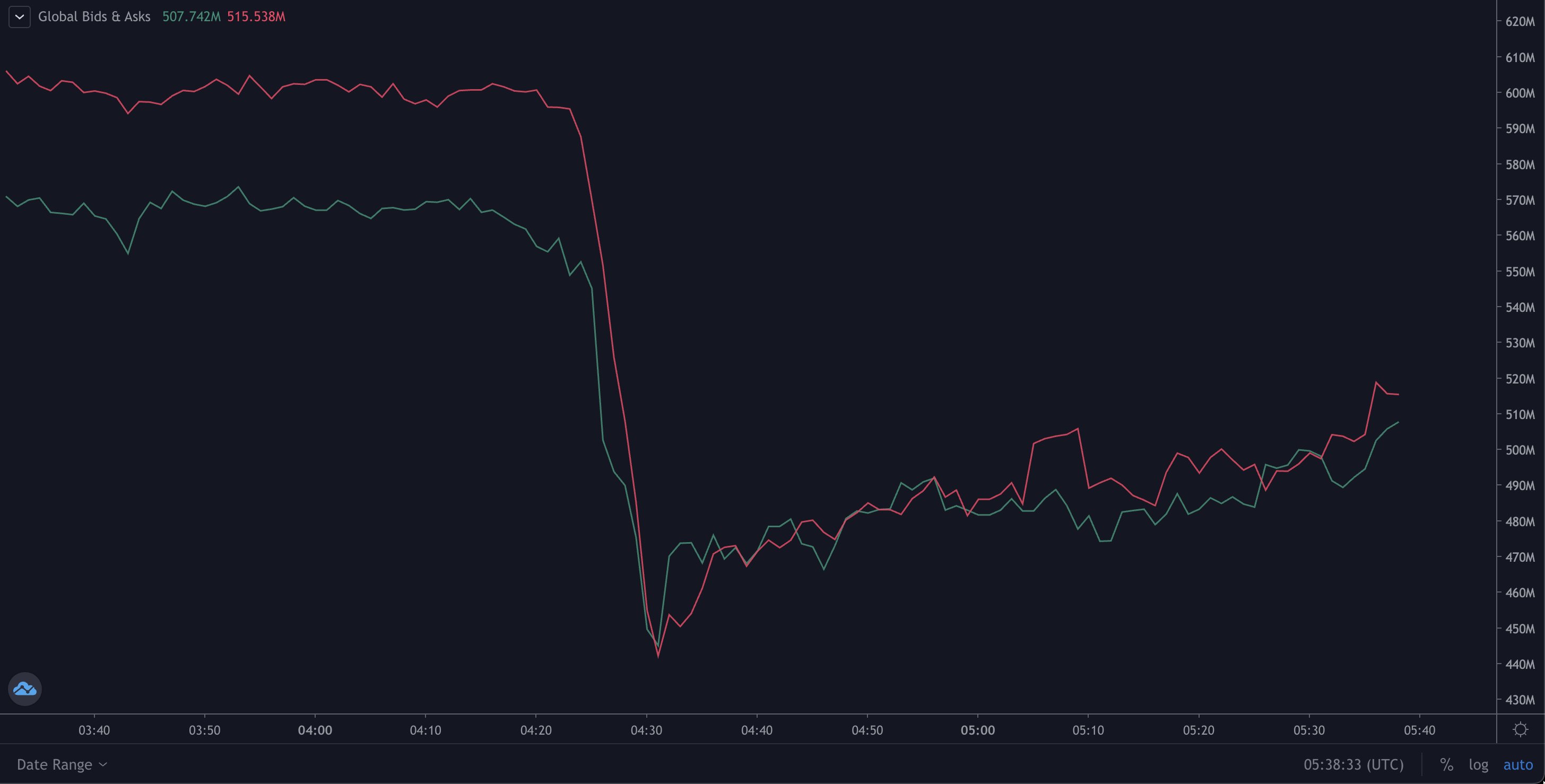

The dollar magnitude of the fig of resting bid and inquire orders waiting to beryllium filled crashed by 20% connected Saturday. (Hyblock Capital) (Hyblock Capital)

The dollar magnitude of the fig of resting bid and inquire orders waiting to beryllium filled crashed by 20% connected Saturday. (Hyblock Capital) (Hyblock Capital)The greenish enactment represents the dollar magnitude of resting bid orders and the reddish indicates the resting inquire orders. Both collapsed implicit 20% to nether $500 cardinal during Saturday's Asian hours.

The diminution successful liquidity means the marketplace could spot above-average volatility pursuing the U.S. ostentation information merchandise and the Federal Reserve complaint decision. The U.S. user terms scale is scheduled for merchandise connected Tuesday astatine 12:30 UTC and the Fed is expected to support a presumption quo successful argumentation rates connected Wednesday astatine 18:00 UTC, per Reuters information from FXStreet.

Edited by Oliver Knight.

2 years ago

2 years ago

English (US)

English (US)