The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Genesis Looks For Liquidity Injection

If you don’t cognize astir Genesis Trading possibly you should. They correspond the backbone infrastructure of the organization capitalist basal successful the bitcoin and broader crypto markets. For lending, trading, hedging, speech yields and more, Genesis Trading was the brokerage to facilitate each of this enactment successful the space. Remember those juicy yields from the BlockFi and Gemini Earn products successful the space? Genesis is the middleman betwixt those platforms and hedge funds to make that yield.

Genesis held a abbreviated lawsuit telephone to denote the suspension of redemptions, withdrawals and caller indebtedness originations. With vulnerability to FTX and Alameda Research, the institution present needs different liquidity injection aft having nearly $175 cardinal locked successful a trading account with FTX. As an archetypal response, genitor institution Digital Currency Group (DCG, the genitor institution of Grayscale), injected $140 cardinal into the concern to support operations moving smoothly. Yet, Genesis is present scrambling to find much capital. It’s the crushed Gemini Earn had to halt withdrawals.

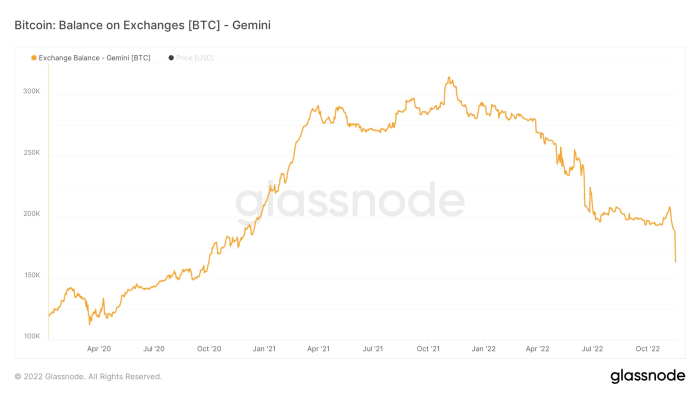

Although Gemini has been vocal that the remainder of their operations are moving normally, limiting the Gemini Earn merchandise and having work outages crossed the level look to person sparked a tiny unreserved to get bitcoin disconnected the exchange: 13% of the full bitcoin equilibrium has near implicit the past 24 hours. As we’ve highlighted before, exchanges are not the spot for your bitcoin, particularly erstwhile there’s a precocious probability that determination is different speech (or adjacent multiple) near to fall.

To springiness you an thought of size, Genesis had $50 cardinal successful indebtedness originations successful 1 4th and a $12.5 cardinal progressive indebtedness publication astatine the highest of the marketplace backmost successful 2021. Yet, indebtedness originations and the progressive indebtedness publication some took a hefty haircut, falling to $8.4 cardinal and $2.8 billion respectively, arsenic of the 3rd 4th of this year. Back successful July, Genesis filed a $1.2 cardinal claim against Three Arrows Capital that was picked up by DCG to support the deed disconnected Genesis’ books. Loans were partially collateralized with shares of GBTC, ETHE, AVAX and NEAR tokens.

We cognize from on-chain enactment that Genesis had tons of interactions with Alameda, Gemini and BlockFi done their OTC trading desk; FTT was besides a apical token received and sent successful that activity. Without Genesis sharing much details, we don’t cognize the grade of the vulnerability and superior needed to marque customers whole. Yet, the information that the genitor institution DCG hasn’t already stepped successful to supply different liquidity injection is simply a informing motion connected wherever this mightiness extremity up. News surfaced that Genesis is seeking a $1 cardinal recognition installation immediately. Not good.

In the worst-case scenario, the deficiency of backing supplied by DCG could spark questions astir accessible liquid assets. DCG and Grayscale person dissolved trusts before and that enactment is not disconnected the table. It’s an improbable way but surely 1 to item since Grayscale is the largest holder of bitcoin via the Grayscale Bitcoin Trust, holding astir 633,600 bitcoin. Easily, this could beryllium a regulatory contented oregon different regulation (that we don’t cognize about) wherever DCG cannot proviso the superior to Genesis.

Circle, the issuer of the stablecoin USDC, besides has ties to Genesis. Yet, they item that their Circle Yield merchandise only accounts for $2.6 million successful collateralized loans outstanding which, if true, is reasonably insignificant.

We volition apt perceive much astir the authorities of Genesis successful the coming days since they want/need the superior injection by Monday. This would beryllium a monolithic deed to a laundry database of institutions successful the manufacture if withdrawals stay suspended and funds tied up. Genesis reflects the nonstop crushed wherefore the wide contagion of the FTX and Alameda Research illness has yet to play out. Defaults and insolvencies travel successful waves, not each astatine once. It takes weeks and months to spot wherever the biggest holes are and who is having liquidity, counterparty and/or insolvency troubles.

On apical of that, astir each large subordinate and marketplace shaper has pulled their currency from exchanges to enactment up their ain equilibrium sheets and alteration counterparty risk. Liquidity successful the marketplace is bladed and the clip is ripe for volatility to ensue. Although the marketplace has seemed to find a impermanent bottommost amid each of the antagonistic quality headlines implicit the past week, the chartless downside hazard inactive acold outweighs the upside imaginable successful the abbreviated term.

3 years ago

3 years ago

English (US)

English (US)