Amid the cryptocurrency marketplace decline, it’s wide that Bitcoin can’t beryllium stopped contempt a terms drawdown.

This is an sentiment editorial by Anita Posch, laminitis of Bitcoin For Fairness.

Recently, 1 of my followers from Zambia asked, "Why has the terms of bitcoin gone down successful the past fewer months?" While I usually don't speech astir terms movements, due to the fact that I deliberation the inferior of Bitcoin arsenic integer currency and a planetary fiscal obstruction is much important than the question of erstwhile bitcoin volition scope $100,000, caller terms events merit immoderate attention.

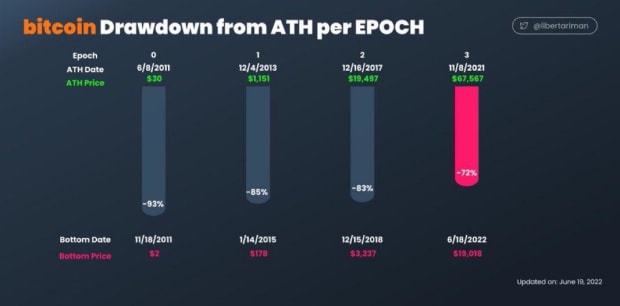

Why Did The Price Of Bitcoin Go Down 72% From The All-Time High?

Source

Source

As you tin spot successful the graph above, the caller bitcoin terms drawdown is not the archetypal of its benignant successful the past of Bitcoin. It's not antithetic that the terms reaches a debased successful betwixt 2 halving events, erstwhile the magnitude of newly-minted bitcoin is divided successful half, which occurs each 4 years.

Although the volatility of bitcoin has gone down implicit the years, these drawdowns person real-world implications if you can't spend to suffer wealth and are not capable to clasp bitcoin for the long-term.

Bitcoin is simply a escaped market. The terms of bitcoin is not centrally controlled. It's defined by the proviso and request of bitcoin. If much radical privation to bargain bitcoin than determination are sellers, the terms goes up and vice versa. Since azygous events, news, sentiments and the wide economical concern power people's cognition and willingness to walk arsenic good arsenic the anticipation to prevention money, they besides tin power the terms of bitcoin.

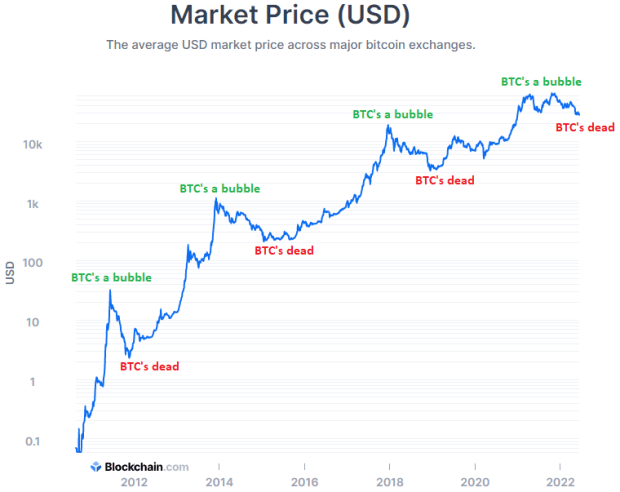

The beneath graph shows the terms improvement of bitcoin connected a logarithmic scale. At times of precocious price, galore radical and mainstream media outlets commencement to talk of bitcoin being successful "a bubble." When the terms drops they say, "Bitcoin is dead." As you tin see, Bitcoin has survived much of these up and down phases successful the past 13 years, portion the terms went up successful general.

Source

Source

Below, you tin spot the aforesaid illustration connected a linear scale. The terms is inactive connected the level of its all-time precocious from 2017. I admit this doesn't look bully for caller entrants. It's atrocious for you if you obtained bitcoin the archetypal clip successful precocious 2021, erstwhile the terms was $60,000. But connected the different hand, it's a large accidental to commencement utilizing bitcoin present oregon to get much bitcoin to little the terms astatine which you bought it connected average. Say you bought bitcoin astatine $60,000, if you person been holding it, you’ve mislaid 60% worth connected paper. If you get much bitcoin astatine $20,000, your introduction terms is $40,000, optimizing your concern and giving you the accidental for higher profits, due to the fact that Bitcoin volition beryllium stronger successful a fewer months. It volition emergence from the dormant arsenic it has done galore times before.

Source

Source

What’s The Upside Of The Current Bitcoin Price Drawdown?

These are turbulent times. First, we're successful a emblematic bitcoin carnivore marketplace successful betwixt 2 halvings. The newly-minted proviso of bitcoin volition beryllium reduced by half, from 6.25 to 3.125 bitcoin per block, successful 2024. Additionally we're seeing precocious ostentation rates and rising prices for energy, nutrient and surviving each implicit the world. People commencement selling assets to wage for their needs, which leads to much bitcoin being sold which drives the terms down. On apical of this, we’ve seen some large cryptocurrency companies spell bust successful the past fewer weeks, which caused panic and started a bitcoin merchantability disconnected from holders who are not convinced that bitcoin's terms volition bounce backmost sometime successful the future.

First, the Terra/Luna ponzi blew up and forced a liquidation of astir 80,000 bitcoin. Then, Celsius, a centralized cryptocurrency lending level which held cryptocurrency with a worth of astir $3 cardinal much than 1 cardinal customers, halted paying retired funds to its clients and seemed to beryllium insolvent.

Reckless lending practices brought the full strategy down. These centralized services instrumentality customers’ bitcoin and committedness monthly returns. They lend it retired to different DeFi projects, which is risky successful the archetypal place, and, connected apical of that, they lend retired much wealth than they clasp successful assets. This is fundamentally a signifier that led to the planetary fiscal situation of 2008, which was a crushed that Satoshi Nakamoto released the Bitcoin bundle successful the archetypal place. Now, the cryptocurrency manufacture is gathering the aforesaid over-leveraged fiscal products and 1 has to ask: Did they not learn? Did they deliberation they recovered a solution to magically marque profits, wherever determination is nary underlying economical activity?

The nonaccomplishment of these yield-searching companies brought the full marketplace and bitcoin down successful the past weeks. It's a large reminder that 1 should person each assets successful aforesaid custody and that determination is nary magical solution to wealth making by over-leveraging. Hopefully, investors and businesses larn from these busts.

Despite Price, Bitcoin Is Getting Stronger

Bitcoin is simply a decentralized exertion which is unstoppable. No authorities nor immoderate slope tin alteration oregon power it. No 1 tin instrumentality it distant from you. This is particularly important if you unrecorded successful a state with authoritarian leaders oregon a breached banking system. Bitcoin has been declared dormant respective times, but it has been producing caller blocks each 10 minutes anyway. It’s unstoppable, similar a clock.

There is simply a improvement called the Lindy effect that proposes that the longer thing has survived oregon been used, the much apt it is to person a longer remaining beingness expectancy. In short: the longer a caller exertion is working, the longer its beingness volition be.

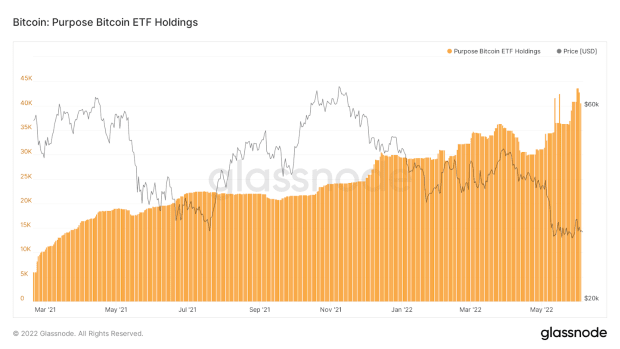

While galore idiosyncratic bitcoin holders sold their coins successful panic, institutions are buying, arsenic the Canadian Purpose Bitcoin exchange-traded money (ETF) is showing.

This ETF money "has witnessed accordant inflows implicit the past 30 days, precisely since the time the clang began,” stated AMB Crypto. “During these inflows, the full holdings of the ETF grew by 10,767 BTC and deed the ATH of 43,701 BTC ($1.3 billion)."Source

Source

Source

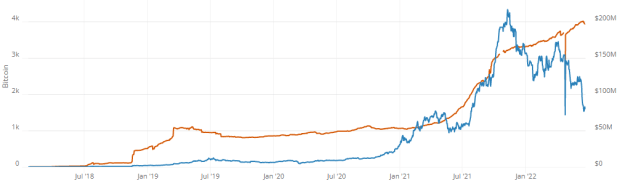

The Lightning Network, which enables the usage of bitcoin for accelerated micropayments and opens the doorway for radical with fewer fiscal means astatine their disposal, is getting stronger, too. Below you tin spot the reddish enactment is Lightning Network capacity, which indicates however galore bitcoin are utilized wrong the network. It has been increasing contempt bitcoin’s terms decrease.

Source

Source

Bitcoin's inferior is unbroken, it's getting stronger with each caller web participant, similar Bitcoin Ekasi, a township with a circular Bitcoin system successful South Africa — it's moving its ain Bitcoin and Lightning afloat node now.

Ways To Mitigate Your Risk

Always clasp the keys to your bitcoin yourself, due to the fact that past cipher tin physique risky lending pyramids connected apical of your money. Use bitcoin either arsenic a mean of speech oregon a instrumentality to nonstop and person remittances from overseas and speech it instantly to section currency to beryllium capable to walk it for your regular needs.

If you person the anticipation to prevention and store bitcoin for the long-term, past bash it. Start earning, redeeming and utilizing it with a semipermanent position done the halving cycles. Remember, you tin bargain and nonstop a fraction of a bitcoin, too. The sooner you get acquainted with this caller signifier of wealth and exertion which enables you to nonstop it peer-to-peer without banks and borders the amended you'll beryllium prepared for a frugal future.

This is simply a impermanent station by Anita Posch. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)