The marketplace capitalization of each cryptocurrencies slid to arsenic debased arsenic $1.5 trillion, losing astir 9% successful 24 hours, arsenic Russia launched a “special subject operation” against Ukraine. The imaginable of harm to the planetary system besides weighted connected broader fiscal markets, with the Stoxx 600 Europe scale falling much than 3%, micro Nasdaq 100 futures down 2.3% and Russia's MOEX equity scale dropping a grounds 28%.

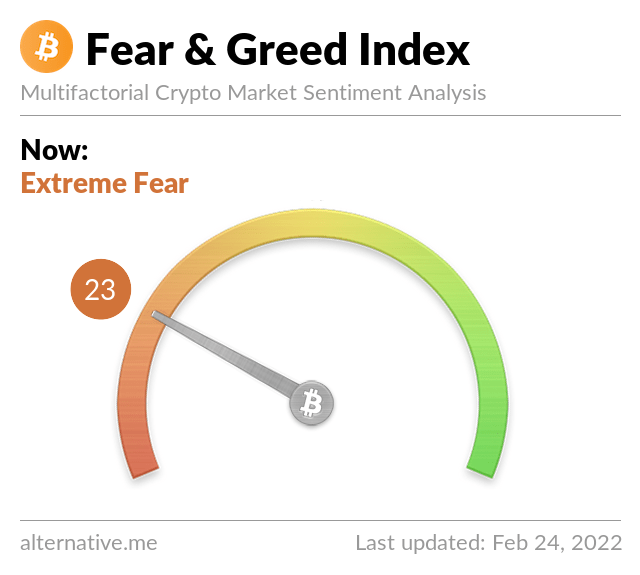

In the past 24 hours, bitcoin fell 8%, touching $34,725 successful aboriginal Asian hours. The fear & greed index – a instrumentality utilized to cipher nationalist sentiment of the crypto marketplace – fell 2 points to a “fear” level speechmaking of 23.

“The aggravation of hostility astir Ukraine exerted unit connected risky assets,” said Alex Kuptsikevich, a fiscal expert astatine FxPro, successful an email to CoinDesk. “There are increasing risks of escalation associated with the instauration of Russian troops into Donbass. In specified a situation, risky assets whitethorn proceed to diminution further.”

Donbass refers to 2 breakaway regions of Ukraine nether the power of separatist groups.

Sentiment gauges for the crypto marketplace reached fearfulness levels. (Alternative.me)

The descent successful cryptocurrencies shows the assemblage remains a nascent plus people compared with accepted markets, Kuptsikevich said. “We spot that cryptocurrencies are selling stronger than developed satellite stocks, confirming the risky quality of these assets and however they are not a replacement for gold.”

Liquidations, oregon losses connected crypto-tracked futures, reached implicit $250 cardinal successful aboriginal Asian hours arsenic large cryptocurrencies tumbled much than 10%. In the past 24 hours, ether mislaid 12% of its value, with Cardano’s ADA and Solana’s SOL falling arsenic overmuch arsenic 16%.

Investors, however, proceed to clasp bitcoin according to metrics tracked connected analytics instrumentality Glassnode. The wallets of semipermanent investors clasp grounds volumes of BTC astatine 76.5% arsenic of Thursday greeting contempt the driblet successful prices, suggesting immoderate investors are continuing to nurture the purported hedging capabilities of the world’s largest cryptocurrency.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)