With ostentation reaching caller highs month aft month, and the Federal Reserve taking an progressively hawkish stance, the U.S. system is exposed to an elevated hazard of upcoming recession.

The COVID-19 recession that began successful February 2020 and lasted done April of that twelvemonth – the astir caller successful the U.S. – did, however, person a affirmative interaction connected cryptocurrencies. It changeable bitcoin (BTC) to an all-time high supra $28,000 and, much importantly, caused investors and Wall Street firms to commencement taking the largest cryptocurrency by marketplace capitalization seriously.

But if analysts are right, and the U.S. system is bound to spell into different recession arsenic aboriginal arsenic adjacent year, the cryptocurrency marketplace could spot a precise antithetic result this time.

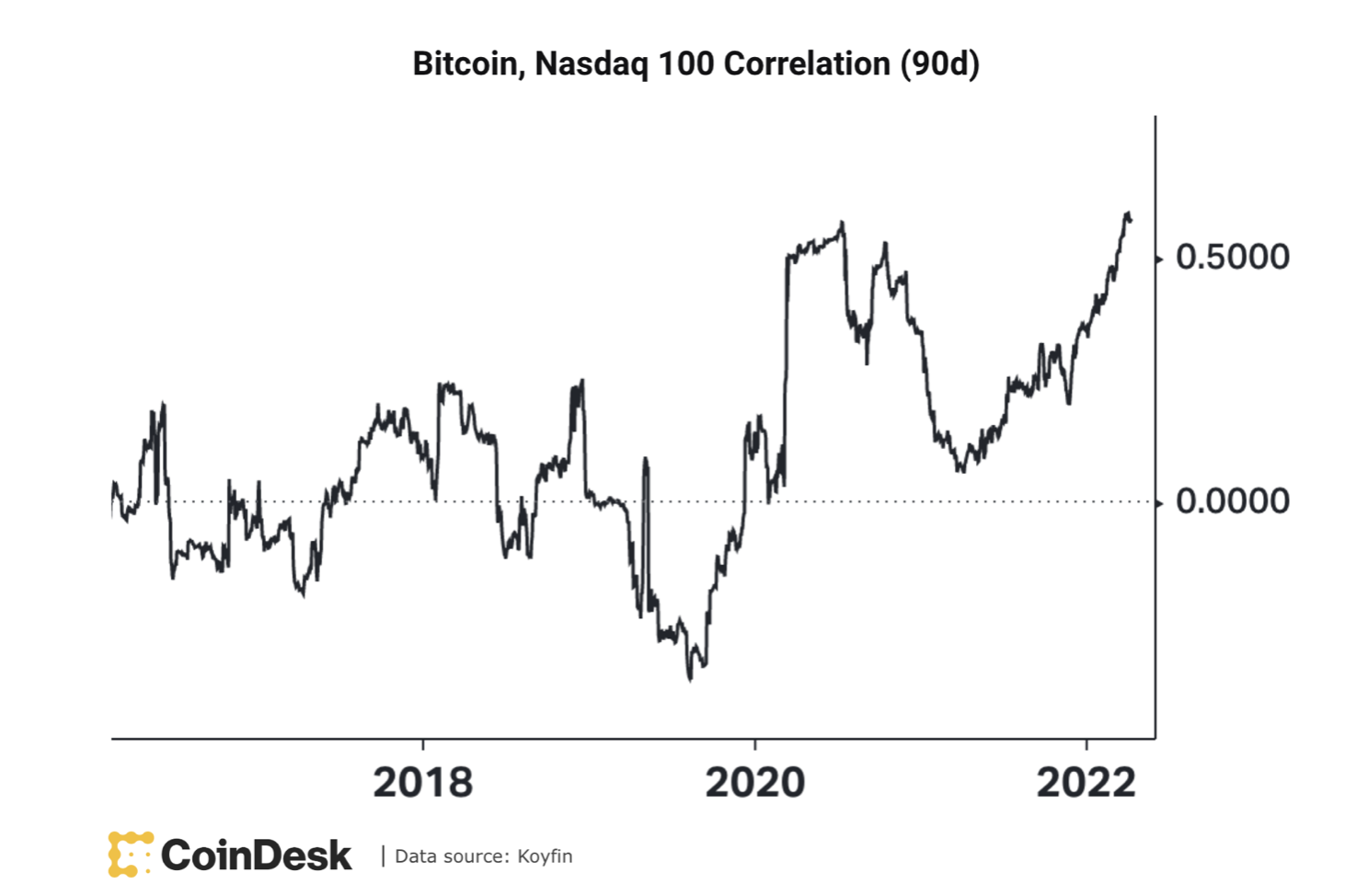

Because of bitcoin’s caller strong correlation to U.S. stocks – from the Nasdaq Composite Index to the Standard & Poor's 500 to the tech-heavy Nasdaq 100 – the largest cryptocurrency's show volition apt beryllium connected what the broader markets do, according to immoderate analysts.

“Bitcoin has truly bound itself to the Nasdaq successful presumption of correlation, and if the Fed keeps hiking rates and if the marketplace believes [it is] going to hike rates, recession oregon not, Nasdaq suffers successful the abbreviated term,” said Bob Iaccino, main strategist astatine Path Trading Partners and co-portfolio manager astatine Stock Think Tank. "And if this correlation continues, past crypto suffers, too."

The 90-day correlation betwixt bitcoin and the tech-heavy Nasdaq 100 scale has remained elevated since 2020, precocious reaching a caller precocious arsenic shown successful the illustration below.

Bitcoin, Nasdaq correlation (CoinDesk, Koyfin)

“During an extended recession I deliberation we volition spot affirmative terms question with BTC but the remainder of the crypto marketplace would look headwinds arsenic investors proceed to determination hazard disconnected and investors find it harder to rise funds successful a tighter lending market,” said Howard Greenberg, a cryptocurrency pedagogue astatine Prosper Trading Academy.

That beardown affirmative correlation – not conscionable existent for bitcoin but some different ample crypto assets, similar ether (ETH), excessively – means cryptocurrency returns could endure from a recession.

“Over the past fewer years they person go adjacent much correlated to equity markets, and much precocious the enslaved market,” said Joe Haggenmiller, caput of markets astatine XBTO, a crypto trading platform.

“This inclination whitethorn proceed should we spell into a recession," helium said. "We expect the large cryptocurrencies to travel the broader marketplace connected a short-to-medium word basis, connected the upside and downside.”

This would beryllium a precise antithetic script from what crypto markets saw during the COVID-19 recession. While bitcoin deed an all-time-hime and roseate implicit 50% successful 2020, equity markets suffered terrible losses during the play betwixt January and March 2020 earlier bouncing backmost to mean levels arsenic the Fed stimulated accepted markets with freshly printed money.

A recession that drives down stocks mightiness propulsion the Fed to reverse its hawkish stance and determination backmost to a much accommodative stance. And that could extremity up being a bully happening for bitcoin and cryptocurrencies , according to Iaccino.

What would hap to bitcoin during a recession?

“During an extended recession I deliberation we volition spot affirmative terms question with BTC but the remainder of the crypto marketplace would look headwinds arsenic investors proceed to determination risk-off and investors find it harder to rise funds successful a tighter lending market,” Greenberg said.

One crushed wherefore the correlation betwixt crypto and the equity marketplace is strengthening mightiness beryllium that traders are starting to spot stocks arsenic a hedge against inflation, conscionable similar bitcoin.

“In inflationary environments, stocks person a chiseled vantage implicit bonds – they’re linked to companies that tin set pricing – whereas bonds, not truthful much,” Lawrence Creatura, a money manager astatine PRSPCTV Capital LLC, told Bloomberg.

Digital assets mightiness spot a driblet successful prices successful the short-term, Jeff Dorman, main concern serviceman astatine Arca, wrote successful a March 28 report. But integer assets make worth done web maturation and marque loyalty arsenic opposed to equity and debt, which correspond a assertion connected assets.

"Given this backdrop, it’s imaginable integer assets are the lone plus people that a recession wouldn’t negatively impact," Dorman wrote.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)