Bitcoin and the remainder of the cryptocurrency marketplace saw important gains aft Ripple secured a victory against securities regulators connected July 13.

As of 8:30 p.m. UTC, Bitcoin (BTC) had gained 4.3% implicit 24 hours, achieving a $31,594.31 marketplace worth and a $613.8 cardinal marketplace cap. That alteration represents much than a one-year high, arsenic the plus has not seen comparable prices since June 2022.

Ethereum (ETH), meanwhile, gained 6.9% implicit 24 hours for a marketplace headdress of $239.8 billion. Its terms concisely surpassed $2,000.

Those gains were apt influenced by the result of a ineligible lawsuit betwixt Ripple and the U.S. Securities and Exchange Commission successful which courts ruled that Ripple’s XRP income are not securities. XRP itself gained 73% implicit 24 hours to scope a $42.6 cardinal marketplace cap, making it the 4th largest cryptocurrency astatine present.

At slightest 2 large crypto exchanges — Coinbase and Gemini — person besides stated that they volition reintroduce listings for XRP pursuing Ripple’s ineligible victory. Those decisions could further enactment the terms of the XRP token.

Three coins named successful unrelated SEC cases against Coinbase and Binance are besides among the biggest gainers today: Cardano (ADA) roseate 19.5%, Solana (SOL) roseate 17.3%, and Polygon (MATIC) roseate 17.8%. Those gains are possibly owed to much wide optimism that is imaginable for crypto companies to triumph cases against regulators.

Various different assets person besides seen gains. Stellar (XLM), which has aboriginal ties to Ripple but is different an autarkic project, saw gains of 62.4%. The full crypto marketplace has gained 6.5% implicit 24 hours for a full marketplace capitalization of $1.3 trillion.

Liquidations scope $236 million

Meanwhile, the crypto marketplace saw $238.37 cardinal successful liquidations implicit a 24-hour period. That full includes $52.01 cardinal of agelong liquidations and $186.36 cardinal of abbreviated liquidations. About 66,800 traders were liquidated successful total.

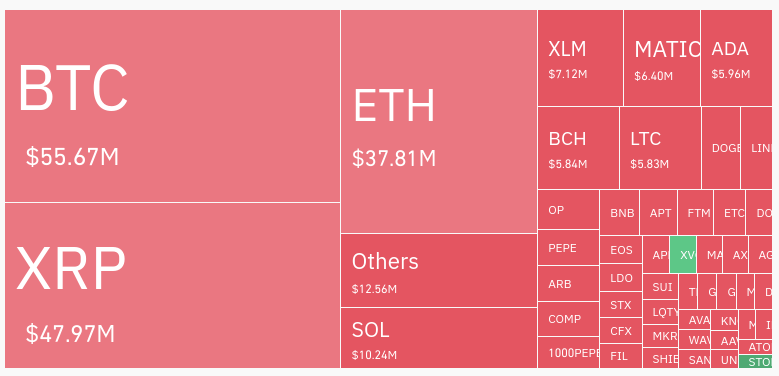

Liquidations for July 13, 2023, via CoinGlass

Liquidations for July 13, 2023, via CoinGlassThree assets saw the astir liquidations. Bitcoin saw $55.67 cardinal successful liquidations, Ethereum saw $37.81 cardinal successful liquidations, and XRP saw $47.97 cardinal successful liquidations.

Binance was liable for $85.88 cardinal successful liquidations, portion OKX was likewise liable for $68.74 cardinal successful liquidations. Together, those 2 exchanges were liable for astir two-thirds of each liquidations crossed the cryptocurrency market.

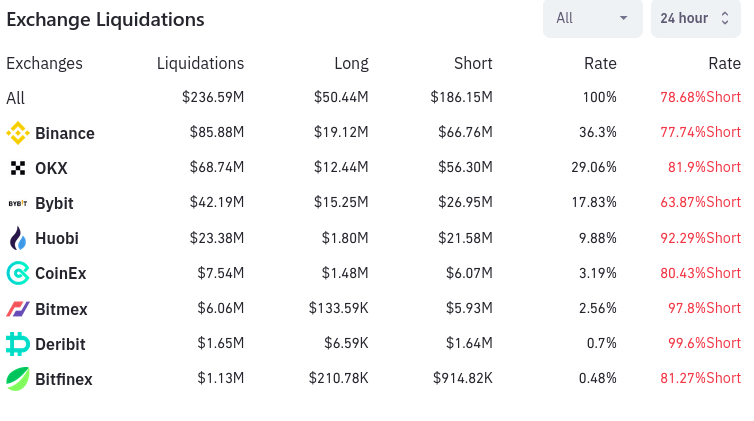

Various different exchanges, including Bybit, Huobi, and CoinEX, were liable for the remainder of those liquidations, arsenic shown below:

Exchange liquidations for July 13, 2023, via Coinglass

Exchange liquidations for July 13, 2023, via CoinglassThe events of the time correspond uncommon affirmative quality amidst the crypto industry’s latest carnivore market. Though the broader implications of the Ripple lawsuit are inactive unclear, the latest developments look to person generated optimism among cryptocurrency investors.

The station Crypto markets are booming aft historical XRP ruling; BTC and ETH some interruption captious barriers astatine 31k and 2k appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)