The crypto marketplace is splitting successful two.

Institutional and retail investors are taking progressively antithetic paths, with organization players anchoring themselves successful bitcoin BTC and Ethereum's ether ETH portion retail investors determination into altcoins and memecoins, according to a mid-year study from crypto trading steadfast Wintermute.

Analyzing over-the-counter spot trading volumes, organization trading volumes with the 2 largest tokens held dependable astatine 67%, apt backed by ETF inflows and structured accumulation vehicles, the study said. Meanwhile, retail investors dropped their BTC and ETH vulnerability from 46% to 37%, shifting superior toward newer, much speculative tokens.

"This divergence isn’t a impermanent thing; It’s the motion that we are experiencing a much mature, blase and specialized crypto market," said Evgeny Gaevoy, CEO and laminitis of Wintermute.

"Investors are nary longer chasing the aforesaid trend," helium added. "Institutions are treating crypto arsenic a macro asset, portion retail traders proceed to gravitate to innovation."

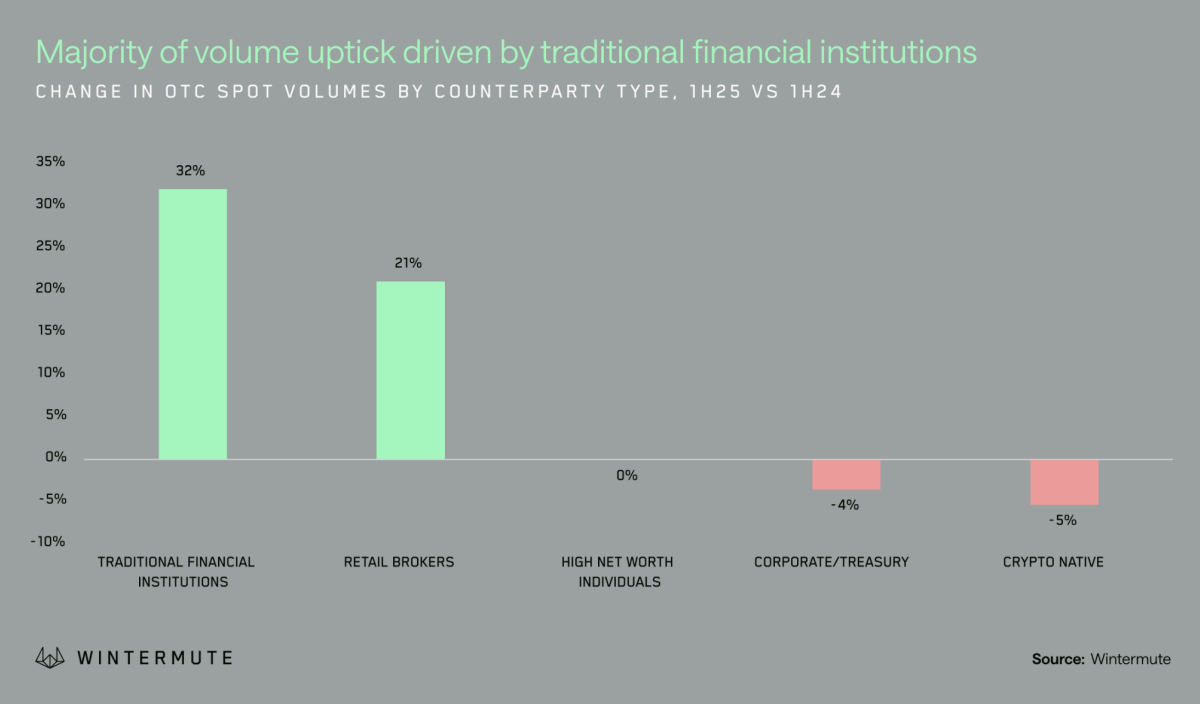

Overall, accepted concern (TradFi) firms were the fastest-growing cohort successful OTC trading volumes, increasing 32% year-over-year. That maturation was being fueled by regulatory developments similar the U.S. GENIUS Act and the EU’s ongoing MiCA rollout, which person fixed larger firms much assurance to participate, the study said.

Retail brokers besides saw beardown activity, with a 21% emergence successful measurement implicit the aforesaid period. Meanwhile, crypto-native firms dialed back, down 5%.

OTC options measurement jumped 412% compared to the archetypal fractional of 2024, arsenic institutions embraced derivatives for hedging and output generation, the study noted. Meanwhile, Contracts for Difference (CFDs) doubled successful variety, offering entree to little liquid tokens successful a much capital-efficient way.

Wintermute said its ain OTC table saw spot trading volumes turn astatine much than doubly the gait of centralized exchanges, signaling a displacement toward much discreet, large-volume trading favored by accepted finance.

The steadfast noted that memecoin enactment has go much fragmented. While wide retail trading successful memecoins declined, the fig of tokens traded by idiosyncratic users doubled, signaling a broadening appetite for micro-cap assets successful the agelong process of the market.

With that, bequest names similar dogecoin DOGE and shiba inu SHIB mislaid crushed to a increasing database of niche tokens specified arsenic bonk BONK, dogwifhat WIF and popcat POPCAT, the study noted.

Looking up to the 2nd fractional of 2025, Wintermute analysts said to support an oculus connected spot dogecoin ETF filings with spot with a last regulatory determination expected by October.

"The result could importantly interaction the retail marketplace and acceptable a precedent for different alternate assets," the study said.

5 months ago

5 months ago

English (US)

English (US)