Following connected from 1 of the craziest days successful crypto past connected Nov. 9, the 24/7 crypto markets support investors busy. Binance released its proof-of-reserves, FTX’s stablecoin equilibrium nears zero, the Curve 3pool became concentrated with USDT, and 60,000 BTC near Binance. Rumors are brewing of an Alameda Research abbreviated presumption connected Tether USDT arsenic it perchance looks for a last-ditch lifeline.

Binance proof-of-assets

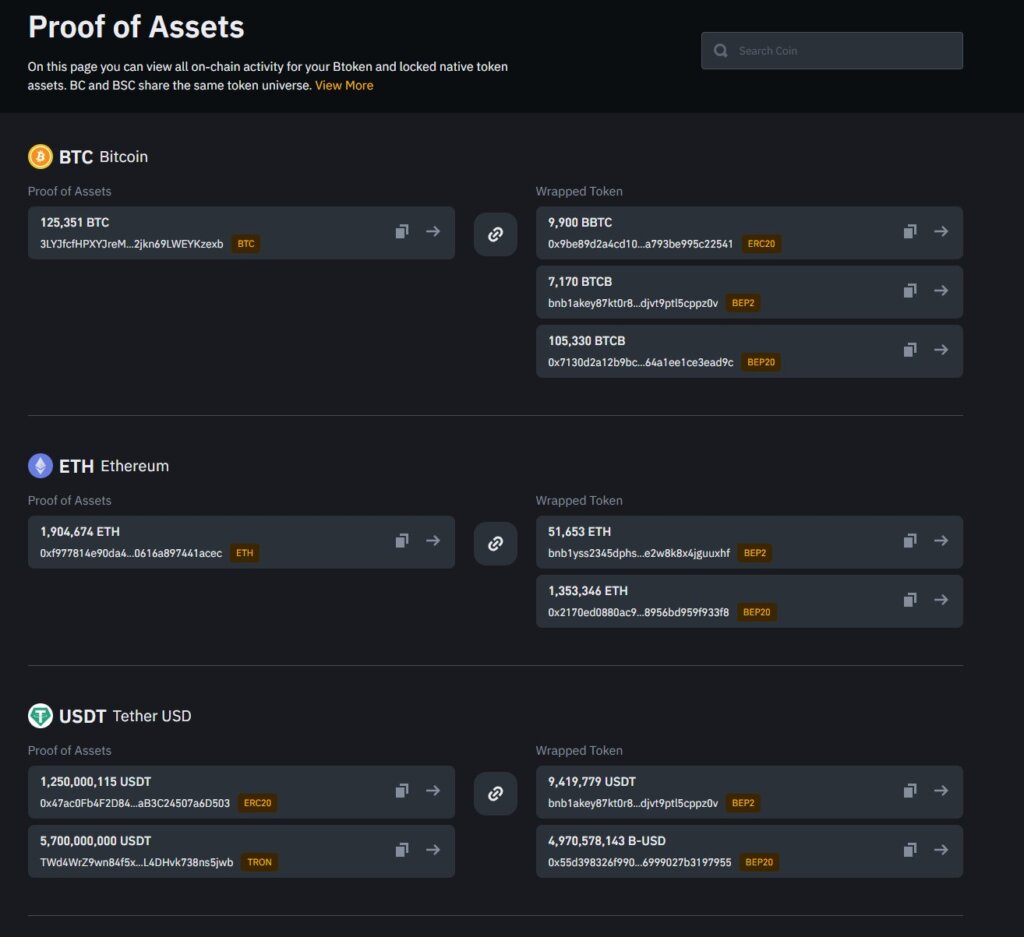

Binance released the proof-of-assets accusation that CZ had promised pursuing the impending illness of FTX. In a much intended to buoy the markets and inject spot into the speech aft it was revealed that FTX had a spread successful its equilibrium expanse of $8 cardinal and nary mode to process lawsuit withdrawals, Binance published a caller leafage of its website entitled “Proof of Assets.”

Binance Proof of Assets

Binance Proof of AssetsBinance outlined each of its plus holdings, and the speech included each the on-chain addresses for each token on with a nexus to amusement the correlation with bridged assets connected different chains. The quality to unfastened the blockchain explorer for each web and presumption the information on-chain showcases the powerfulness and quality of exchanges to beryllium afloat transparent.

The level of transparency shown by Binance is 2nd to nary and gives investors assurance that determination is nary spot required. Following claims from speech leaders astatine Celsius, Voyager, and present FTX that their assets were afloat backed up until the constituent wherever the companies announced insolvency, the trustless attack to transparency by Binance is to beryllium applauded.

Some notable holdings are listed below:

- 125,351 BTC

- 1,904,674 ETH

- 6,950,000 USDT

- 50,805,657 DOT

- 469,665,508 XRP

- 745,000 LTC

- 5,325,500,000 BUSD

- 987,571,153 ADA

- 878,999,999 USDC

- 100,000,000 DAI

The full worth of the supra assets is astir $18.3 billion. However, determination are 385 tokens crossed the full exchange, truthful a afloat breakdown of each assets would beryllium required to springiness an close fig connected the full holdings.

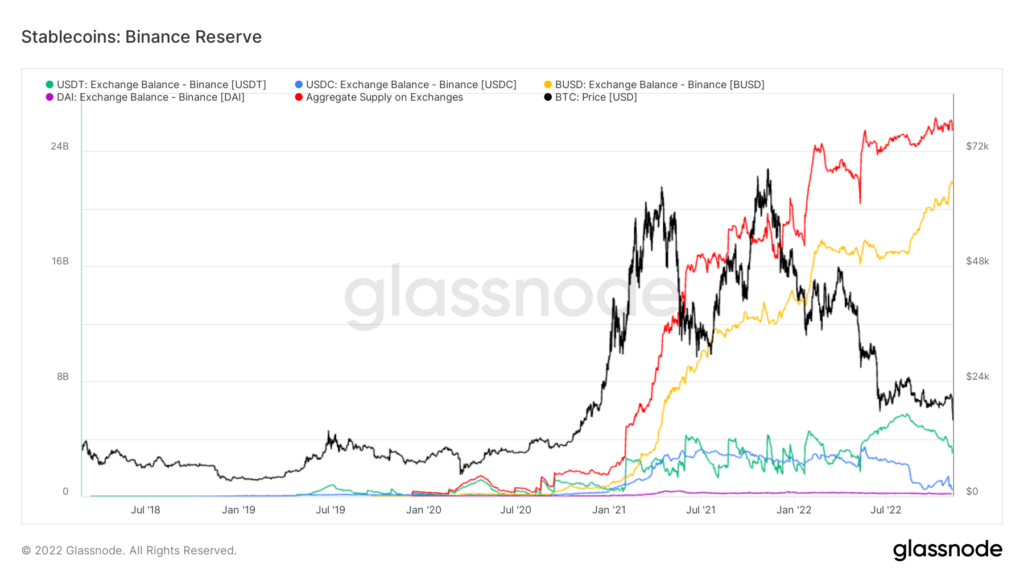

Stablecoin reserves deplete

One token that has seen accrued inflows to Binance implicit the past fewer days is Binance USD (BUSD), which is the lone stablecoin to spot an summation successful deposits. The aggregate proviso of each stablecoins connected Binance nears $26 billion. The illustration beneath shows the nett inflow of BUSD onto Binance successful opposition with different stablecoins.

Source: Glassnode

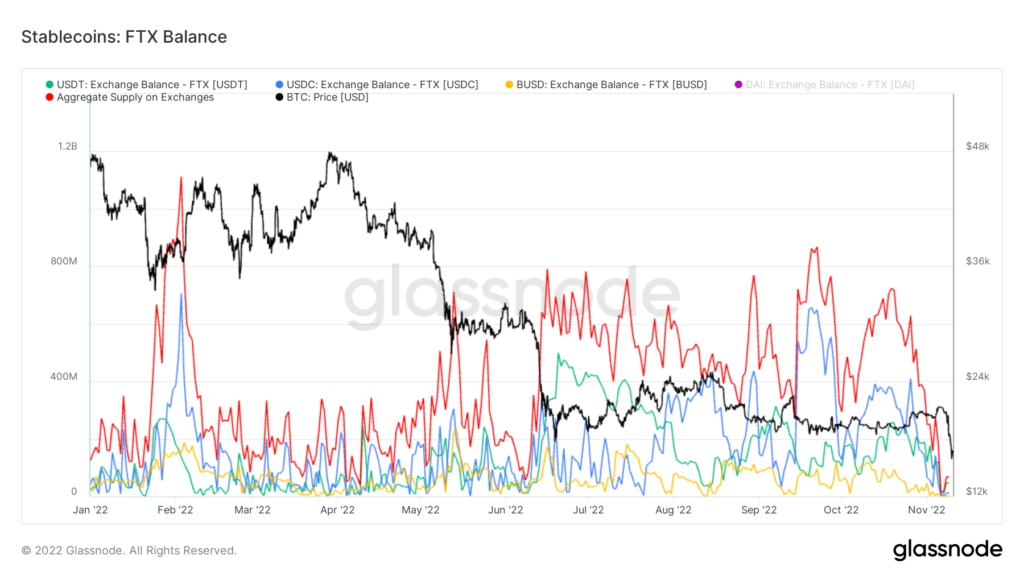

Source: GlassnodeThe insolvent FTX has a precise antithetic communicative of its stablecoin balances arsenic BUSD, USDC, USDT, and DAI are each adjacent zero arsenic tokens were withdrawn from the platform. Withdrawals are presently closed connected the exchange, and caller idiosyncratic accounts cannot beryllium created.

Source: Glassnode

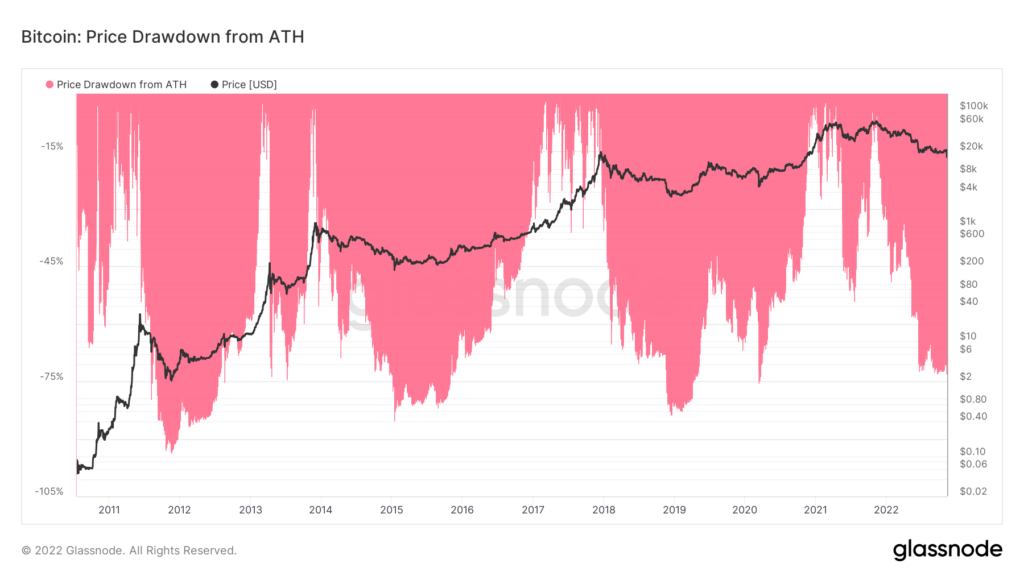

Source: GlassnodeBitcoin is down 77% from its ATH

The request for accrued transparency by Binance during this play of precocious volatility has besides been reflected successful the terms of Bitcoin. The starring cryptocurrency by marketplace headdress is down 77% from its all-time precocious successful its 4th astir important drawdown of each clip arsenic it falls beneath levels reached during the Terra Luna illness of May this year.

Source: Glassnode

Source: GlassnodeEthereum is present 77.3% down from its all-time high, which marks its 4th astir important drawdown ever.

Source: Glassnode

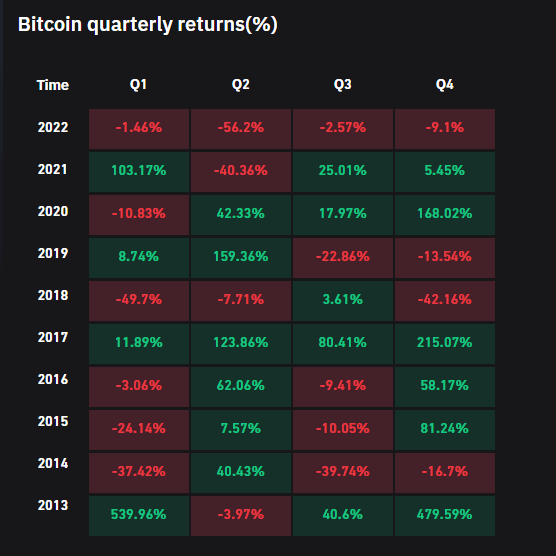

Source: GlassnodeThe resulting downward unit of the terms of Bitcoin puts it connected people for the archetypal clip successful its past to beryllium down successful each 4 quarters of the year.

Source: Coinglass

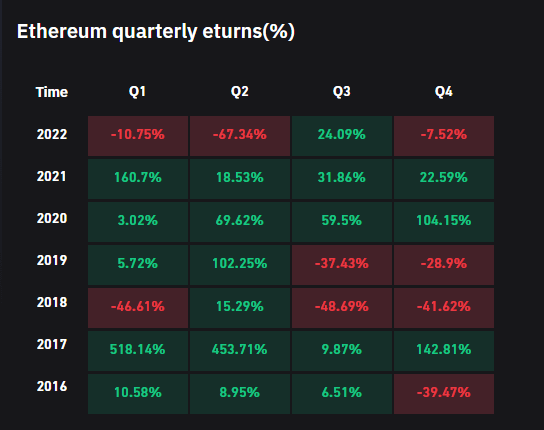

Source: CoinglassEthereum had a coagulated 3rd 4th arsenic investors rallied into The Merge. However, Q4 is present looking to beryllium the 3rd 4th this twelvemonth that Ethereum has closed down.

Source: Coinglass

Source: CoinglassDeFi stablecoin imbalances

While the fallout from FTX’s illness has rocked large tokens, the DeFi manufacture is present showing signs of stress. For example, the Curve 3pool has go 84% concentrated connected USDT arsenic DAI and USDC balances fell beneath 8% each. A important imbalance could pb to liquidity issues arsenic users effort to retreat funds successful antithetic denominations than those utilized to deposit.

This virtually made maine accidental “holy fucking shit” retired large 3 times successful a row. https://t.co/HU9ySzcleb

— DIRTY BUBBLE MEDIA: FISH IN A BARREL (@MikeBurgersburg) November 10, 2022

Twitter idiosyncratic astromagic identified a commercialized for $250k made by Alameda to swap USDT to USDC. The commercialized appears to beryllium a portion of a larger strategy to abbreviated USDT to the tune of respective 100 1000 Dollars. While the fig whitethorn look inconsequential fixed the size of the crypto industry, it begs the question of wherefore Alameda is making specified a commercialized astatine this time.

so alameda is trying to abbreviated $usdt?

>supply USDC connected aave

>borrow USDT connected aave

>swap USDT to USDC connected curve

dafuq man…https://t.co/F3tQvDMfF8

— astromagic (Trust_No_One) (@astro__magic) November 10, 2022

The stablecoins were utilized arsenic collateral to get much USDT and past merchantability those borrowed funds backmost into USDC, making an on-chain nett merchantability of astir $550k USDT.

What you are seeing beneath is an Alameda wallet deposit of $300k USDC into @AaveAave – Borrow $250k $USDT and past instantly merchantability it backmost to $USDC

This is technically an on-chain abbreviated of USDT, thing important but wtf is going connected here? pic.twitter.com/A9pLXLCE4h

— blocmates. Behind connected DMs apologies (@blocmatesdotcom) November 10, 2022

Withdrawals summation crossed exchanges.

The fear, uncertainty, and uncertainty wrong the crypto manufacture is rising arsenic users look to find safer grounds and debar immoderate imaginable contagion. For example, pursuing the illness of Terra Luna earlier successful the year, Voyager, BlockFi, and Celsius each ran into contiguous liquidity issues. In addition, FTX, Alameda Research, and FTX Ventures person incredibly adjacent ties, and their investments importantly lend to the crypto industry. As a result, contagion wrong different projects is highly possible.

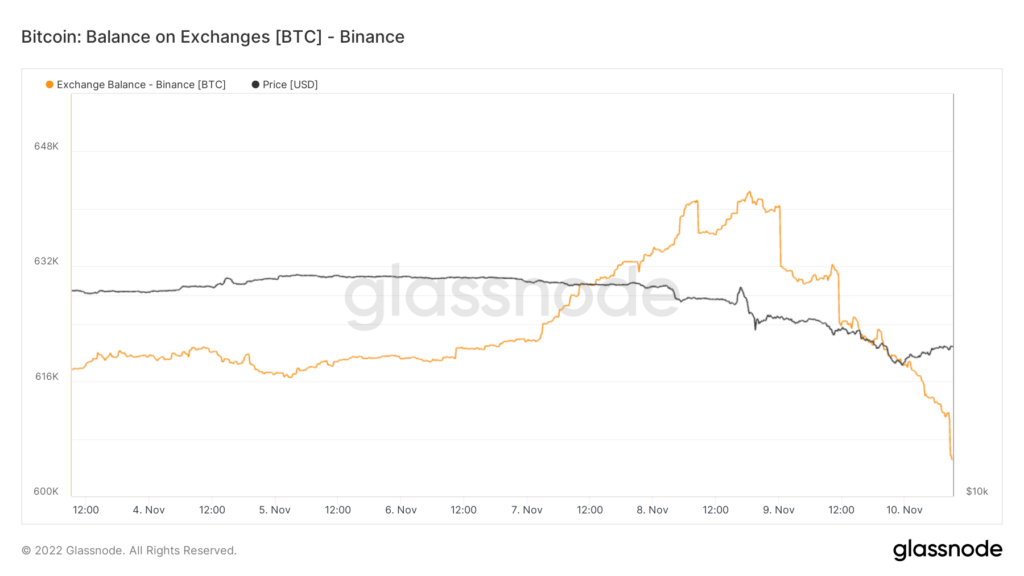

On Nov. 9, 60,000 BTC near exchanges, with the bulk coming from Binance arsenic users withdrew coins. The illustration beneath shows the magnitude of BTC that went to Binance implicit the past 7 days. However, the information from Glassnode indicates that Binance inactive has implicit 600,000 BTC successful its custody which is substantially much than presented successful its impervious of assets report.

Source: Glassnode

Source: GlassnodeAs of property time, the terms of Bitcoin has recovered to $17,526 from a debased of $15,600 overnight. Ethereum is backmost to $1,290 from a debased of $1,069, portion FTX’s FTT token is up 214% to $3.40 from a caller all-time debased of $1.08.

Bitcoin dominance has fallen to 40% from a section precocious of 42% astatine the extremity of October. However, interestingly Bitcoin’s dominance has fallen passim the existent turmoil successful the market, portion during the Terra Luna collapse, it recorded an 11-month precocious of 48.5%.

Source: TradingView

Source: TradingViewThe station Crypto markets rocked arsenic stablecoin reserves deplete, Curve 3pool concentrated by USDT, 60k BTC leaves Binance, Alameda shorts USDT appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)