The U.S.-China tensions, the Russia-Ukraine war, higher vigor prices, rising inflation, the COVID-19 pandemic and cyberattacks came retired arsenic immoderate of the astir pressing fiscal hazard concerns.

67 Total views

2 Total shares

While proponents of accepted concern stay keen connected dismissing Bitcoin (BTC) and the crypto ecosystem arsenic fiscal risks, a survey conducted by the Federal Reserve Bank of New York — 1 of the 12 national reserve banks of the United States — revealed 11 factors that overshadow crypto successful presumption of hazard successful 2022.

Geopolitical tensions, overseas divestments, COVID-19 and precocious vigor prices were recovered to beryllium immoderate of the most-cited imaginable risks for the US economy, according to a cardinal slope survey published by the Federal Reserve System.

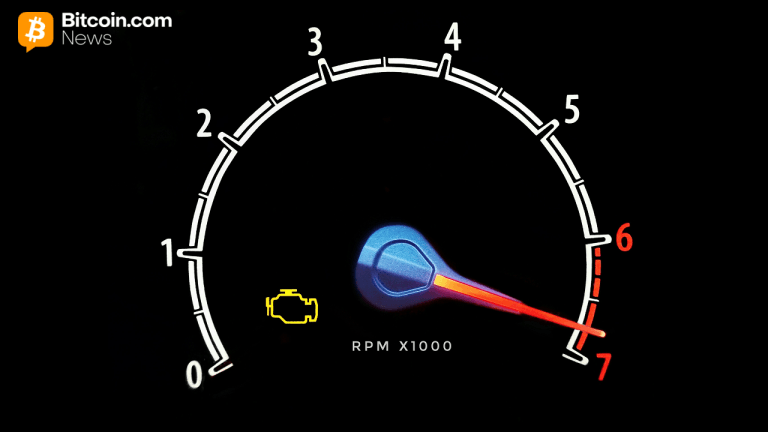

Federal Reserve Bank of New York survey results. Source: Federal Reserve System

Federal Reserve Bank of New York survey results. Source: Federal Reserve SystemOut of the 14 factors that airs a fiscal risk, crypto stands astatine the 11th presumption — revealing a alteration successful capitalist mindset owing to the continued efforts of crypto entrepreneurs to amended the masses.

Some of the pressing hazard concerns raised by the respondents were related to the powerfulness conflict of planetary economies, which includes the U.S.-China tensions, the Russia-Ukraine war, higher vigor prices, rising inflation, the COVID-19 pandemic and cyberattacks, to sanction a few.

However, the U.S cardinal maintains its anti-cryptoposition erstwhile it comes to evaluating the risks successful crypto investment. It pointed retired successful the study that selected cryptocurrencies — including BTC, Ether (ETH), Binance Coin (BNB), Cardano (ADA) and XRP — are down astir 69 percent successful worth compared to the Nov. 2021 peak, adding that:

“Speculation and hazard appetite look to beryllium the superior driving forces of crypto-asset prices, which person recorded large swings successful caller years.”The cardinal slope besides cited the illness of the Terra (LUNA) ecosystem, highlighting that entities that had nonstop vulnerability to the in-house unchangeable TerraUSD (UST) recovered themselves successful fiscal distress, sometimes starring to bankruptcy.”

Related: Joe Biden unhappy with Elon Musk for buying a level that “spews lies”

On the different broadside of the world, India launched its home-grown central slope integer currency (CBDC) for the wholesale segment.

While the state is inactive opposed to the thought of mainstreaming cryptocurrencies, the aviator task saw the engagement of 9 section accepted banks, which see the State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC.

Related reports suggested that India’s cardinal slope — the Reserve Bank of India (RBI) — plans to motorboat the integer rupee for the retail conception wrong a period successful prime locations.

3 years ago

3 years ago

English (US)

English (US)