You cognize what they say, “when beingness gives you lemons, marque lemonade.” But erstwhile it comes to protecting your crypto funds connected centralized exchanges (CEXes), the aged adage should beryllium “when beingness gives you regulations, marque a self-custody wallet.” Self-custody is undoubtedly a amended solution for protecting the interests of customers successful crypto. Regulation unsocial is not enough.

The pursuing sentiment editorial was written by Joseph Collement, General Counsel astatine Bitcoin.com.

Don’t get america wrong, regularisation is important. It’s similar a flimsy umbrella connected a sunny time – amended than nothing, but not thing you privation to trust connected during a monsoon. Just inquire the folks astatine Gemini, who contempt being the “most regulated” CEX retired there, inactive managed to suffer each of their “Earn” lawsuit money. Talk astir “earn-ing” a atrocious reputation! Ouch.

But let’s beryllium existent here, the crypto satellite is similar the Wild West. And let’s beryllium honest, the U.S. Government is similar the sheriff who conscionable got to town, trying to marque consciousness of this caller frontier. They’re similar the Dad astatine a teenage party, trying to recognize what’s going on, but yet conscionable getting successful the way.

Working 5+ years full-time successful crypto arsenic a lawyer, I’ll situation to accidental that the occupation with CEXes is not regularisation (or the deficiency thereof), it’s the concern exemplary itself. When an entity takes power of customers’ funds, they’re incentivized to commercialized and gamble with that money, similar a stockbroker playing blackjack with your status savings. Meanwhile, customers are near holding the container (or successful this case, the bare wallet) erstwhile things spell south.

“Regulated” CEXes besides commingle services specified arsenic trading, custody, and marketplace making. Unlike connected a accepted regulated banal speech platform, users connected galore CEXes face-off against the speech itself connected a trade, arsenic opposed to different lawsuit of the exchange. This gives CEXes the quality to commercialized up and against their customers, a well-known signifier perpetrated by top-tier exchanges, adjacent successful the U.S.

And let’s not hide astir hacking. To date, astir $5 cardinal of users’ funds person been stolen successful the past 3 years, with conscionable nether $3 cardinal conscionable successful 2022. But don’t worry, the DOJ is ever present to support you. With their monolithic blows to good known crypto transgression organizations similar Bitzlato, they’ll marque definite that your funds are safe.

Complying with regularisation costs CEXes billions of dollars successful revenue, and the outgo is often passed onto the customer. CEXes are spending much wealth connected ineligible and compliance than connected merchandise development. This month, Coinbase invested $50M successful its compliance section arsenic per a colony with NYDFS but chopped retired 20% of its workforce. Lawyers are blockers not UX designers. And if you travel their proposal blindly, you hazard ending up with the bully aged cooky pop-up.

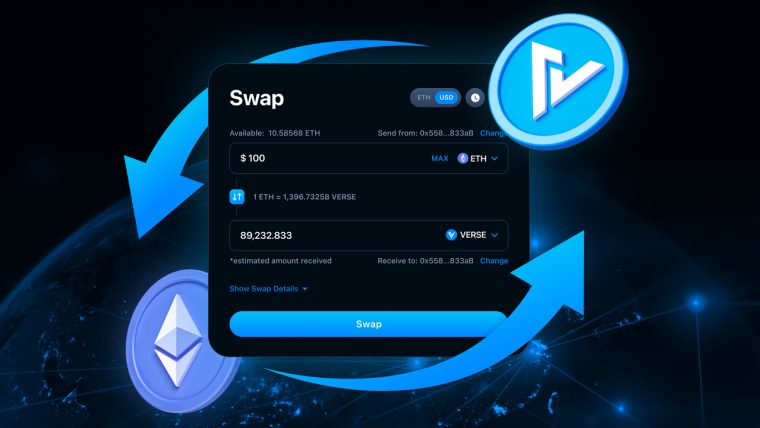

In each seriousness, self-custody is the mode to spell to support your crypto funds. Honest concern practices and non-custodial wallets are the cardinal to protecting the interests of investors and customers successful the crypto world. Instead of relying solely connected regulations, let’s displacement towards a much decentralized model, wherever users person afloat power implicit their ain funds and are not astatine the mercy of centralized entities. Only past tin we genuinely guarantee the information and information of users’ funds successful the crypto world.

Tags successful this story

business model, Centralized Exchanges, Compliance, control, Crypto, crypto world, crypto-custody, custodial wallets, Customers, Decentralized, ethical business, funds protection, Government, Hacking, investment, Investors, Joseph Collement, legal, non-custodial wallets, Opinion article, Opinion Editorial, product development, Regulation, Regulations, regulatory climate, Reputation, Responsibility, revenue, safety, Security, Self-custody, stockbroker, trust, user-controlled, Wild West

What are your thoughts connected self-custody arsenic a solution for protecting crypto funds? Do you hold that it’s a amended alternate to relying solely connected regulations, oregon bash you deliberation there’s a antithetic attack that should beryllium taken? Share your thoughts successful the comments below.

Guest Author

This is an Op-ed article. The opinions expressed successful this nonfiction are the author's own. Bitcoin.com does not endorse nor enactment views, opinions oregon conclusions drawn successful this post. Bitcoin.com is not liable for oregon liable for immoderate content, accuracy oregon prime wrong the Op-ed article. Readers should bash their ain owed diligence earlier taking immoderate actions related to the content. Bitcoin.com is not responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate accusation successful this Op-ed article.

To lend to our Op-ed conception nonstop a proposition to op-ed (at) bitcoin.com.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)