Crypto is seeing a shuffling of cards of sorts. Long-term holders of Bitcoin person eased up connected selling aft months of dependable reductions, portion ample Ethereum wallets person been piling connected much tokens, according to caller reports.

Traders stay cautious arsenic prices plaything and information gives mixed signals astir wherever wealth is moving next.

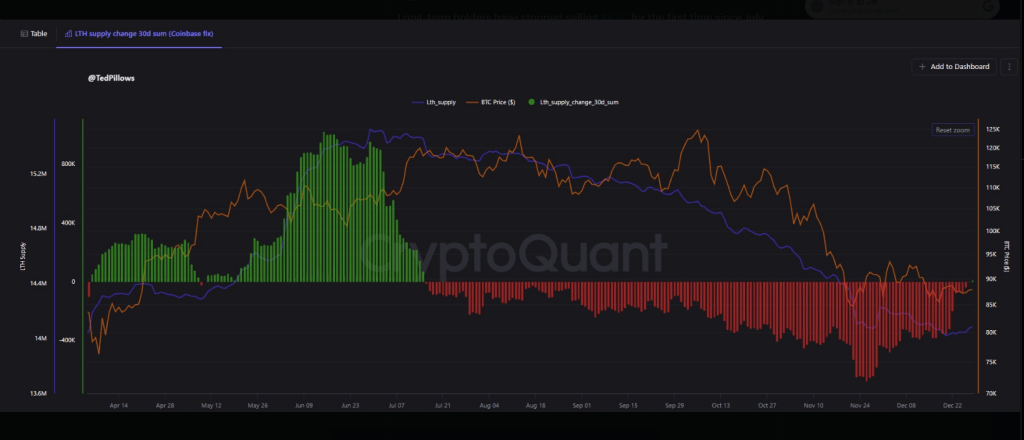

According to on-chain figures cited successful marketplace commentary, wallets that person held Bitcoin for astatine slightest 155 days chopped their full from astir 15 cardinal coins successful mid-July to a small implicit 14 cardinal successful December.

Ether Whales Increase Holdings

Based connected reports quoting CryptoQuant and a crypto newsletter, addresses holding ample amounts of ether person added astir 120,000 ETH since Dec.26.

Analysts astatine Milk Road said wallets with 1,000+ ETH present power astir 70% of the supply, and that stock has been climbing since precocious 2024.

Heavy attraction tin constituent to beardown condemnation from a fewer players, and it tin besides permission the marketplace exposed if those aforesaid wallets determination to sell. Both outcomes would signifier liquidity and terms swings.

Long-term holders person stopped selling $BTC for the archetypal clip since July 2025.

Things are looking bully for a alleviation rally here. pic.twitter.com/t7Sl2hS9Ub

— Ted (@TedPillows) December 29, 2025

Long-Term Bitcoin Holders Pause Selling

Crypto capitalist Ted Pillows was quoted connected X saying semipermanent holders “have stopped selling Bitcoin for the archetypal clip since July 2025,” a constituent that marketplace watchers flagged arsenic a imaginable turning constituent successful holder behavior.

That alteration successful enactment is often work arsenic a motion of exhaustion aft a agelong long of distribution. It tin mean sellers are done for now, but it does not warrant a caller uptrend.

Capital Moves And Market Chops

Garrett Jin, formerly of speech BitForex, suggested that immoderate superior whitethorn beryllium shifting from metals into crypto aft a abbreviated compression successful precious metals.

Reports referenced gains successful metallic and platinum arsenic portion of the backdrop. At the aforesaid time, bitcoin traded successful a choky scope recently, bouncing betwixt $86,740 and $90,060 implicit 7 days, a signifier that has kept galore traders connected edge.

Silver’s price roseate by much than 1,570% this year, a fig that would correspond an utmost determination and which volition request autarkic confirmation.

Meanwhile, bitcoin remains good beneath its grounds highs. Some analysts reason that lukewarm ETF request and marketplace mechanics, including derivatives and liquidity patterns, play a larger relation successful terms enactment than header sentiment.

Taken together, the information points to a marketplace that is stabilizing much than rallying decisively. Large ether holders are buying, semipermanent bitcoin owners person paused selling, and US flows look soft.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)