The integer assets marketplace has transformed from a niche experimentation into a planetary unit reshaping finance, commerce, and technology. In May 2025, the planetary crypto marketplace is valued astatine $3.05 trillion, increasing astatine a gait connected par with the net roar successful the 90s.

A look astatine the maturation curve

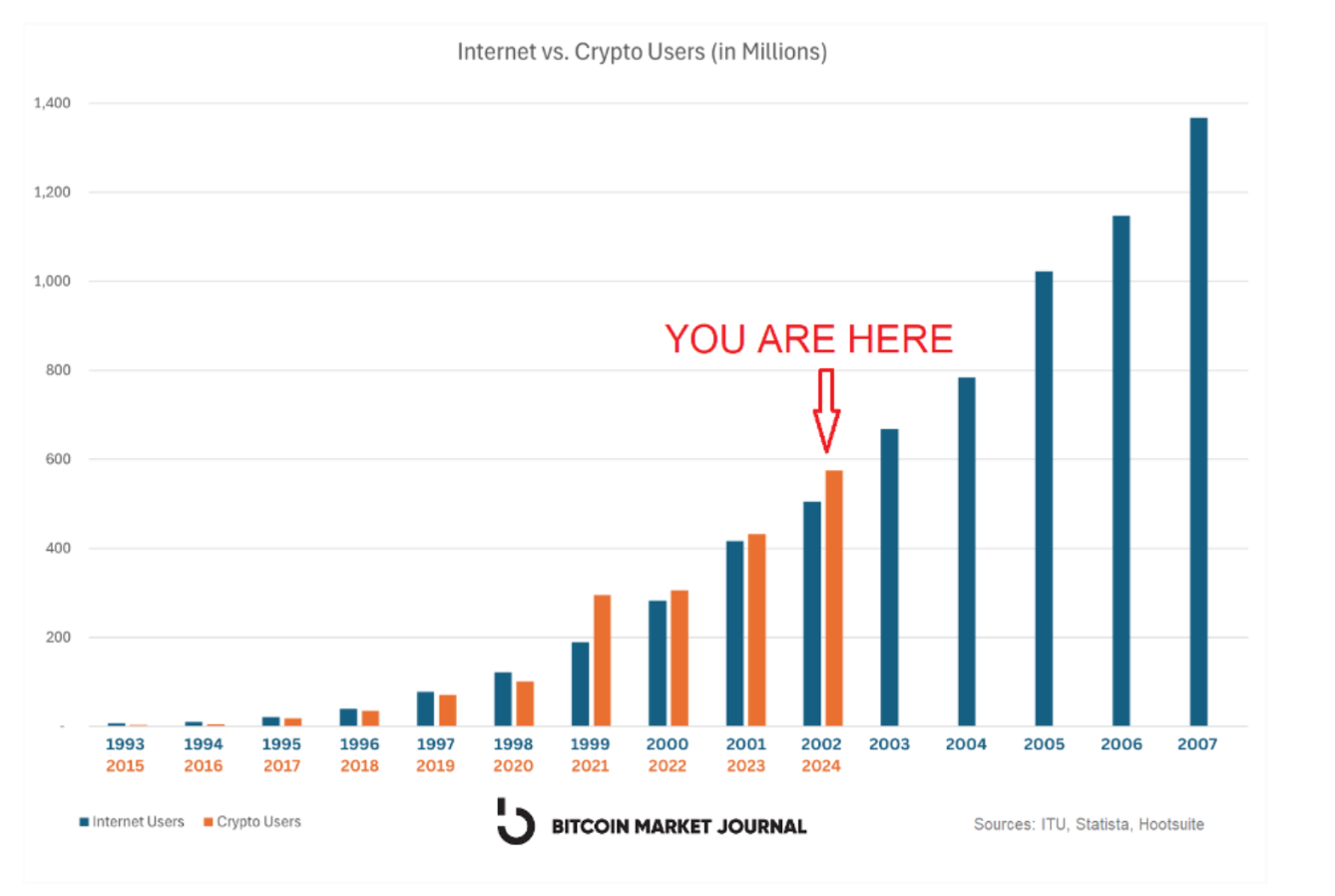

Historical adoption curves for technologies similar the net and smartphones show that 10% penetration often marks a tipping point, aft which maturation accelerates exponentially owed to web effects and mainstream acceptance. Digital assets are present connected this trajectory, driven by rising idiosyncratic adoption, organization concern and innovative usage cases. After years of nationalist uncertainty, a pivotal milestone whitethorn beryllium achieved this year: cryptocurrency idiosyncratic penetration tin surpass the captious 10% threshold, estimated to scope 11.02% globally successful 2025 by Statista, up from 7.41% successful 2024.

The illustration beneath compares the aboriginal idiosyncratic adoption curves of cryptocurrency and the internet. It highlights that crypto is increasing astatine a importantly faster complaint than the net did successful its aboriginal years.

The 10% threshold: a catalyst for exponential growth

With crypto expected to transverse the 10% threshold of adoption successful 2025, it is important to enactment that the 10% people is not arbitrary —- it’s a well-documented tipping constituent successful exertion diffusion, rooted successful Everett Rogers’ diffusion of innovations theory. This exemplary shows that adoption shifts from aboriginal adopters (13.5%) to the aboriginal bulk (34%) astatine astir 10–15% penetration, marking the modulation from niche to mainstream.

Crossing 10% marketplace penetration triggers accelerated maturation arsenic infrastructure, accessibility and societal acceptance align. Two precise caller examples of this are the smartphone and the internet.

For cryptocurrencies, surpassing 10% penetration successful 2025 would awesome a akin inflection point, with web effects amplifying adoption — much users summation liquidity, merchant acceptance and developer activity, making crypto much applicable for mundane transactions similar payments and remittances.

In the U.S., 28% of adults (approximately 65 cardinal people) ain cryptocurrencies successful 2025, astir doubling from 15% successful 2021. Additionally, 14% of non-owners program to participate the marketplace this year, and 66% of existent owners mean to bargain more, reflecting important momentum. Globally, 2 retired of 3 American adults are acquainted with integer assets, signaling a crisp departure from its earlier speculative reputation. These figures underscore the increasing mainstream acceptance of integer assets, aligning with the post-10% adoption surge observed successful different transformative technologies.

Crypto’s economical interaction spans remittances, cross-border trade, and fiscal inclusion, peculiarly successful Africa and Asia, wherever it empowers the unbanked.

Drivers of accelerated penetration

Several factors are propelling crypto past the 10% threshold:

- Blockchain technology: Its transparency and information enactment remittances, proviso concatenation tracking, and fraud prevention, with Ethereum handling implicit 1.5 cardinal regular transactions.

- Financial inclusion: Crypto enables financial entree for unbanked populations, particularly successful Africa and Asia, via mobile and fintech platforms.

- Regulatory clarity: Pro-crypto policies successful the UAE, Germany, and El Salvador (where bitcoin is ineligible tender) boost adoption, though uncertainty successful India and China poses challenges.

- AI integration: Nearly 90 AI-based crypto tokens successful 2024 heighten blockchain functionality for governance and payments.

- Economic instability: Crypto’s relation arsenic a hedge against ostentation drives adoption successful markets similar Brazil ($90.3 cardinal successful stablecoin transactions) and Argentina ($91.1 billion).

Institutional and concern adoption

Institutional and concern engagement is accelerating integer assets’ mainstream integration. Major fiscal players similar BlackRock and Fidelity are going each successful connected crypto services and person launched crypto exchange-traded funds (ETFs), with 72 ETFs awaiting SEC approval successful 2025.

Businesses are adopting crypto payments to chopped fees and scope planetary customers, peculiarly successful retail and e-commerce. Examples see Burger King successful Germany accepting bitcoin since 2019 and PayPal’s 2024 concern with MoonPay for U.S. crypto purchases. Platforms similar Coinbase Commerce and Triple-A, alongside partnerships similar Ingenico and Crypto.com, alteration merchants to judge crypto with section currency settlements, reducing volatility risks.

DeFi enactment has accrued importantly successful Sub-Saharan Africa, Latin America, and Eastern Europe. In Eastern Europe, DeFi accounted for implicit 33% of full crypto received, with the portion placing 3rd globally successful year-over-year DeFi growth.

Challenges and acceleration ahead

Despite its momentum, integer assets look hurdles:

- Volatility: Crypto is simply a precise volatile asset, often excessively volatile for organization investors.

- Security concerns: Hacks, mislaid backstage keys and 3rd enactment risks each lend to uncertainty among investors.

- Regulatory scrutiny: Despite a precise affable U.S. authorities stance toward crypto and progressively tolerant governments astir the world, determination are questions astir however crypto volition beryllium treated crossed jurisdictions, specifically arsenic they subordinate to securities.

Still, the trajectory is promising.

Bullish sentiment and crypto-friendly regulators, coupled with ETF momentum and outgo integrations, underscore this trajectory. If innovation continues to equilibrium retired with trust, integer assets are apt to travel the net and smartphone playbook — and turn adjacent faster.

7 months ago

7 months ago

English (US)

English (US)