Sub-saharan Africa recorded $100.6 cardinal worthy of crypto transactions on-chain betwixt July 2021 and June 2022, according to a Chainalysis report.

While it represented a maturation of 16% year-over-year, it accounted for lone 2% of planetary crypto transactions — the lowest successful the world.

However, the latest Chainalysis study indicates that the portion has immoderate of the astir well-developed crypto markets, with:

“Deep penetration and integration of cryptocurrency into mundane fiscal activity.”

Leader successful tiny retail crypto transactions

In Sub-saharan Africa, retail crypto transfers relationship for 95% of each crypto-related transactions successful the region, according to the report.

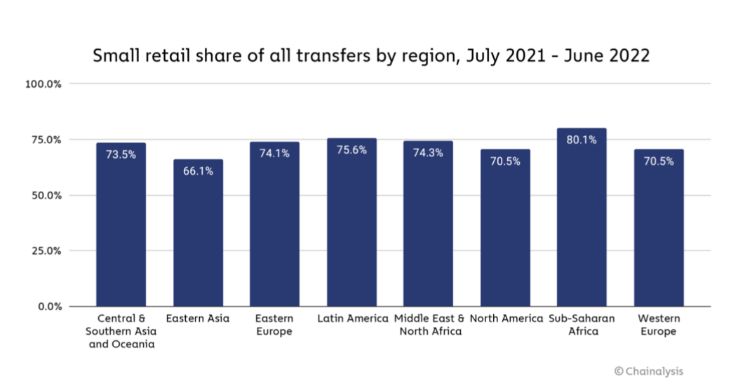

Small retail transfers of little than $1,000 made up for 80% of crypto transactions betwixt July 2021 and June 2022, much than immoderate different portion successful the world. Comparatively, the stock of tiny retail crypto transfers successful North America stood astatine 70.5% during the aforesaid period.

Nigerian blockchain consultancy and merchandise workplace Convexity laminitis Adedeji Owonibi told Chainalysis that Sub-saharan Africa does not person organization crypto investors. Instead, the region’s crypto marketplace is driven by retail usage, wherever regular traders effort to gain a surviving amid precocious unemployment rates. He added:

“It [crypto] is simply a mode to provender their household and lick their regular fiscal needs.”

Therefore, the adoption of cryptocurrencies is being driven by necessity successful Sub-saharan Africa. This is wherefore the fig of tiny retail transactions successful the portion grew erstwhile the carnivore marketplace started successful May 2022, according to Chainalysis data.

The study further stated that the fluctuating worth of fiat currencies of immoderate countries successful the portion — specified arsenic Kenya and Nigeria — supply further inducement to commercialized cryptocurrencies, particularly stablecoins. Many investors successful the portion person turned to stablecoins to support their savings amid the volatility of section currencies.

Peer-to-peer trading is the key

According to the Chainalysis report, P2P exchanges relationship for 6% of each crypto transactions successful the region.

Anti-crypto regulations, similar Nigeria banning banks from interacting with crypto businesses successful 2021, person caused much and much radical to crook to P2P trades.

Furthermore, P2P trading is not lone constricted to P2P exchanges successful the portion similar Paxful, whose customers grew 55% year-over-year successful Nigeria.

According to the report, crypto traders successful the portion besides transportation retired backstage trades via groups connected societal media platforms similar WhatsApp and Telegram.

Crypto for remittances and planetary concern payments

The Sub-saharan portion has thousands of outgo systems with nary interoperability oregon connection with each other.

Sending a outgo to a state successful the portion tin beryllium highly costly compared to crypto.

Businesses successful the portion with planetary suppliers besides usage crypto to marque payments.

The station Crypto’s inferior driving adoption successful Sub-saharan Africa – Chainalysis appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)