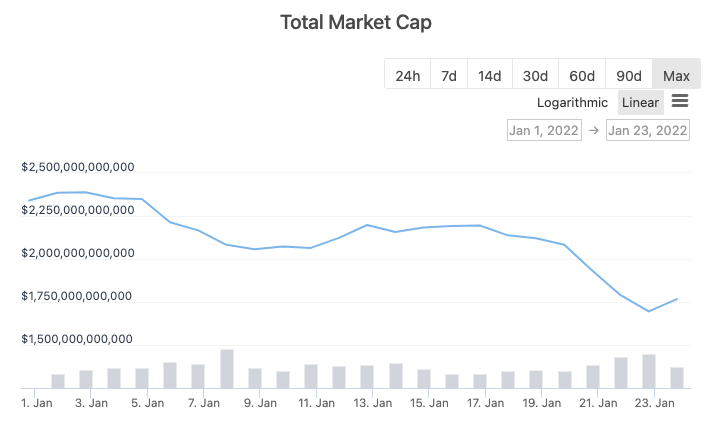

Cryptocurrencies are deep successful the reddish this year aft manufacture marketplace capitalization plummeted to $1.6 trillion arsenic of Monday from $2.3 trillion astatine the commencement of 2022, a diminution of astir 30% successful conscionable implicit 3 weeks.

According to information from CoinGecko, astir $700 cardinal of worth has been erased erstwhile the marketplace correction sent bitcoin (BTC) down 28% for the twelvemonth to day and ether (ETH) fell 40%.

The caller figures connote cryptocurrency marketplace capitalization has astir halved since its all-time precocious astir $3.1 trillion successful November.

Cryptocurrency marketplace capitalization done Jan. 23 (CoinGecko) (CoinGecko)

“Crypto winter” flashback

It's not antithetic for highly volatile cryptocurrencies to acquisition swift and devastating drawdowns with magnitudes exceeding 50%.

In April 2013, the terms of bitcoin rallied to a precocious of $230 from conscionable $13 successful January. Within days, bitcoin suffered a steep driblet to $68, a diminution of 70%.

The past crypto bull tally successful 2017-2018 saw a akin signifier – a swift, parabolic terms pump, past a steep drawdown wrong consequent weeks.

During the 2018 sell-off, crypto marketplace capitalization plummeted from a precocious of $850 cardinal successful January to $130 cardinal successful December, a staggering diminution of 85%.

It took 3 years for bitcoin to instrumentality to its 2017 all-time high, marking a achy play seasoned HODL-ers retrieve arsenic “crypto winter.”

While the drawdowns alteration successful magnitude with each consequent crypto cycle, it appears the "supercycle" hypothesis – that crypto is connected the verge of wide adoption – floated by immoderate traders past twelvemonth is dormant successful the water.

For immoderate traders, the emergence of large altcoins successful the existent rhythm appears to beryllium providing immoderate reprieve from the oversea of red.

As the cryptocurrency abstraction matures, bitcoin and ether dominance has been connected the decline, meaning altcoins are making up a larger chunk of the broader cryptocurrency marketplace cap.

Tokens specified arsenic Fantom’s FTM (-21% twelvemonth to date) and Cosmos’ ATOM (-7%) person outperformed some bitcoin (-28%) and ether (-40%).

Traders who were agelong FTM and ATOM and hedged positions with abbreviated selling connected BTC oregon ETH were inactive capable to marque profits. Short selling occurs erstwhile an capitalist borrows a information (or successful this lawsuit a cryptocurrency), sells it connected the unfastened marketplace and expects to bargain it backmost aboriginal for less.

Meanwhile, immoderate of 2021’s hottest tokens specified arsenic Polygon’s MATIC (-44%), Solana’s SOL (-51%) and Avalanche’s AVAX (-48%) person notched steep losses successful little than a month.

There’s 1 happening weary traders tin look guardant to now: the adjacent cycle.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)