Crypto prices slipped Thursday aft an unexpectedly hot PPI ostentation print, but analysts said it's conscionable a pullback wrong the rally.

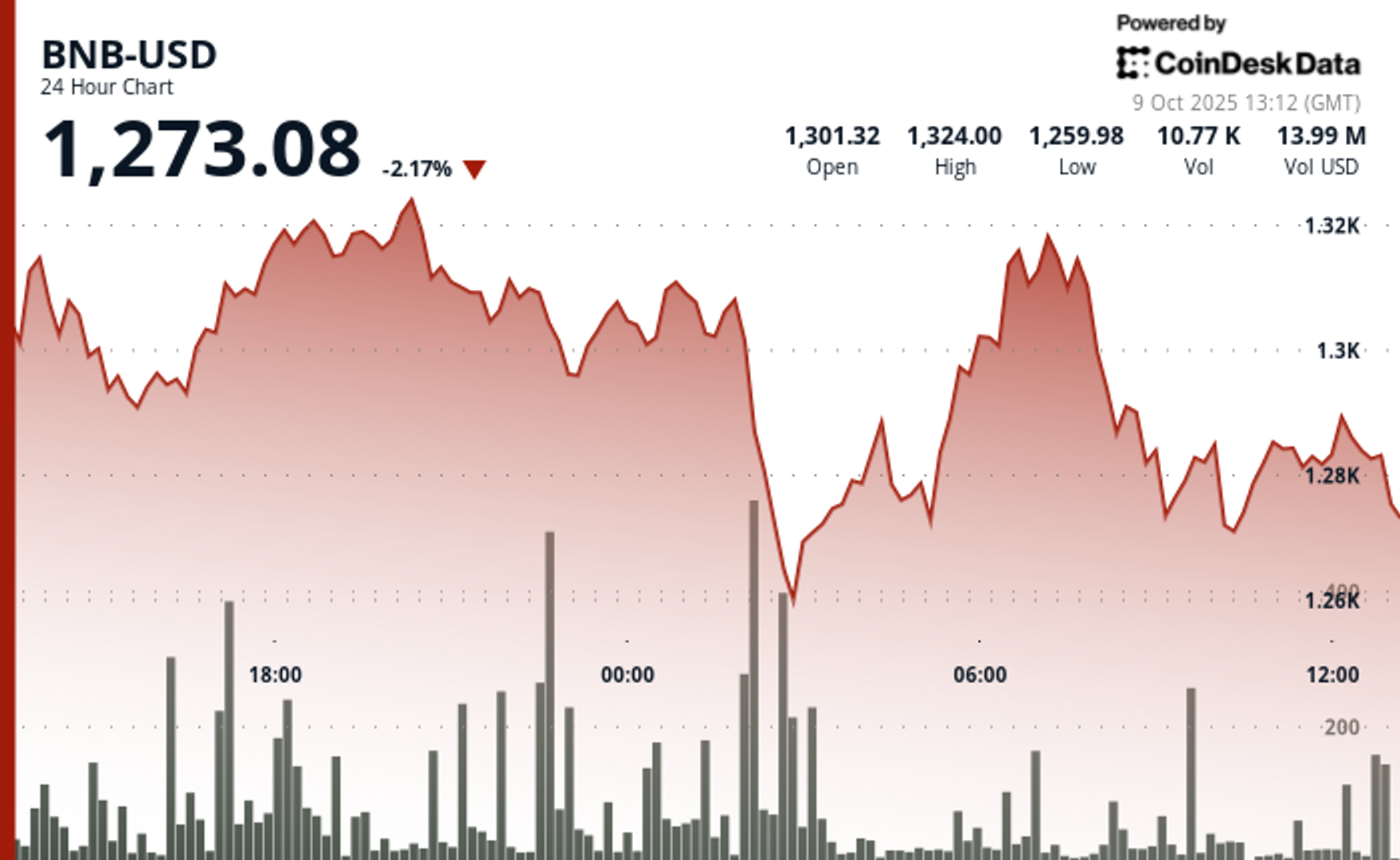

The CoinDesk 20 Index of largest cryptocurrencies fell 2.1% implicit the past 24 hours, with bitcoin (BTC) dropping 2.3%. XRP (XRP) mislaid 4.6% with ether (ETH) outperforming by edging down 0.7%.

"The pullback is, successful my view, simply a recalibration successful an different bullish trend," said David Siemer, co-founder and CEO of Wave Digital Assets. "Bitcoin remains firmly entrenched arsenic the anchor of organization crypto strategies."

Bitcoin's (BTC) unreserved to caller all-time highs implicit $124,000 was fueled by rising expectations for Federal Reserve interest-rate cuts successful September coupled with surging ETF inflows and organization adoption.

The Thursday reversal to arsenic debased arsenic $118,000 was "equally normal," helium said.

"After specified a crisp rally, profit-taking tends to acceptable in, and we saw short-term traders liquidate their positions and instrumentality gains," Siemer said. "In addition, higher-than-expected ostentation data, peculiarly astir halfway user prices, has tempered immoderate of the Fed optimism that drove the rally.

"It’s a steadfast consolidation alternatively than a reversal," helium concluded.

Joel Kruger, marketplace strategist of LMAX Group shared a akin view.

"It comes arsenic nary astonishment to spot a circular of nett taking footwear successful pursuing immoderate awesome moves successful crypto markets this week," Kruger wrote successful a greeting note. "But overall, the outlook remains highly constructive and dips should beryllium good supported."

Looking ahead, cardinal risks for crypto prices are imaginable overextension of valuations, geopolitical turbulence oregon economical information that could recalibrate Fed projections, Kruger added.

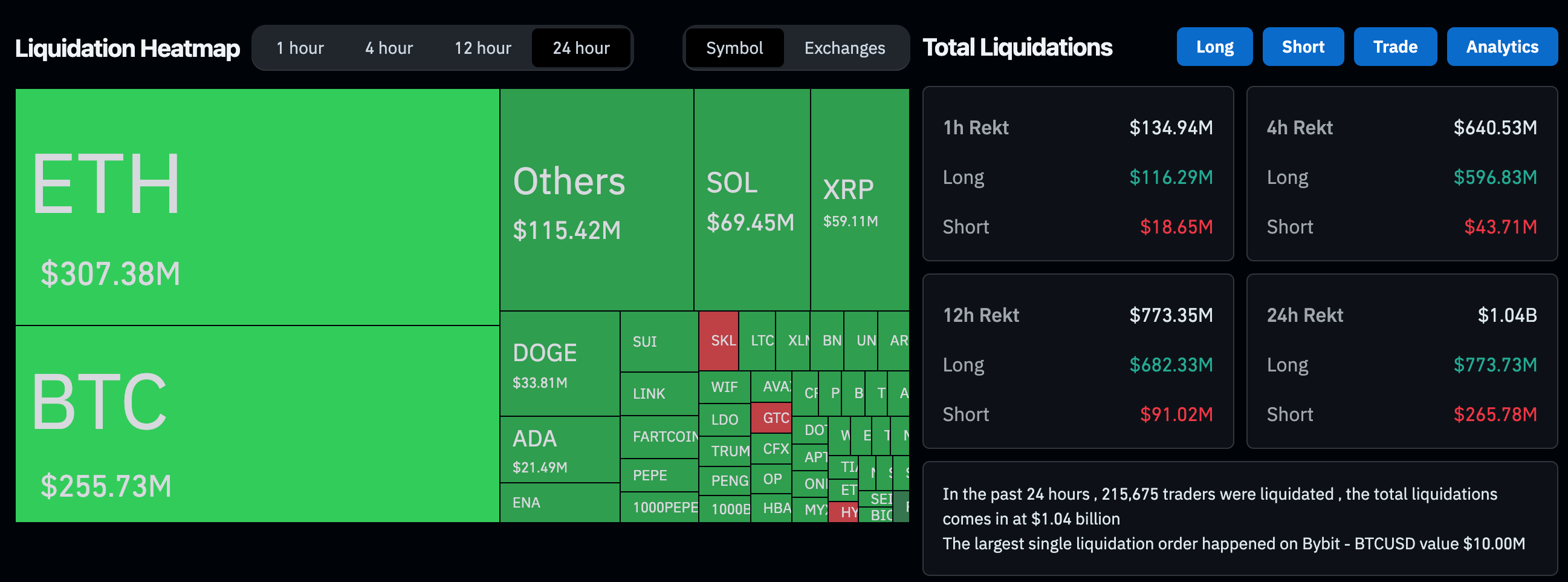

Still, precocious bulls were punished for their exuberance. The shakeout triggered a monolithic leverage flush, liquidating implicit $1 cardinal successful leveraged trading positions crossed each crypto derivatives implicit the past 24 hours, mostly longs betting connected rising prices, CoinGlass data shows.

That's the largest agelong liquidation since astatine slightest the late July-early August plunge. That time, BTC dipped beneath $112,000 and galore altcoins saw double-digit pullbacks, yet carving retired the section bottommost for astir of the integer plus market.

"The 'I conjecture opening a 50x agelong aft a 7-day 50% determination was not the champion idea' benignant of shakeout here," well-followed trader Bob Loukas said successful an X post.

Read more: Bitcoin Hits $124K Record arsenic 4 Tailwinds Align: Crypto Daybook Americas

1 month ago

1 month ago

English (US)

English (US)