Where are the sanctions-evading crypto usage cases? Surely by this constituent we’d spot thing astir that, right?

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

One of crypto's purported usage cases is arsenic an uncensorable, stateless means to store and transact value. We're benignant of seeing that play retired successful Ukraine. We aren't seeing different usage lawsuit play retired astatine each successful Russia – astatine least, not yet.

Crypto faces different defining infinitesimal arsenic lawmakers and users virtually worldwide see its uses – existent and imaginable – successful the Russian penetration of Ukraine. It volition beryllium an absorbing trial for the sector.

This peculiar newsletter originated connected Saturday nighttime erstwhile I was getting drinks with my workfellow Danny Nelson (if you don't already work him, you should).

We person heard a batch implicit the past week that crypto is not being utilized to undermine planetary sanctions against Russia oregon breakaway regions of Ukraine, and my question is: Why connected Earth not? The full thought of crypto is that it is expected to beryllium a stateless signifier of wealth oregon store of value, 1 that allows you to support your fiscal resources extracurricular of the authorities oregon extracurricular of immoderate authorities entity. It's expected to beryllium a formation to information erstwhile mean outgo rails chopped you disconnected oregon marque it hard for you to support connected arsenic you were.

(Note: I’m not advocating for radical to evade sanctions utilizing crypto, conscionable sincerely asking wherefore it isn’t happening.)

Evading sanctions would look to beryllium a cleanable usage lawsuit for this, no? And yet this doesn't look to beryllium happening connected immoderate appreciable scale. The U.S. authorities has adjacent gone retired of its mode to accidental this isn’t happening. Todd Conklin astatine the U.S. Treasury Department precocious told TRM Labs' Ari Redbord successful a webinar that crypto isn’t being utilized arsenic a instrumentality to evade sanctions, astatine slightest not successful Russia astatine this time.

The Financial Crimes Enforcement Network (FinCEN), the Treasury Department’s money-laundering watchdog, supported that presumption yesterday by publishing a connection informing that portion individuals mightiness crook to cryptocurrencies to bypass sanctions, the Russian authorities doing truthful “is not needfully practicable.”

Part of that is due to the fact that the manufacture conscionable doesn’t person capable liquidity to conscionable the needs of a sovereign nation, Redbord aboriginal told me.

For a country, that would beryllium hundreds of billions of dollars. The full crypto marketplace headdress is astir $2 trillion.

Furthermore, the Russian authorities has enactment precisely zero effort into creating the indispensable infrastructure to run a crypto-based alternate to its existent dollar economy. (In fact, the Russian cardinal bank appears to person kept rather a spot of its warfare thorax successful dollars in offshore accounts that person now been seized.)

But what if we look to individuals, specified as, say, the dozens of Russian oligarchs who present find themselves connected the Treasury Department's Office of Foreign Asset Control's Specially Designated Nationals list? Surely, they volition beryllium turning to crypto to evade sanctions; ri–no, wait, it seems that they, too, are not utilizing crypto successful immoderate appreciable standard astatine this time.

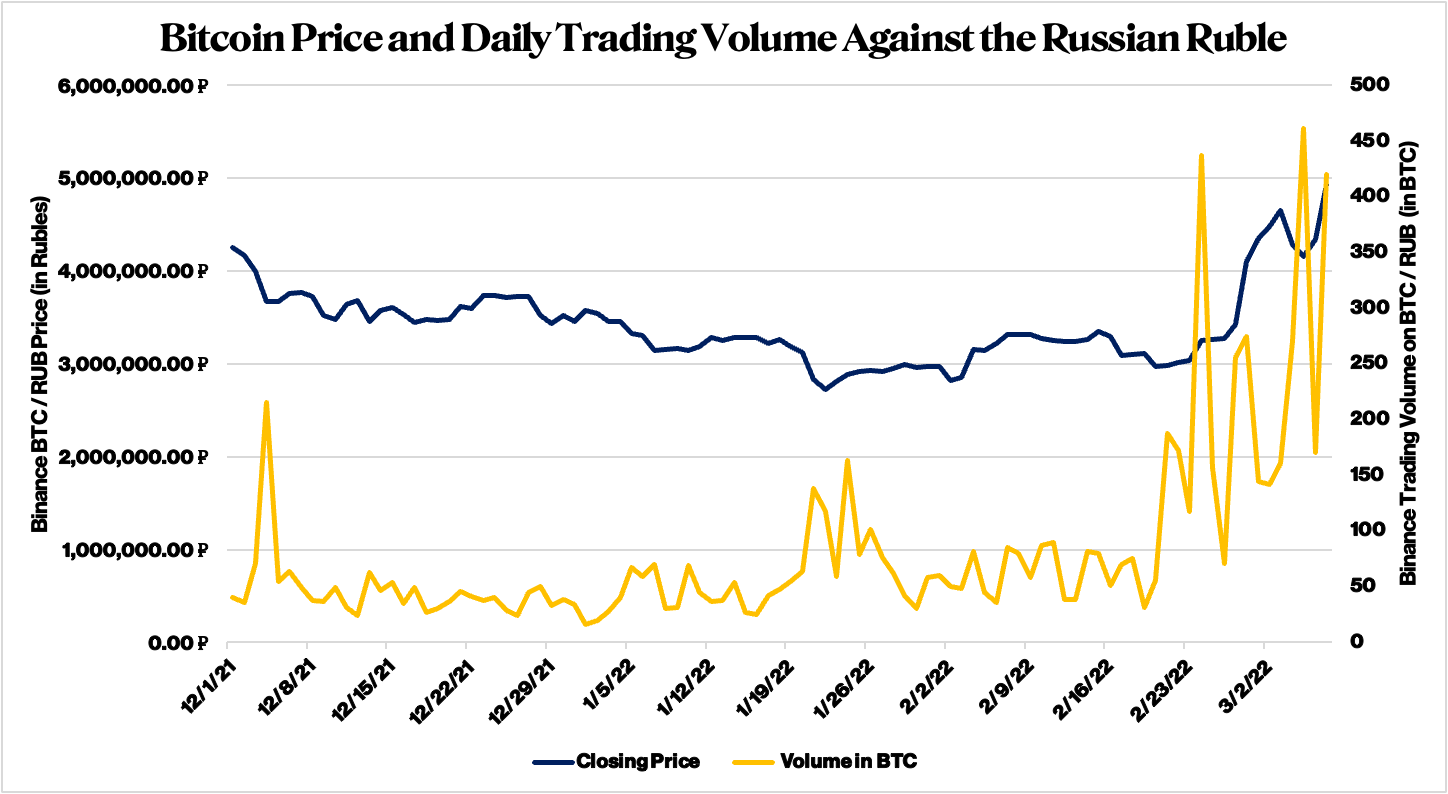

Certainly, we saw a spike successful ruble-bitcoin trading pairs connected crypto platforms operating successful Russia instantly aft the penetration was announced, but volatility successful that country of the marketplace seems to person calmed down (relatively speaking) implicit the past week oregon so.

(CoinDesk Research)

It’s, of course, surely imaginable that these oligarchs mightiness beryllium utilizing over-the-counter trading desks oregon different trading pairs (especially plausible if their wealthiness is held successful assets that aren’t the ruble).

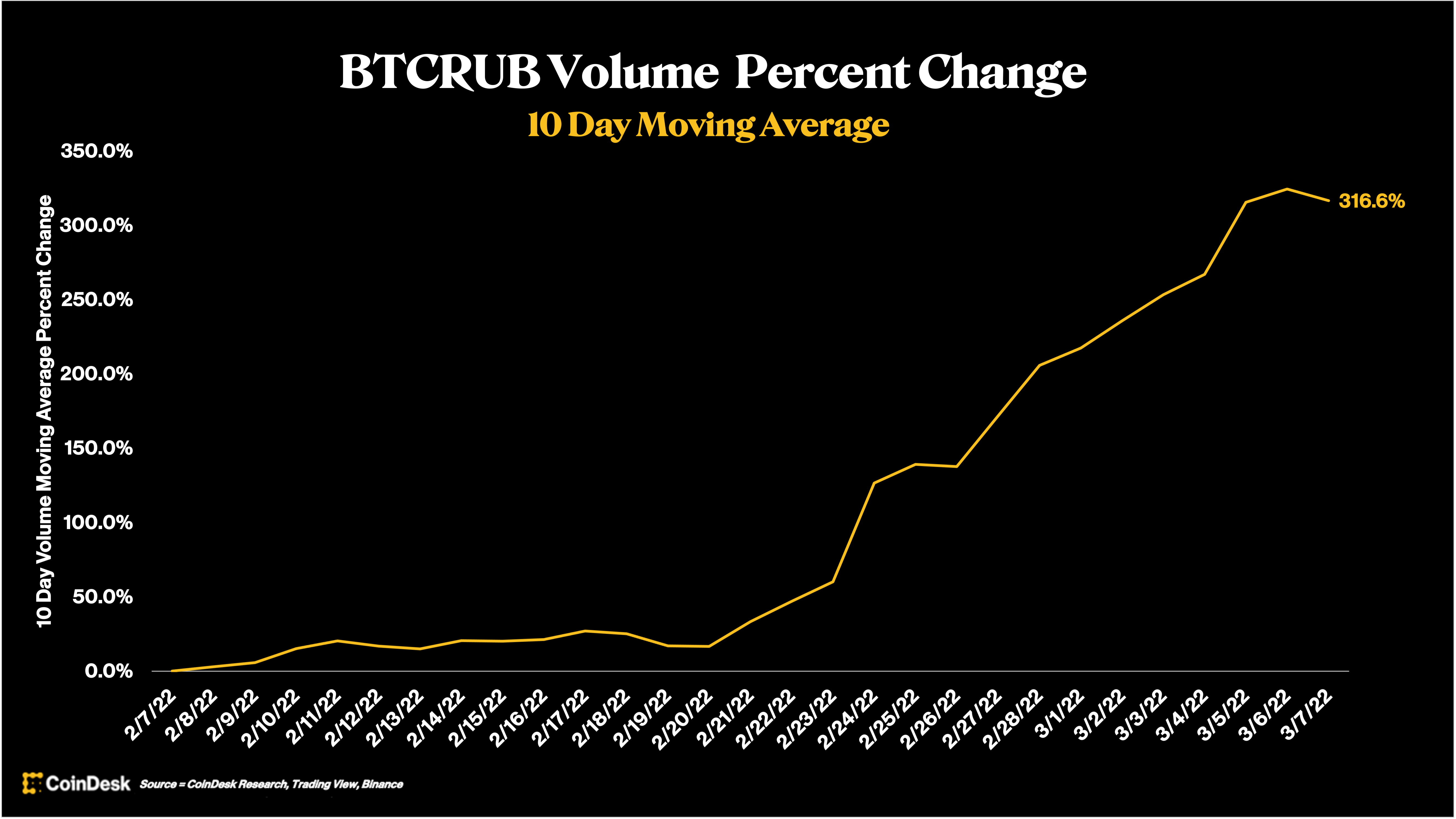

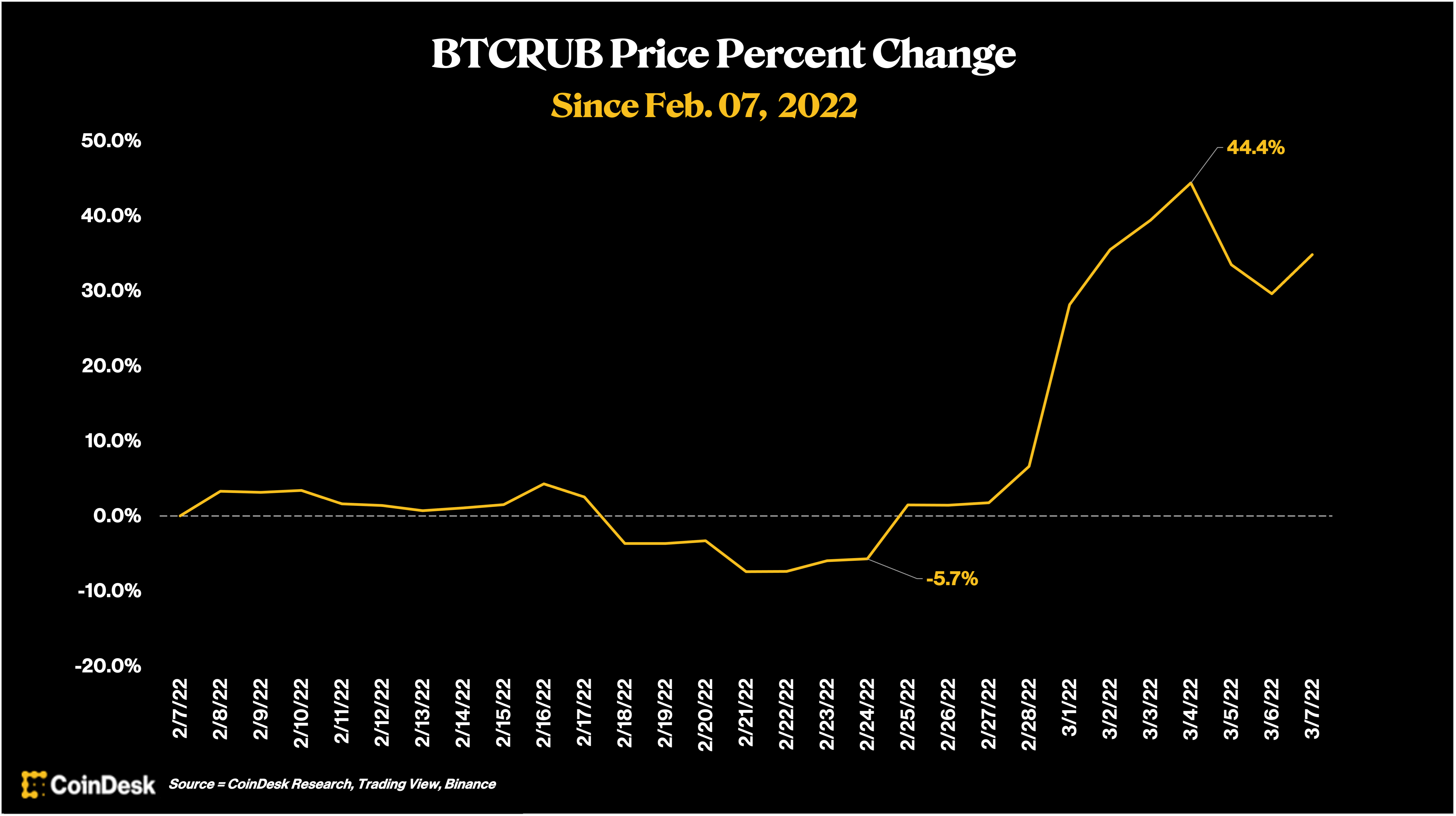

A speedy look astatine the bitcoin-ruble terms alteration shows wherefore that mightiness marque sense.

(CoinDesk Research)

(CoinDesk Research)

The ruble’s worth has plummeted compared with different currencies since the commencement of the invasion. One U.S. dollar was worthy astir 84 rubles the nighttime the penetration began, according to TradingView. As of Monday night, it was worthy astir 131 rubles, down from 154 rubles earlier successful the day. So what the charts supra are truly telling america is that the ruble isn’t worthy a batch now.

The irony present is this volition astir apt impact mundane Russian residents much than the oligarchs (like however Visa/Mastercard/American Express/PayPal’s cutting disconnected Russia volition apt impact mundane residents much than the oligarchs).

And contempt that, it seems wide that oligarchs aren’t fleeing the ruble for bitcoin.

“We’re not seeing the ample types of inflows we would spot that would beryllium indicative of inflows of ample amounts of wealth that would correspond to a important magnitude of an oligarch’s nett worth,” said Salman Banaei, caput of nationalist argumentation astatine Chainalysis.

"We've seen benignant of ammunition companies and antithetic analyzable laundering schemes implicit the years," Redbord said. "They volition usage perfectly everything that they tin and crypto volition beryllium portion of that playbook, astatine slightest successful immoderate tiny way."

Banaei said helium would look for inflows into privacy-enhanced cryptocurrencies similar montero oregon wallet addresses tied to exchanges with anemic know-your-customer enforcement arsenic immoderate imaginable signs that radical mightiness beryllium trying to evade enforcement officials.

The main mode to way money movements would beryllium to nexus addresses to individuals directly, Redbord said.

To beryllium sure, crypto has been utilized to large effect arsenic a fundraiser for the Ukrainian government. So far, $60 cardinal worthy of crypto has been donated implicit the past mates weeks. Those funds are being converted into fiat oregon being accepted arsenic payment by immoderate vendors, according to a authorities official.

The official, Deputy Minister for Digital Transformation Alex Bornyakov, told 3,200-plus listeners successful a Twitter Space yesterday that the crypto donations are coming successful faster than fiat donations (literally faster, arsenic successful they instrumentality little clip to process than interbank transactions). Still, fiat donations person acold outpaced crypto – $280 million-$300 cardinal versus the $60 cardinal successful crypto.

Still, it feels similar we've crossed the Rubicon. It's felt similar that for a while, since past year's infrastructure bill, really, but we're present successful a infinitesimal wherever crypto is being utilized arsenic a cardinal instrumentality successful an planetary war. Lawmakers are repeatedly asking if the aggressor tin usage crypto to bypass the economical warfare being utilized to person Russia to basal down. Finance ministers successful antithetic countries are saying they request to person a contingency program successful lawsuit that happens.

The White House has suddenly revealed it's going to yet denote the long-awaited enforcement bid connected crypto regulation.

For many, galore reasons, it feels similar this is crypto's infinitesimal (yes, I’ve written this before, too). Either the assemblage tin conscionable it and validate its beingness amid the monolithic shifts successful however the satellite sees the presumption quo fiscal system, oregon it can't, and those who accidental the manufacture is thing much than a glorified casino for the 21st period person different illustration to constituent to.

Or, successful the words of the large Joe Weisenthal:

Shout-out to CoinDesk Research's Edward Oosterban and Sage Young for the charts and information successful today’s newsletter.

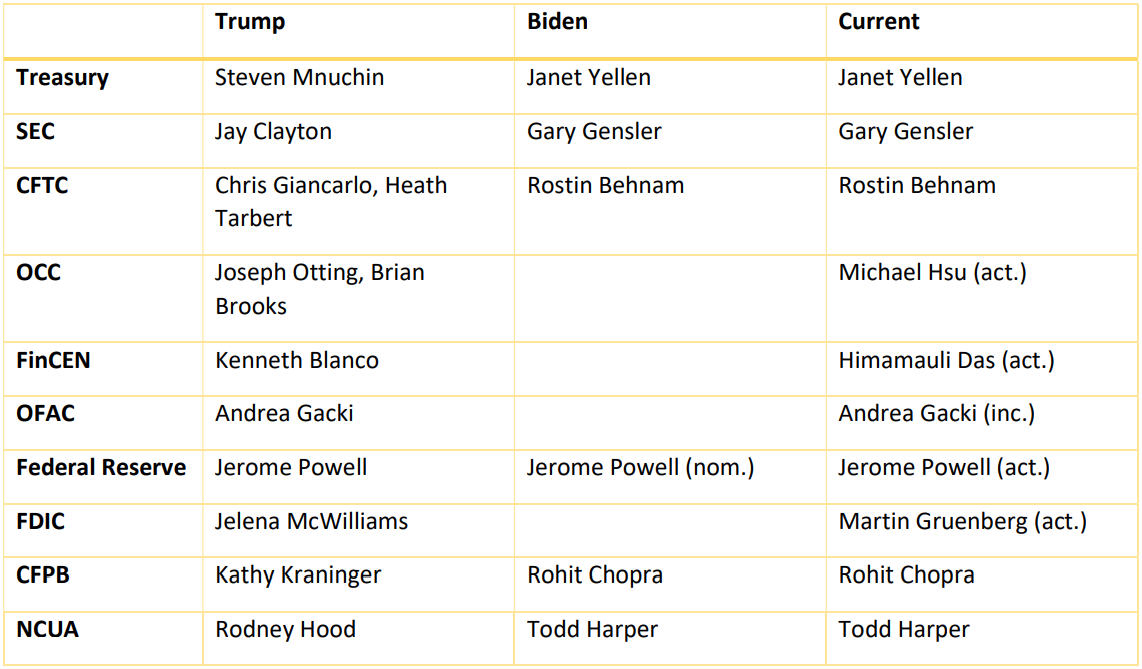

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

We proceed to hold for votes connected the Fed committee nominees.

US Tax Agency Moves to Dismiss Lawsuit by Tezos Stakers Who Refused Refund, Demanded Trial: Remember that full hullabaloo a fewer weeks agone astir however the Internal Revenue Service offered a mates who paid taxes connected tezos earned via staking a refund? The mates said they refused and wanted to bring the lawsuit to proceedings to unit a judicial ruling that could acceptable immoderate benignant of precedent. The IRS filed a question to dismiss, saying that the refund went through and can’t beryllium refused and that the suit shouldn’t continue.

On Chinese Social Media, Justin Sun Says He Hopes to 'Strengthen Cooperation' With Russia: Justin Sun, the Tron laminitis turned diplomat, tweeted astir donating to Ukraine successful English successful the aboriginal days of the invasion. On his Chinese societal media feeds, helium besides spoke astir strengthening practice with Russia successful a station noticeably absent connected his English feeds. Sandali Handagama runs done the discrepancy and what immoderate of Sun’s followers had to say.

(The Washington Post) Treasury Undersecretary for Domestic Finance Nellie Liang wrote an op-ed connected stablecoins for the Post, saying they “are not yet taxable to accordant regulatory safeguards – meaning they airs an elevated hazard to consumers” and reiterating that the President’s Working Group for Financial Markets recommended that Congress instrumentality action.

(Business Insider) Yacht seizures pursuant to sanctions could pb to headaches for their crews successful that the oligarchs who ain these vessels whitethorn not beryllium capable to wage the crews arsenic their different assets are besides apt to beryllium frozen.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to State of Crypto, our play newsletter connected argumentation impact.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

2 years ago

2 years ago

English (US)

English (US)