sponsored

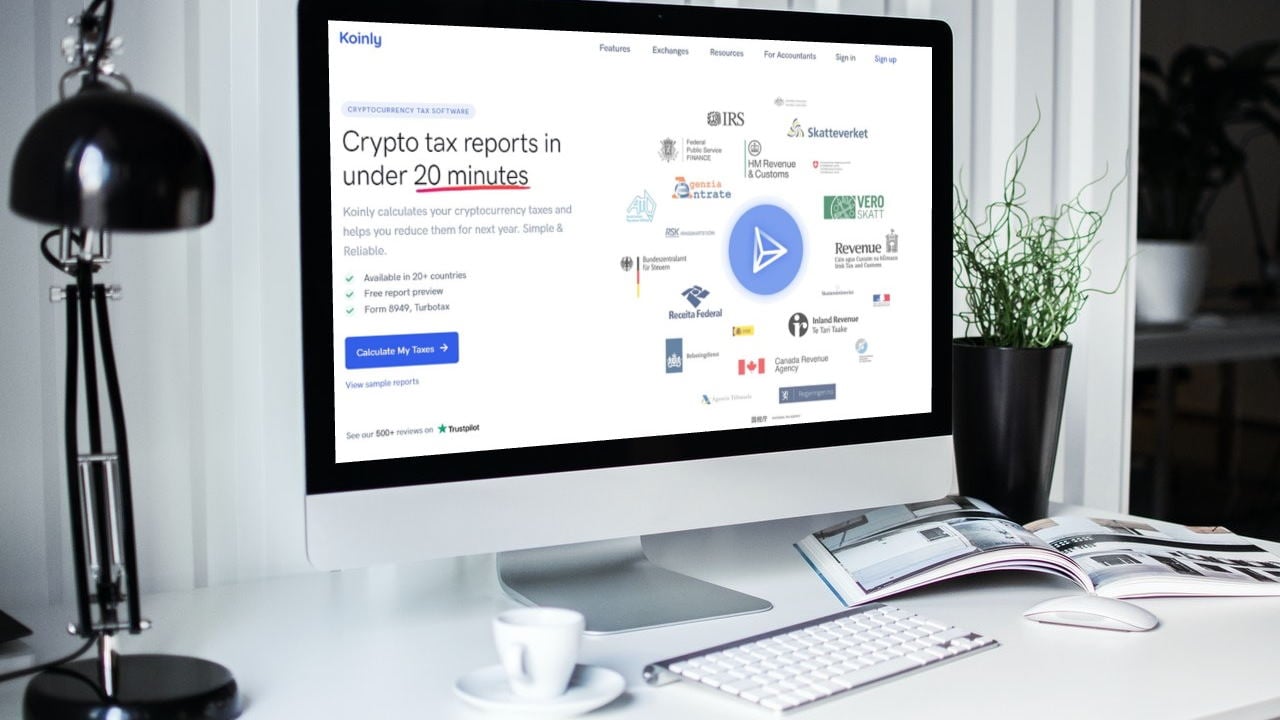

Cryptocurrency users tin look a batch of challenges uncovering the close accusation needed for reporting taxes. Koinly, a starring cryptocurrency taxation calculator and portfolio tracker for traders, has created the eventual usher to help.

Koinly Presents The Ultimate Bitcoin Tax Guide for 2022

Crypto taxation regulations and laws tin beryllium confusing, leaving investors with galore questions astir what crypto taxation looks similar – however overmuch taxation to wage connected Bitcoin and the taxation rate? But bash not worry. Koinly brings an eventual crypto taxation guide to assistance reply each the questions related to crypto taxes and more.

Bitcoin, conscionable similar immoderate different cryptocurrency, is not recognized arsenic a fiat currency – similar USD, GBP and AED, by astir each countries worldwide. For taxation purposes, crypto is an plus & is taxed conscionable similar immoderate different plus – overmuch similar property, stock, oregon shares. So yes, taxes are owed connected Bitcoin.

It does not substance wherever idiosyncratic lives, arsenic astir taxation departments worldwide are cracking down connected crypto and taxing Bitcoin and different cryptocurrencies. Each state has somewhat varying views connected crypto and its taxation. Koinly offers regularly updated guides connected galore countries, including the US and Canada too.

Since Bitcoin is an plus for taxation purposes, the proprietor indispensable wage a Capital Gains Tax anytime an plus is liquidated and disposed of. In what scenarios are Bitcoin disposals taxed?

- When Bitcoin sells for Fiat currency

- When Bitcoin/crypto swaps for different cryptocurrency, including stablecoins

- Goods oregon services bought utilizing Bitcoin

- And successful Ireland, Australia and the UK, the taxation is levied adjacent erstwhile Bitcoin is gifted

Aside from Capital Gains Tax, determination are instances wherever Bitcoin tin beryllium taxed due to the fact that it is besides transacted successful different ways. Bitcoin transactions that could beryllium taxed arsenic income include:

- Getting paid successful Bitcoin – similar a salary.

- Mining Bitcoin – similar income.

- Earning Bitcoin done loaning – similar earning interest.

- Receiving caller coins from a Bitcoin fork – a bonus.

In mentation it is casual to fig retired however overmuch Bitcoin superior gains taxation idiosyncratic needs to pay. You request to cognize the just marketplace worth of Bitcoin connected the time it is received, and connected the time it is disposed successful fiat currency presumption – similar USD oregon GBP. The quality successful terms volition contiguous either a nett oregon a loss, and it’s a nett that attracts superior gains tax. When an individual’s Bitcoin is taxed arsenic income, it volition beryllium taxed astatine the aforesaid complaint arsenic their existent Income Tax rate.

It is important to enactment that the Bitcoin idiosyncratic has paid Income Tax connected volition inactive beryllium taxable to Capital Gains Tax when it is disposed of later. It mightiness look daunting astatine first, but acknowledgment to Koinly, it is not that hard to fig retired crypto tax.

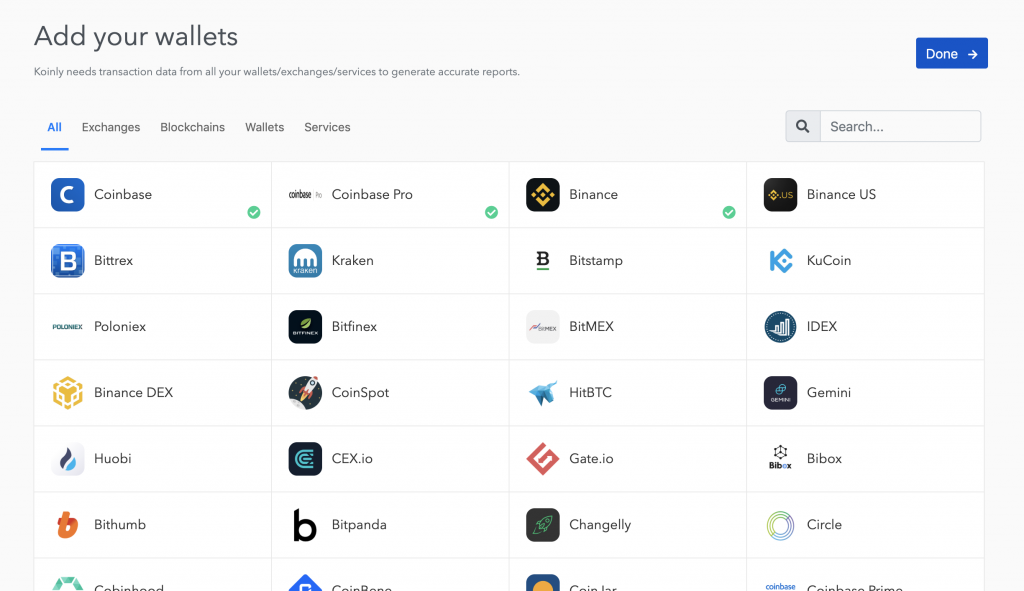

Koinly Screenshot: Add your wallets

Koinly Screenshot: Add your walletsFree Bitcoin Tax Calculator

It is advisable to usage a crypto-tax calculator similar Koinly to enactment tax-compliant due to the fact that the IRS, HMRC, the ATO, the CRA and more, are cracking down hard connected crypto each day. They are moving with large crypto exchanges to summation customers’ accusation and nonstop letters to investors who request to wage Bitcoin tax. Koinly makes it elemental and casual to cipher taxation and hole reports to the taxation office. While determination are different crypto-tax calculators, Koinly is a free Bitcoin taxation calculator, supporting Bitcoin and different large cryptocurrencies, making it easier for users to cipher crypto tax. Koinly is besides adding enactment for aggregate caller tokens and coins each the time; besides keeping up with the perpetually evolving and changing crypto taxation authorities and laws.

It is truthful casual to sign up for an relationship connected Koinly. Once a idiosyncratic has signed up for an account, they tin usage Koinly’s extended functionality to sync each the crypto wallets, exchanges, oregon blockchains they use, with Koinly, via API oregon CSV record upload. Instead of manually calculating taxation rates and formulas to fig retired tax, fto Koinly cipher the taxes for you. It rapidly calculates gains and losses and Bitcoin income and expenses wrong minutes.

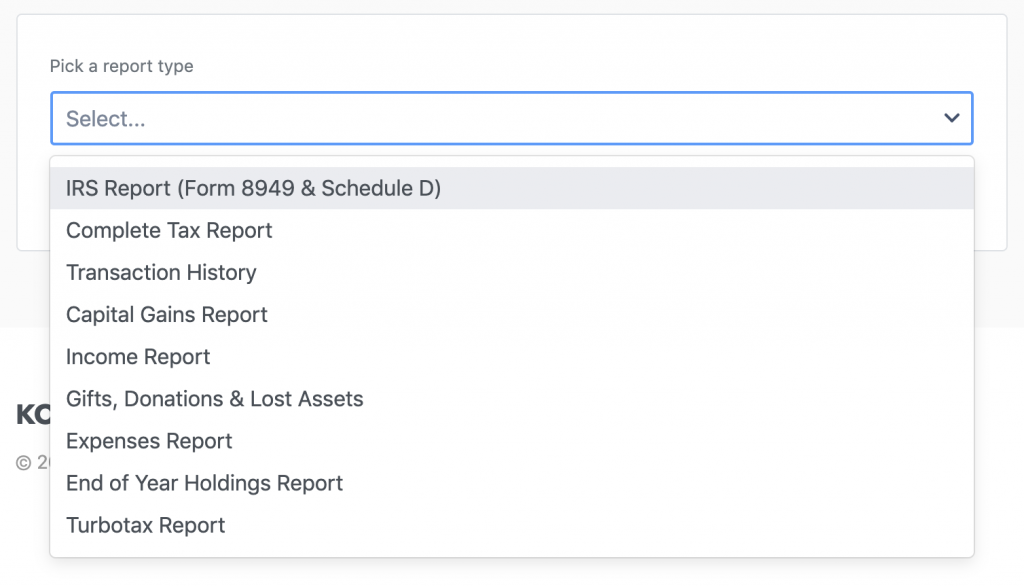

The idiosyncratic tin besides caput to the taxation reports leafage successful Koinly to spot a summary of their Bitcoin taxes. Scrolling down connected the leafage volition assistance the idiosyncratic find the benignant of taxation study they need. They tin download a circumstantial benignant of taxation study based connected their country – similar the IRS Form 8949 and Schedule D for reporting Bitcoin gains for American investors oregon the HMRC Capital Gains Summary Form for reporting Bitcoin gains for UK investors. Koinly tin adjacent make taxation reports for taxation apps similar TurboTax and TaxAct.

Koinly Screenshot: Download your taxation reports

Koinly Screenshot: Download your taxation reportsTo larn much astir crypto taxes successful 2022 cheque retired Koinly today.

This is simply a sponsored post. Learn however to scope our assemblage here. Read disclaimer below.

Bitcoin.com Media

Bitcoin.com is the premier root for everything crypto-related.

Contact [email protected] to speech astir property releases, sponsored posts, podcasts and different options.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)