September’s ostentation data, which had been delayed by the authorities shutdown, is expected to beryllium precocious astatine 3.1% but it is improbable to halt momentum for Fed complaint cuts.

Crypto marketplace observers person locked their regard connected the delayed US ostentation study for September, which is expected to beryllium published connected Friday and transcend 3% for the archetypal clip successful 2025, which could person a knock-on effect connected crypto markets.

The US Bureau of Labor Statistics is scheduled to publish the user terms scale (CPI) for September connected Friday. It has been delayed owed to the ongoing authorities shutdown, which is present successful its 24th day.

Economists forecast that September inflation roseate 0.4% monthly and 3.1% annually, truthful it would beryllium the archetypal clip header CPI would transcend 3% this year, according to Trading Economics.

CPI people could interaction crypto

The CPI study volition beryllium the archetypal large information merchandise since the US authorities shutdown astatine the opening of this month.

Investor Ted Pillows said that if CPI comes successful astatine 3.1% oregon more, the complaint chopped likelihood could spell down, but if it comes successful astatine 3% oregon lower, “it’ll beryllium bully for the markets.”

Related: US gov shutdown ‘likely’ to extremity this week: Trump adviser

Analyst ‘Ash Crypto’ concurred, stating that higher than 3.1% volition beryllium bearish for markets “because it'll people the highest CPI people since June 2024.”

Around 3.1% volition beryllium successful enactment with expectations, but beneath 3.1% is the “perfect script for risk-on assets.”

“Rate cuts volition happen, and besides the MoM summation successful CPI volition beryllium conscionable 0.1% oregon 1.2% annualized. This volition besides boost chances of much complaint cuts and volition origin liquidity to travel into risk-on assets.”“We recognize that the Fed has said that their absorption is present connected the employment picture, but whether tomorrow’s CPI information is simply a batch antithetic than expectations oregon not could inactive person an interaction connected their thinking,” Matt Maley, main marketplace strategist astatine Miller Tabak, told Bloomberg.

“So, it volition inactive person a large interaction connected the markets if it is so retired of enactment with what the statement is thinking,”But hotter-than-expected ostentation figures volition not apt deter the Federal Reserve from cutting rates, according to Barron’s.

The cardinal slope is much focused connected the weakening labour market, and the probability of a complaint chopped adjacent Wednesday is 98.3%, according to CME futures prediction markets.

However, the ongoing authorities shutdown could complicate the economical representation up of the Fed’s December meeting, erstwhile different complaint chopped is expected.

Markets march marginally higher

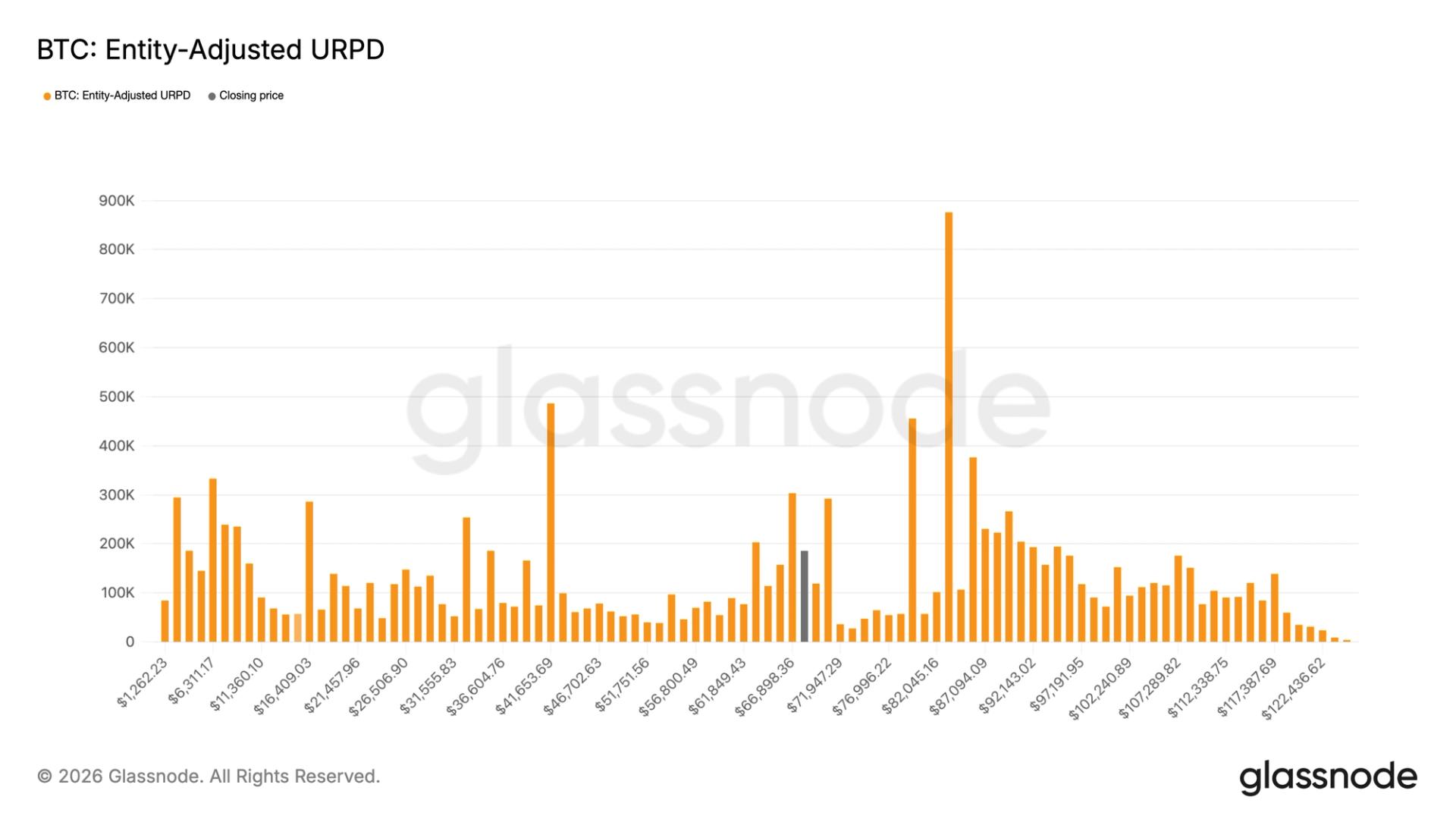

Crypto marketplace capitalization has inched up 1.8% implicit the past 24 hours to scope $3.8 trillion.

Bitcoin (BTC) has led the determination with a little spike supra $111,000 successful precocious trading connected Thursday earlier falling back to the $110,500 level astatine the clip of writing.

Magazine: Bitcoin to endure if it can’t drawback gold, XRP bulls backmost successful the fight: Trade Secrets

4 months ago

4 months ago

English (US)

English (US)