Wintermute, a cryptocurrency marketplace maker, is launching an over-the-counter (OTC) trading level targeting organization investors.

The caller platform, Wintermute Node, volition beryllium a one-stop store providing terms discovery, trading and vulnerability monitoring of integer assets. The single-dealer platform, which volition complaint zero fees, allows clients to straight entree Wintermute’s liquidity implicit API and web interface.

Wintermute Node appears to beryllium competing with the bevy of other organization trading platforms connected the marketplace for entree to crypto bid travel – including FalconX and Coinbase Prime.

“The others are charging a lot,” Wintermute laminitis and CEO Evgeny Gaevoy told CoinDesk successful an interview. “Our level eliminates an other furniture of fees.”

While the caller level volition not complaint immoderate fees, each of the orders placed done Node volition beryllium executed by Wintermute, giving the steadfast entree to a greater measurement of bid flow. Users volition beryllium shown a bid-ask dispersed with prices that are identical to the spreads that the steadfast shows to its counterparties crossed different venues, the steadfast told CoinDesk.

Crypto marketplace makers, similar their counterparts successful accepted fiscal markets, punctuation bargain and merchantability prices for token pairs, and nett by pocketing the spread.

“We tin besides bash much connected the structured products side,” added Gaevoy, who roseate to caput the ETF concern astatine marketplace making steadfast Optiver earlier launching Wintermute.

The caller Node API expands connected Wintermute’s existing OTC API, which archetypal launched successful June 2021.

Founded successful 2017, Wintermute has grown to go 1 of the largest and astir progressive crypto marketplace participants. According to a property release, the steadfast presently trades successful implicit 60 centralized and decentralized trading venues.

“We’re connected to the astir liquidity sources – that’s the main happening differentiating us,” said Gaevoy, who added that Wintermute is progressive successful making markets for implicit 250 tokens.

Most recently, Wintermute was 1 of 2 marketplace makers retained by Yuga Labs – the institution down the NFT postulation Bored Ape Yacht Club – to jump-start trading for its ApeCoin token.

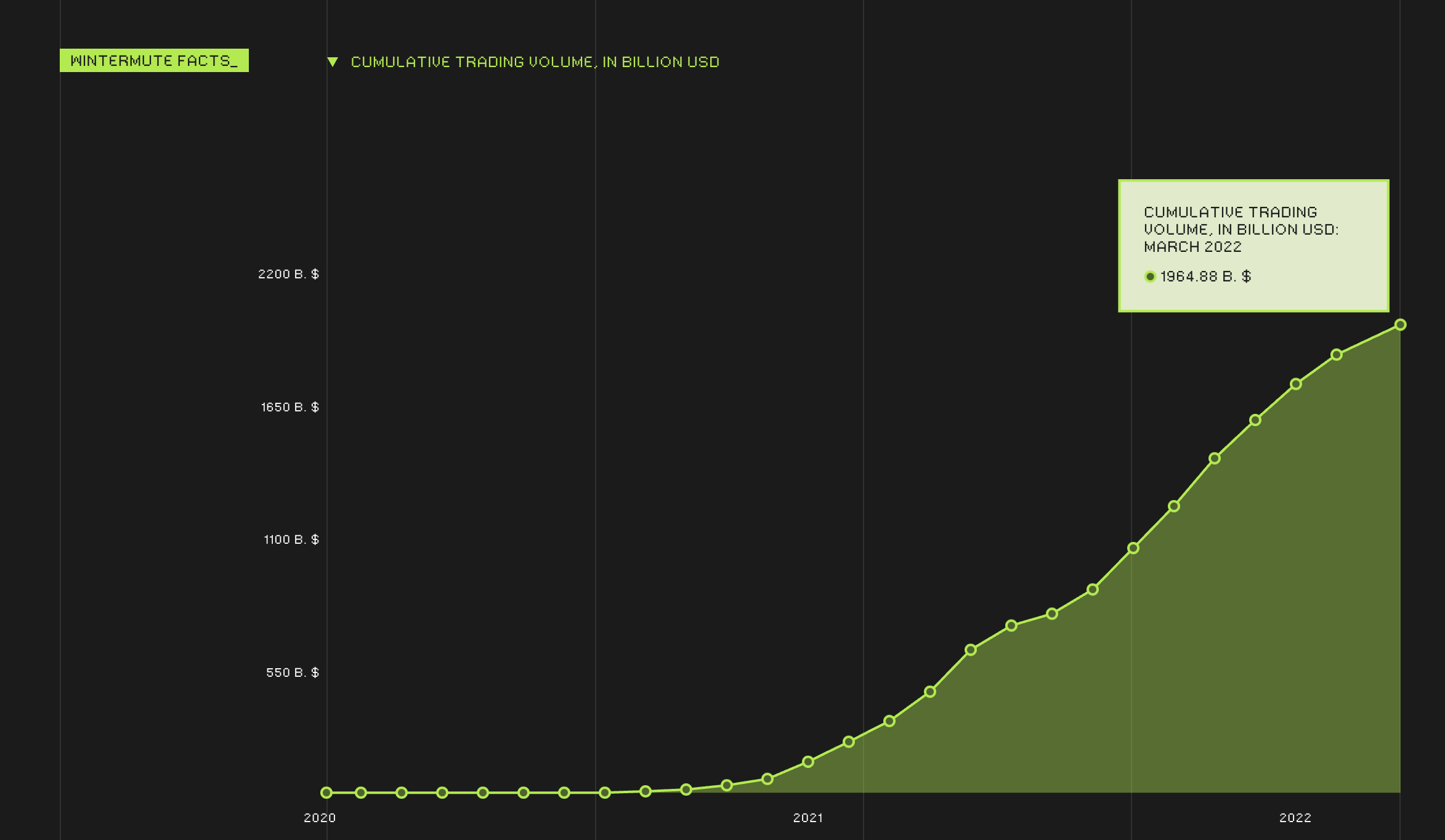

Since inception, Wintermute has done astir $2 trillion successful cumulative trading volume, with implicit 90% of that fig traded since 2021. The steadfast says it trades implicit $5 cardinal successful measurement daily.

“If you are a idiosyncratic oregon an entity progressive connected exchanges, aggregators, brokers oregon borrowing-lending platforms, determination is simply a bully accidental your transactions are really executed by Wintermute,” said Gaevoy successful a statement.

Wintermute cumulative trading volumes (Source: Wintermute).

With its caller platform, Wintermute besides appears to beryllium vertically integrating its concern exemplary by gathering a nonstop pipeline to large crypto buyers and their bid flow.

Wintermute has besides been much progressive successful the venture capital front, participating successful implicit 40 effect and bid A investments past year. Some of their investments see Aave, dYdX, Polygon and Paraswap.

The determination follows successful the footsteps of Jump Crypto and Alameda Research, different influential crypto marketplace makers and possibly 2 of Wintermute’s largest competitors successful the space. Jump and Alameda some built up their trading businesses earlier expanding to task superior and beyond.

“We privation to screen much of the ecosystem," said Gaevoy. "The much counterparties we have, the much businesslike we tin be.”

Institutional investors are progressively prioritizing execution prime and minimizing fees, signaling the slow-but-sure maturation of crypto markets.

“Retail is not arsenic delicate erstwhile it comes to execution quality, but erstwhile you speech to funds oregon whales, they bash care,” Gaevoy told CoinDesk.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)