Low-income households successful the United States are turning crypto profits into opportunities for homeownership, arsenic revealed by a Nov. 26 report from the Office of Financial Research (OFR), a US Treasury Department probe arm.

Samuel Hughes, Francisco Ilabaca, Jacob Lockwood, and Kevin Zhao conducted the survey based connected taxation data. It offers a important look astatine however crypto is shaping fiscal behaviors successful economically susceptible communities.

Mortgage and auto-debts

The study noted the emergence of “high-crypto” areas, defined arsenic zip codes wherever implicit 6% of households reported crypto holdings successful taxation filings. These regions person seen a important uptick successful owe and car indebtedness activity, coinciding with important crypto marketplace gains.

In these high-crypto areas, low-income households experienced a surge successful owe enactment betwixt 2020 and 2024. The fig of consumers with mortgages grew by much than 250%, portion mean owe balances jumped from $172,000 successful 2020 to $443,000 successful 2024, an summation of implicit 150%.

These figures suggest that crypto windfalls person enabled galore families to unafraid larger loans and participate the lodging market.

The study stated:

“For low-income households, mean owe indebtedness balances and mortgage-holding rates sharply accrued successful zip codes with precocious crypto exposure. This indicates that low-income households whitethorn beryllium utilizing crypto gains to instrumentality retired caller mortgages and to instrumentality retired larger mortgages.”

The study besides sheds airy connected car indebtedness trends successful these areas. Among low-income households, car indebtedness balances roseate astir sharply successful high-crypto regions. Interestingly, portion delinquency rates accrued successful low- and mid-crypto zip codes, they declined successful high-crypto areas. This signifier suggests that crypto net whitethorn beryllium helping immoderate households negociate car indebtedness payments much effectively.

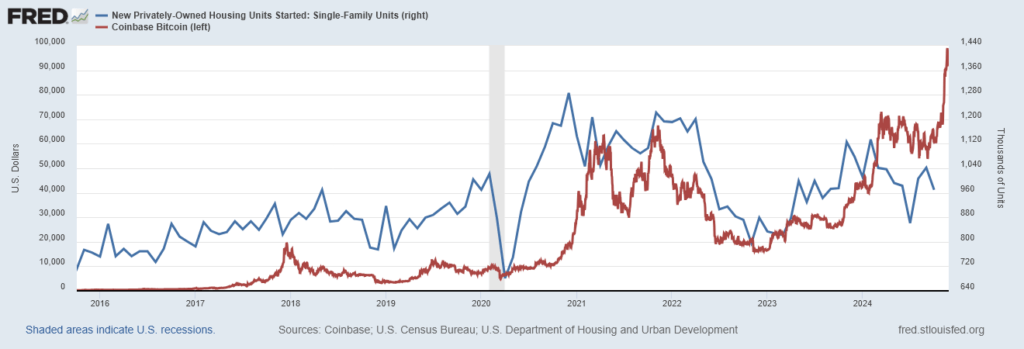

Since the 2008 banking crisis, which led to wide defaults, single-family location ownership has ne'er recovered. However, since Bitcoin’s inception successful 2009 figures person continued to rise. While the correlation is not indicative of causation, it is absorbing to enactment that the 2021 bull tally and consequent carnivore marketplace of 2022 besides saw increases and declines successful caller single-family homes.

U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Single-Family Units [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, November 27, 2024

U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Privately-Owned Housing Units Started: Single-Family Units [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/HOUST1F, November 27, 2024Risks

Despite these affirmative trends, the researchers pass of imaginable risks tied to rising indebtedness and leverage among low-income households with important crypto exposure.

While delinquencies stay debased overall, economical downturns oregon a slump successful the crypto marketplace could pb to fiscal instability. The attraction of vulnerability successful systemically important institutions could amplify these risks.

The researchers concluded:

“An important takeaway for aboriginal monitoring is the accrued indebtedness balances and leverage among low-income households with crypto exposure. Rising distress successful this radical could origin aboriginal fiscal stress, particularly if vulnerability to these types of high-leverage, high-risk consumers is concentrated successful systemically important institutions.”

The station Crypto windfalls boost homeownership dreams for low-income Americans appeared archetypal connected CryptoSlate.

11 months ago

11 months ago

English (US)

English (US)