Aside from bringing the satellite to a standstill, the 2020 pandemic brought connected the largest fiscal stimulus programme ever seen.

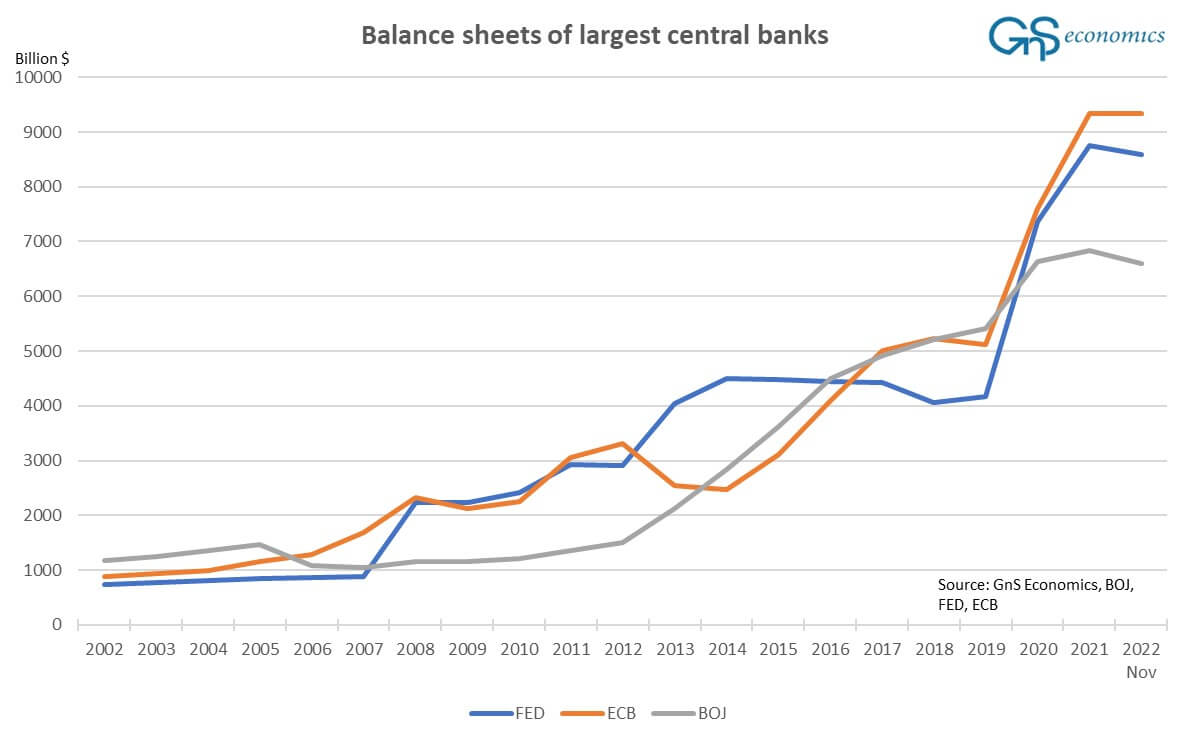

Two of the largest cardinal banks successful the satellite — the U.S. Federal Reserve and the European Central Bank (ECB) — saw their equilibrium sheets treble successful little than a year. The Federal Reserve accrued its equilibrium expanse from conscionable implicit $4 trillion astatine the extremity of 2019, to implicit $8.7 trillion astatine the extremity of 2020.

The European Central Bank grew its equilibrium expanse from $5 trillion to implicit $9 trillion successful a year. Meanwhile, the Bank of Japan was much blimpish with its equilibrium sheet, adding astir $1.5 trillion successful a twelvemonth to scope a full of astir $7 trillion successful 2021.

Balance sheets of the US Fed, the ECB, and the Bank of Japan (Source: GnS Economics)

Balance sheets of the US Fed, the ECB, and the Bank of Japan (Source: GnS Economics)The historically unprecedented stimulus programme has resulted successful rampant ostentation that’s yet to scope its peak. Consumer terms indexes crossed the satellite person been steadily expanding since 2020 and person picked up gait successful the 2nd 4th of 2022.

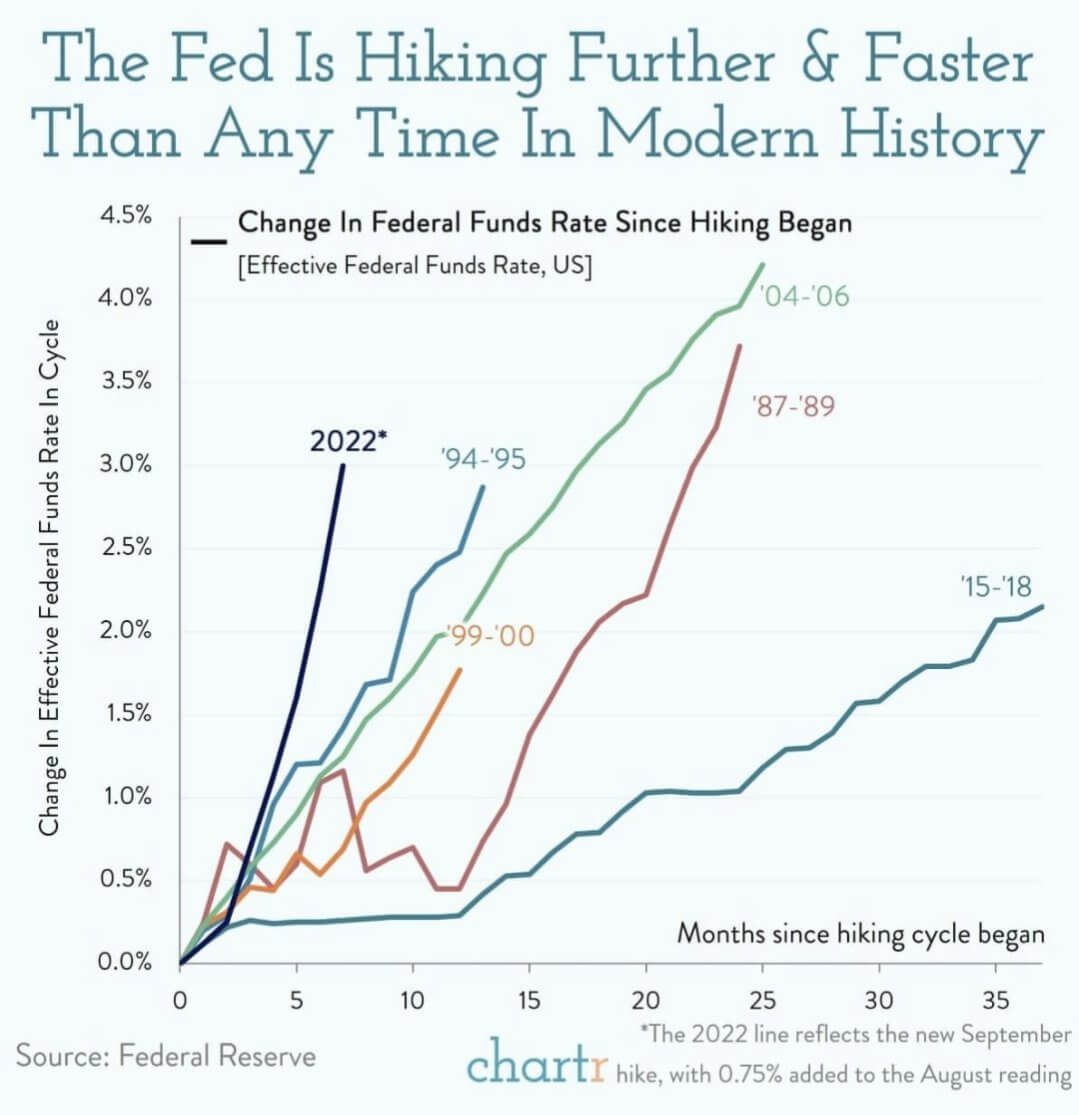

To curb the rising CPI, cardinal banks astir the satellite are racing to summation involvement rates and marque lending much expensive. Since the opening of 2022, ostentation successful the U.S. has been rising astatine specified an alarming pace, the Federal Reserve has embarked connected the quickest complaint of involvement complaint hikes successful modern history.

Graph showing the alteration successful the Federal funds complaint since involvement complaint hikes began (Source: The Federal Reserve)

Graph showing the alteration successful the Federal funds complaint since involvement complaint hikes began (Source: The Federal Reserve)Looking astatine the single-digit CPI summation successful the U.S. fails to amusement conscionable however assertive ostentation truly is. Since 2020, galore commodities person seen triple-digit increases, with state seeing its terms summation by much than 233% successful 2 years. The prices of wheat, corn, and fabric accrued by implicit 100% each.

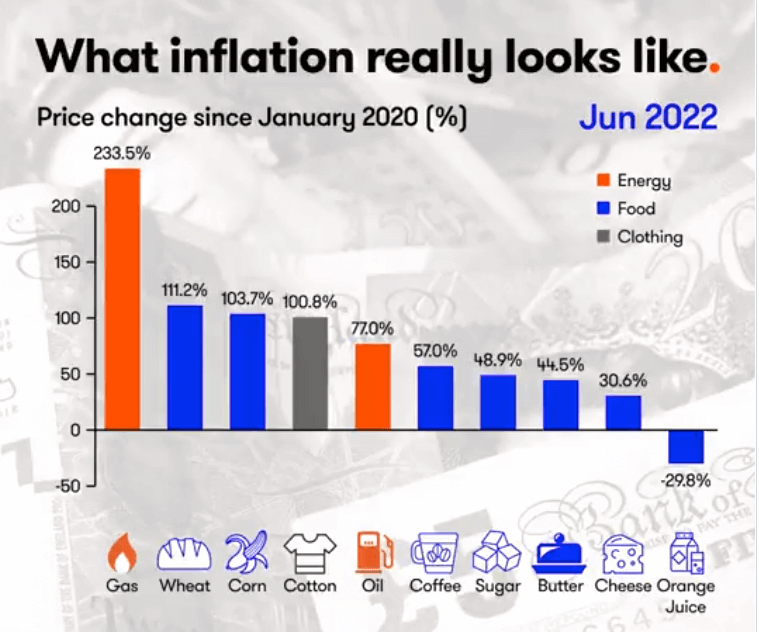

Price alteration successful commodities and user goods successful the U.S. (Source: Interactive Investor)

Price alteration successful commodities and user goods successful the U.S. (Source: Interactive Investor)Traditional fiscal assets person besides seen an incredibly volatile mates of years.

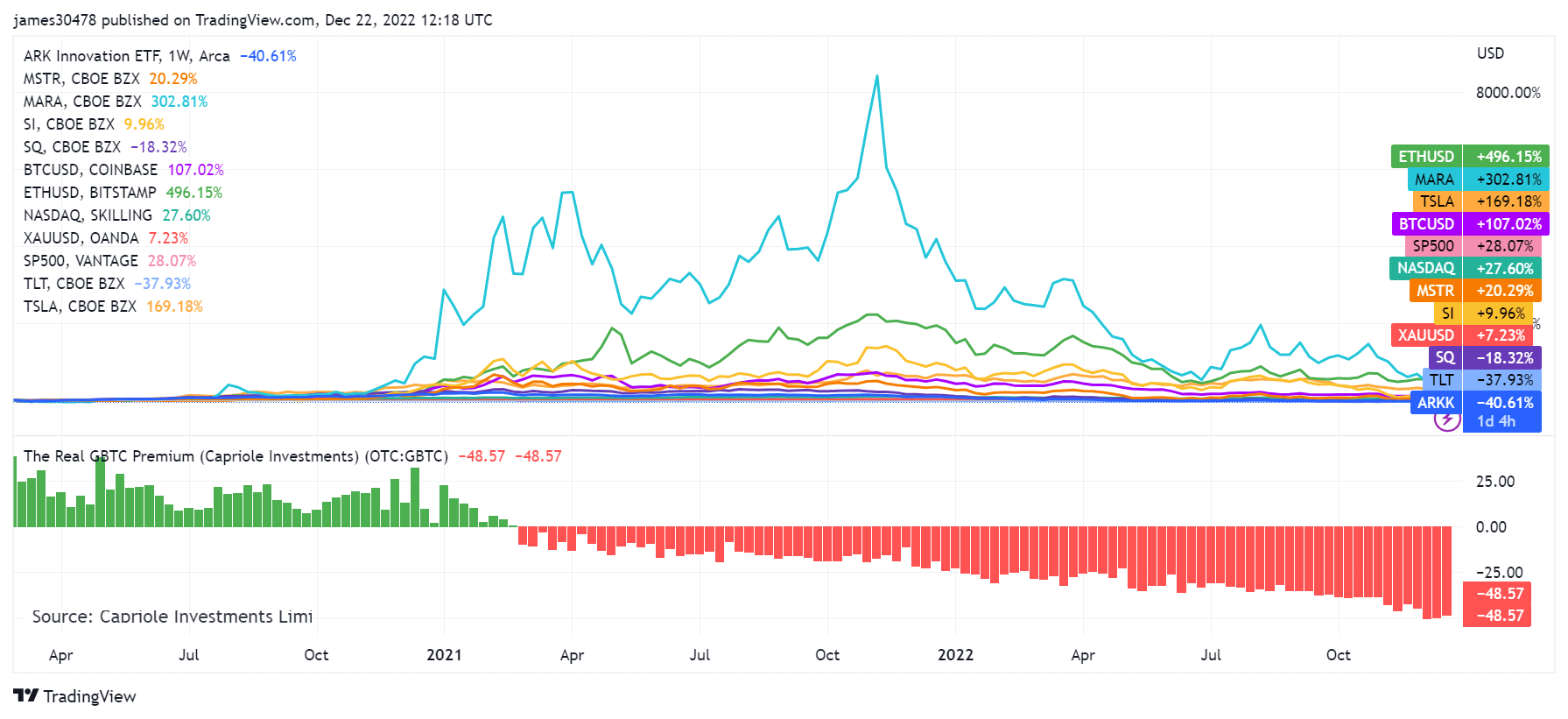

Nasdaq and the S&P 500 managed to station humble maturation that has been much oregon little successful enactment with ostentation successful the past year, with the erstwhile expanding by 27.6% and the second increasing by 28%.

Gold saw a comparatively level year, increasing lone 7.23% since 2020.

Long-term U.S. Treasury bonds person seen their worth alteration by much than 39% since January 2020, showing investors person mislaid assurance successful 20+ twelvemonth authorities bonds.

On the different hand, the crypto manufacture and the companies operating wrong it not lone outpaced ostentation but near astir each accepted assets successful the dust.

Ethereum and Bitcoin person appreciated astir 496.15% and 107.02% respectively since January 2020.

Marathon Digital, 1 of the largest publically traded Bitcoin miners, saw its banal summation by 302.81%, portion Tesla appreciated astir 170% during the aforesaid period.

Other ample crypto and crypto-connected companies appreciated arsenic good — Michael Saylor’s Microstrategy accrued implicit 20%, portion Silvergate saw its banal emergence astir 10%.

Graph showing the complaint of appreciation from January 2020 to December 2022 for ARKK, MSTR, MARA, SI, SQ, BTCUSD, ETHUSD, NASDAQ, XAUUSD, SP500, TLT, TSLA, and GBTC (Source: TradingView CryptoSlate)

Graph showing the complaint of appreciation from January 2020 to December 2022 for ARKK, MSTR, MARA, SI, SQ, BTCUSD, ETHUSD, NASDAQ, XAUUSD, SP500, TLT, TSLA, and GBTC (Source: TradingView CryptoSlate)However, the crypto manufacture saw immoderate losers arsenic well. The ARK Innovation ETF, a money tracking Cathie Wood’s Ark Invest, dropped over 40% successful 2 years.

Square, Jack Dorsey’s fiscal tech company, posted a nonaccomplishment of 18.32%.

Grayscale’s Bitcoin’s spot mislaid astir 50% of its value against Bitcoin’s NAV since 2020. Before the pandemic, GBTC was trading astatine a 20% premium to Bitcoin’s marketplace price.

The station Cryptocurrencies are outpacing ostentation – but accepted assets are not appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)