The biggest quality successful the cryptosphere for Oct. 10 includes Google’s caller concern with Coinbase to commencement accepting crypto payments, Bittrex’s $30 cardinal good for violating national sanctions, and the SEC’s rejection of WisdomTree’s Spot Bitcoin ETF for not having capable surveillance.

CryptoSlate Top Stories

Google to integrate crypto payments with unreality services from 2023 via Coinbase partnership

Google and Coinbase are collaborating to motorboat a crypto payments solution. Upon the announcement, COIN shares recorded a spike of 6%.

The duo volition let Google unreality services users to wage via cryptocurrencies supported successful Coinbase. Google volition besides store its crypto holdings utilizing Coinbase Prime.

Bittrex to wage $30M for sanctions violation

Crypto speech level Bittrex was fined $30 cardinal by the U.S. Treasury Department’s Office of Foreign Assets (OFAC) and the Financial Crimes Enforcement Network (FinCEN) for violating national sanctions.

Bittrex allowed astir 1,800 individuals from sanctioned regions similar Iran, Crimea, and Syria to behaviour crypto transactions connected its level betwixt 2014 and aboriginal 2017. The speech agreed to wage the good and marque indispensable adjustments to comply with the sanctions.

SEC rejects WisdomTree’s Spot Bitcoin ETF

The U.S. Securities and Exchange Commission (SEC) rejected the Wisdom Tree Bitcoin (BTC) Trust ETF for not offering a valid measurement that could support investors against marketplace manipulation.

The SEC said that fixed the highly unregulated quality of the crypto market, the surveillance was important earlier approving immoderate spot Bitcoin-ETF.

Temple DAO hacked for implicit $2.3M

Temple DAO was hacked connected Oct. 11 and mislaid 1,831 Ethereum (ETH), equating to implicit $2.3 million. The task squad offered a bounty connected the hacker’s caput and unopen down the dApp to forestall accidental usage.

#PeckShieldAlert Seems similar @templedao got exploited. The exploiter funded from SimpleSwap and already transferred 1,831 $ETH (~$2.34M) to a caller code 0x2B63d…B5A0 @peckshield https://t.co/bOyOARyyxY pic.twitter.com/SVEm8o95U6

— PeckShieldAlert (@PeckShieldAlert) October 11, 2022

Coffeezilla calls retired Celsius laminitis Alex Mashinsky for dumping CEL tokens

Crypto sleuth Coffeezilla blamed Celsius (CEL) laminitis Alex Mashinsky for allegedly dumping implicit 10,000 CEL tokens during the aboriginal hours of Oct. 11.

Coffeezilla published his accusations connected his Twitter relationship arsenic a thread. Mashinsky’s wallet code was aboriginal identified by Nansen, which revealed that astir 10,000 CEL tokens were so swapped for astir $9300 USD Coins(USDC).

BNY Mellon receives New York support for crypto custodial services

Bank of New York Mellon (BNY Mellon) was approved to connection integer assets custody services connected Oct. 11. With that, BNY Mellon customers volition beryllium capable to store keys to their assets with the bank.

CNN’s NFT marketplace shutdown sparks rug propulsion accusations

CNN’s NFT Marketplace “Vault by CNN” announced that it unopen down. The level was launched successful the summertime of 2021 during the NFT boom, and its unexpected shutdown sparked talks of a imaginable rug pull.

A spokesperson from CNN responded to the community’s concerns by saying that Vault by CNN holders tin expect to beryllium compensated with astir 20% of the distributions based connected the NFTs successful their wallets.

Research Highlight

Liquidations expected arsenic Bitcoin unfastened interest, leverage ratio spike higher

Given the authorities of the fiat marketplace and Bitcoin’s comparatively level terms movements, which remained betwixt $18,400 and $22,800 implicit the past months, Bitcoin mightiness beryllium giving signals of decoupling from bequest markets.

CrytpoSlate analysts examined 3 antithetic indicators; Bitcoin Futures Estimated Leverage Ratio (ELR), Futures Open Interest, and Futures Perpetual Funding Rates (FPFR) to observe that the crypto marketplace is importantly blistery and overleveraged to the upside.

This is an indicator for the upcoming wide liquidations period, which mightiness diminution the plus prices led by Bitcoin.

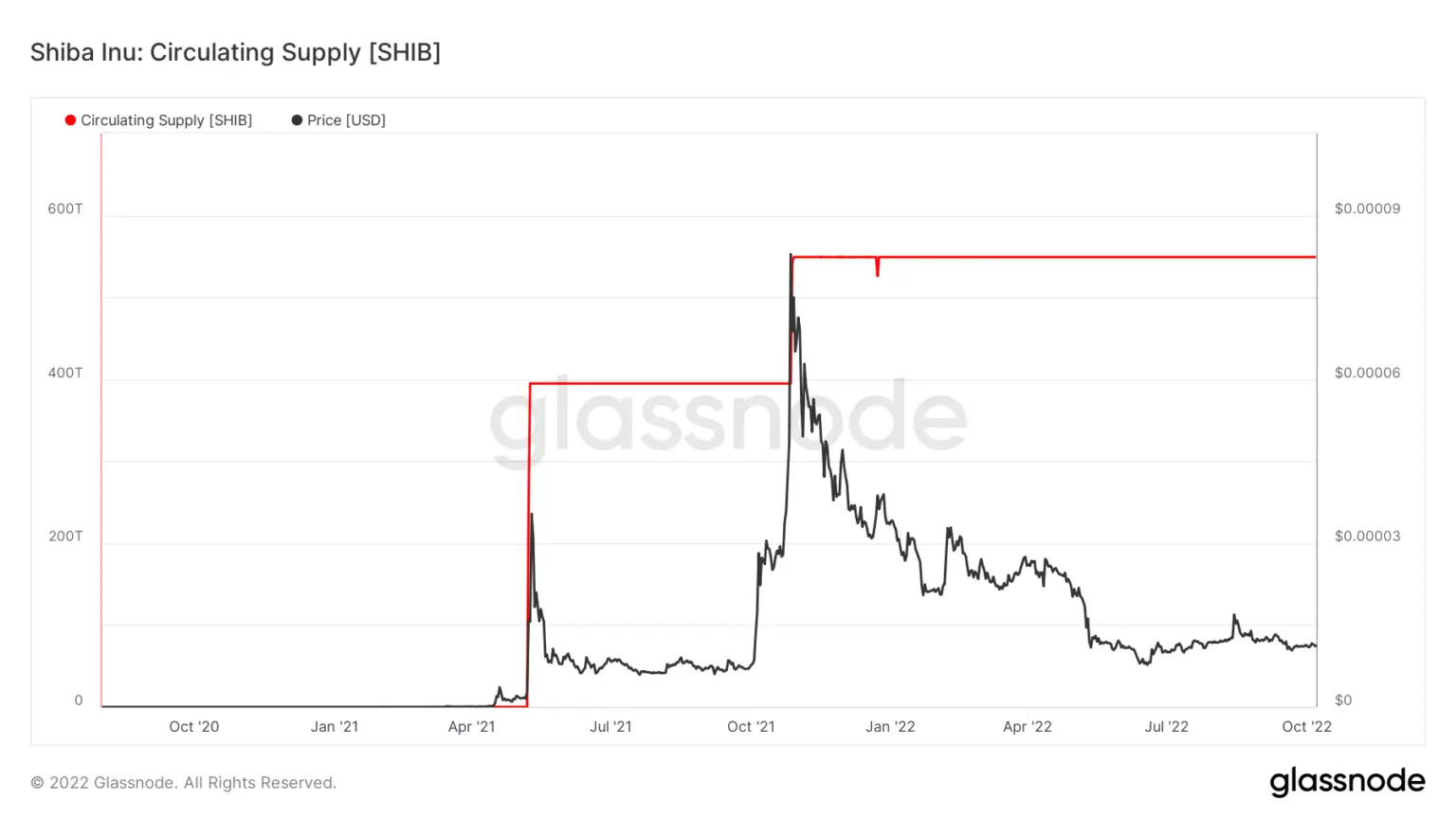

Research: What precisely happened successful 2021 for Shiba Inu?

Shiba Inu (SHIB) soared done 2021, lone to support falling successful 2022. CryptoSlate analysts identified a quality successful the magnitude of SHIB held by exchanges successful some large SHIB unlocks.

Circulating Supply SHIB

Circulating Supply SHIBSHIB was released for the archetypal clip successful April/May, which soared the terms and the magnitude of SHIB tokens held connected exchanges. The 2nd large unlock took spot successful October/November and recorded a caller terms ATH. However, SHIB tokens held by exchanges decreased drastically.

SHIB terms lone continued to autumn from that constituent on. According to CryptoSlate data, SHIB fell by 58.32% successful the past 365 days, and the existent terms lingers astir $0.000011, which is 88% little than its ATH.

News from astir the Cryptoverse

YugaLabs faces SEC probe for unregistered offerings

Bored Ape creators, Yuga Labs is facing an probe from the SEC, according to Bloomberg. The committee is examining the legality of Yuga Labs’ high-value NFT sales.

Crypto Market

Bitcoin (BTC) decreased by 1.19% successful the past 24 hours to beryllium traded at $19,003, portion Ethereum (ETH) besides fell by 2.02% to commercialized astatine $1,282.

Biggest Gainers (24h)

- TerraUSD (USTC): +34.71%

- Hedera (HBAR): +2.48%

- Huobi Token (HT): +1.57 %

Biggest Losers (24h)

- ApeCoin (APE): -11.11%

- Ravencoin (RVN): -7.64%

- NEAR Protocol (NEAR): -7.45%

The station CryptoSlate Wrapped Daily: Another Spot Bitcoin ETF gets rejected by SEC; Google, Coinbase spouse for crypto payments appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)