The biggest quality successful the cryptoverse for Nov. 22 includes the expanding complaint of miner sellouts, realized Bitcoin nonaccomplishment from FTX fallout surpassing the losses caused by the Terra collapse, and Digital Currency Group CEO Barry Silbert’s comments regarding the liquidity concern astatine Genesis.

CryptoSlate Top Stories

Bitcoin miners selling aggressively arsenic crypto marketplace continues to struggle

Selling unit connected Bitcoin (BTC) miners continues arsenic the Bitcoin terms struggles beneath the $16,000 mark.

It's a Bitcoin miner bloodbath.

Most assertive miner selling successful astir 7 years now.

Up 400% successful conscionable 3 weeks!

If terms doesn't spell up soon, we are going to spot a batch of Bitcoin miners retired of business. pic.twitter.com/4ePh0TIPmZ

— Charles Edwards (@caprioleio) November 21, 2022

According to Capriole Fund’s laminitis Charles Edwards, miners are selling astatine their astir assertive levels successful 7 years, with a 400% summation successful selling unit implicit the past 3 weeks.

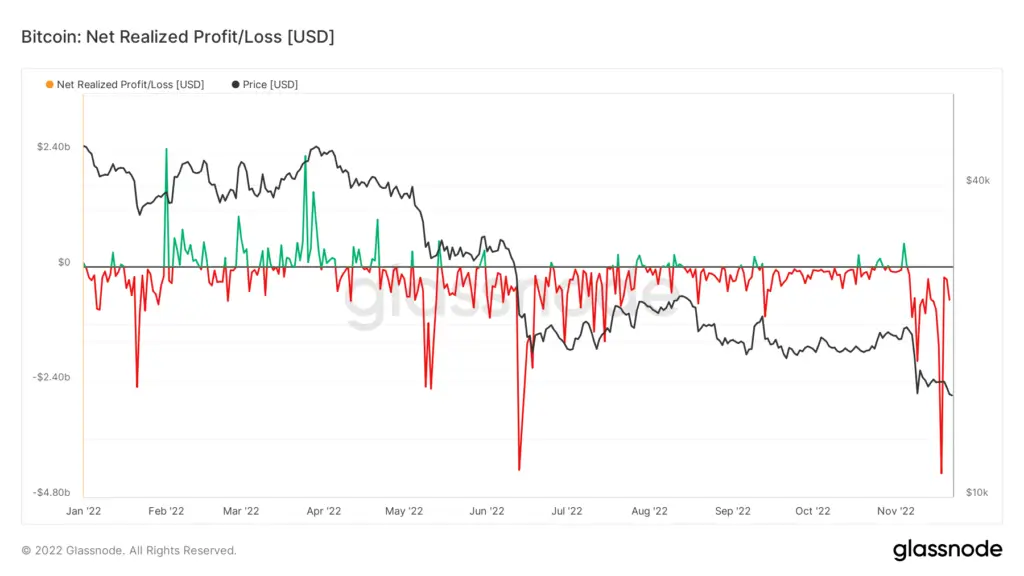

Realized Bitcoin nonaccomplishment from the FTX fallout surpasses LUNA collapse

Realized Bitcoin nonaccomplishment owed to the FTX illness has exceeded the losses caused by the Terra (Terra) illness successful May.

Bitcoin nett realized loss:profit

Bitcoin nett realized loss:profitThe archetypal question of selling unit came successful November and accrued the realized nonaccomplishment to astir $2 billion. According to data, realized Bitcoin losses reached their yearly precocious of $4.3 billion.

Digital Currency Group CEO Barry Silbert downplays FTX interaction connected Genesis, expects $800M gross successful 2022

Digital Currency Group‘s (DCG) CEO, Barry Silbert, sent a memo to the institution shareholders to code the concerns regarding the liquidity of Genesis

Silbert explained that the suspension of withdrawals astatine Genesis’ lending limb is owed to an contented of “liquidity and duration mismatch.” He continued to accidental that this contented has nary important interaction connected Genesis and expects the DCG to scope $800 cardinal successful gross successful 2022.

FTX bought $121M properties successful Bahamas wrong 2 years

FTX, its elder executives, and Sam Bankman-Fried‘s (SBF) parents bought astatine slightest 19 properties successful the Bahamas successful the past 2 years. The properties are worthy $121 cardinal successful total.

Seven of these properties were condominiums successful a grounds assemblage called Albany and were purchased by FTX, which are worthy astir $72 cardinal successful total. FTX co-founder Gary Wang, SBF, and erstwhile caput of engineering Nishad Singh besides purchased condos worthy $950,000 and $2 cardinal for residential use.

FTX ordered to indemnify and reimburse Bahamas for assets safekeeping

On Nov. 21, the Bahamas Supreme Court ordered FTX to indemnify and reimburse the Securities Commission of Bahamas (SCB) for expenses it volition brushwood portion safekeeping its integer assets.

The watchdog said:

“[The tribunal order]confirms the Commission is entitled to beryllium indemnified nether the instrumentality and FDM shall yet carnivore the costs the Commission incurs successful safeguarding those assets for the payment of FDM’s customers and creditors, successful a mode akin to different mean costs of administering FDM’s assets for the payment of its customers and creditors.”

Binance muscles successful connected hardware wallet assemblage with bid A concern successful NGRAVE

Exchange elephantine Binance announced that it would beryllium starring wallet shaper NGRAVE’s upcoming bid A backing round.

NGRAVE was founded successful 2018 and aimed to alteration the mode radical acquisition crypto by eliminating the accidental of loss. The squad said that they made empowering radical their ngo to let them to maestro their wealthiness and beryllium escaped to unrecorded the beingness they want.

U.S. Senators impulse Fidelity to driblet BTC amid FTX fallout

Three U.S. senators composed a missive and sent it to Fidelity Investments to inquire them to reconsider its determination to connection Bitcoin vulnerability successful its 401(k) plans. The missive expressed the Senators’ concerns astir the FTX fallout.

The missive stated:

“Once again, we powerfully impulse Fidelity Investments to reconsider its determination to let 401(k) program sponsors to exposure program participants to Bitcoin.

Since our erstwhile letter, the integer plus manufacture has lone grown much volatile, tumultuous, and chaotic—all features of an plus people nary program sponsor oregon idiosyncratic redeeming for status should privation to spell anyplace near.”

Binance CZ denies Bloomberg study of Abu Dhabi fundraising attempt

Bloomberg published a study connected November 21, saying that Binance was gathering with investors from Abu Dhani to rise currency for the industry’s recovery.

NEW: Abu Dhabi investors met with Binance to rise currency for manufacture betterment money – Bloomberg

— Bitcoin Archive

(@BTC_Archive) November 22, 2022

(@BTC_Archive) November 22, 2022

On Nov.22, Binance CEO Changpeng Zhao replied to this quality and denied its truth.

Justin Sun wants to reportedly bargain FTX assets

TRON Dao (TRX) laminitis Justin Sun reportedly revealed his involvement successful buying FTX assets. He reportedly talked to Singaporean journalists astir FTX and said:

“We are unfastened to immoderate benignant of deal. I deliberation each the options [are] connected the table. Right present we are evaluating assets 1 by one, but arsenic acold arsenic I recognize the process is going to beryllium agelong since they are already successful this benignant of bankruptcy procedure.”

Craig Wright creates ambiguity implicit Satoshi posts connected BitcoinTalk forum

Craig Wright claimed that the existent Satoshi sends lone immoderate posts sent by Satoshi to the BitcoinTalk forum.

Wright claimed to beryllium Satoshi himself and said that “It is simply a story that each the posts connected Bitcointalk (bitcointalk.org) from my relationship (Satoshi) are, successful fact, excavation and person not been edited oregon changed and that the login connected the website belongs to me.”

Research Highlight

Research: Long-term Bitcoin holders stubbornly clasp connected contempt 33% holding losses

Even though Bitcoin marked its 106-week debased and sank to $15,500, Long Term Holders (LTH) defy getting caught successful the contagion fears and are continuing to accumulate.

Total proviso held by semipermanent holders

Total proviso held by semipermanent holdersThe full proviso held by semipermanent holders (TSHLTH) refers to Bitcoin that is held for longer than six months. The illustration supra demonstrates that the LTHs are accumulating during terms suppression and selling during bull runs.

The existent TSHLTH level is astatine 13.8 cardinal Bitcoin, which corresponds to 72% of the circulating proviso and marks an all-time precocious for this metric.

News from astir the Cryptoverse

FTX Japan to let withdrawals this year

According to section quality sources, FTX Japan is looking to let withdrawals by the extremity of this year. To marque that possible, the Japanese corp is processing its ain strategy to let withdrawals. Reportedly, FTX Japan presently holds 19.6 cardinal Yen successful currency and deposits.

FTX and Alameda mislaid billions earlier 2022

According to an nonfiction by Forbes, FTX and Alameda Research person mislaid $3.7 cardinal earlier 2022. This challenges the representation SBF built for FTX and Alameda and makes the assemblage question the highly profitable 2021 year.

Crypto Market

In the past 24 hours, Bitcoin (BTC) accrued by 2.08% to commercialized astatine $16.149, portion Ethereum (ETH) spiked by 2.09% to commercialized astatine $1,128.

Biggest Gainers (24h)

- Curve DAO Token (CRV): +28.55%

- Holo (HOT): +13.33%

- Litecoin (LTC): +13.3%

Biggest Losers (24h)

- Immutable X (IMX): -6.26%

- GMX (GMX): -6.09%

- Chiliz (CHZ): -4.84%

The station CryptoSlate Wrapped Daily: Bitcoin miners proceed to merchantability arsenic realized nonaccomplishment from FTX exceeds LUNA collapse appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)