Darius Dale is the Founder and CEO of 42 Macro, an concern probe steadfast that aims to disrupt the fiscal services manufacture by democratizing institutional-grade macro hazard absorption processes.

Key Takeaways

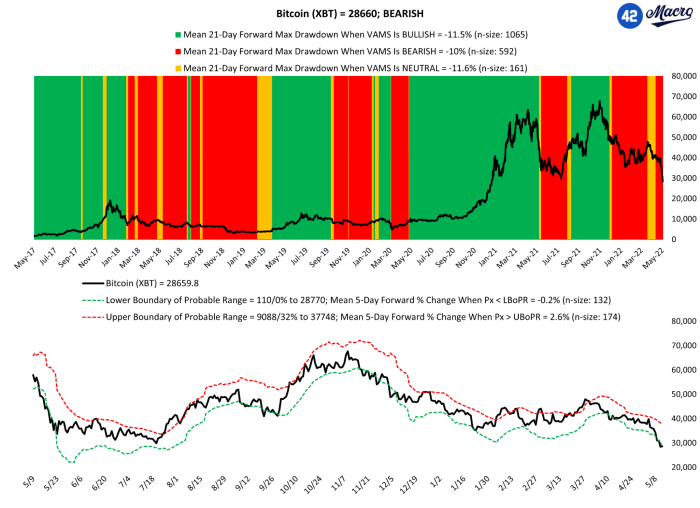

Short-Term (less than 1 month): Our marketplace signaling process is pointing to a continuation of the challenging situation for hazard assets. While a downside astonishment successful the U.S. April CPI information provided immoderate reprieve, we, astatine 42 Macro, don’t deliberation a grossly anticipated antagonistic complaint of alteration inflection volition bash overmuch successful isolation to catalyze a durable bottommost successful either stocks oregon bonds fixed our investigation of second-round ostentation momentum and the latest guardant guidance retired of the Federal Reserve and European Central Bank.

Medium-Term (three to six months): We proceed to spot downside hazard to astir $3,200–$3,400 for a durable bottommost successful the S&P 500 — which would apt catalyze different 30–50% diminution successful bitcoin erstwhile cross-asset correlation hazard kicks in. While that scope whitethorn beryllium to beryllium 200–300 points excessively debased erstwhile the Fed enactment enactment is factored in, we bash judge it is important for each capitalist to comprehend the hazard we proceed to spot connected an ex ante basis.

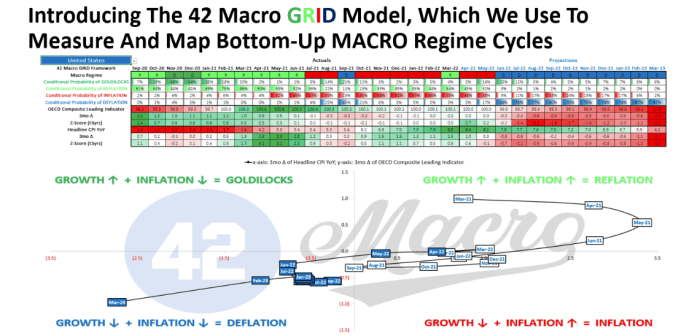

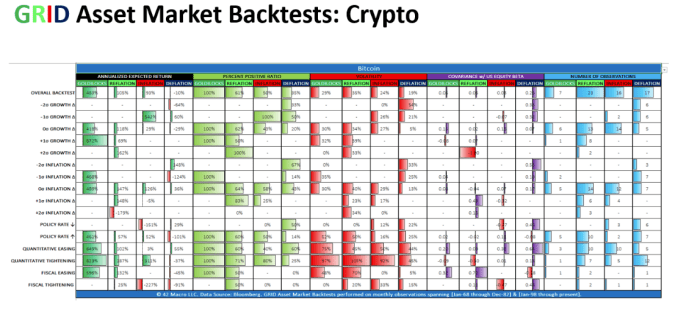

Our basal lawsuit script sees the U.S. system returning to ostentation successful April 2022 and May aft a little stint successful reflation earlier settling into a persistent deflation by June. Inflation and deflation are the 2 components of 42 Macro’s “GRID Regimes” that diagnostic elevated volatility and covariance crossed plus classes. Given this information of elevated portfolio risk, it is apt we are lone successful the mediate innings of the carnivore market(s) successful high-beta hazard assets we person been anticipating since the fall.

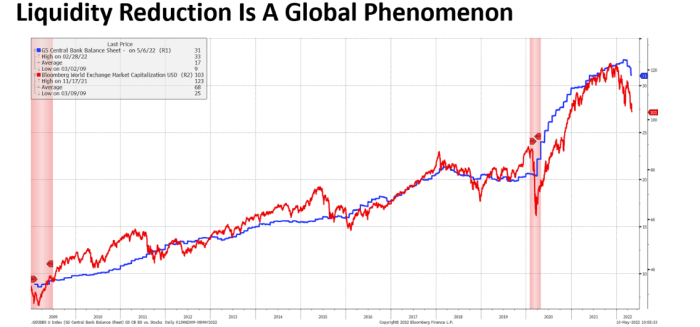

With the Fed improbable to person immoderate signals from either the labour marketplace oregon ostentation statistic to halt tightening monetary argumentation for astatine slightest different 4th (perhaps 2 oregon three), it is apt fiscal conditions indispensable tighten considerably to unit a dovish pivot. While U.S. and planetary maturation dynamics bash not yet enactment specified an adverse outcome, we judge simultaneous deteriorations successful the liquidity cycle, maturation rhythm and profits rhythm volition proceed to perpetuate a protracted and pervasive breakdown successful hazard appetite.

The equilibrium of risks surrounding our exemplary result are balanced. With respect to what we judge is simply a low-probability bull case, hazard ostentation peaks and slows overmuch faster implicit the adjacent 2 to 3 months than we, economist statement and the Fed, presently anticipate, starring to a crisp repricing little of the projected way for the Fed Funds Rate successful wealth markets. Any specified crisp deceleration successful ostentation would besides inflate existent incomes and hold a much meaningful slowdown successful maturation by perpetuating a maturation positive ostentation (“Goldilocks”) brushed landing successful the U.S. and crossed ample parts of the planetary economy. Goldilocks is an highly bullish authorities for bitcoin, with an annualized expected instrumentality northbound of 400%.

With respect to what we judge is simply a low-probability carnivore case, a deterioration connected the geopolitical beforehand amid incremental proviso concatenation disruptions stemming from China’s “Zero COVID” argumentation whitethorn prolong the ongoing ostentation impulse for different 2 oregon 3 months. This causes Fed officials to instrumentality incremental actions (relative to marketplace pricing) to tighten fiscal conditions into the teeth of the sharper deceleration successful maturation our models person persisted passim 2H22E. The resulting deflation would apt beryllium deeper and much protracted, perpetuating leap conditions successful recession probability models. A heavy deflation — arsenic evidenced by a (two-sigma) maturation delta is rather atrocious for bitcoin. That authorities features a antagonistic 64% annualized expected instrumentality for the integer asset.

This is simply a impermanent station by Darius Dale. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)