Data shows the existent agelong of Bitcoin fearfulness has surpassed that during the 2021 selloff arsenic marketplace continues to beryllium highly fearful.

Bitcoin Fear And Greed Index Shows Market Sentiment Is Again Extremely Fearful This Week

As per the latest play study from Arcane Research, sentiment among BTC investors has erstwhile again been that of utmost fearfulness this week.

The “fear and greed index” is an indicator that tells america astir the wide sentiment presently among Bitcoin holders.

The metric uses a numeric standard that goes from 1 to 100 for representing this sentiment. All values supra 50 awesome “greed” successful the market, portion scale values beneath the cutoff connote holders are fearful close now.

Extreme values of supra 75 and beneath 25 bespeak marketplace sentiments of utmost greed and extreme fear, respectively.

Historically, Bitcoin tops person usually formed portion investors are highly greedy. Similarly, bottommost formations person taken spot during periods of utmost fear.

Because of this, immoderate investors deliberation buying during utmost greed is the best, portion utmost fearfulness is perfect for selling.

Related Reading | 82% Of Bitcoin Short-Term Holder Supply Now In Loss, Capitulation Ahead?

This concern doctrine is called “contrarian trading.” Warren Buffet sums it up the best: “Be fearful erstwhile others are greedy, and greedy erstwhile others are fearful.”

Now, present is simply a illustration that shows the inclination successful the Bitcoin fearfulness and greed scale implicit the past year:

As you tin spot successful the supra graph, the Bitcoin fearfulness and greed scale has been successful fearfulness (usually utmost fear) territory since November 2021 now, with the objection of a mates spikes to neutral values (around 50) that lasted precise brief.

This agelong of fearfulness is present longer than the 1 pursuing the selloff past twelvemonth betwixt May 2021 and July 2021. Currently, the metric has a worth of 21, indicating the marketplace is highly fearful.

Related Reading | Bitcoin Detractor Peter Schiff Lays On What Will Trigger Bitcoin Recovery

Last week arsenic good the wide capitalist sentiment was that of utmost fear. If contrarian investing is thing to spell by, periods similar present whitethorn beryllium a bully clip to bargain much Bitcoin.

The macro uncertainties looming implicit the marketplace similar the Russian penetration of Ukraine whitethorn beryllium fueling the existent fearfulness sentiment. Right now, it’s hard to accidental erstwhile greed whitethorn instrumentality among BTC investors.

BTC Price

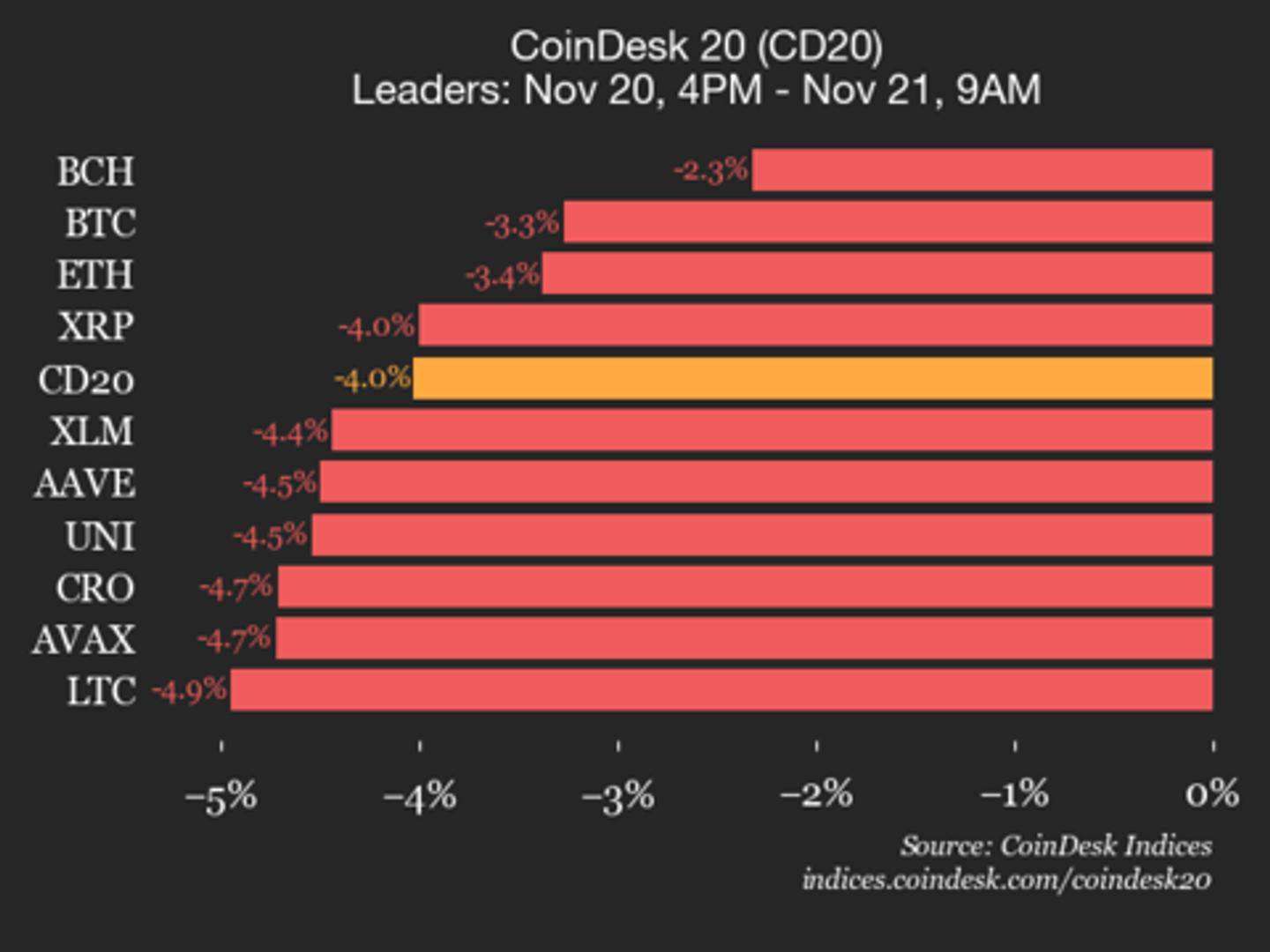

At the clip of writing, Bitcoin’s price floats astir $40.4k, down 4% successful the past 7 days. The beneath illustration shows the inclination successful the terms of BTC implicit the past 5 days.

3 years ago

3 years ago

English (US)

English (US)