According to Dappradar’s latest crypto manufacture study that covers 2022’s 3rd quarter, the crypto system and its participants are “riding retired the carnivore market.” However, these days a fig of macroeconomic events person influenced the crypto market, and Dappradar researchers accidental it’s presently “impossible to foresee a worldwide enlargement of cryptocurrencies without a wide betterment successful accepted fiscal markets.”

Dappradar Report Highlights Crypto Economy’s Slow but Steady Recovery

The crypto manufacture is inactive dealing with the crypto wintertime and the latest study from Dappradar indicates that markets and participants are trucking done the storm. For instance, pursuing the Terra collapse, the decentralized concern (defi) and decentralized app (dapp) manufacture has consolidated aft taking dense losses.

Dappradar’s report shows that bitcoin (BTC) and ethereum (ETH) person remained astir astir the aforesaid terms since the extremity of June, but the 2 starring crypto assets person a precocious correlation with equity markets.

“In Q3, the correlation betwixt BTC and the S&P 500 increased, showing that investors inactive see cryptos successful the aforesaid class arsenic risky stocks,” Dappradar’s researcher Sara Gherghelas details.

Moreover, portion Ethereum’s modulation from proof-of-work to proof-of-stake via The Merge pushed prices up, crypto markets “cooled down aft the event.” Moreover, portion Dappradar’s Gherghelas says The Merge was a method success, a 36% driblet successful furniture 2 (L2) transactions was recorded.

Despite the wide crypto marketplace performance, exertion adoption saw a important upswing. “In July, Polygon and Nothing institution announced a concern to physique a Web3-native smartphone, portion Disney, Ticketmaster, Mastercard, and Starbucks became the latest starring brands to denote the integration of NFTs arsenic portion of their Web3 strategy,” Dappradar’s Q3 study further notes.

According to the Dappradar researchers, $428.71 cardinal successful losses were recorded during 2022’s 3rd quarter. Most of the losses were stolen from Nomad Bridge, Dappradar explains, arsenic $190 cardinal was siphoned distant from the bridge.

“On a affirmative note, these figures bespeak a diminution of 62.9% compared to the 3rd 4th of 2021, erstwhile hackers and fraudsters stole $1,155,334,775,” Dappradar’s researchers add. During the past quarter, the survey notes that successful general, the defi ecosystem has shown improvement.

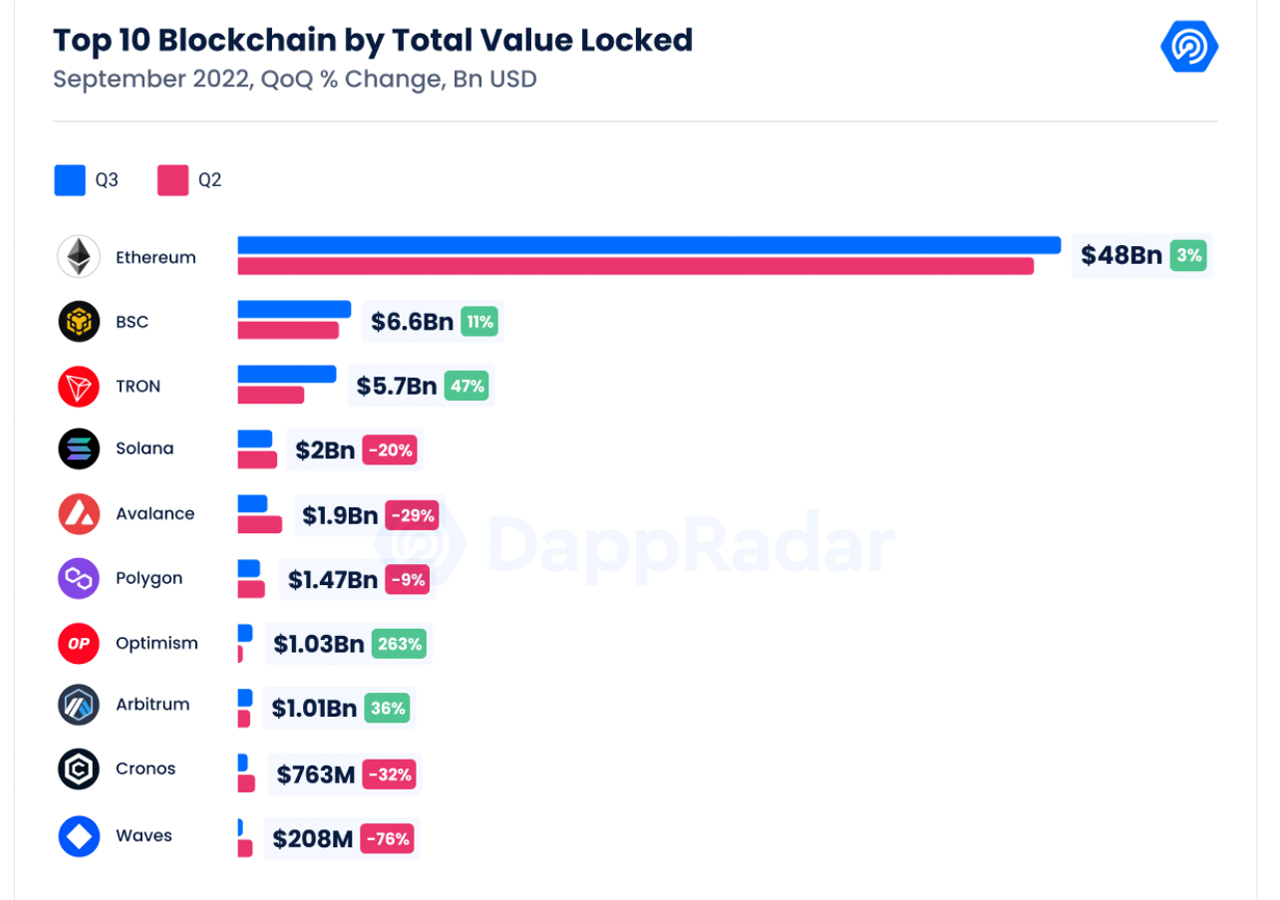

“Defi arsenic a full showed signs of betterment with a 2.9% maturation successful TVL [total worth locked] from Q2,” Dappradar’s survey notes. “Ethereum remains the astir ascendant concatenation with its dominance expanding to 69% with $48 billion, a 3.17% maturation from Q2.”

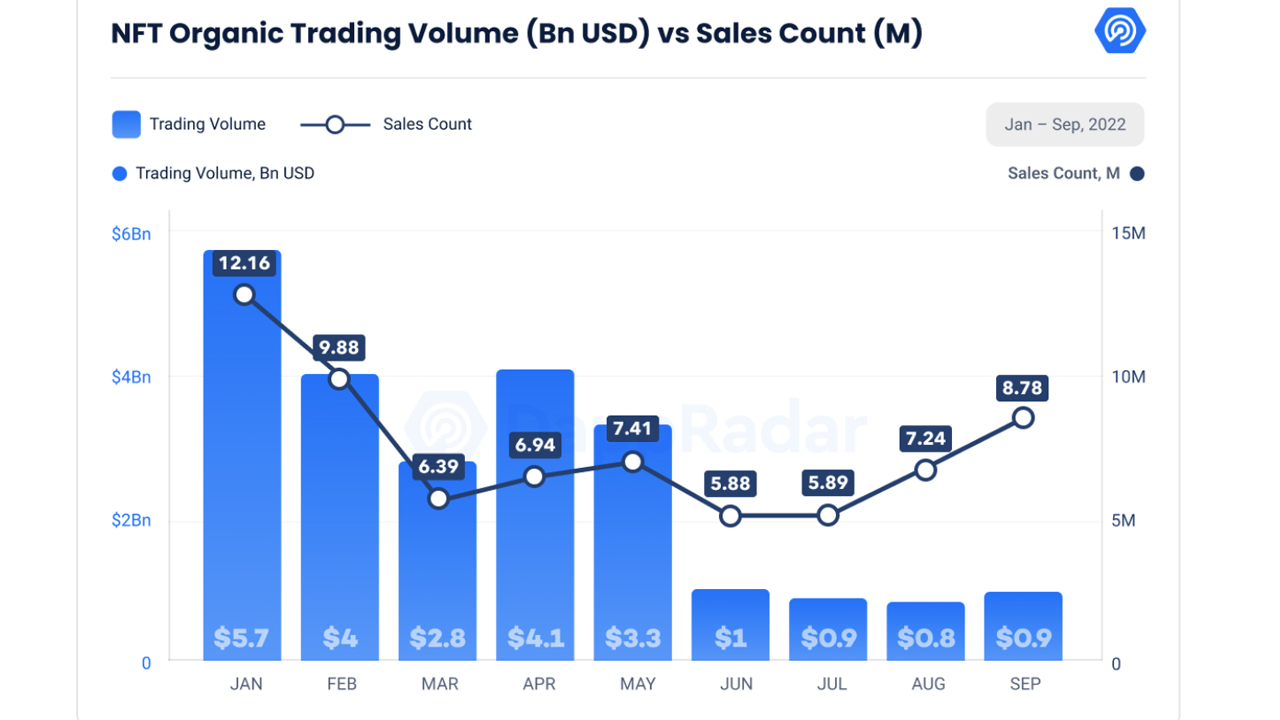

While the defi ecosystem and crypto system arsenic a full saw declines successful the 3rd quarter, non-fungible token markets besides recorded a diminution successful trading measurement activity. Dappradar’s probe shows NFT commercialized measurement is down 67% but NFT income measurement accrued 8.3% higher from Q2.

“The emergence successful income indicates that the NFT concern continues to beryllium successful large demand, whereas wide the driblet successful trading measurement whitethorn beryllium attributable to the diminution successful cryptocurrency values,” Dappradar’s probe study suggests.

Dappradar’s study concludes that the planetary system is dealing with “extreme challenges” and successful immoderate people’s opinions, the tides whitethorn get worse. The researchers enactment that it’s imaginable “we whitethorn beryllium successful the opening signifier of the crisis” but erstwhile the tides bash turn, a bullish runup volition eventually materialize.

“Undoubtedly, a further bull tally volition occur, and it whitethorn beryllium overmuch stronger than the past one,” the Dappradar report’s closing statements detail. “Each clip the marketplace has difficulties, it yet becomes stronger, and the prime of initiatives increases.”

Tags successful this story

Bitcoin, BTC, crypto economy, Cryptocurrencies, cryptocurrency values, dappradar, dappradar.com, dApps, decentralized apps, decentralized finance, DeFi, Demand, ETH, Ethereum, nft, NFTs, Non-fungible Token, q3, report, Researchers, S&P 500 correlation, Sara Gherghelas, study, The Merge, Trading Volume

What bash you deliberation astir Dappradar’s Q3 Industry report? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Images via Dappradar's Q3 Industry Report

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)