Bitcoin has not had the champion mates of things and altcoins person been subjected to the aforesaid destiny too. The marketplace has continued to succumb to unit being mounted by assorted societal issues, from the Canada protests to the brewing struggle betwixt Ukraine and Russia. In each of this, however, bitcoin has mounted amended absorption and this is evident successful the data.

Bitcoin Holds Ahead Of Indexes

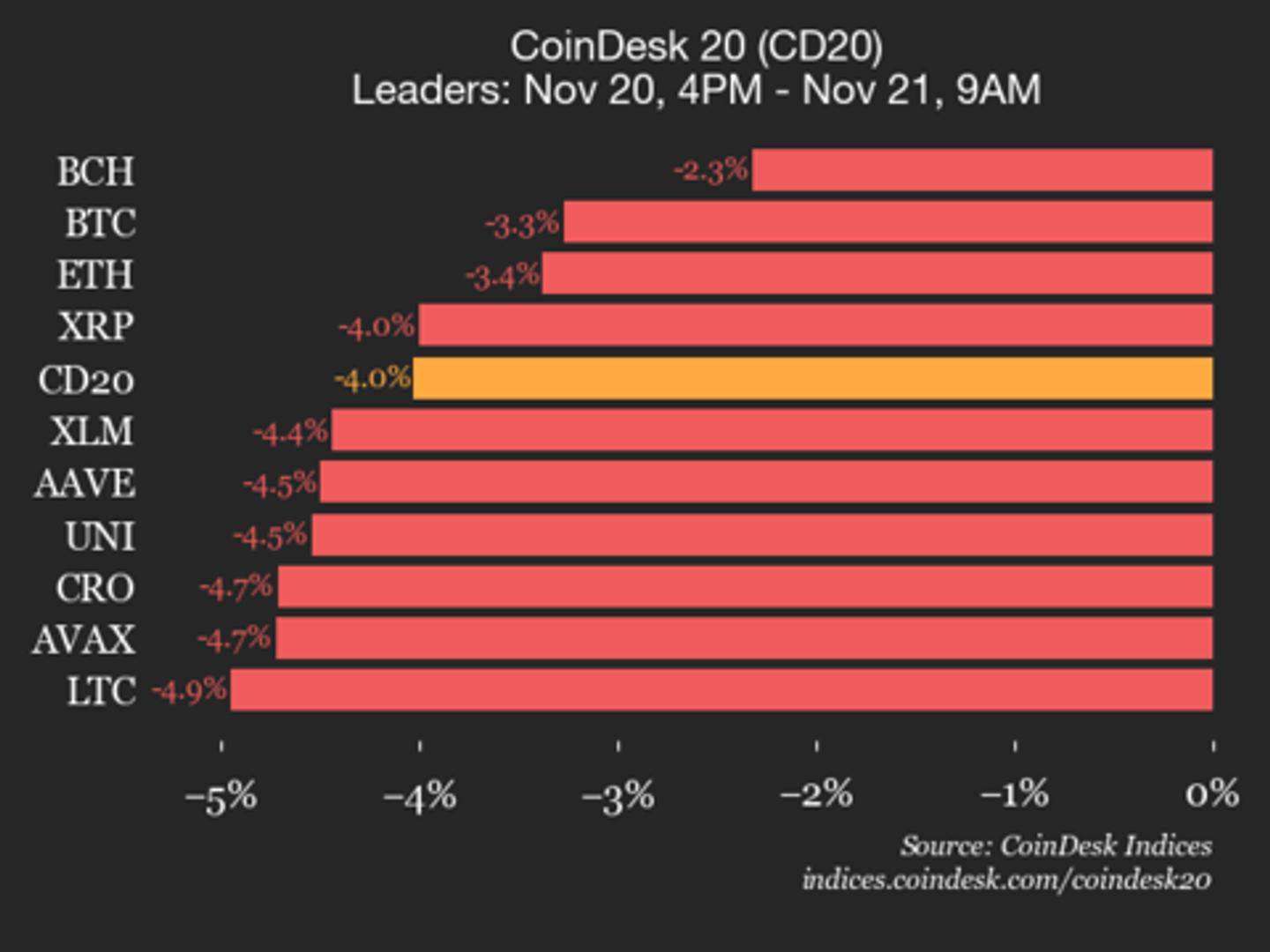

Bitcoin has erstwhile again proven to beryllium the champion stake erstwhile the marketplace is successful turmoil. With the caller downtrend, each of the indexes person suffered, conscionable similar bitcoin, but the second has held up amended successful the look of adversity. While immoderate of the indexes person recorded double-digit losses, BTC remains the apical performer with lone a 4% loss, a tiny worth fixed that the nett best-performing scale saw losses doubly arsenic large.

Related Reading | Bearish Signal: Ethereum Exchange Balances Touch 3-Month High

The Large Cap Index which is known for holding up to macro turmoil and usually seen arsenic a harmless haven for investors returned 8% successful losses, treble that of bitcoin. As for the Mid Cap Index, determination was much atrocious quality to beryllium had with losses moving into the double-digits. In total, this scale which comprises immoderate fast-rising projects successful the crypto abstraction saw 14% losses.

The Small Cap Index is people the worst-performing campaigner successful times similar these. These altcoins that are inactive carving a niche retired for themselves ever get deed the hardest, losing much than doubly the worth suffer by pb integer assets. This clip around, the scale was connected par with the Mid Cap Index, erstwhile again returning 14% successful losses arsenic of February 2022.

Stablecoins Hold The Market

As mentioned above, the Small Cap Index was among the worst deed successful the market. The altcoins which marque up these indexes are usually the smallest coins and thus, the riskiest plays fixed that successful times of slight-to-safety periods, investors thin to determination holdings to the bigger coins to trim their hazard successful the market.

This flight-to-safety has seen investors moving to assets similar bitcoin and those successful the Large Cap Index. However, the evident victor of this marketplace is the stablecoins which person continued to summation marketplace share.

Related Reading | TA: Bitcoin Recovery Halts, Technicals Suggest Fresh Decline To $36K

These stablecoins which are pegged to the US dollar and are not arsenic volatile arsenic the remainder of the marketplace person presented a harmless haven for investors who privation to thrust retired the marketplace but bash not yet privation to person their holdings to fiat. With this move, stablecoins are present dominating a larger marketplace stock arsenic 3 assets are present successful the apical 10 cryptocurrencies by marketplace cap, namely USDT, USDC, and BUSD. Together, these 3 integer assets present relationship for 9% of the full crypto marketplace cap.

3 years ago

3 years ago

English (US)

English (US)