This is an sentiment editorial by Stanislav Kozlovski, a bundle technologist and macroeconomic researcher.

Many Bitcoiners person heard of Bitcoin’s “lack of scalability” — it is 1 of the astir communal critiques waged against the task by some gluttonous cryptocurrency competitors and incumbent constitution actors.

Some oldtimers whitethorn retrieve the heated, bathed-in-controversy Blocksize Wars of 2015 to 2017 which, aided by manufacture insiders, astir shallowly aimed to marque Bitcoin standard to much transactions by expanding the maximum artifact size and by doing so, astir acceptable precedent and changed Bitcoin’s future people forever.

Both of these issues volition yet beryllium to beryllium near connected the incorrect broadside of history. In this piece, we are going to amusement however the Lightning Network addresses Bitcoin’s scalability problems and undoubtedly proves that the small-block determination was yet the close one.

Base Layer Limitations And Choices

Before we recognize what the Lightning Network is solving, we should archetypal recognize what the inherent occupation is. Simply put: You cannot standard a blockchain to validate the full world’s transactions successful a decentralized way.

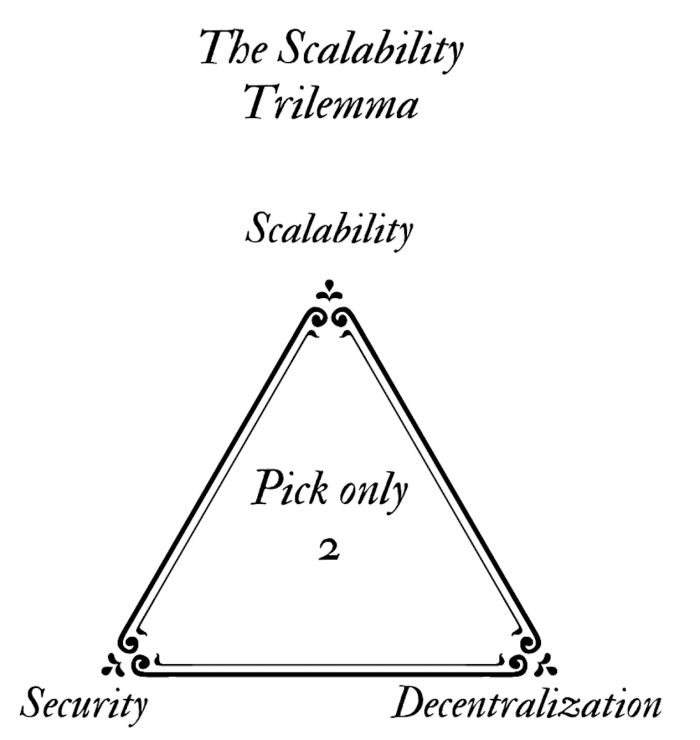

Blockchains endure from an inherent regulation which forces them to commercialized disconnected betwixt 3 qualities — 1 prime of their strategy has to spell for the different two. As pictured above, a blockchain tin lone reliably person 2 of these 3 qualities:

- Decentralized: not controlled by immoderate azygous enactment oregon a tiny fig of elites

- Scalable: standard to a capable fig of transactions

- Secure: not beryllium casual to onslaught and interruption its invariants

It is worthy noting that each of these characteristics beryllium connected separate, analyzable spectrums. For example, you don’t go “secure” implicit a definite threshold, it is precise dependent connected the usage lawsuit and galore antithetic characteristics.

Bitcoin is dilatory for a reason. It explicitly picked to optimize the “security” and “decentralization” sections of the trilemma, leaving “scalability” (transactions per second) connected the sideline.

The cardinal realization is that, overmuch similar today’s net and fiscal system, it is much optimal to comprise the full strategy of abstracted layers, wherever each furniture optimizes for and is utilized for antithetic things.

Bitcoin, the basal layer, is simply a globally-replicated nationalist ledger — each transaction is broadcast to each subordinate successful the network. It is evident that 1 cannot practically standard specified a ledger to accommodate the full world’s increasing transaction rate. Apart from being impractical and privateness damaging, its drawbacks vastly outweigh its insignificant benefits.

Back successful the day, determination was a large civilian warfare betwixt the online assemblage successful what Bitcoin should bash to summation its transaction throughput capacity. There is major, infuriating contention successful this story and is successful ample portion what shaped Bitcoin to stay what it is contiguous — a grassroots, bottom-up question where the mean people (plebs), successful aggregate with 1 another, dictate the rules of the network.

“The Blocksize War” by Jonathan Bier illustrates the conflict betwixt the decentralized web supporters wanting what’s champion for the semipermanent viability of the web and the greed and propaganda perpetuated by large players and corporations to further their ain power-gaining and profit-seeking agendas.

Long communicative short, Bitcoin was forked into a failed fork named “Bitcoin Cash.”

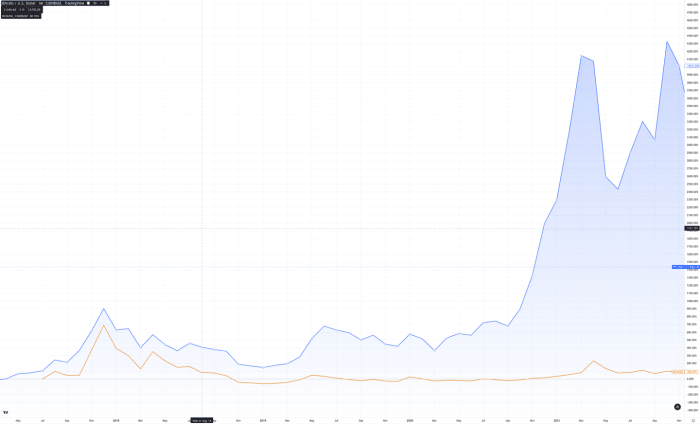

Bitcoin (blue) terms compared to Bitcoin Cash (orange). The fork tin beryllium seen astatine the commencement of the chart. Source: tradingview.com.

The small feline yet won — Bitcoin did not unreserved immoderate atrocious plan choices that would travel to compromise its decentralization, information or censorship resistance. The determination was efficaciously made to standard Bitcoin done layers, introducing 2nd layers that enactment separately from Bitcoin and checkpoint their authorities to the main, slower-but-more-secure network.

In stark contrast, the evidently-unsuccessful fork Bitcoin Cash sacrificed each hopes of decentralization by expanding its artifact size to 32 megabytes, 32 times much than Bitcoin, for a specified maximum of 50 payments per second connected the basal chain.

Block Size

Each Bitcoin artifact has a headdress connected its size and this denotes the precocious bound connected however galore transactions tin beryllium wrong of a block. If request grows to outpace the magnitude of transactions a artifact tin have, the artifact becomes afloat and transactions get near unconfirmed successful the mempool. Users statesman to outbid each different via the adjustable transaction interest successful bid to person their transaction beryllium included by the miners, who are incentivized to take the highest-paying transactions.

A naive solution to this would beryllium to simply summation the artifact size bounds — that is, let much transactions to beryllium included successful a block. The antagonistic broadside effects of this are subtle capable that adjacent intellectuals like Elon Musk marque the mistake of suggesting it.

Increasing the artifact size has second-order effects which alteration the decentralization of the network. As the artifact size grows, the outgo to tally a node successful the web increases.

In Bitcoin, each node has to store and validate each transaction. Further, said transaction has to beryllium propagated to the node’s peers, which multiplies the network’s bandwidth requirements for supporting much transactions. The much transactions, the much the network’s processing (CPU) and retention (disk) requirements turn for each node. Because moving a node yields nary fiscal benefits, the inducement to tally 1 disproportionately decreases the much costly it is.

To enactment it into numbers, if Bitcoin is to ever standard to Visa’s purported highest capableness levels (24,000 transactions per second) a node would request 48 megabytes per second conscionable to person the transactions implicit the network. The pursuing is simply a representation showing the mean net velocity successful the world:

As you tin see, a monolithic portion of the world’s mean velocity would exclude them from the quality to tally a node nether these conditions. Note that mean velocity implies that galore are adjacent little than said threshold. Additionally, it doesn’t relationship for the information that a idiosyncratic would person different uses for their bandwidth — fewer selfless radical would dedicate 50% of their net bandwidth for a Bitcoin node.

More importantly, the magnitude of information this would make would marque it intolerable for anybody to practically store it — it would effect successful 518 gigabytes of information per day, oregon 190 terabytes of information a year.

Further, spinning up a caller node would necessitate 1 to download each of these petabytes of information and verify each signature — some of which would marque it truthful that a caller node would instrumentality a agelong clip (years) to rotation up.

And to marque matters worse, 24,000 transactions per 2nd doesn’t marque for a genuinely unsocial planetary payments web successful and of itself. Visa isn’t the lone payments web successful the world, and the satellite is increasing much interconnected each day.

Lightning Network 101

The Lightning Network is a separate, second-layer network that works connected apical of the main Bitcoin network. Simply said, it batches Bitcoin transactions.

To entree it, you request to tally your ain node oregon usage idiosyncratic else’s. The web has 2 concepts worthy knowing for the purposes here:

- A Lightning node: abstracted bundle that communicates with each different and constitutes a caller peer-to-peer network.

- Channels: a transportation opened betwixt 2 Lightning nodes, allowing for payments to travel betwixt them.

A transmission is virtually a Bitcoin basal furniture transaction, anchoring the transmission to the unafraid chain.

Once 2 nodes unfastened a transmission betwixt 1 another, payments commencement flowing betwixt them. Each consequent outgo modifies the channel’s state, cryptographically revoking the aged 1 and checkpointing the caller 1 successful representation and connected disk of some nodes, but critically, not to the basal chain.

Channels tin and successful my sentiment ideally should enactment unfastened for a agelong clip (e.g., a twelvemonth oregon more). If the nodes ever determine to adjacent down their channel, their latest equilibrium aft each the off-chain payments is restored to their archetypal wallets. This is cryptographically-secured by hashed timelocked contracts (HTLC) and integer signatures, which we won’t get into item for the purposes of this article.

This allows 1 to batch billions of payments into 2 on-chain transactions — 1 for opening the transmission and 1 for closing it. Once a outgo is complete, it is indisputable what the latest equilibrium is betwixt each parties (assuming nodes redundantly store their transmission checkpoints).

Critically, 1 request not beryllium straight connected to different enactment successful bid to wage them — channels tin beryllium utilized by different nodes successful the web successful bid to summation their reachability. In different words, if Alice is connected to Bob and Bob is connected to Caroline, Alice and Caroline tin seamlessly wage each different done Bob.

Lightning Scalability

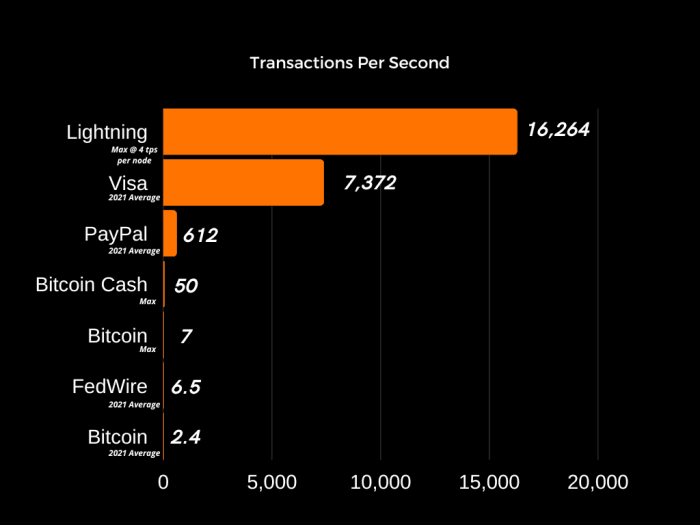

As we volition present prove, the Lightning Network already scales to enactment 16,264 transactions a 2nd contiguous and truthful solves the scalability occupation portion preserving each the benefits Bitcoin has to connection — permissionlessness, scarcity, idiosyncratic sovereignty, portability, verifiability, decentralization and censorship resistance.

For a outgo to marque its mode done the network, it typically has to spell done aggregate outgo channels. To reply however galore payments the web tin bash successful a second, we request to recognize however galore an mean transmission supports.

Statistics amusement that the mean outgo goes done astir three channels.

The benchmark numbers we volition usage for this investigation person per-node throughput capacity, not per-channel. Therefore, we volition inaccurately presume that each node has conscionable 1 channel. The default LND node is said to beryllium capable to bash 33 payments per 2nd with a decent instrumentality (8 vCPUs, 32 GB memory) according to the benchmark.

With 16,266 nodes successful the network (as of November 2022), assuming each outgo has to spell done 3 channels (four nodes), the web should beryllium capable to execute astir 134,194 payments per second.

That is, each outgo has to spell done a radical of 4 nodes, and determination are 4,066 specified unsocial groups successful the network. Assuming each node tin bash 33 payments a second, we multiply 4,066 by 33 to scope 134,194.

Now, to beryllium realistic: Not each node is moving a instrumentality similar the 1 successful the benchmark — galore are simply running connected a Raspberry Pi. Thankfully, it doesn’t instrumentality overmuch to beryllium capable to bushed the existent outgo systems.

Lightning Vs. Traditional Payments

Finding authentic numbers astir the highest capableness of accepted outgo systems is hard, truthful we volition trust connected their mean outgo complaint passim the 2021 fiscal year. We volition comparison that to the theoretical capableness of Lightning, due to the fact that conversely, getting the mean complaint of payments successful Lightning is intolerable owed to its backstage nature, and is besides not revealing of capableness due to the fact that the request for Lightning payments is inactive comparatively low. This examination volition springiness america an thought of however galore payments a Lighting node needs to beryllium susceptible of routing successful bid to out-compete accepted finance.

Visa saw 165 cardinal payments successful 2021, PayPal saw 19.3 cardinal payments crossed its full level and FedWire saw 204 million. Respectively, these magnitude to 7,372, 612 and 6.5 payments per 2nd connected mean for 2021. To enactment into perspective, Bitcoin did 2.44 payments per second successful 2021 and scales up to a maximum of 7 per second.

The numbers are promising — it takes each Lightning node to beryllium susceptible of doing conscionable four payments a second successful bid to bushed the existent outgo networks by astatine slightest 2 times. At that rate, 4,066 unsocial four-node groups tin execute 16,264 payments per 2nd — 2.2 times that of the largest competitor, Visa.

To marque matters worse for accepted outgo networks, the mean Lightning transaction interest is 13 times less that of Visa — 0.1% compared to 1.29%.

It’s worthy remembering that 1 could ever proceed to standard the Lightning Network by creating caller nodes. Since it is adjacent to peer, its scalability is theoretically unlimited arsenic agelong arsenic nodes successful the web grow.

Further, the aforementioned benchmark by Bottlepay makes the lawsuit that determination are nary existent method blockers for Lightning node implementations to yet scope 1,000 payments per second. At specified a number, the network’s current throughput would beryllium person to 4 cardinal per second, not to notation what it would beryllium with an summation successful the fig of nodes.

And lastly, it is worthy remembering that the Lightning Network is inactive precise overmuch immature bundle and has a just magnitude of aboriginal optimizations to beryllium done, some successful the protocol and its implementations. Resources successful presumption of developers are the lone short-term constraint to expanding scalability, which has rightfully travel 2nd to much important matters similar reliability.

To springiness a consciousness of the advancement there, River Financial precocious shared that its outgo occurrence complaint is 98.7% astatine an mean size of $46, which is astonishingly amended than the earliest publicly-available information it could find from 2018, wherever $5 transactions were failing 48% of the time.

Conclusion

In this piece, we exposed each of the antagonistic drawbacks of scaling the Bitcoin blockchain done expanding the basal layer’s artifact size, astir notably severely compromising its decentralization and yet failing to execute its purpose of reaching the immense scalability needed for the demands a planetary payments web has and volition proceed to progressively person successful the future.

We showed that the Lightning Network, arsenic a second-layer solution, astir elegantly solves the scalability occupation by some preserving each of Bitcoin’s benefits portion astatine the aforesaid clip scaling it mode beyond what immoderate base-layer solutions promise.

This is simply a impermanent station by Stanislav Kozlovski. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)