The eurodollar has been an instrumentality that allowed for monolithic planetary recognition and leverage. Bitcoin volition payment from the de-leveraging of that failing system.

Kane McGukin has 13 years of wealthiness absorption acquisition spanning brokerage and organization equity sales. He is an autarkic registered concern advisor.

As the calendar neared September 2021, the wealth printer had slowed and individuals were opening to tyre from the toils of trading a handbasket of work-from-home stocks. At this point, COVID-19 was over, the clang was aged quality and lockdowns were nearing 2 years old. Most were looking to displacement their absorption to thing new. Something similar getting backmost to what utilized to beryllium their existent time jobs.

You Can Only Keep An Animal Caged For So Long

That’s the pugnacious world of the country the Federal Reserve has boxed itself into.

For decades, the Maestro had conducted a seemingly beauteous orchestra, but you tin lone support radical and fiscal instruments locked up for truthful long. Eventually, there’s a breaking constituent — a constituent wherever you tin nary longer massage the information oregon people capable wealth to fulfill quality greed. Greed, that interior emotion that leads 1 to judge if they conscionable get much money, they’ll find happiness.

At immoderate point, carnal spirits statesman to stir. In times of economical stress, these spirits person a dependable of their own. One that cannot beryllium tamed oregon controlled by a committee of 12 members, headed by a chair.

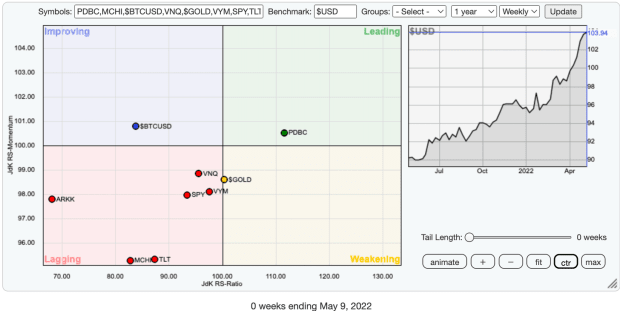

For galore years, and much specifically successful 2021 and 2022, I’ve watched the rotations of the large fiscal plus classes. Recently, to my surprise, lone 3 plus classes person had affirmative returns implicit the past 7 months. Those are commodities, golden and the dollar (though erstwhile accounting for [tru]inflation, 11.8% present with a highest of 12.74%, the dollar’s instrumentality is really antagonistic arsenic of clip of this writing).

Note: existent existent property has been up and rather bubbly successful galore places successful the U.S., though the nationalist marketplace ETF shows antagonistic returns. Likely due to the fact that nationalist markets are each down and it’s a publically traded instrument.

(Source)

(Source)

Most assets person been punished since precocious 2021, arsenic markets began to chill and rates started to reverse their 40-year downtrend.

(Source)

(Source)

When Money Is Free, Leverage Builds In The System

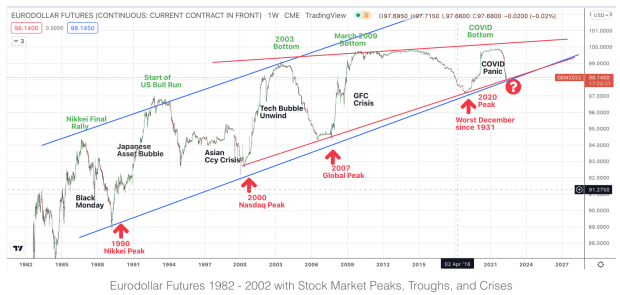

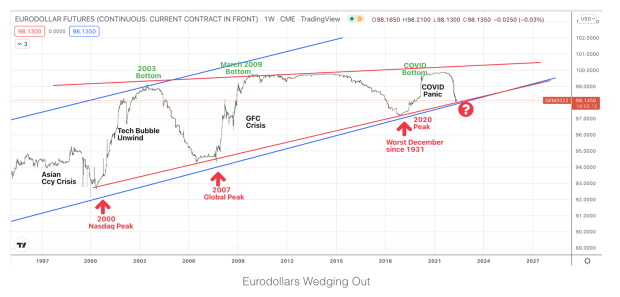

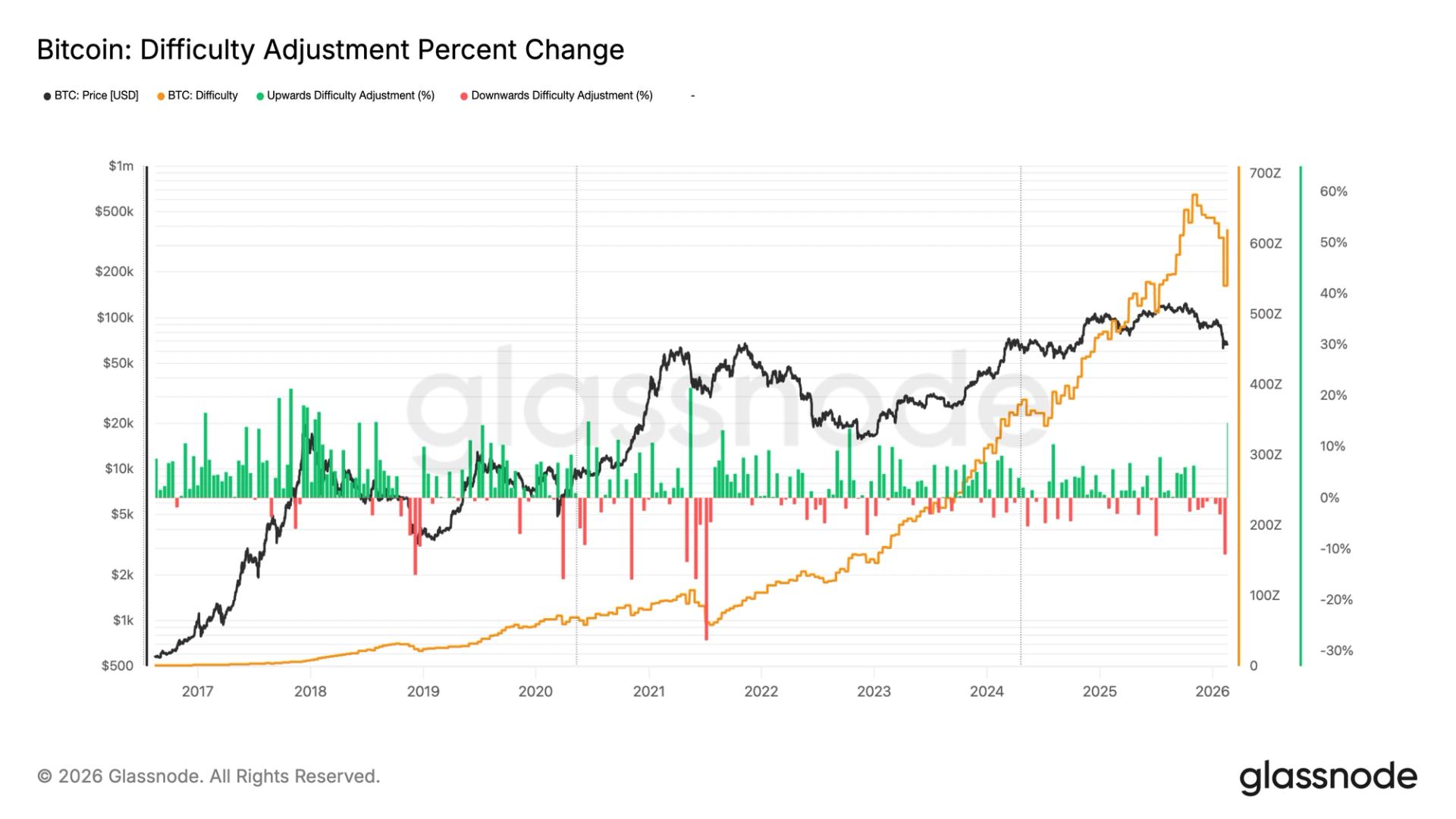

The eurodollar marketplace is simply a spot obscure successful that its size is relatively unknown (about $14T successful 2016), and it was liable for astir 90% of planetary loans successful 1997. So, 1 tin presume that eurodollars are the halfway of astir planetary fiscal enactment erstwhile it comes to lending. This is abundantly wide erstwhile viewing the eurodollar futures illustration below.

Image source: Personal Tradingview relationship / illustration creation

Image source: Personal Tradingview relationship / illustration creation

Background: The eurodollar marketplace started successful 1957 erstwhile non-U.S. banks began holding dollars connected behalf of entities oregon nations perchance being blocked from holding existent dollars straight with U.S. banks. For doing so, these intermediary banks received higher interest connected the dollars they lent retired and besides paid a higher level of involvement to the rightful, but not actual, owner/holder of the dollars. Given the further linkages, which pb to much layers of risk, it makes consciousness that higher involvement rates are expected by investors.

These dollars, much oregon less, became a 2nd derivative of the U.S. dollar.

When you interruption it down, is it not truly conscionable an planetary slope holding dollars and re-lending them extracurricular of the purview of the ineligible jurisdiction of the Fed?

Effectively, these non-U.S. banks make wealth without having the aforesaid powers arsenic the U.S. Fed. Remember, the planetary cognition is that the Fed is the lone 1 who tin lend dollars. However, owed to the planetary dispersed of fractional reserve banking and fiscal engineering, we tin spot that done eurodollars galore different banking institutions person been playing “Fed” with their ain re-lending of dollars passim the planetary fiscal system.

Over the past 37 years, a wide transmission was established for the eurodollar. As terms approached the precocious broadside of the transmission (nearing par), bottoms formed successful fiscal markets; and arsenic terms approached the bottommost broadside of the channel, tops formed successful assorted planetary markets.

Image source: Personal Tradingview relationship / illustration creation

Image source: Personal Tradingview relationship / illustration creation

Note, the bottommost broadside foreshadowed immoderate of the worst fiscal crises successful past arsenic planetary leverage unwound and eurodollar prices began spiking higher during those runs toward $100.

As the illustration shows, successful the 1980s, the roar successful recognition was truly opening arsenic globalization began heating up. At this point, with U.S. dollars firmly cemented arsenic the planetary reserve currency, it was the eurodollar that was the existent maturation driver. They were utilized to concern planetary growth, make leverage oregon successful immoderate cases circumvent sanctions by the U.S. Outside of situation times, eurodollars mostly roseate portion existent dollars fell. During the pugnacious periods, lending and leverage would abate, portion recognition was unwound and disasters struck planetary fiscal markets (eurodollars falling, dollars rising).

Definitionally, “Eurodollar futures are interest-rate-based fiscal futures contracts circumstantial to the Eurodollar, which is simply a U.S. dollar connected deposit successful commercialized banks extracurricular of the United States.”

The TL;DR

In much caller decades, arsenic astir assets person been financialized, precise fewer really clasp the underlying asset, and astir transactions oregon loans trust connected reserves, recognition oregon a dispersed of immoderate kind, alternatively than the transportation of a carnal underlying asset.

For example, with eurodollar futures arsenic an anticipation of aboriginal rates, if they autumn from 99 to 98 the anticipation is for rates to autumn (relationship: the underlying — dollars — spell up).

This is what the Bretton Woods strategy promoted: get inexpensive wealth (at debased rates) to lever up and bargain assets.

As rates statesman rising, it yet slows the inducement to bargain assets that are rising implicit time. This encourages aboriginal derivative levers to unwind backmost to dollars, Treasuries, and/or golden (safety) arsenic marketplace hazard increases. That is the formation to safety: backmost to a “risk free” asset. In turn, this selling of assets and moving backmost to safety, puts unit connected prices and crashes, with precocious buyers oregon anemic hands losing money. After being flushed out, the process begins again with eurodollars astatine a little terms and country to reflate to the upside again. When I look astatine these charts, this is what becomes abundantly clear.

Image source: Personal Tradingview relationship / illustration creation

Image source: Personal Tradingview relationship / illustration creation

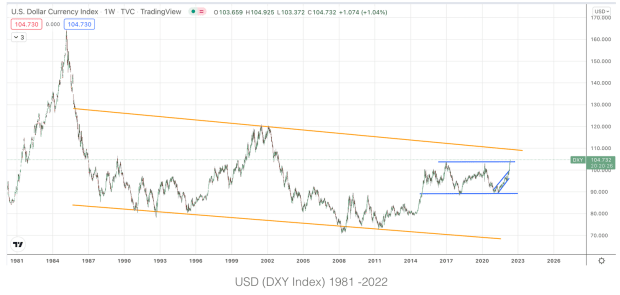

From the ‘80s to now, the dollar fell from $160s to a debased of astir $70, portion eurodollars roseate from astir $85 to conscionable nether $100. One acted arsenic the reserve, and the different arsenic the instrumentality of leverage and recognition to thrust planetary consumption.

According to Wikipedia,

“Several factors led eurodollars to overtake certificates of deposit (CDs) issued by U.S. banks arsenic the superior backstage short-term wealth marketplace instruments by the 1980s, including:

- The successive equilibrium of payments deficits of the United States, causing a nett outflow of dollars;

- Regulation Q, the U.S. Federal Reserve's ceiling connected involvement payable connected home deposits during the precocious ostentation of the 1970s

- Eurodollar deposits were a cheaper root of funds due to the fact that they were escaped of reserve requirements and deposit security assessments”

Taking A Closer Look

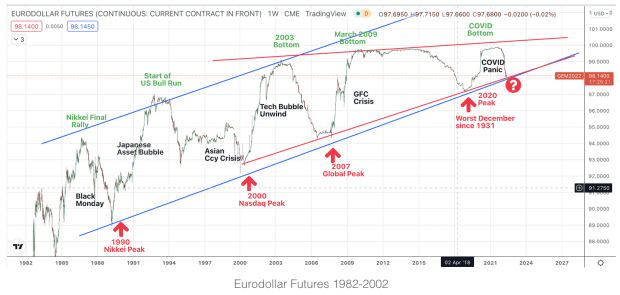

Zooming in, what’s astir absorbing is the wedge that has begun to signifier successful caller years. Since the Great Financial Crisis, terms has not reached the precocious bound indicating a waning momentum.

Thinking this through, it makes consciousness connected a mates of fronts.

First, globally, we are astatine highest recognition and wealth sloshing astir successful the system. U.S. authorities stimulus successful 2020 amounted to 40% of each dollars ever created. Think connected that 1 for a minute.

(Source)

(Source)

So, if the mean idiosyncratic needs recognition oregon leverage, it’s mostly disposable 1 mode oregon another.

Second, if you deliberation astir eurodollars arsenic a derivative of the dollar, past it would marque consciousness that you would not privation to wage implicit par (100) to lever-up much than needed. Especially if the interior complaint of instrumentality was not importantly higher than your borrowing rate. It conscionable doesn’t marque mathematical sense.

Last, eurodollar futures are besides a gauge for involvement rates successful that they respond to 3-month Libor involvement rates. Since 1981, involvement rates have fallen from 16% to adjacent 0% successful 2021. As an inverse, the eurodollar rose. Were Treasuries acting arsenic a savings mechanics portion the derivative eurodollar was the recognition mechanism? During this period, acting arsenic the planetary reserve currency, the U.S. has mostly been the benefactor here.

That’s wherefore existent macro and geopolitical skirmishes are truthful heated these days.

Image source: Personal Tradingview relationship / illustration creation

Image source: Personal Tradingview relationship / illustration creation

Looking backmost astatine the chart, this dynamic makes the wedge setup precise interesting.

Wedges astatine peaks and troughs thin to bespeak terms corrections and inclination changes successful the other direction. In this case, eurodollars would apt autumn to the mid- to low-90s. If that were to be, I tin ideate it would mean a batch of players successful planetary markets would beryllium de-levering for 1 crushed oregon another.

Additionally, it would bespeak that involvement rates would person a batch much country to upside. Inflation anyone?

Again, arsenic a 2nd oregon 3rd derivative, wherefore would you privation to wage implicit 100 to bid it up adjacent more? Room to the upside is needed unless the full satellite goes connected a zero interest-rate policy.

That would mean involvement rates would person to spell antagonistic and enactment negative, which doesn’t precisely work. A fewer European countries tried this, lone to halt sometime aft arsenic they had nary thought arsenic to what other mightiness interruption successful the system. Nor did they recognize the unintended consequences due to the fact that it’s ne'er been done earlier (except successful Japan).

The setup seems to suggest we whitethorn spot a reflation of stocks, but apt not for excessively agelong arsenic determination are lone 2 points to the upside earlier reaching eurodollar par (100). Is the adjacent eurodollar rollover the all-asset bubble? Is it a prime indicator? Or, does the U.S. propulsion retired the Japanese playbook and instrumentality rates antagonistic to stave disconnected the inevitable?

Granted, we’ve mocked and criticized Japan for the amended portion of 30 years, truthful determination would beryllium an about-face if the U.S. were to reverse people successful economical policies. By the aforesaid token, it's hard to accidental what the existent medication is susceptible oregon incapable of doing these days. Sorry, the proof’s successful the data.

My thought aft this reappraisal is that the eurodollar has been an instrumentality that allowed for monolithic planetary recognition and leverage for implicit 3 decades. But, there’s nary longer immoderate country to tally due to the fact that we’re fundamentally astatine 100. In bid for the Fed and different cardinal banks to footwear the tin down the roadworthy erstwhile more, they’ll request different tool.

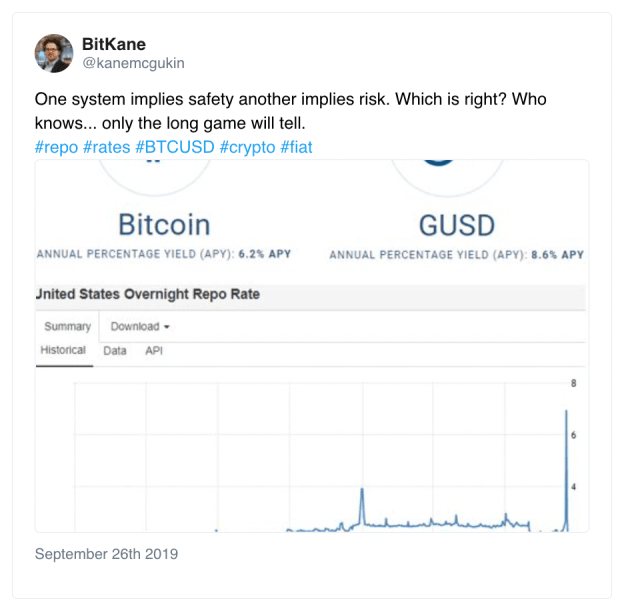

(Source)

(Source)

The Role of Stablecoins? Eurodollars 2.0?

(Source)

(Source)

First things first. If cryptocurrency was pointless, past the S&P has nary concern looking astatine Compound, a Decentralized Finance (DeFi) involvement complaint protocol. Much less, giving it a rating! That’s a cardinal sign, successful my opinion, that cryptocurrency is present to stay, and the fiscal rails are decidedly successful transition.

With the Fed and different planetary cardinal banks retired of ammunition, and individuals and institutions uninterested successful surviving without recognition (being mostly productive). There are lone 2 options:

- Take a monolithic haircut: Let the eurodollar autumn and de-lever portion the planetary fiscal strategy unwinds successful a nasty way.

- Introduce different instrumentality successful a parallel fiscal strategy that allows for leverage and lending to transportation on, but much importantly, allows governments to footwear the tin down the roadworthy erstwhile again. That’s the way chosen for the past 20 years. That’s a relation stablecoins and cardinal slope integer currencies (CBDCs) could fill, the second of which would beryllium afloat Modern Monetary Theory, successful my opinion. Also adding a overmuch deeper Big-Brother penetration into however and wherever radical walk their money. (Remember however good this worked retired with Facebook…) Plus, providing the capableness to adhd oregon propulsion funds astatine immoderate constituent that agencies want, and for immoderate reason.

Assuming a caller portion is added to the foray of leverage (dollars, Treasuries, eurodollars, stablecoins/CBDCs), this perchance allows — astatine minimum — disbursement of the leverage that has happened connected a singular dependable asset, gold. For a speedy primer connected this past history, work Nik Bhatia’s “Layered Money.” It’s casual and a must-read.

In addition, we’re presently watching a caller parallel fiscal strategy being built. That’s the Bitcoin web and it provides an further and much-needed dependable wealth asset.

Bitcoin on with different integer plus integrations provides on- and off-ramps betwixt stablecoins, integer assets and accepted dollar assets/financial markets. In the coming decades, wealth volition beryllium capable to travel from our aged planetary dollar fiscal web to a caller fiscal web built connected Bitcoin, due to the fact that aft all, information is the caller oil. And wealth is the top signifier of connection that we have.

These supporting casts volition beryllium important arsenic the strategy continues its transition, overmuch similar it did successful the 1930s from a gold-based strategy to the Bretton Woods strategy of pegged currencies. Eventually, a gathering volition beryllium held and the caller Bretton Woods statement volition beryllium announced, paving the mode for the Bitcoin system to supply ample enactment to the failing, aged and rusty fiscal rails of the past.

The adjacent fewer decades of concern are going to beryllium fun, but not without a fewer bumps and bruises arsenic we’ve seen precocious with the demise of the algorithmic stablecoin Terra Luna.

Opinions expressed successful this nonfiction are not to beryllium considered concern advice. Past show is not indicative of aboriginal show arsenic each investments transportation hazard including imaginable nonaccomplishment of principle.

This is simply a impermanent station by Kane McGukin. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)