The Ethereum (ETH) to Bitcoin (BTC) ratio (ETH/BTC) is simply a pivotal metric, offering insights into the comparative spot and marketplace dominance of the 2 largest cryptocurrencies. Representing the worth of 1 Ethereum successful presumption of Bitcoin, the ratio serves arsenic a captious instrumentality for investors and analysts to gauge the comparative show and sentiment towards these integer assets.

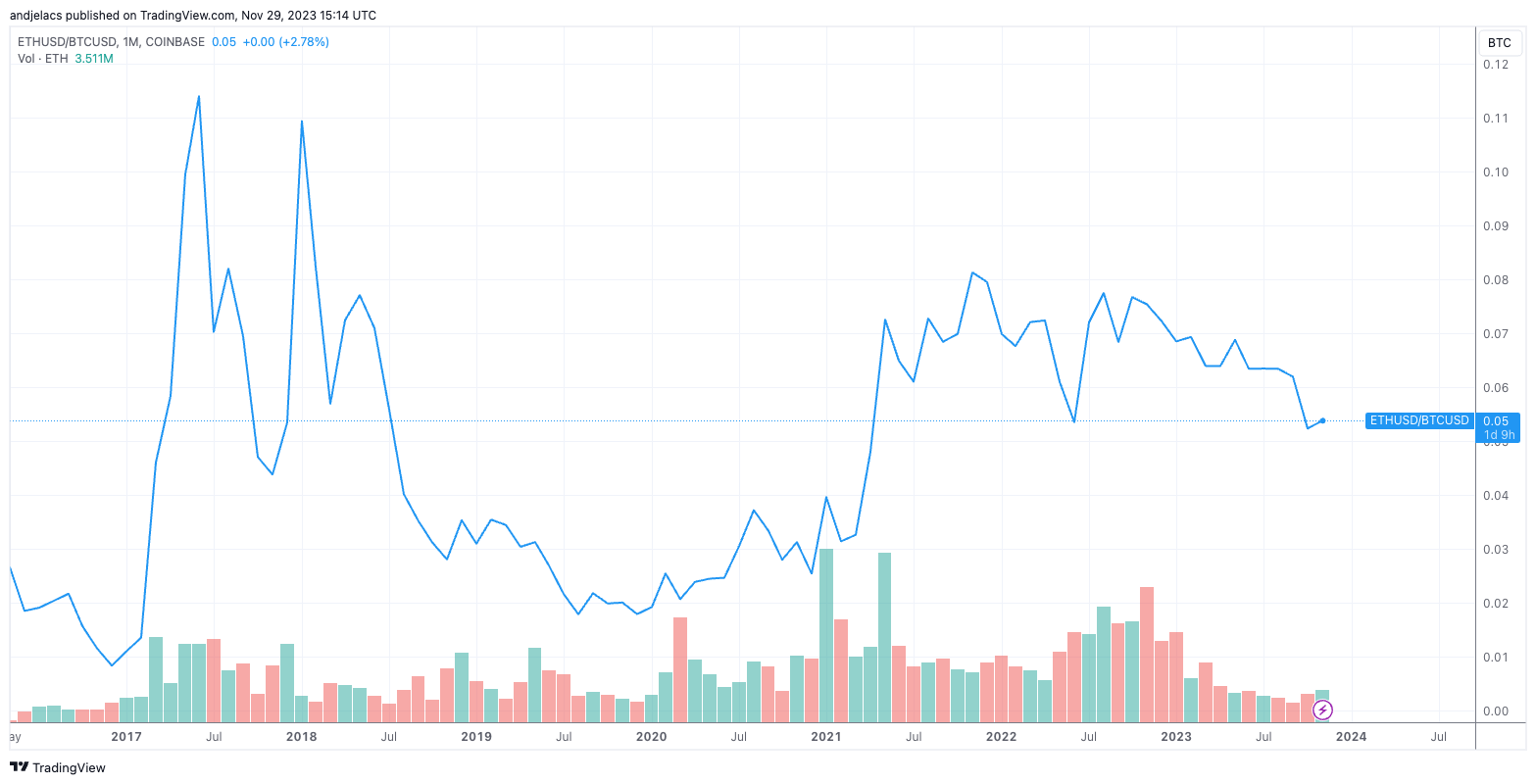

Historically, the ratio has experienced important fluctuations. It reached its all-time precocious successful June 2017, erstwhile Ethereum’s worth importantly overshadowed Bitcoin’s. Conversely, Dec. 2016 saw the ratio scope its all-time low, reflecting a clip erstwhile Ethereum’s worth dropped importantly compared to Bitcoin.

The graph shows the ETH/BTC ratio from May. 1, 2016, to Nov. 28, 2023 (Source: TradingView)

The graph shows the ETH/BTC ratio from May. 1, 2016, to Nov. 28, 2023 (Source: TradingView)However, the wide volatility of this ratio, measured by the modular deviation of its humanities closing prices, is comparatively moderate. This is indicative of the often parallel terms movements of BTC and ETH, arsenic they typically reflector each other’s marketplace trends.

The synchronized question of BTC and ETH is simply a defining origin successful the observed stableness of the ETH/BTC ratio. When some cryptocurrencies acquisition akin bullish oregon bearish trends, their ratio maintains equilibrium, underscoring the interdependence successful their marketplace movements. This improvement is simply a testament to the correlated quality of the crypto market, wherever large currencies often stock akin marketplace sentiments and outer influences.

From Jan. 2020 to Oct. 2022, the ETH/BTC ratio saw an uptrend, attributed chiefly to the anticipation surrounding the Merge — Ethereum’s modulation to a Proof-of-Stake statement mechanism. This important upgrade successful Ethereum’s blockchain was viewed arsenic a pivotal measurement towards enhancing its ratio and scalability, perchance expanding its worth comparative to Bitcoin.

However, aft Oct. 2022, the ratio exhibited a downward trend. This diminution could beryllium a marketplace correction pursuing the precocious expectations the Merge acceptable oregon a reflection of broader marketplace trends affecting some cryptocurrencies. It besides shows that, during this period, Ethereum’s maturation oregon diminution successful worth was not arsenic pronounced arsenic Bitcoin’s, starring to a alteration successful its comparative value.

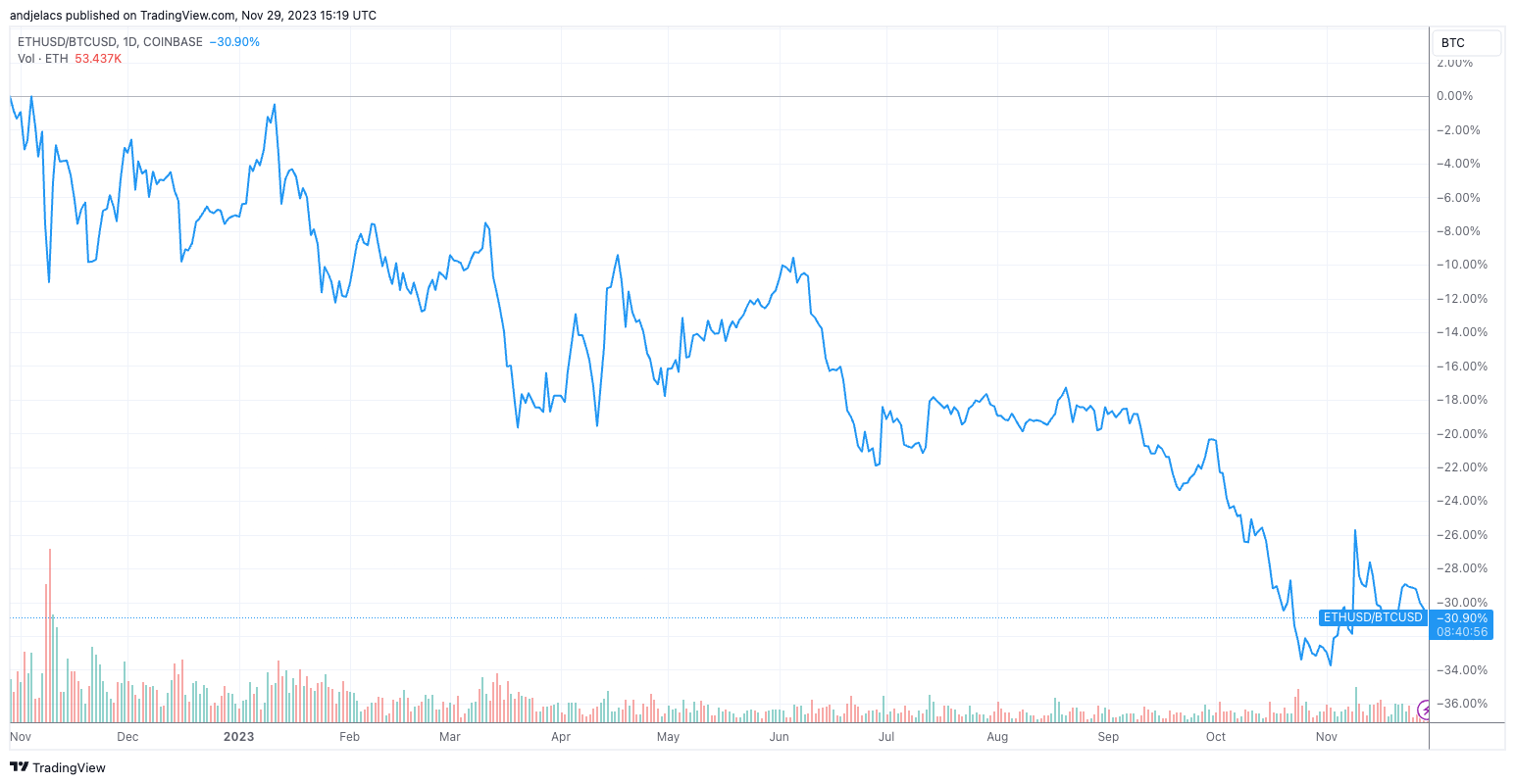

Graph showing the ETH/BTC ratio from October 2022 to November 2023 (Source: TradingView)

Graph showing the ETH/BTC ratio from October 2022 to November 2023 (Source: TradingView)The ETH/BTC ratio offers important insights into the market’s existent dynamics. The comparatively debased ratio tin beryllium chiefly attributed to Bitcoin’s much important terms summation than Ethereum. YTD, Bitcoin has seen a 126% increase, portion Ethereum’s growth, though notable, was comparatively little astatine 69%. This disparity successful their maturation rates has been a captious origin successful keeping the ETH/BTC ratio subdued.

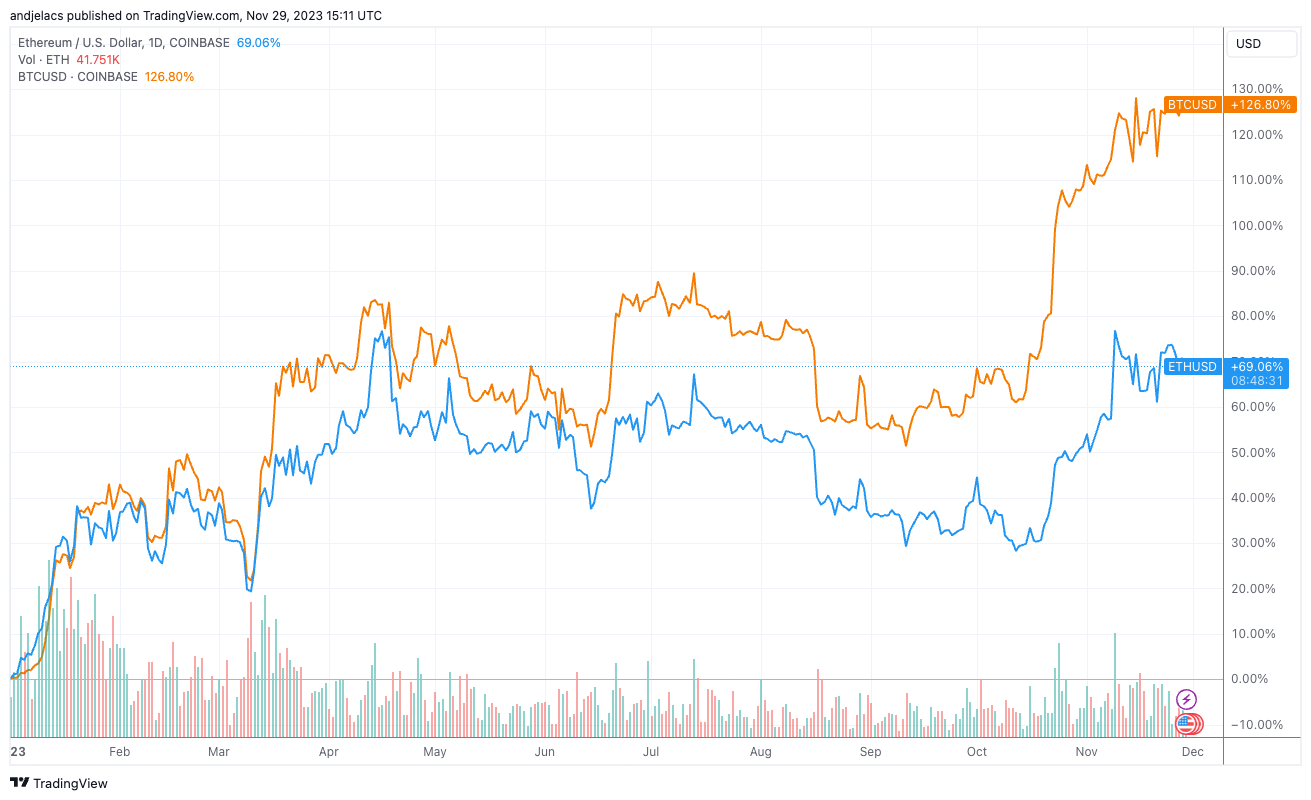

Graph showing the YTD percent instrumentality for Bitcoin (BTC) and Ethereum (ETH) (Source: TradingView)

Graph showing the YTD percent instrumentality for Bitcoin (BTC) and Ethereum (ETH) (Source: TradingView)The differing trajectories successful their prices amusement Bitcoin’s expanding dominance successful the market. While Ethereum continues to play a important relation successful the crypto ecosystem, particularly arsenic the location of DeFi, Bitcoin’s much important terms summation underscores its increasing prominence and perchance greater capitalist confidence. This inclination is reflected successful the ETH/BTC ratio, serving arsenic a barometer for Bitcoin’s strengthening presumption comparative to Ethereum.

The ratio’s question intelligibly indicates the shifting equilibrium of powerfulness wrong the crypto market, with Bitcoin presently taking a much ascendant role.

The station Decline successful ETH/BTC ratio shows Bitcoin’s rising marketplace dominance appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)