In airy of DeFi’s caller lending marketplace economical attacks, hazard monitoring and absorption has go a cardinal origin for occurrence wrong the ecosystem. Appropriate procedures request to beryllium taken into relationship successful bid to guarantee the aboriginal maturation of the space. This nonfiction aims to research the caller Mango Markets economical attack, however it was orchestrated, and imaginable mitigation strategies.

In bid to recognize however susceptible DeFi protocols are to each circumstantial benignant of risk, we delve into the 62 largest incidents that person taken spot to date. This includes hacks successful the hundreds of millions for bridges, economical collapses of algorithmic stablecoins, and outright robbery of idiosyncratic funds.

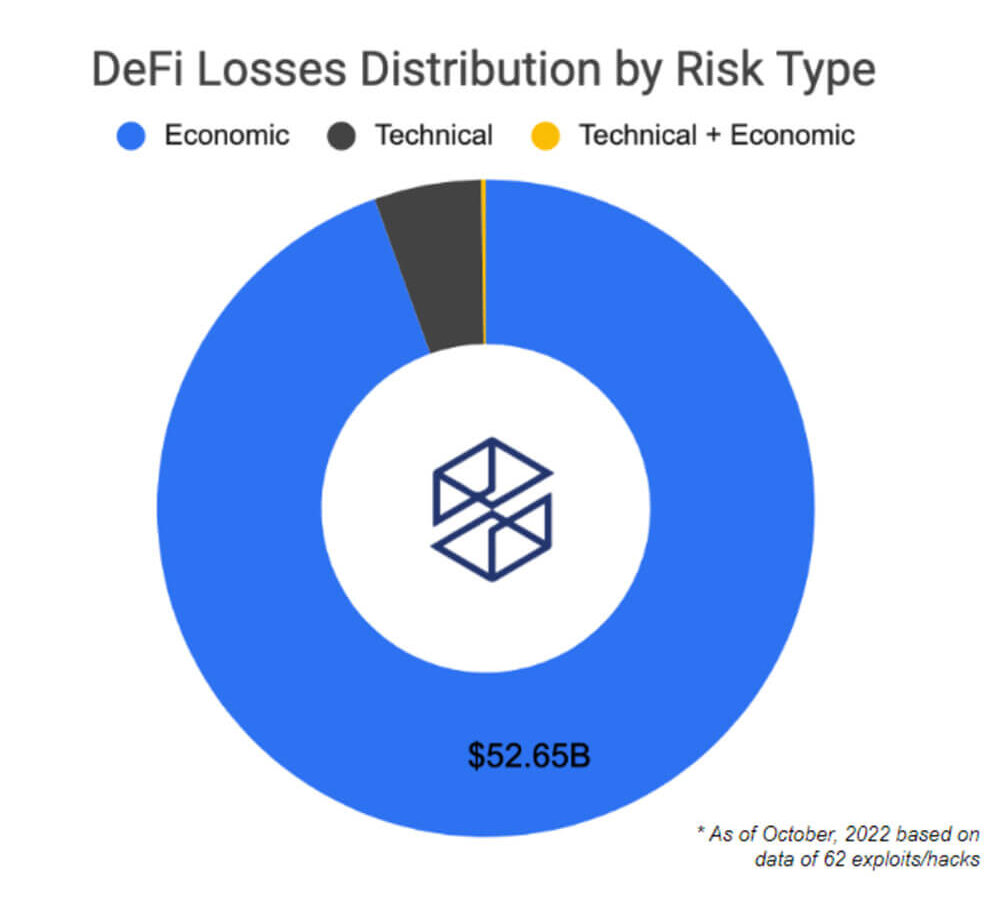

DeFi Losses Distribution by Risk Type (Source: IntoTheBlock)

DeFi Losses Distribution by Risk Type (Source: IntoTheBlock)Here is the organisation of the main hazard factors down the 62 largest DeFi attacks. Over $50B successful losses are accounted for economical risks. This estimation includes the illness of the infamous Terra ecosystem. Despite method factors being down the astir fig of attacks successful DeFi, a greater dollar worth has really been mislaid owed to economical risks.

Moreover, the caller bid of economical attacks connected respective lending protocols similar Mango and Moola has brought airy to the information that this poses implicit the ecosystem. In addition, galore of these lending protocols were attacked utilizing the aforesaid vector. The onslaught consisted of a highly analyzable strategy successful which the attacker identified the supported collateral plus with the lowest liquidity and marketplace cap. Low liquidity assets are the astir susceptible to flash loans oregon terms oracle manipulation attacks.

DEX Pools Liquidity (Source: IntoTheBlock)

DEX Pools Liquidity (Source: IntoTheBlock)The indicator shown supra is conscionable for acquisition purposes; nary unrecorded information is shown since it’s conscionable for reference. DEX Pools Liquidity indicator is portion of a acceptable of mock-ups built for a connection connected the Euler forum.

By tracking liquidity disposable for an plus successful decentralized exchanges, we tin gauge however prone it tin beryllium to being manipulated. A steadfast level of disposable liquidity for supported collateral assets is an important information factor. In the lawsuit of debased liquidity tokens listed arsenic collateral, problems of stableness successful the protocol could arise. Moreover, this could facilitate an easier way for terms manipulation, successful which attackers instrumentality vantage of the protocol.

The main extremity of an attacker orchestrating this benignant of onslaught volition beryllium to summation the magnitude of wealth helium tin borrow. This could beryllium done by pumping the spotted debased liquidity plus successful bid to beryllium capable to get ample quantities of different supported, much unchangeable assets.

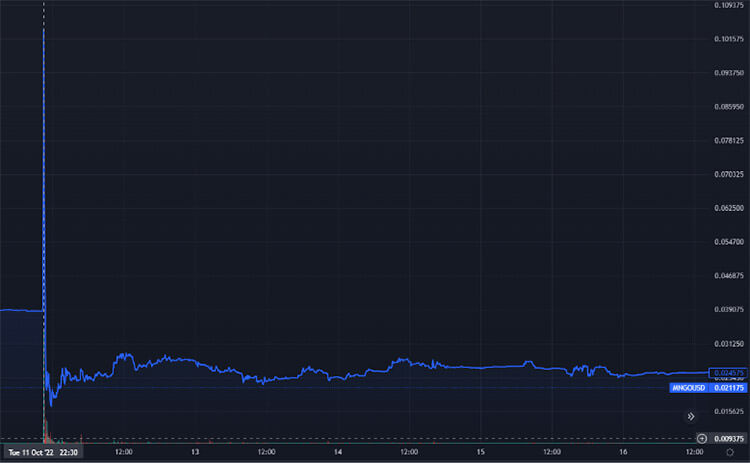

Mango Markets Price (via TradingView)

Mango Markets Price (via TradingView)The graph supra portrays the MNG token terms connected the FTX exchange. In this case, the attacker combined the lending functionalities of the protocol with its perpetual contracts. The attacker manipulated the spot terms connected Raydium, which triggered an oracle update. This enabled him to get against different unfastened presumption that helium had antecedently placed connected the Mango Markets protocols. Eventually, erstwhile the MNGO terms recovered, the protocol was near with a indebtedness default.

In narration to the indicators shown above, successful which they effort to fig retired anemic links successful the protocol, determination are besides ways to effort and fig retired imaginable threats from the attacker side. Usually, economical exploits are fastly executed; hence indicators shown beneath service acquisition purposes successful trying to measure imaginable threats from the proviso attraction of whales.

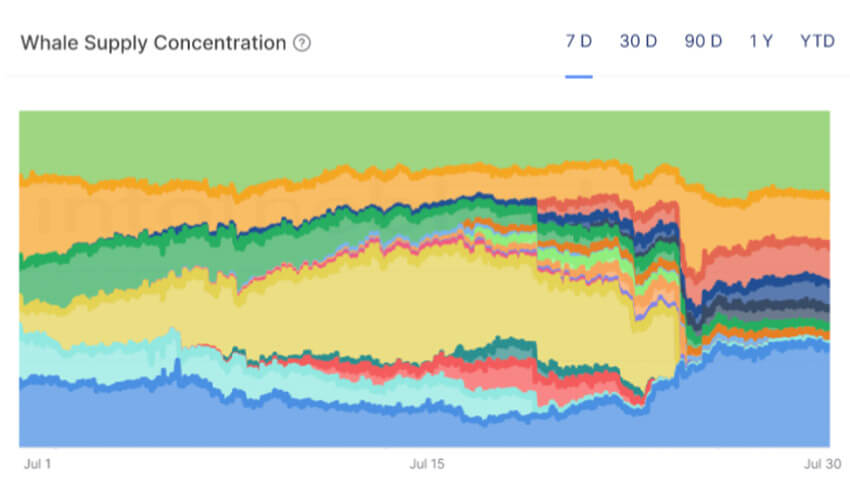

Whale Supply Concentration (via IntoTheBlock)

Whale Supply Concentration (via IntoTheBlock)The Whale Supply Concentration indicator is besides portion of the connection connected the Euler forum. This indicator is utile to spot imaginable threats to the protocol depositors. For example, if 1 of the largest protocol depositors is successful the slightest liquid plus that the protocol supports arsenic a collateral asset, it could beryllium worthy to further looking into the circumstantial address.

This indicator could beryllium invaluable to usage unneurotic with the DEX Pools Liquidity indicator shown supra and is peculiarly worthy monitoring if the attraction whale tokens is 1 of the weakest tokens supported by the protocol. This could assistance bring airy to imaginable damaging events.

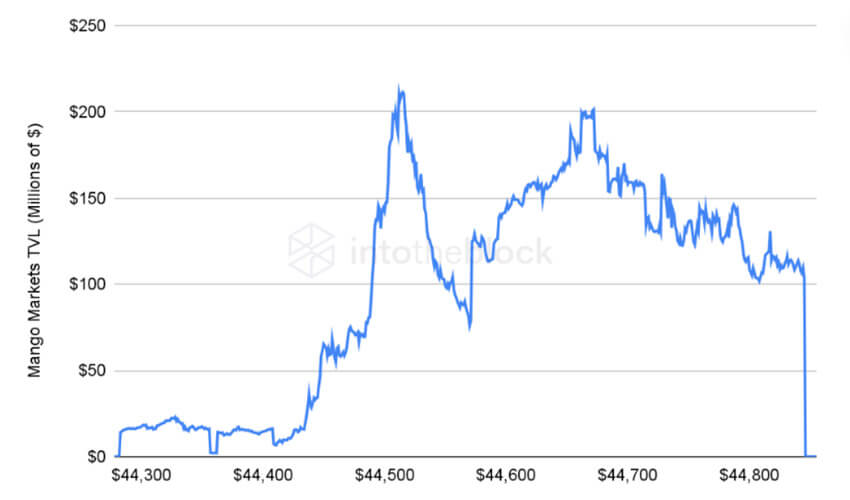

Mango Markets TVL (Millions of $) (via IntoTheBlock)

Mango Markets TVL (Millions of $) (via IntoTheBlock)Mango Markets protocol TVL tin beryllium seen connected the indicator above. A wide driblet tin beryllium seen aft the attacker borrowed wealth with his presumption connected the MNGO token arsenic collateral. Ultimately the protocol was near with atrocious indebtedness owed to the terms manipulation events.

Appropriate tools similar the above-shown purpose to determination the DeFi ecosystem 1 measurement person successful the close direction. These are conscionable immoderate of the archetypal indicators that archetypal picture the caller events and 2nd effort to support users from incidents similar this successful the future. The entity is that users and protocols summation an vantage from disposable on-chain information.

The station Deep-dive into the Mango Markets economical attack appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)