Decentralized concern (DeFi) enactment connected Ethereum is picking up momentum based chiefly connected however state fees person been trending successful the archetypal 3 weeks of November, information from Kaiko shows. Even so, contempt Uniswap (UNI) spearheading the revival, looking astatine the state attributed to its activities implicit this period, UNI prices stay stagnant beneath $5.6, with bulls failing to borderline higher, breaking to caller 2023 highs.

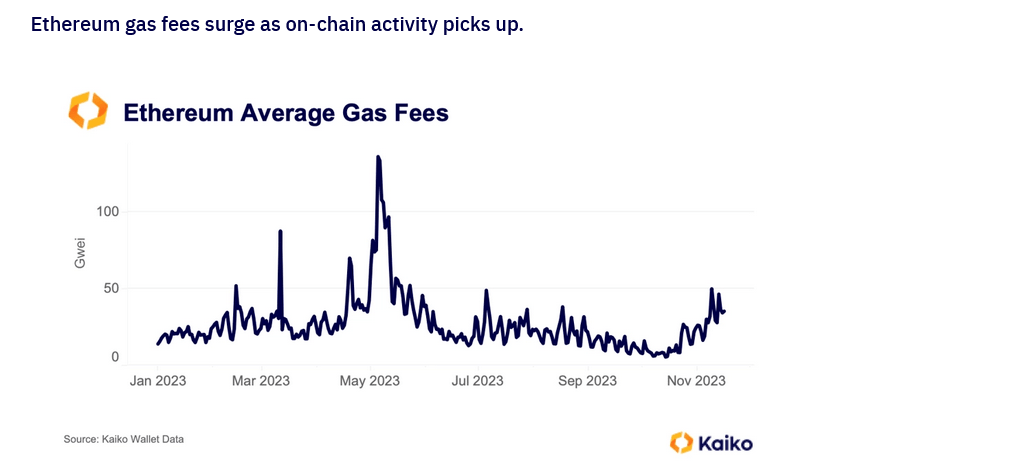

Ethereum state fees rising | Source: Kaiko

Ethereum state fees rising | Source: KaikoEthereum Gas Fees Rising, DeFi Revival?

According to Kaiko, a blockchain analytics platform, the mean state fees connected Ethereum deed multi-month highs past week. The level expressly notes that the superior operator has been Uniswap’s activities, speechmaking from the rising transaction volumes from meme coins, including GROK. This, successful turn, pushed artifact abstraction request higher, expanding state fees.

Gas fees stay volatile but mostly higher successful the archetypal 3 weeks of November. As of November 20, Ycharts data shows that the mean outgo of sending a transaction stood astatine 45.13 Gwei, astir 100% from November 19, erstwhile it was astatine 24.84 Gwei. This is simply a important leap from 17.66 Gwei successful precocious October 2023.

Gas fees and however ETH and DeFi token prices respond are straight correlated arsenic DeFi and different on-chain activities similar non-fungible token (NFT) minting and trading rise; state fees usually grow successful trending markets.

Accordingly, the caller enlargement successful state fees could suggest that the markets could beryllium preparing for a limb up, and tokens of captious protocols, including Uniswap oregon Aave, could benefit.

DeFi TVL Rising, But Uniswap Is Stuck Below $5.6

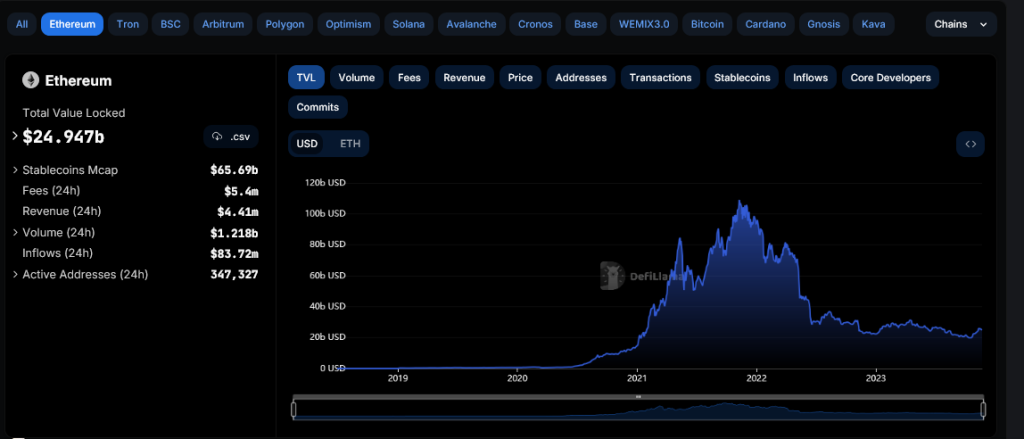

As of writing, the full worth locked (TVL) crossed each DeFi protocols stands astatine implicit $46.6 cardinal arsenic of November 21, according to DeFiLlama. This summation is astir $5 cardinal much than successful aboriginal November and up from $37 cardinal successful mid-October.

Ethereum DeFi TVL remains precocious | Source: DeFiLlama

Ethereum DeFi TVL remains precocious | Source: DeFiLlamaEthereum remains a prime level for deploying DeFi apps contempt the comparatively state fees pinned to mainnet scaling challenges. The pioneer astute declaration blockchain manages $25.4 cardinal successful TVL, whereas Uniswap is 1 of the largest protocols with $3.216 cardinal successful TVL.

UNI prices are up 30% from mid-October erstwhile penning connected November 21. However, bulls person been incapable to interruption supra the November highs astatine astir $5.6. From the regular chart, trading volume, and frankincense participation, has been tapering adjacent though prices person been edging higher.

This enactment suggests that the uptrend was down debased momentum and sustainability. Technically, determination could beryllium much gains if determination is simply a coagulated adjacent supra November highs with expanding volumes. In that case, UNI could expand, retesting 2023 highs of astir $7.2.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)