Decentralized concern (defi) has continued to stay profoundly ingrained successful the cryptocurrency system arsenic the ecosystem provides users with a non-custodial mode to speech integer assets, lend cryptocurrencies, contented stablecoins, and ways to nett from arbitrage. In the lending assemblage of defi, a batch has changed during the past 12 months arsenic lending applications similar Terra’s Anchor Protocol spot the dust, and 71.95% of the full worth locked successful defi lending protocols evaporated.

From $37 Billion to $10 Billion: The Top Five Defi Lenders Then and Now

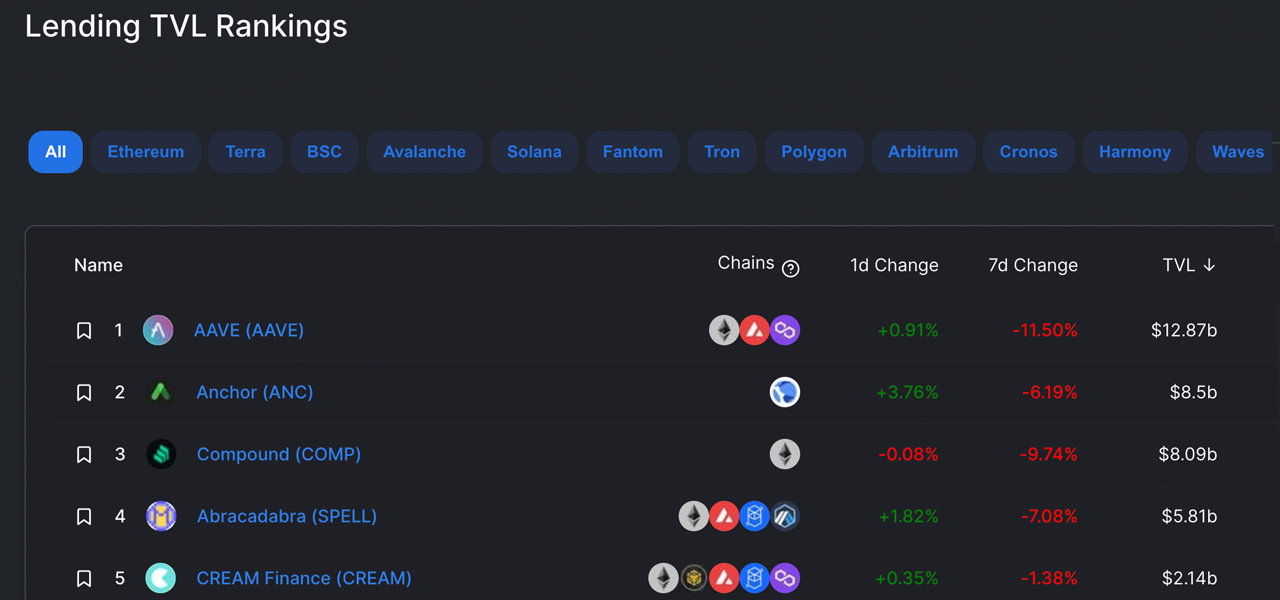

Last twelvemonth astir this time, decentralized concern lending protocols held $37.41 cardinal successful full worth locked (TVL), and the defi protocol Aave dominated with $12.87 billion. An archive.org snapshot from Jan. 10, 2022, shows that Aave’s $12.87 cardinal TVL was larger than the TVL the apical 5 defi lending protocols held connected Jan. 17, 2023.

Top 5 lending protocols by full worth locked connected Jan. 10, 2022.

Top 5 lending protocols by full worth locked connected Jan. 10, 2022.Data shows that the apical 5 defi protocols successful mid-Jan. 2023 see Aave ($4.58 billion), Justlend ($3.02 billion), Compound ($1.85 billion), Venus ($813.63 million), and Morpho ($221.59 million). Currently, each 5 of the aforementioned defi protocols person a combined TVL of astir $10.49 billion.

Top 5 lending protocols by full worth locked connected Jan. 17, 2023.

Top 5 lending protocols by full worth locked connected Jan. 17, 2023.On Jan. 10, 2022, Terra’s Anchor Protocol held astir $8.5 cardinal successful value, but present the defi protocol is successful ashes. Anchor was 1 of the main components successful the Terra ecosystem arsenic terrausd (UST) holders deposited UST for a 20% yearly percent complaint instrumentality that compounded daily.

But successful May 2022, UST depegged from its $1 parity, and Anchor holds lone astir $2 cardinal today. Compound held the third-largest TVL successful presumption of defi lending protocols with $8.09 cardinal astatine the time. On Jan. 17, 2023, Compound’s TVL has shrunk to $1.85 billion.

The second-largest defi lending protocol contiguous is Justlend with $3.03 billion. The Tron-based Justlend moved from the seventh-largest defi lending protocol TVL to the 2nd by jumping from $1.72 cardinal to the existent $3 billion. Justlend is 1 of the lone decentralized concern lending applications that saw an summation during the past 12 months.

The 4th and fifth-largest defi lenders past year, Abracadabra and Cream Finance, are nary longer successful the apical 5 standings and person been replaced by Venus and Morpho. Cream Finance is present successful the 20th position, dropping from $2.14 cardinal to the existent $42.94 million.

Tags successful this story

Aave, Abracadabra, anchor protocol, Arbitrage, ashes, Change, Compound, cream finance, Cryptocurrencies, Cryptocurrency, decentralized finance, DeFi, defi lending, depegged, Digital Assets, drop, Economy, evaporated, Exchange, increase, Justlend, lend, lending, lending applications, lending defi, Morpho, Non Custodial, Parity, Profit, Protocols, Sector, Stablecoins, Terra, total worth locked, tron, TVL, value locked, Venus

What bash you deliberation astir the defi lending protocol shake-up implicit the past 12 months? Let america cognize your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)