Options protocols built connected Ethereum and different networks person seen falling volumes and users since the commencement of 2022, according to information analytics instrumentality Glassnode. The inclination follows a autumn successful the broader crypto market, analysts said.

An enactment is simply a declaration that allows its holder the right, but not the obligation, to bargain oregon merchantability an underlying plus astatine a specified terms connected oregon earlier a specified date.

While options are predominantly utilized by banks and concern firms successful accepted finance, respective options protocols person sprouted successful the past 2 years arsenic decentralized finance (DeFi) – oregon products that usage smart contracts for fiscal services – gained steam successful the broader crypto market.

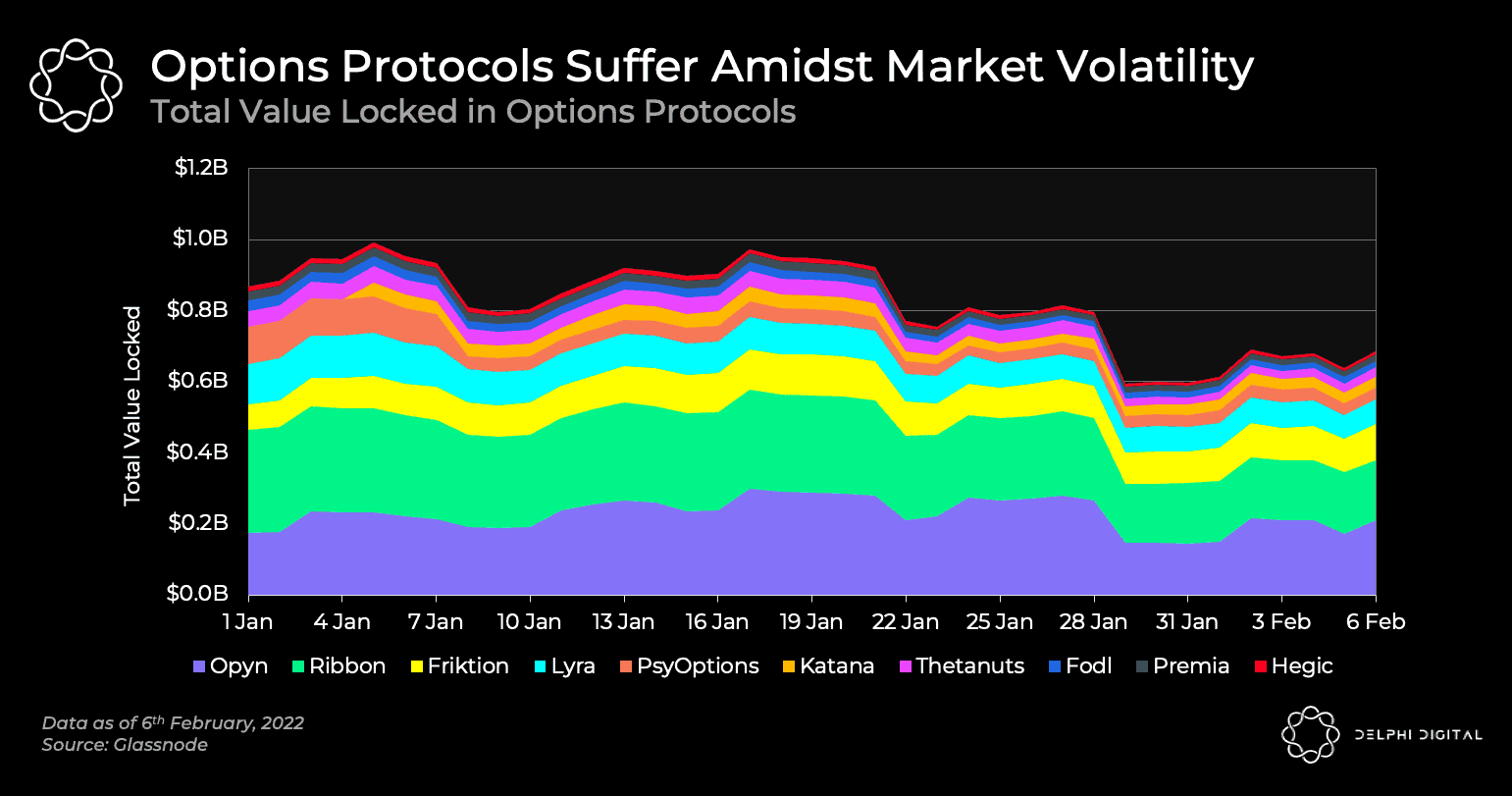

Options usage, however, seems to beryllium correlated to marketplace movements. The total worth locked (TVL) successful options protocols has experienced an exodus of hundreds of millions of dollars since the commencement of 2022, according to probe from Delphi Digital this week.

TVL connected platforms similar Hegic dropped to nether $800 cardinal from $1 cardinal astatine the commencement of January, portion immoderate similar Opyn saw nominal drops followed by a recovery.

Options protocols mislaid millions of dollars successful locked value. (Delphi Digital)

Analysts said the driblet came arsenic crypto sentiment fell. “The driblet is apt attributable to falling plus prices. Lower plus prices effect successful mediocre show for put-selling vaults and a 'flight to safety' amid the marketplace volatility, causing investors to retreat superior from risky enactment vaults,” Delphi Digital said successful a enactment this week.

Ether prices fell to nether $2,200 astatine the commencement of January, losing 37% since November’s all-time highs of implicit $4,800. Tokens of different furniture 1, oregon base, blockchains fell similarly, with Solana’s SOL losing 59% and Polkadot’s DOT losing 63% since November highs, CoinGecko data shows.

Risky for immoderate and profitable for others

Developers down immoderate crypto platforms said options for crypto – which are themselves a risky plus people – signifier 1 of the riskiest strategies successful the market, 1 that sees an contiguous exodus if conditions crook bearish.

“The integer currency ecosystem is mostly known arsenic a precise risky terrain based connected the volatility of inherent assets,” Dmitry Mishunin, laminitis of crypto audit institution HashEx, told CoinDesk successful a Telegram message. “Many pulled funds from perceived risky assets, and marketplaces of which DeFi options represents one.”

“If you hold to bargain Ethereum erstwhile it goes -40% successful a week and you are consenting to merchantability Ethereum erstwhile it goes +40% successful a week, you tin usage 'covered call' and 'writing put' vaults to make an further 40-50% yields connected your holdings,” explained Andrey Belyakov, laminitis of derivatives level Opium Protocol, successful a Telegram connection to CoinDesk.

Belyakov, however, cautions, “It is similar a crisp knife, tin beryllium highly adjuvant for cooking oregon 1 tin suffer a digit if helium is not bully with it.”

At the clip of writing, the DeFi options marketplace had a TVL of $761.1 cardinal crossed a excavation of 31 protocols. But immoderate expect the TVL to instrumentality should marketplace conditions improve.

“Confidence is expected to instrumentality to the ecosystem implicit the adjacent fewer weeks, but each is babelike connected however the broader integer currency ecosystem performs,” Mishunin said.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)