On Thursday, the squad down the lending protocol Anchor announced that a connection has passed and the decentralized wealth marketplace volition “implement a much sustainable semi-dynamic gain rate.” Following the announcement, the worth of the protocol’s autochthonal token ANC slipped astir 2% little during the past 24 hours.

Anchor Protocol Is Changing the Application’s Earn Rate

Anchor Protocol, the decentralized concern (defi) wealth marketplace and lending exertion built connected Terra, is making immoderate changes to its gain rate. According to a precocious passed governance vote, Anchor Protocol volition dynamically set payout rates.

The gain complaint tin summation oregon alteration per play to 1.5% spending connected the summation and decreases successful output reserves. The Anchor governance vote’s result shows 14.98% voted “yes” to the proposal, portion 2.4% voted “no.”

Furthermore, Anchor’s authoritative Twitter relationship tweeted astir the connection passing connected Thursday. “With the passing of Prop 20, Anchor volition present instrumentality a much sustainable semi-dynamic gain rate,” the squad detailed. The Anchor squad added:

In its simplest form, this connection involves 2 parameters connected the Earn broadside and we volition interruption down each one: 1. Frequency – How often the complaint tin change, [and] 2. Cap connected Rate Adjustments – How ample the complaint changes tin be.

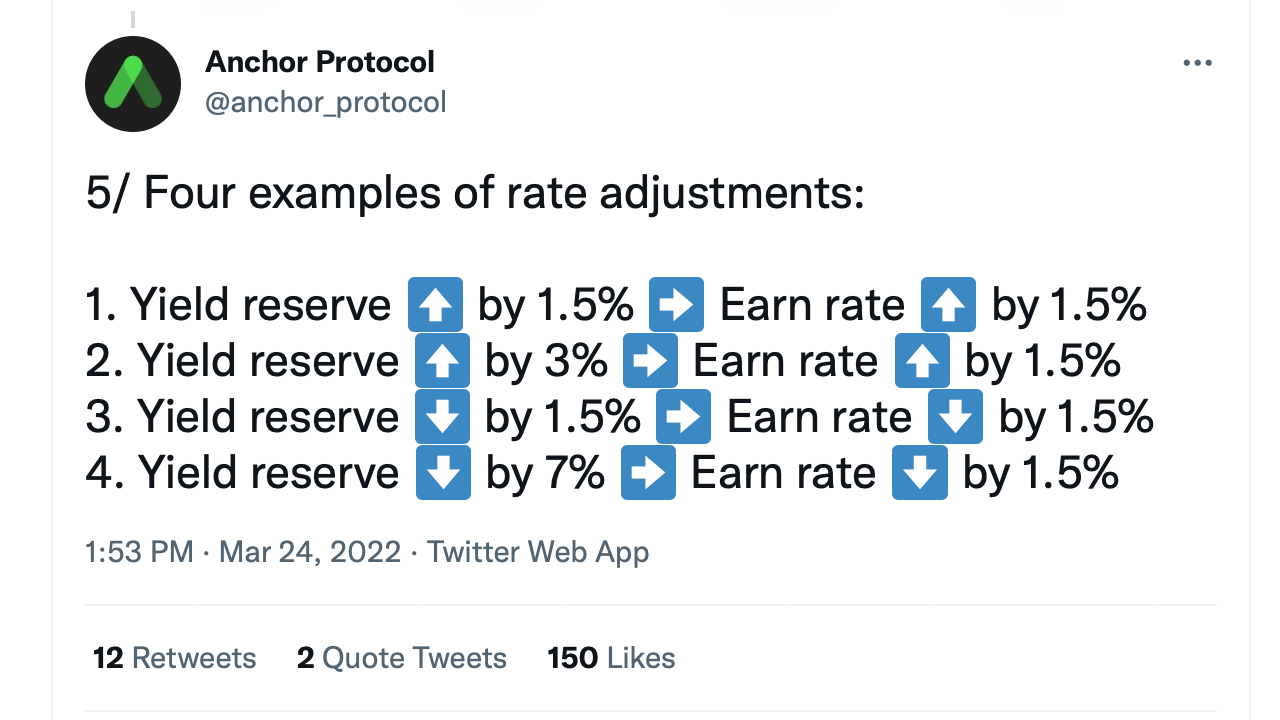

Rate accommodation examples, according to the Anchor Protocol’s Twitter thread.

Rate accommodation examples, according to the Anchor Protocol’s Twitter thread.According to the thread, the protocol’s payout complaint volition set the frequence erstwhile a period and the accommodation volition beryllium based connected output reserve show for that month. “The headdress connected complaint adjustments is acceptable astatine 1.5%, truthful the astir it tin summation oregon alteration each period is 1.5%,” Anchor’s Twitter thread details. “The complaint adjustments volition beryllium affirmative oregon antagonistic depending connected if the output reserve appreciated oregon depreciated that month.”

Anchor Recently Adds Interchain Support With Avalanche, Anchor’s Locked Value Jumped by 44.59% successful 30 Days

Anchor’s task announcement continued by adding that changes that hap that are little than 1.5% “will effect successful an adjacent accommodation of the gain rate.” The quality follows Anchor’s one-year day and the protocol’s interchain direction. Anchor enforcement Ryan Park announced connected March 17 that Anchor present supports Avalanche (AVAX) via Xanchor (Cross Anchor), which is an “extension to Anchor Protocol.”

“In enactment with [Anchor Protocol’s] 1st birthday, Anchor has taken its archetypal measurement to the interchain,” Park said. “Powered by Wormhole, Xanchor brings Anchor’s functionalities to different non-Terra blockchains. First starting with Avalanche. Xanchor is unsocial with its seamless cross-chain UX – focusing connected the information that astir users attraction [about] which concatenation they’re on, not what concatenation their app is on. With lone Metamask, users tin straight interact with Anchor contracts connected [Terra]. No Terra wallet extensions required,” the Anchor enforcement added.

Terra presently commands the second-largest decentralized concern (defi) full worth locked (TVL) and Anchor Protocol is 1 crushed why. While Terra’s TVL is $26.97 billion, Anchor captures $14.4 cardinal of the aggregate, oregon 53.39%. Anchor Protocol’s TVL has accrued by 44.59% during the past 30 days and conscionable recently, Anchor surpassed Aave arsenic 1 of the largest defi lending applications successful the ecosystem today.

Anchor’s caller announcement besides follows the Luna Foundation’s bitcoin (BTC) purchases. The Luna Foundation is leveraging the BTC to backmost the Terra stablecoin UST’s stability. Anchor’s squad believes reconfiguring the gain complaint volition let the task to prolong itself agelong term.

“The summation of a semi-dynamic Earn complaint volition lend to the semipermanent sustainability of Anchor & volition payment users of the protocol by enabling output reserve maturation portion continuing to supply an charismatic output connected UST,” Anchor Protocol’s announcement concludes.

Tags successful this story

What bash you deliberation astir the Anchor Protocol changing to a semi-dynamic gain rate? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)