The full worth of assets locked (TVL) connected decentralized concern (DeFi) projects recorded a 30% year-on-year diminution to driblet to its lowest constituent for this twelvemonth astatine $36.95 billion, per information from DeFillama.

While DeFi projects started the twelvemonth strongly, peaking astatine much than $52 cardinal successful April, the assemblage has witnessed six months of accordant underperformance, dragging it to its existent low.

DeFi Projects TVL. (Source: DeFillama)

DeFi Projects TVL. (Source: DeFillama)Liquid staking projects thrive

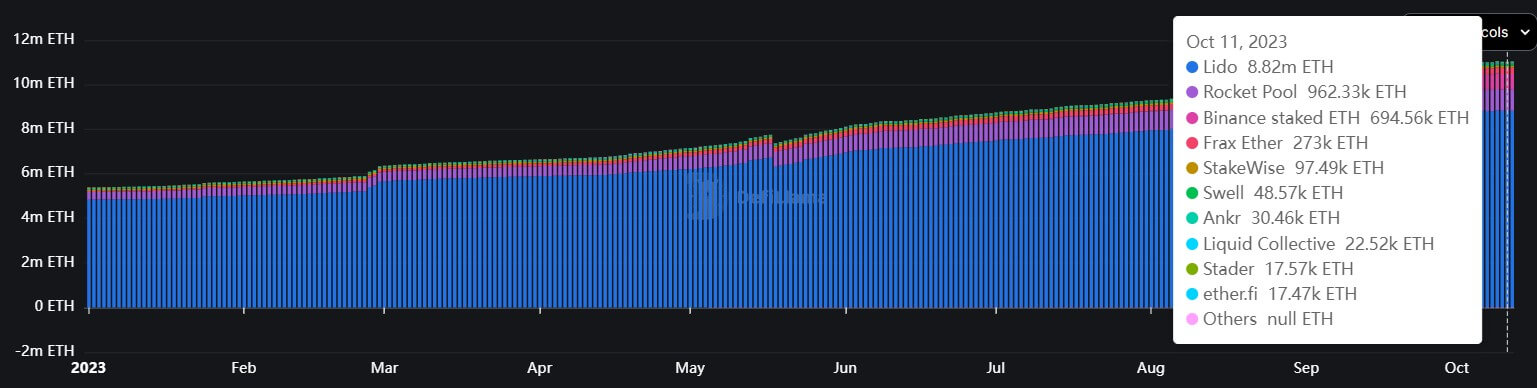

In the ever-evolving scenery of the DeFi sector, liquid staking projects person emerged arsenic a beacon of resilience, contrasting with the broader diminution seen successful different DeFi categories.

Liquid staking projects inflow (Source: DeFillama)

Liquid staking projects inflow (Source: DeFillama)Despite the prevailing bearish sentiments, liquid staking projects person thrived, returning astir 300% from their 2022 debased to astir $20 cardinal successful TVL, according to DeFillama data. As of the latest figures, TVL present stands astatine $17.67 billion.

Lido is the ascendant subordinate wrong this niche, maintaining implicit 50% of the marketplace share, outpacing large contenders similar Binance, Coinbase, and Kraken, arsenic per insights from Nansen information shared with CryptoSlate.

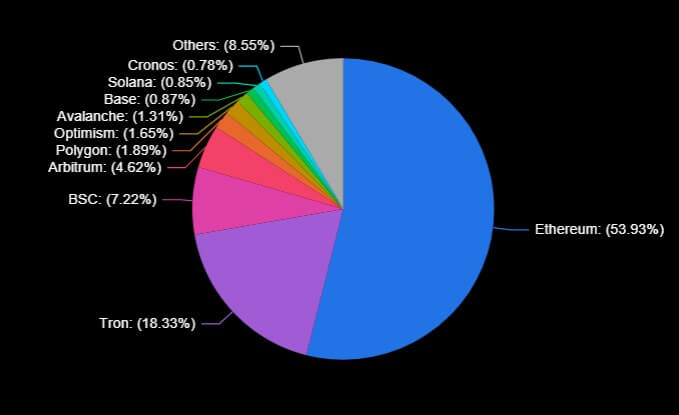

Tron-based projects TVL rise

The Tron network, too, has witnessed important maturation successful its DeFi projects, with their publication to the wide TVL hitting an all-time precocious of 18.23% from the 6.5% recorded earlier successful the year.

TVL Across Chains. (Source: DeFillama)

TVL Across Chains. (Source: DeFillama)On-chain sleuth Patrick Scott attributed Tron’s accrued TVL to the maturation of the archetypal Real-World Assets (RWA) connected the network, stUSDT. According to DeFillama data, the project’s TVL is nearing $2 cardinal successful conscionable 4 months since its launch.

However, CryptoSlate reported that the task has travel nether scrutiny, chiefly owed to its governance and transparency, portion immoderate of its claimed partners, similar Tether (USDT), person denied immoderate affiliations.

Meanwhile, Ethereum remains the superior level for DeFi projects and applications, controlling much than 50% of the market. Other networks similar Binance Smart Chain, Polygon, Arbitrum, and others besides big galore projects.

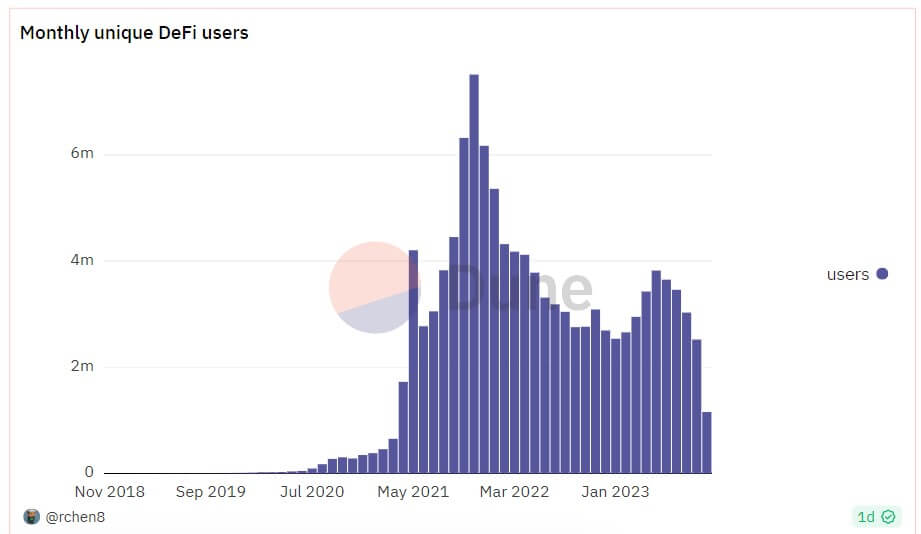

DeFi projects mislaid 2.5M monthly users.

As the TVL has flatlined, DeFi projects person encountered different challenge: a alteration of astir 2.5 cardinal progressive monthly users passim the year, Altindex reported, citing a Dune Analytics dashboard by rchen8. Per the report, the diminution commenced successful May and has maintained a downward trend.

Source: Dune Analytics

Source: Dune AnalyticsIn May, the DeFi assemblage boasted implicit 3.8 cardinal monthly users, but by October, this fig had dwindled to astir 1.15 million, compared to the 2.7 cardinal users reported the erstwhile October. Overall, monthly unsocial users person dropped by 66% from the all-time precocious of 7.51 cardinal recorded successful November 2021.

The station DeFi TVL down 30% YoY yet liquid staking and Tron based projects defy trend appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)