The full magnitude of superior locked connected decentralized concern (DeFi) protocols hit $170 cardinal connected Thursday, a landmark fig arsenic present each of the the losses from the 2022 Terra/LUNA ecosystem collapse and consequent carnivore marketplace person been erased.

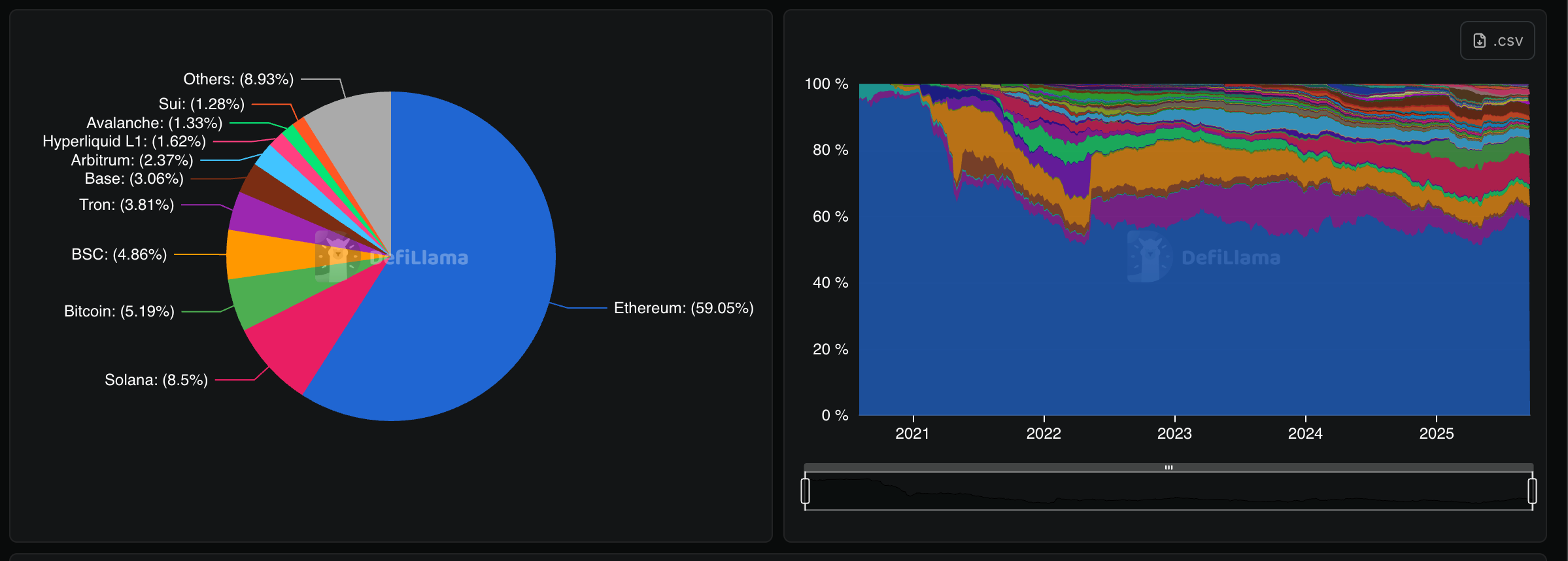

While Ethereum inactive commands the lion's stock of superior astatine 59%, newcomers including Coinbase-backed furniture 2 web Base, HyperLiquid's furniture 1 blockchain and Sui person begun to spot distant astatine Ethereum's dominance, collectively amassing much than $10 cardinal worthy of full worth locked (TVL), representing astir 6%.

Investor trends person shifted successful this caller cycle; organization adoption of ether has led to outflows from accepted liquid staking products similar Lido into organization staking products similar Figment, portion determination has besides been maturation successful Solana and BNB Chain owed to a seismic emergence successful memecoin activity.

Solana is present the 2nd largest blockchain successful presumption of DeFi with $14.4 cardinal successful TVL with BNB concatenation down that with $8.2 billion.

A maturing sector

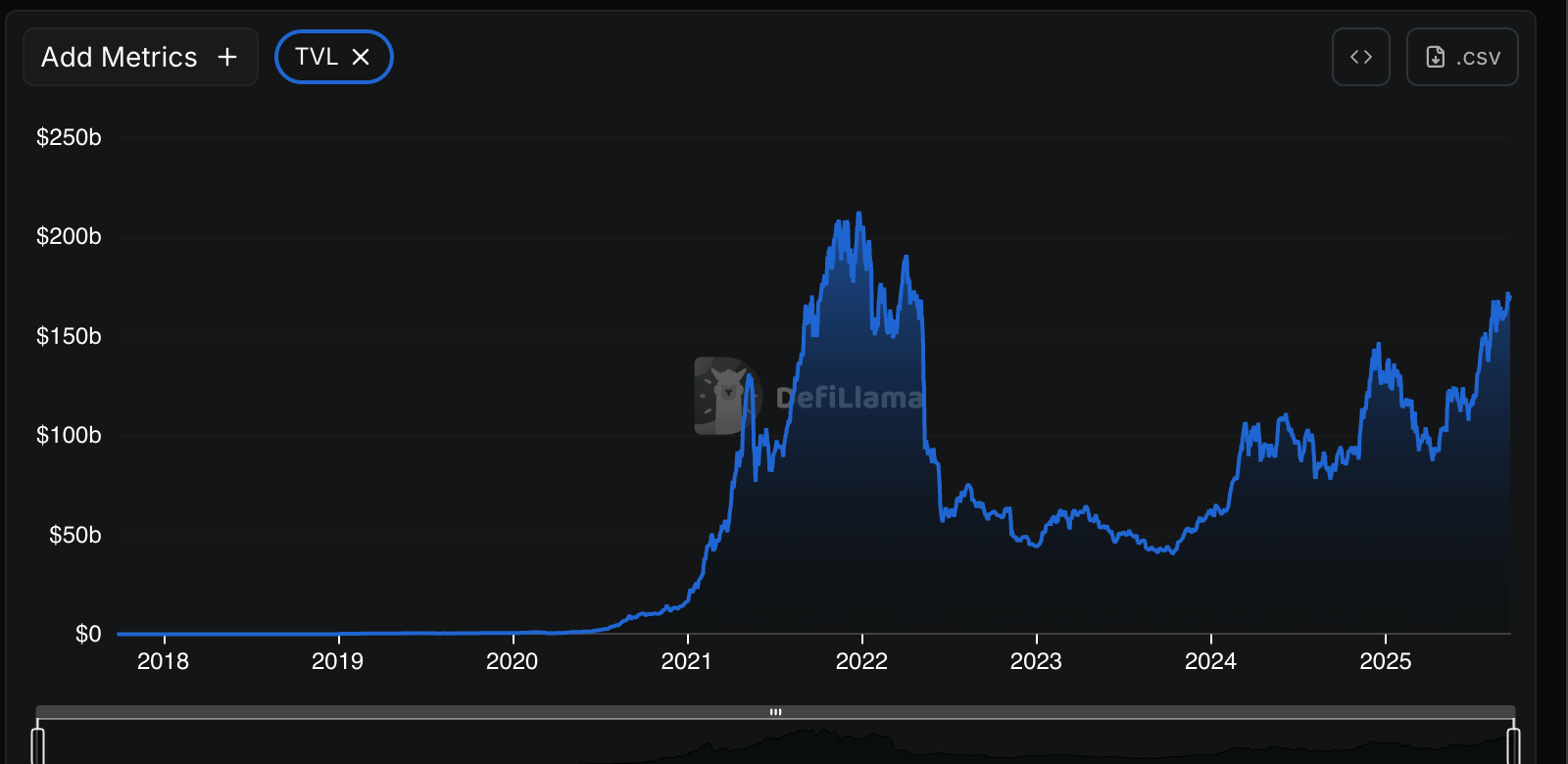

The erstwhile bull marketplace betwixt January 2021 and April 2022 saw accelerated maturation crossed the DeFi ecosystem, with TVL jumping from $16 cardinal to $202 billion. This rhythm has been much measured with a dilatory but dependable summation from $42 cardinal successful October 2022 to $170 cardinal successful September 2025.

The emergence suggests crypto investors mightiness beryllium learning from their mistakes of 2022 and person created a much mature ecosytem to lend, get and make yield.

The Terra implosion saw $100 cardinal worthy of TVL wiped disconnected astir overnight arsenic investors, including bankrupt crypto hedge money Three Arrows Capital, took a gung ho attack connected an algorithmic stablecoin that yet failed — starring to contagion and atrocious indebtedness spreading crossed the full industry.

Terra was the crypto-form of a classical "dividend trap," a merchandise that offered yields that were excessively bully to beryllium existent but yet turned retired to beryllium unsustainable.

Now, yields person receded with lending protocol Aave offering a 5.2% output connected stablecoins portion restaking protocol Ether.fi is offering 11.1%, acold little than the 20% Terra was offering connected its stablecoin.

What adjacent for DeFi?

With the DeFi assemblage present being backmost wherever it was earlier the Terra debacle, albeit with much sustainable yields, critics volition inquire however tin the marketplace proceed to turn to topple 2021's grounds precocious successful presumption of TVL.

The reply to that is nuanced. While it's existent that organization adoption and inflows to assets similar ether and solana volition proceed to thrust a bullish narrative, the manufacture is inactive battling with rampant hacks, scams and rug pulls connected to memecoins.

Crypto investors lost $2.5 billion to hacks and scams successful the archetypal fractional of 2025 and successful bid for the manufacture to genuinely go a viable alternate to accepted finance, investors request to beryllium protected.

Unlike accepted concern wherever deposits are often insured and protected, the precise essence of cryptocurrencies means that you are connected your own; if you suffer your keys, get phished oregon hacked, determination is no helpline to call.

The adjacent iteration of DeFi, whether that is successful this rhythm oregon the next, volition request to absorption connected information and hack prevention — due to the fact that the manufacture is inactive 1 large implosion distant from different crypto winter.

2 months ago

2 months ago

English (US)

English (US)