This nonfiction is to service arsenic thing much than a publication to the bitcoin mining community.

I’m not a mathematician.

I’m not a statistician nor a certified economist.

I’m conscionable a bitcoin miner, a builder, and a freethinker that loves spreadsheets and algebra and, for the past 4 years, I’ve been trying to fig retired a mode to decently worth bitcoin ASICs astatine immoderate fixed clip portion taking into information wide marketplace conditions.

The pursuing is the evolved calculation I person utilized to find whether oregon not I should propulsion the trigger and acquisition an ASIC — oregon alternatively this is simply a calculation that helps maine from becoming overzealous and overpaying for hardware. I’ve been inspired to stock this by the phenomenal folks successful DBF.

It has kept maine from making mistakes, hopefully you find it to beryllium useful.

Denver’s Derivative Explained

Some presumption to define:

- Watts/Th = An ASIC’s full watt depletion divided by its nominal Th/s rating.

- $/Th = The full outgo of an ASIC divided by its nominal Th/s rating.

- WattDollar = The merchandise of an ASIC’s watts/Th multiplied by $/Th.

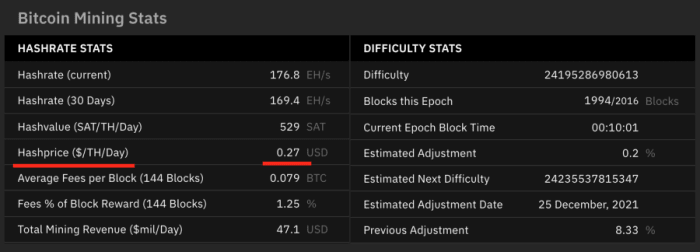

- Hash terms = USD worth of 1 Th/s implicit the people of 24 hours.

- Elongated hash terms = USD worth of 1 Th/s implicit the people of 50,000 blocks.

Denver’s Derivative (DD) = WattDollar/Elongated hash terms =

- >50 = If your powerfulness is little than ~$0.035 OR you’re going to tally the ASIC for five-plus years.

- <50 = If your powerfulness is little than ~$0.055 OR you’re going to tally the ASIC for four-plus years.

- <40 = If your powerfulness is little than ~$0.075 OR you’re going to tally the ASIC for three-plus years.

- <30 = If your powerfulness is little than ~$0.125 OR you’re going to tally the ASIC for 3 years.

- <20 = If your powerfulness is little than ~$0.15 OR you’re going to tally the ASIC for two-plus years.

- <15 = Borrow to bargain each the hardware (just kidding but not really).

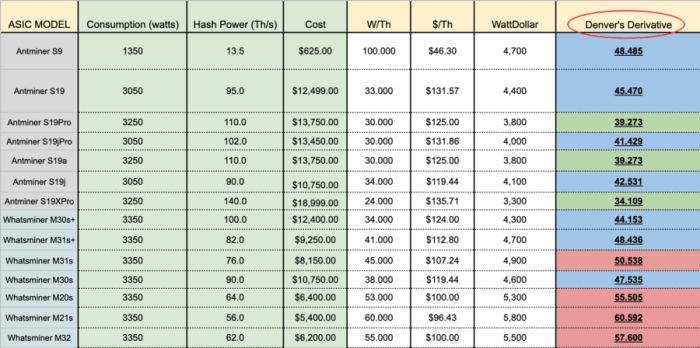

Below is simply a screenshot of immoderate existent bitcoin ASIC models, their respective specifications and their DD rating:

Denver’s Derivative Spreadsheet Screenshot (ASIC specifications whitethorn not beryllium precisely accurate)

Keep successful caput these calculations were based connected the existent hash terms of $0.275 and, therefore, an elongated hash terms of $95.48 astatine the clip I wrote this nonfiction per the Slush Pool/Braiins dashboard:

The Problem

The occupation contiguous is that ASICs are priced based much connected bitcoin’s marketplace terms than connected profitability of the ASICs.

While that mightiness dependable similar the aforesaid happening and, yes, bitcoin’s terms decidedly plays a relation arsenic to whether oregon not an ASIC is profitable — but it’s not the only variable — full web contention needs to besides beryllium taken into account. This is wherefore the hash price is important — the hash terms takes into information the worth of a azygous Th/s implicit the people of 24 hours — this accounts for full competition/difficulty connected the network. Therefore, ASICs should beryllium priced based upon hash rate, but alternatively they’re seemingly priced solely connected bitcoin’s marketplace terms and sentiment astir that marketplace price.

A speedy illustration of however this creates disequilibrium passim hardware markets:

Let’s accidental contiguous an Antminer S19 is priced astatine $10,000 adjacent and bitcoin’s marketplace terms is astatine $50,000 even. In today’s market, what we spot is if bitcoin’s marketplace terms moves to $55,000 (a 10% increase), we’ll often spot a comparable comparative summation successful ASIC prices, and that $10,000 ASIC is present $11,000 delivered. But that ASIC whitethorn not beryllium 10% much profitable denominated successful USD. Here’s why: If, portion the bitcoin terms accrued from $50,000 to $55,000, the full contention connected the web could person accrued from 160 Eh/s to 168 Eh/s (5% increase). So yes, the bitcoin that the aforesaid ASIC is earning is present worthy 10% more, however, it is besides earning 5% little bitcoin than it was before, truthful truly that ASIC is maybe lone 5% much profitable, but it’s present 10% much expensive. I wanted to quantify that alpha to effort and debar overpaying for hardware, portion being capable to instrumentality vantage of terms dips successful hardware outgo comparative to profitability (a uncommon occurrence).

This is wherefore incorporating the elongated hash price adaptable was important: It allowed maine to tether the terms and ratio of ASICs to the world of however profitable bitcoin mining is “in general” (or however invaluable a Th/s is, successful general) astatine immoderate fixed time.

This world is indicative of an immature marketplace ripe for disruption, innovation and commoditization. I anticipation to spot maturation successful the coming 9 years, but successful the abbreviated term, I’ll beryllium relying upon this derivative to cognize whether oregon not my ASIC terms is connected par with humanities prices.

Conclusion

The crushed I personally find this calculation to beryllium utile is due to the fact that it takes into information the 3 astir important variables erstwhile purchasing an ASIC:

- The thermodynamic/computational ratio of the ASIC — w/Th

- The capital/cost ratio of the asic — $/Th

- The wide wellness of the hash powerfulness marketplace — elongated hash price

This mode I could archer if I was getting a bully terms crossed time.

This mode I could assistance those who privation to excavation astatine location utilizing Upstream Data’s BlackBox.

I anticipation you find it to beryllium utile and I invited immoderate and each criticism.

May you find large occurrence successful each your hashing endeavors.

— Adam Ortolf

This is simply a impermanent station by Adam Ortolf. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

4 years ago

4 years ago

English (US)

English (US)