Several months ago, investors facing FOMO – the fearfulness of missing retired – disquieted that the vessel had sailed erstwhile it came to crypto. Now, however, portion that vessel whitethorn person near the harbor, the upwind is retired of its sails arsenic it floats directionless for the clip being. Perhaps it’s due to the fact that of upcoming Fed tightening; enthusiasm seems to person dampened. That sentiment is backed up by immoderate marketplace information showing marketplace enactment has fallen and that could instrumentality prices with it.

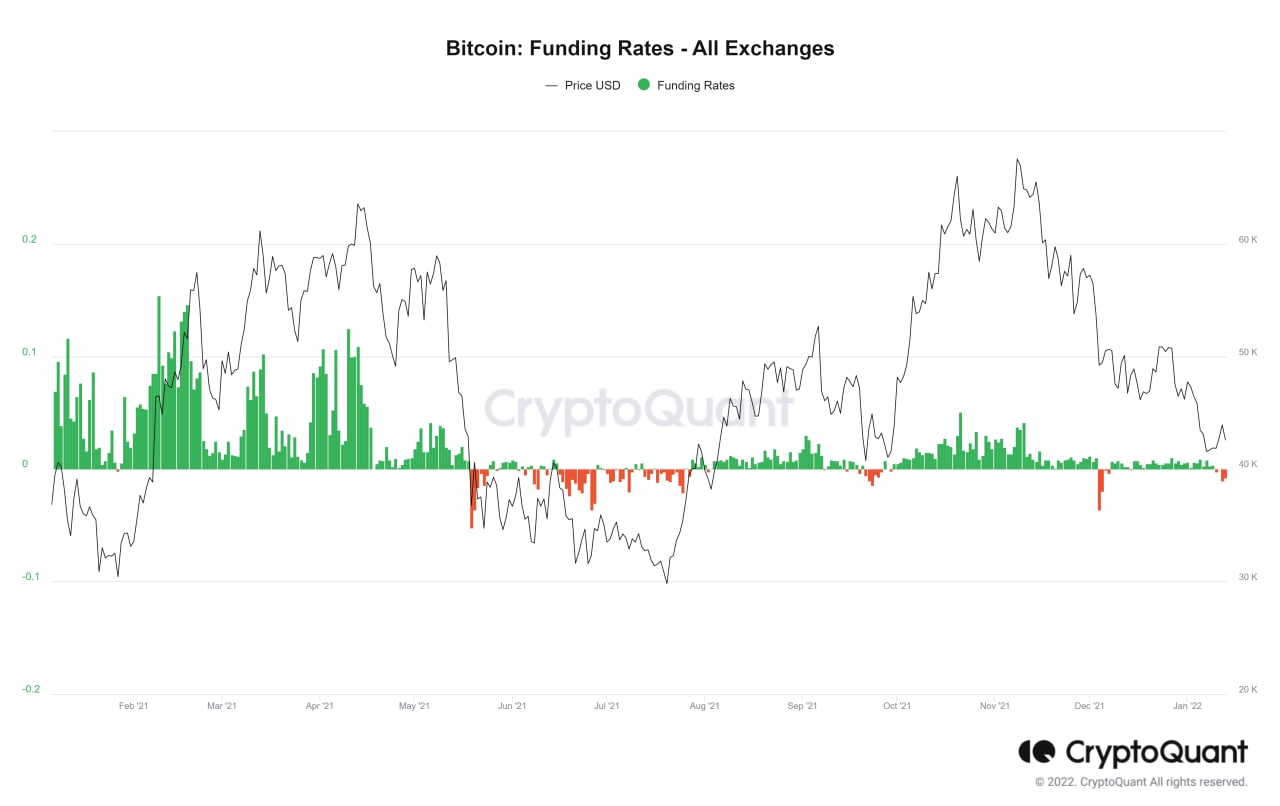

1. Funding rates person gone negative.

Bitcoin Funding Rates vs. Price (via CryptoQuant.com)

Rates from respective large exchanges compiled by analytics steadfast CryptoQuant amusement that the outgo of borrowing to bargain crypto connected leverage has fallen to the constituent wherever it’s somewhat negative. That implies that request for wealth to marque leveraged bets has taken a hit. Traders aren’t successful immoderate unreserved to adhd to their positions.

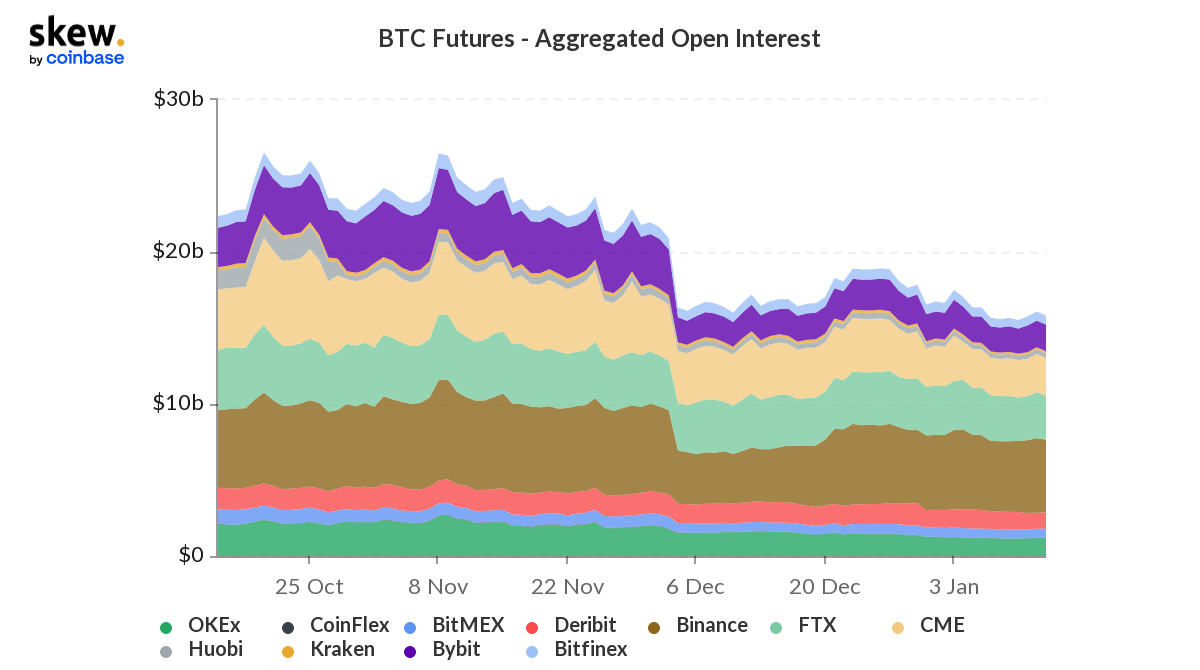

2. Open involvement (OI) successful bitcoin futures is down somewhat since the past week of December.

Bitcoin Futures Open Interest (via Skew.com)

It’s presently $16 billion, according to information tract Skew.com, down from conscionable shy of $19 cardinal astir Christmastime. During bitcoin’s November peak, unfastened involvement was astir $26 billion.

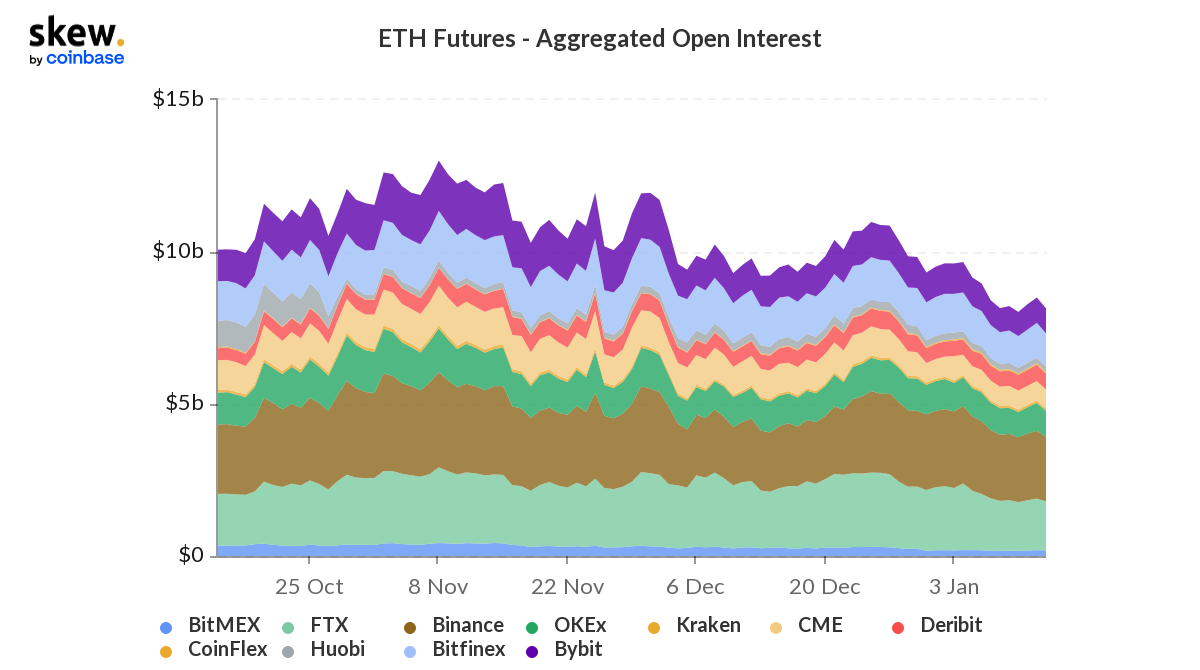

3. Ether futures besides person seen declining unfastened interest.

Ether Futures Open Interest (via Skew.com)

Since its ain November highest of $13 billion, unfastened involvement for the smaller ether futures marketplace is presently astir $8 billion.

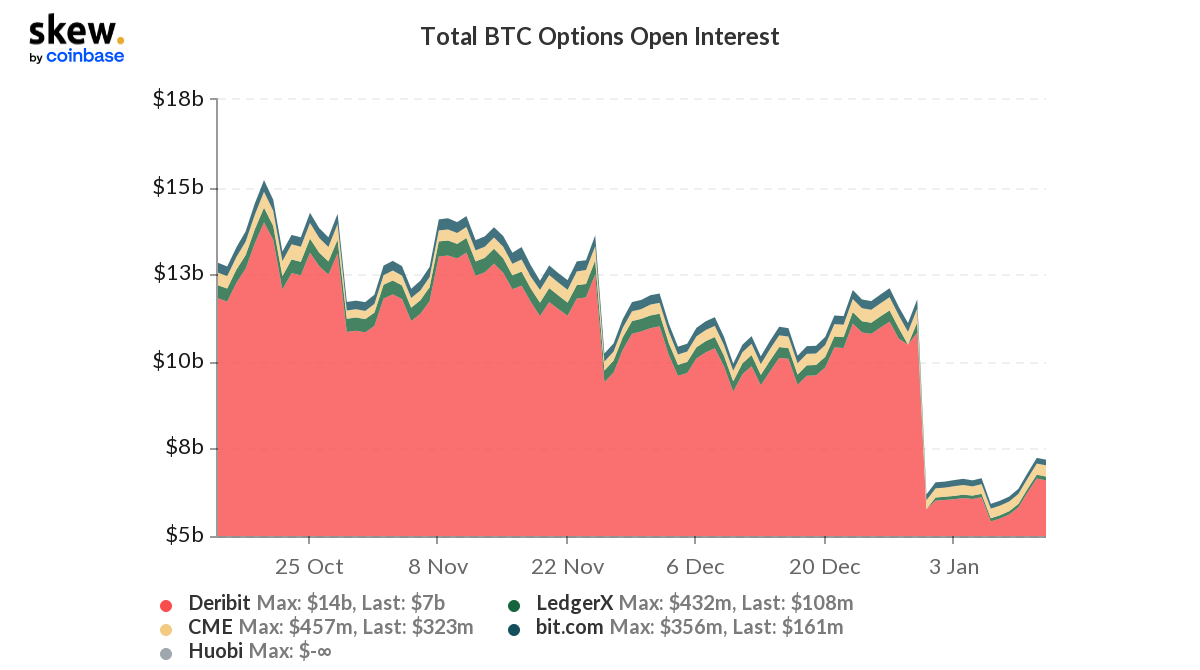

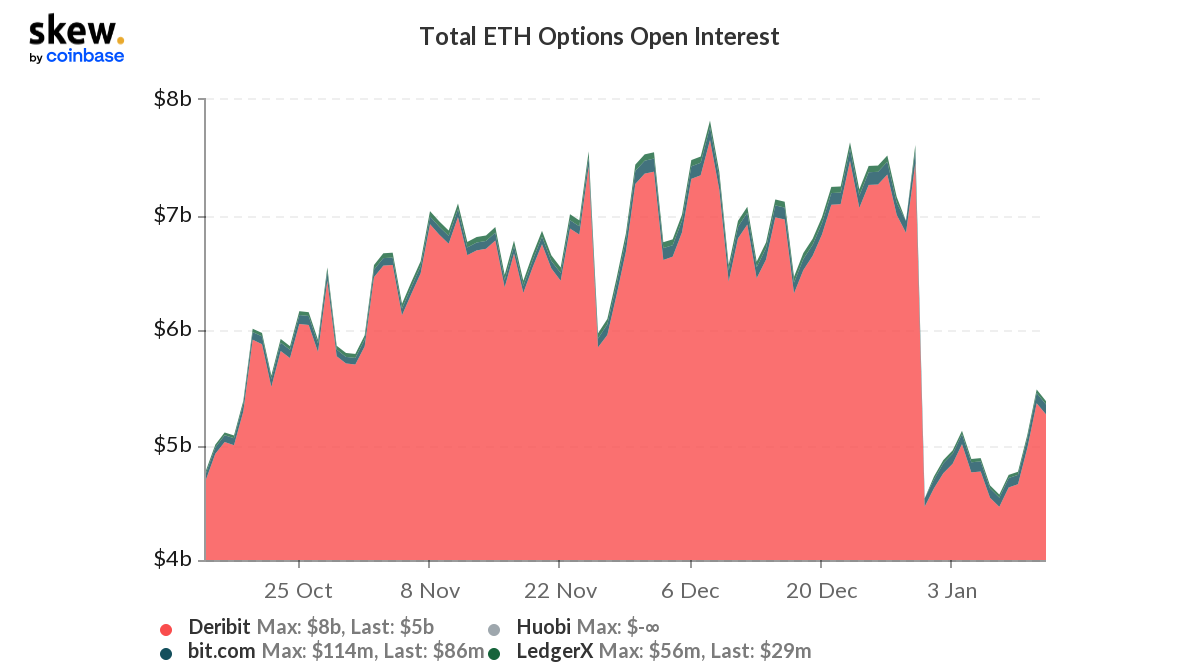

4. Options unfastened involvement connected bitcoin and ether are down to wherever they were successful aboriginal October.

Bitcoin Options Open Interest (via Skew.com)

OI for bitcoin options is present astatine $7 cardinal and $5 cardinal for ether. Back successful December, those figures were astir northbound of $10 cardinal and $7 billion, respectively.

Ether Options Open Interest (via Skew.com)

Some of the falloff tin beryllium attributed to year-end bets taken passim the people of 2021. While existent OIs are inactive importantly larger for some cryptocurrencies than wherever they were past year, they are inactive astir wherever things were successful October, earlier the large run-up successful prices.

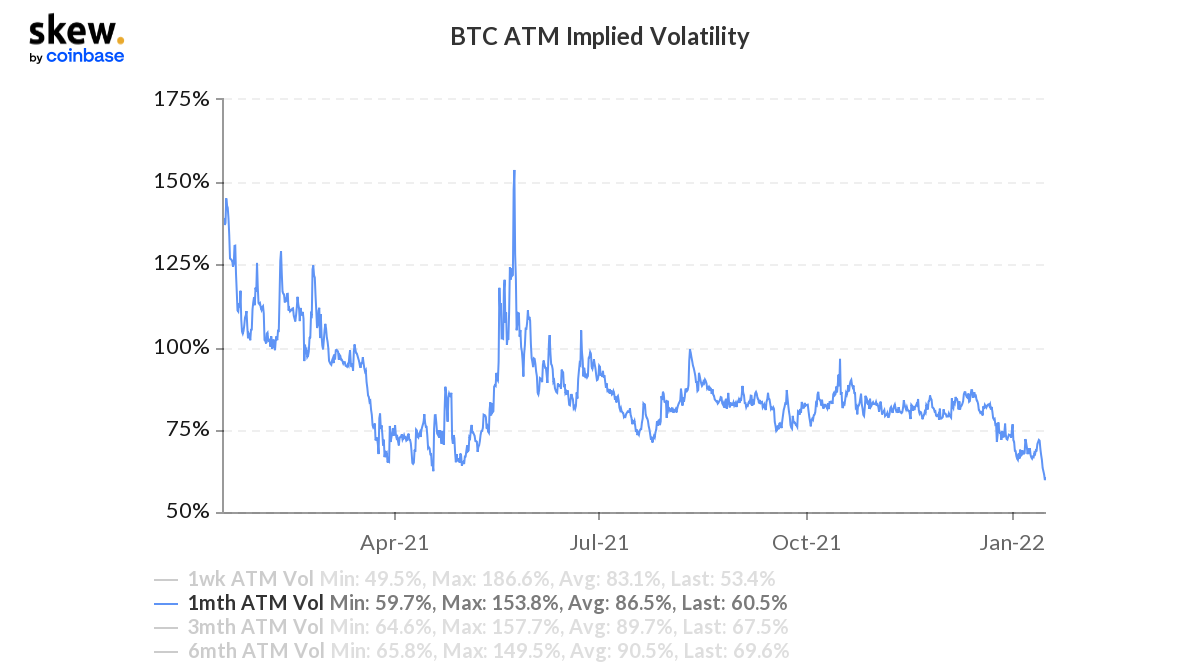

5. Implied volatilities connected bitcoin are falling precipitously.

Bitcoin At-The-Money One-Month Implied Vols (via Skew.com)

Implied vols, which are calculated disconnected options premiums and gauge the market’s presumption of aboriginal risk, are down to levels not seen since October 2020. To beryllium sure, regular levels successful crypto implied volatilities would awesome alarm and panic successful the equity market, but since the 2nd week of December, crypto’s implied vols person drifted down. In the past mates of days, that driblet has accelerated. One-month at-the-money implied vols are present astatine 60%; they had been hovering successful the 80% scope since the summer. When request for options falls, implied volatilities autumn with it.

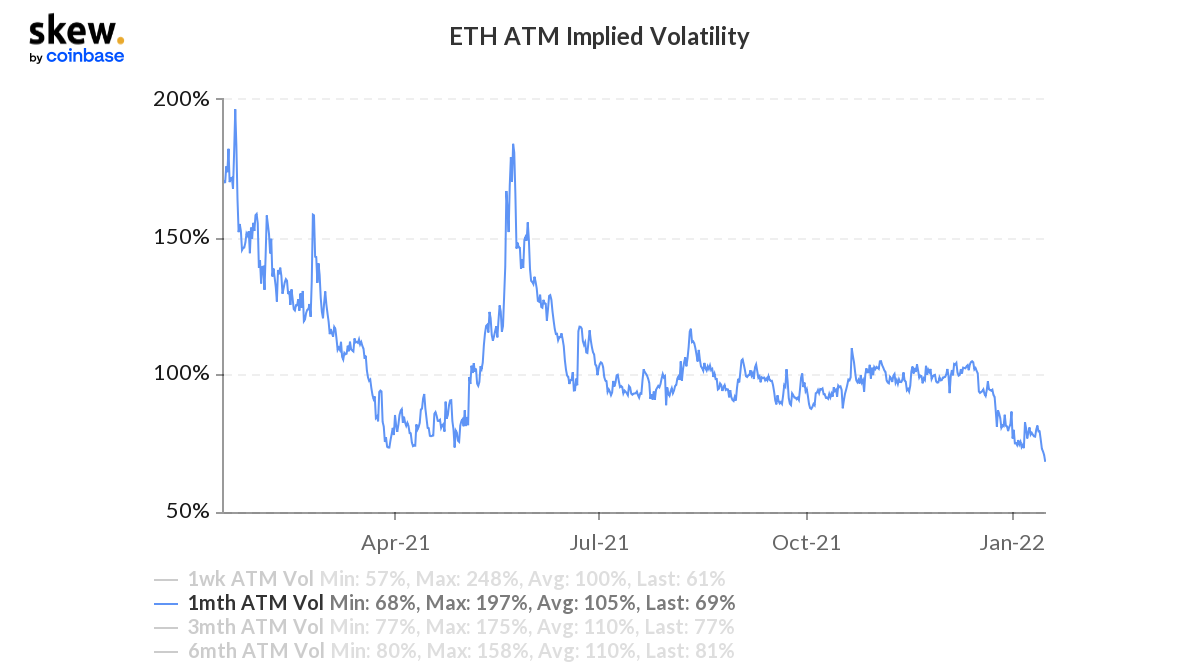

6. Ether’s implied vols are besides down.

ETH At-The-Money 1-Month Implied Vols (via Skew.com)

Now astatine 69%, implied volatilities connected one-month at-the-money options connected ETH had been astir the 100% level since June. It has been implicit a twelvemonth since they were regularly beneath 70%.

Of course, this doesn’t mean muted markets tin past forever, but successful the coming days oregon weeks, 1 shouldn’t beryllium amazed if prices drift south.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)