Bitcoin regained the $66,000 level successful the nighttime betwixt May 15 and May 16, recovering immoderate of the losses it incurred successful the past week. This spike substantially impacted the derivatives market, importantly influencing some unfastened involvement and trading volume.

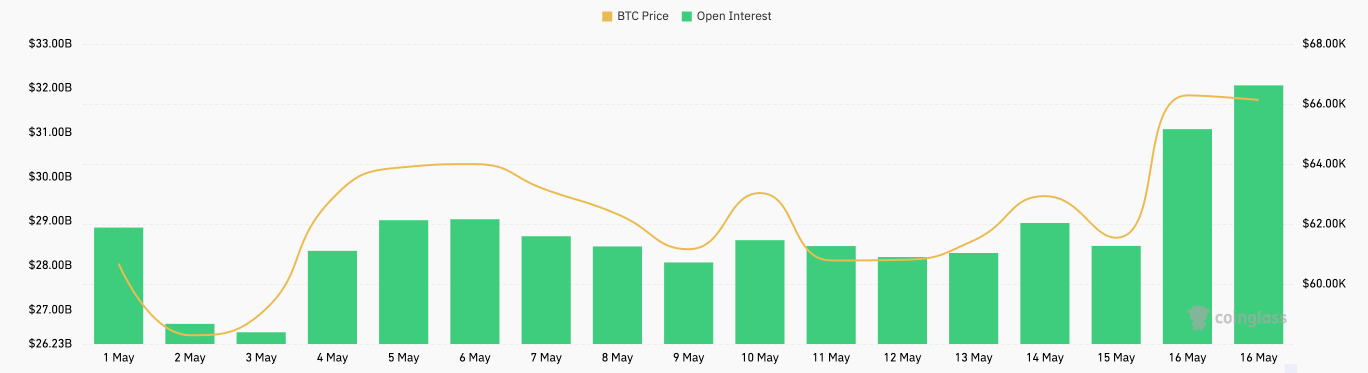

Futures unfastened interest, which indicates the full worth of outstanding futures contracts yet to beryllium settled, experienced a marked increase. On May 15, futures unfastened involvement stood astatine $28.45 cardinal but surged to $31.18 cardinal by May 16. This represents a important summation of astir 9.6%. This emergence suggests a increasing capitalist involvement successful Bitcoin futures, driven by the anticipation of further terms movements. The emergence successful OI is indispensable arsenic it shows an influx of caller superior into the market, signaling traders’ expectations and imaginable terms direction.

Chart showing the unfastened involvement successful Bitcoin futures from May 1 to May 16, 2024 (Source: CoinGlass)

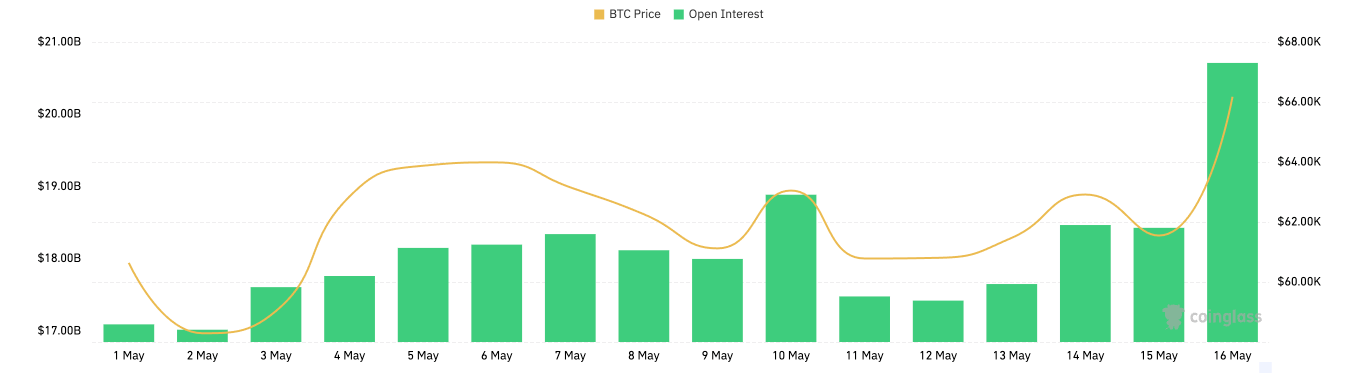

Chart showing the unfastened involvement successful Bitcoin futures from May 1 to May 16, 2024 (Source: CoinGlass)In the options market, unfastened involvement besides saw a important uptick. On May 15, options unfastened involvement was $18.43 billion, rising to $20.71 cardinal by May 16. This summation of astir 12.4% highlights the heightened enactment and involvement successful options contracts arsenic traders positioned themselves for the terms surge.

Chart showing the unfastened involvement successful Bitcoin options from May 1 to May 16, 2024 (Source: CoinGlass)

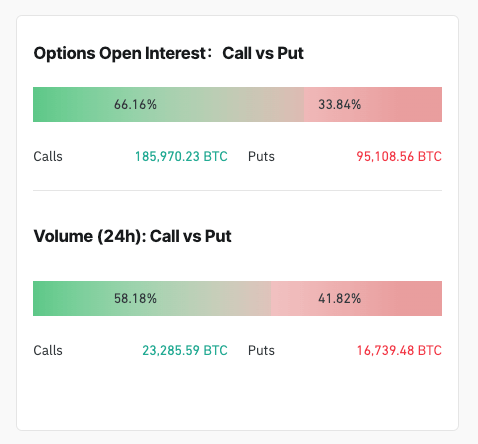

Chart showing the unfastened involvement successful Bitcoin options from May 1 to May 16, 2024 (Source: CoinGlass)The organisation of options unfastened involvement connected May 16, with calls accounting for 66.16% and puts for 33.84%, indicates a bullish sentiment among traders, expecting further upward question successful Bitcoin’s price. A deeper look astatine the options measurement further confirms the overwhelmingly bullish sentiment. On May 16, the measurement of telephone options constituted 58.18%, compared to 41.82% for puts, showing that traders were predominantly betting connected the terms increase.

Screengrab showing the organisation of options unfastened involvement and measurement connected May 16, 2024 (Source: CoinGlass)

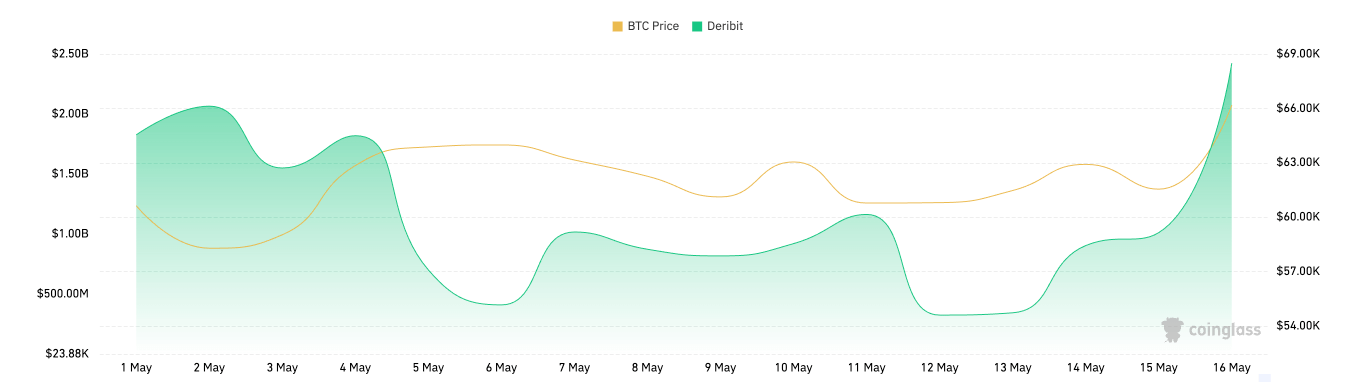

Screengrab showing the organisation of options unfastened involvement and measurement connected May 16, 2024 (Source: CoinGlass)Deribit’s regular options measurement dramatically increased, jumping from $1.01 cardinal connected May 15 to $2.42 cardinal connected May 16.

Graph showing the trading measurement for Bitcoin options connected Deribit from May 1 to May 16, 2024 (Source: CoinGlass)

Graph showing the trading measurement for Bitcoin options connected Deribit from May 1 to May 16, 2024 (Source: CoinGlass)The measurement and organisation betwixt shorts and longs supply further insights into the authorities of the market. On May 16, the full liquidations amounted to $150.52 million, with agelong liquidations astatine $40.76 cardinal and abbreviated liquidations astatine $109.76 million. The importantly higher abbreviated liquidations bespeak that galore traders were caught disconnected defender by the terms increase, resulting successful the forced closure of abbreviated positions. This liquidation asymmetry reinforces the bullish inclination observed during this period, arsenic shorts were squeezed retired of the market.

Analyzing the changes successful OI and volumes is important for knowing however the derivatives marketplace responds to terms movements. Once a niche marketplace catering to a tiny subset of blase investors, Bitcoin derivatives person grown to go a marketplace foundation. The tens of billions successful unfastened contracts crossed products amusement that derivatives are important and important capable to impact the broader crypto market.

Data from CoinGlass indicates a increasing bullish sentiment among traders, with a notable penchant for telephone options and a precocious measurement of abbreviated liquidations. This behaviour suggests that traders are positioning for further terms appreciation successful Bitcoin. If this bullish sentiment persists and is supported by continued affirmative terms action, we whitethorn spot further increases successful unfastened involvement and trading volumes, perchance driving Bitcoin’s terms higher.

The station Derivatives saw spike successful Open Interest and measurement arsenic Bitcoin broke $66k appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)