Bitcoin regained the psychologically important $40,000 level during the play aft spending past week struggling to surpass $39,500. As of property time, it stands astatine conscionable supra $42,000, showing coagulated resilience astatine this level. This betterment positively affected the broader crypto marketplace and the show of nationalist Bitcoin mining companies.

Despite being listed and traded connected banal exchanges similar Nasdaq, nationalist Bitcoin mining companies are susceptible to changes successful Bitcoin’s spot terms and different developments successful the crypto market. As astir TradFi investors progressive with the stocks spot them arsenic a proxy for trading and owning Bitcoin, increases successful Bitcoin’s terms automatically construe into increases successful the banal worth of these companies. Conversely, a alteration successful the terms of BTC leads to a simplification successful revenues, adversely affecting their stock performance.

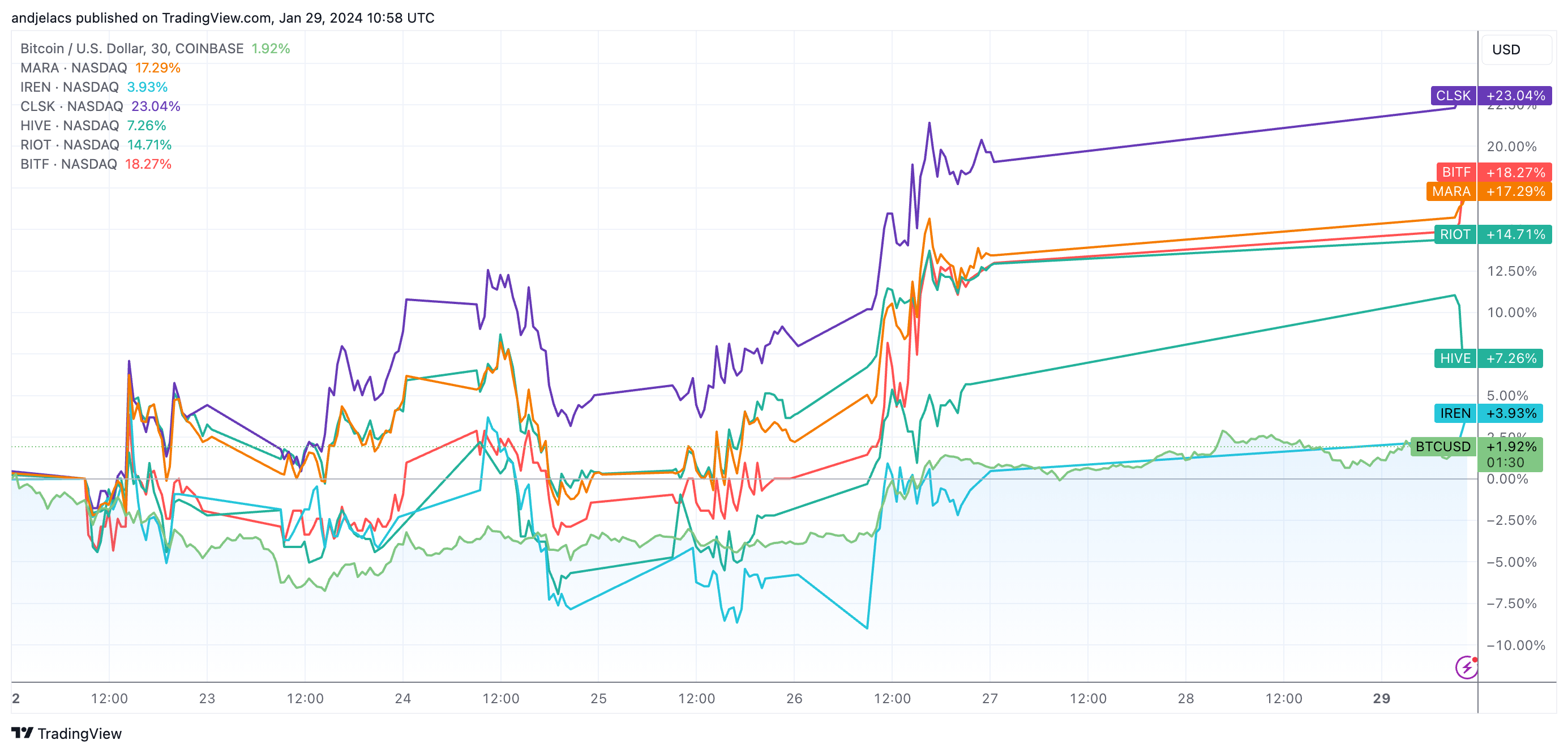

After experiencing a crisp slump successful the archetypal 2 weeks of January, nationalist miners look to person recovered astir of their losses. Between Jan. 22 and Jan. 29, CleanSpark (CLSK) led the battalion with a 23% increase, with Bitfarms (BITF) adjacent down with 18.27%. Marathon Digital (MARA), Riot (RIOT), and Hive (HIVE) grew by 17.29%, 14.71%, and 7.26%, respectively, with Iris Energy (IREN) posting the slightest maturation of 3.93% during the period.

Graph showing the show of nationalist Bitcoin mining companies from Jan. 22 to Jan. 29, 2024 (Source: TradingView)

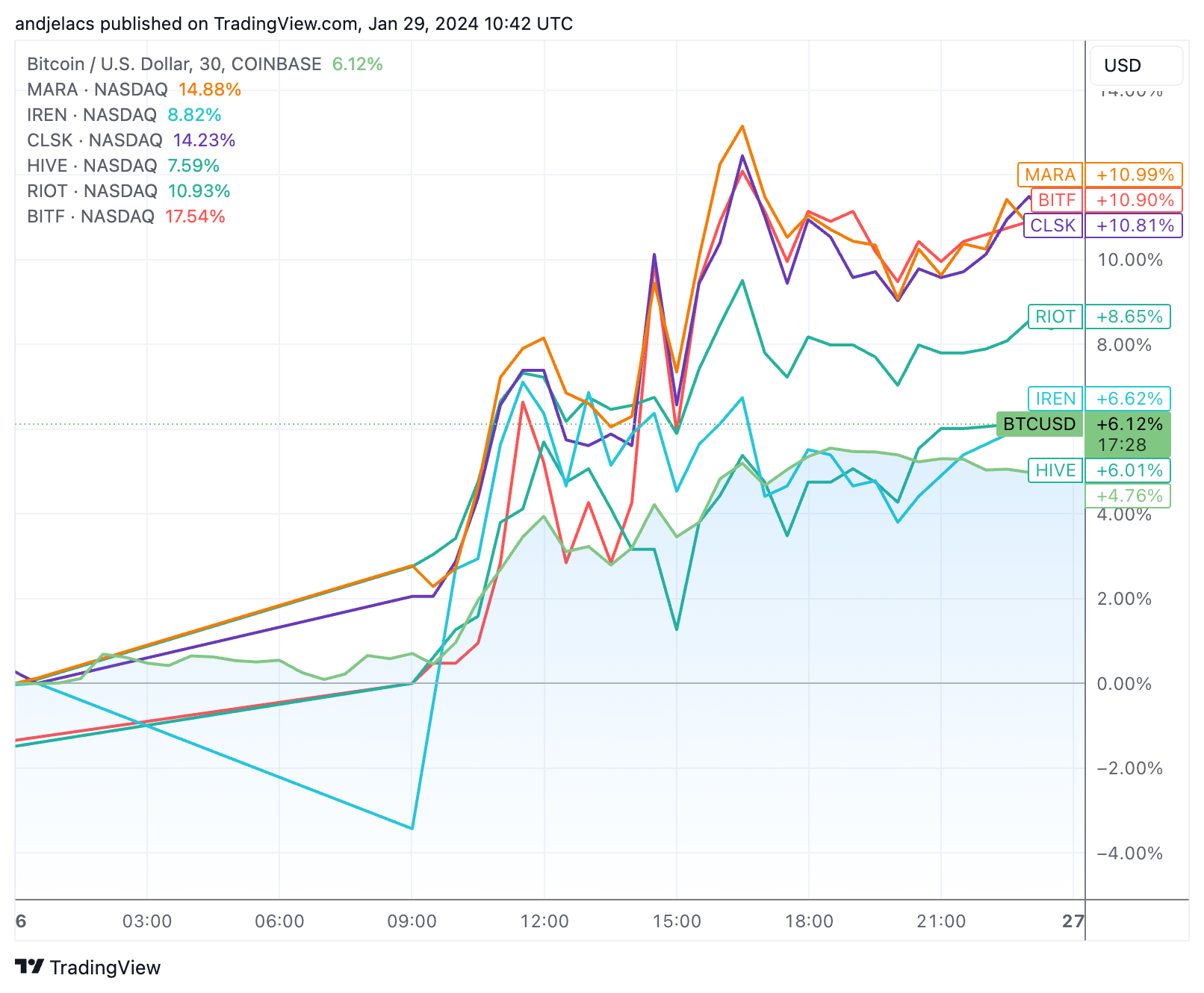

Graph showing the show of nationalist Bitcoin mining companies from Jan. 22 to Jan. 29, 2024 (Source: TradingView)This upward inclination was highly pronounced connected Friday, Jan. 26, erstwhile astir each of the mentioned stocks outperformed Bitcoin’s maturation of 6.12%, with MARA, BITF, and CLSK each showing increases of implicit 10.80%.

Graph showing the show of nationalist Bitcoin mining companies connected Jan. 26, 2024 (Source: TradingView)

Graph showing the show of nationalist Bitcoin mining companies connected Jan. 26, 2024 (Source: TradingView)On Jan. 29, arsenic of property time, determination has been a deficiency of effect from Bitcoin mining stocks to Bitcoin’s terms movement. This lag is owed to the antithetic trading hours betwixt the crypto market, which operates 24/7, and accepted banal exchanges similar Nasdaq, which operates lone connected weekdays and wherever each of the mentioned stocks are listed. This discrepancy often results successful a delayed absorption successful mining banal prices to Bitcoin’s play terms movements. Given Bitcoin’s emergence past $42,000 implicit the weekend, we could spot further maturation in mining stocks arsenic the marketplace opens connected Jan. 29 and adjusts to the improvement successful the coming week. Stocks specified arsenic RIOT, MARA, and CLSK are up 3%, 3.9%, and 4.2%, respectively, truthful acold successful pre-market trading.

The show of these stocks besides reflects the somewhat accrued miner revenue, which was volatile past week but showed an wide affirmative uptrend. According to information from Glassnode, the full regular USD gross paid to miners fluctuated betwixt $39 cardinal and $47 million, pursuing Bitcoin’s terms volatility. Miner gross is simply a captious benchmark for assessing the wellness and show of mining stocks, and gross increases are 1 of the astir important factors pushing banal prices up.

The station Despite ETF inflows, mining stocks retrieve arsenic Bitcoin crosses $42K appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)