Too galore proceed to conflate Bitcoin with cryptocurrencies, but those arguments tin beryllium dismantled, measurement by step.

This is an sentiment editorial by Federico Rivi, an autarkic writer and writer of the Bitcoin Train newsletter.

Would you accidental that shot and shot are portion of the aforesaid manufacture due to the fact that some playing fields are covered with writer and successful some games a shot is involved? Would you accidental that Bitcoin and cryptocurrencies are portion of the aforesaid manufacture conscionable due to the fact that they are some successful the integer realm and cryptography is progressive successful both?

The analogy is evident but inactive excessively galore equate Bitcoin with cryptocurrencies, refusing to spot the important differences. The latest illustration comes from the Financial Times, whose columnist, Jemima Kelly, wrote that “Bitcoin can’t beryllium separated from crypto.” Kelly is nary alien to disapproval of Bitcoin — backmost successful 2015, she highlighted the autumn successful the terms of bitcoin from $500 to $300 — but this does not mean that her articles are not worthy analyzing successful detail, adjacent much truthful erstwhile published successful large newspapers specified arsenic the Financial Times.

So, “Bitcoin can’t beryllium separated from crypto,” but why? Kelly provides a database of poorly-argued reasons that are worthy dismantling.

Ponzi Schemes And The Criteria Of Money

“It doesn’t substance what bitcoin’s origins were — the radical who propulsion it present person the aforesaid fiscal incentives arsenic those pushing immoderate different crypto token. Satoshi Nakamoto, the creator of bitcoin, mightiness person intended it to beryllium utilized arsenic money, but that does not marque it truthful — it fulfills nary of the indispensable criteria, and alternatively operates successful a pyramid-shaped operation that relies connected perpetually recruiting caller members.”

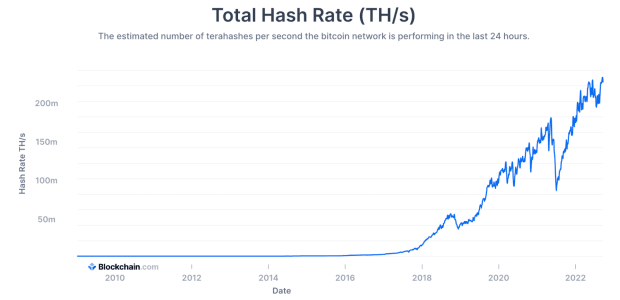

Pyramid schemes are, by definition, structures that tin lone basal arsenic agelong arsenic caller investors support coming successful to wage involvement to the archetypal ones, i.e., those higher up successful the pyramid. The infinitesimal nary caller funds enter, the operation collapses. Kelly fails to explicate successful what mode Bitcoin would illness without caller investors. In fact, we are successful the midst of a carnivore marketplace that started 10 months agone with loads of wealth flowing retired of bitcoin. In specified a scenario, the pyramid strategy should person collapsed by now. As I write, however, Bitcoin is inactive the astir widely distributed network connected the satellite and its hash complaint is astatine an all-time high.

If Bitcoin is simply a pyramid scheme, wherefore would this carnivore marketplace beryllium accompanied by hash complaint all-time highs?

If Bitcoin is simply a pyramid scheme, wherefore would this carnivore marketplace beryllium accompanied by hash complaint all-time highs?

Bitcoin works with and without caller funds coming successful each time and this is simply a cardinal quality with the “crypto” world, successful which rug pulls hap connected a regular basis, arsenic the website rekt.news reports.

As for the criteria of money, Kelly forgets to specify what these are and however Bitcoin does not fulfill immoderate of them. Although determination is nary cosmopolitan statement connected however galore cardinal features wealth has, we tin bounds ourselves to highlighting the five main ones: store of value, mean of exchange, transportable, divisible, portion of account.

- Store of value: As ostentation tin beryllium defined arsenic devaluation owed to monetary expansion, Bitcoin is technically and precisely a extortion against ostentation due to the fact that of its fixed supply. It is adjacent amended than golden — the world's astir important store of worth — successful presumption of stock-to-flow ratio, and it is truthful undoubtedly an fantabulous store of value.

- Medium of exchange: Although successful Bitcoin's history, scalability has created rather a fewer scars, contiguous we are fortunate to person a protocol astatine our disposal that makes Bitcoin the champion mode to nonstop wealth from 1 portion of the satellite to different instantaneously and with astir non-existent fees. The Lightning Network is precisely what Bitcoin needed to go a mean of exchange.

- Transportability: Bitcoin is digital, thing to add?

- Divisibility: One bitcoin is divisible into 100 cardinal sats. The Lightning Network besides supports millisats, truthful 1 bitcoin tin beryllium divisible into 100 cardinal units. Try that with dollars.

- Unit of account: This is the lone diagnostic not yet achieved successful Western economies due to the fact that of bitcoin's volatility, owed to its ongoing terms find signifier that is apt to past for a fewer much decades. However, this does not mean that bitcoin is not already a overmuch much reliable portion of relationship successful galore processing countries, wherever section currencies person fallen into hyperinflationary spirals.

Decentralization FUD

“Bitcoin is not successful information decentralised — not lone bash miners radical unneurotic to signifier ‘mining pools’ but wealthiness is besides hugely concentrated. On Tuesday, MicroStrategy announced that it had bought different 301 bitcoins, meaning this institution unsocial present holds astir 0.7 per cent of the full supply.”

Mining pools are not shot teams and determination are 3 considerations that Kelly omitted:

- Individual miners tin interruption distant from 1 excavation and articulation different astatine immoderate clip should they consciousness that 1 is gaining excessively overmuch power.

- If, until now, determination has been the information of transactions being censored by a excavation — since it is the excavation that writes the campaigner artifact and tin truthful theoretically take which transactions to see and which to exclude — with Stratum V2 this occupation is being resolved due to the fact that each idiosyncratic miner volition beryllium capable to constitute its ain campaigner block. In the end, pools are groups of individuals acting for their idiosyncratic interests.

- However undesirable it whitethorn be, a ample hash complaint controlled by a azygous miner does not springiness immoderate powerfulness implicit the rules of the protocol, which are enforced by the idiosyncratic nodes successful the network, arsenic demonstrated successful the Blocksize War and successful the quality of impervious of work.

As for MicroStrategy, Kelly has astir apt made a misguided analogy with the fiat world, wherever powerfulness and wealth spell manus successful hand. There, wealthiness and the quality to power the rules of the strategy are straight proportional, a spot similar successful the proof-of-stake system, which is thing but the crypto transposition of the existent world. In Bitcoin, things enactment differently: arsenic agelong arsenic an idiosyncratic runs a afloat Bitcoin node successful a distant colony successful Kenya, adjacent without holding immoderate bitcoin, they person precisely the aforesaid magnitude of powerfulness that MicroStrategy has implicit Bitcoin (only if the institution runs a afloat node, evidently — different the idiosyncratic has much power).

Innovation And Energy FUD

"...a ‘first-mover advantage’ does not ever last. Other crypto tokens already person assorted features that bitcoin does not, and determination has been renewed speech of a ‘flippening’, successful which Ethereum’s worth overtakes that of bitcoin owed to the former’s power to a little carbon-intensive signifier of mining."

What precisely these features mightiness beryllium is not specified. Maybe astute contracts? It would beryllium capable to survey what is happening with the layers pursuing Bitcoin's blockchain: the Lightning Network, RGB, Taro, Fedimint, Liquid, OmniBolt, Sphinx and tbDEX, conscionable to sanction the champion known.

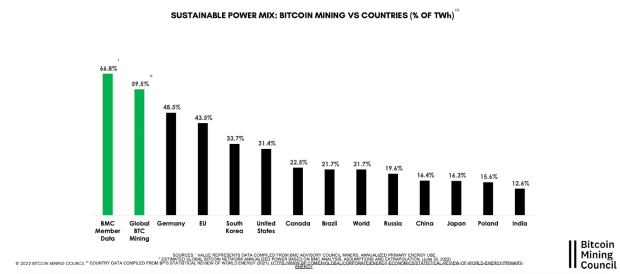

As for “carbon-intensive” mining, a batch of pages could beryllium filled to disprove this idea. For the involvement of this article, I volition conscionable amusement the information from the latest report by the Bitcoin Mining Council, which successful July recovered that 59.5% of the vigor utilized by the Bitcoin web comes from renewable sources, and that though Bitcoin consumes 0.15% of the vigor produced globally, it is liable for lone 0.086% of CO2 emissions, and is truthful overmuch greener than the mean planetary accumulation of goods and services. This inclination volition continue, fixed the inducement of miners to usage low-cost vigor sources. As Nic Carter put it: “Bitcoin mining is converging with the vigor assemblage with astonishing rapidity, yielding an detonation of innovation that volition some decarbonize Bitcoin successful the mean term, and volition dramatically payment progressively renewable grids.”

Bitcoin mining volition dramatically payment renewable vigor grids.

Bitcoin mining volition dramatically payment renewable vigor grids.

The thought that the first-mover vantage does not past everlastingly is besides wrong. There is 1 cardinal cardinal diagnostic that allows Bitcoin to bask this changeless advantage: scarcity or, to beryllium much precise, finiteness. Bitcoin is finite, cryptocurrencies are not. And adjacent if 1 were to usage Bitcoin's codification by creating an identical copy, the archetypal Bitcoin would beryllium the archetypal one: scarcity cannot beryllium re-created erstwhile it has been discovered.

How Many Bitcoins? (Spoiler: Just One)

“Finally, determination is not adjacent statement connected what bitcoin is. For the immense bulk it is the integer coin besides known arsenic ‘BTC’, presently changing hands astatine astir $19,000. But determination are different versions that person divided off, specified arsenic the 1 promoted by Craig Wright, the antheral who claims to beryllium Satoshi and who says BTC is simply a scam”.

This is simply a highly-contradictory sentence. If the “vast majority” agrees that Bitcoin is 1 thing, past determination is an agreement, adjacent if immoderate megalomaniac with astir nary pursuing calls himself Satoshi Nakamoto and wants his token to beryllium considered the existent bitcoin. And successful immoderate case, erstwhile it comes to Bitcoin, wherever determination is nary azygous authorization to supply certificates of authenticity, determination is ever a last judge: the market. Indeed, BTC is agreed upon by the escaped market, though galore Western countries person present forgotten what that is.

This is simply a impermanent station by Federico Rivi. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)