The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

On-Chain Data Trends

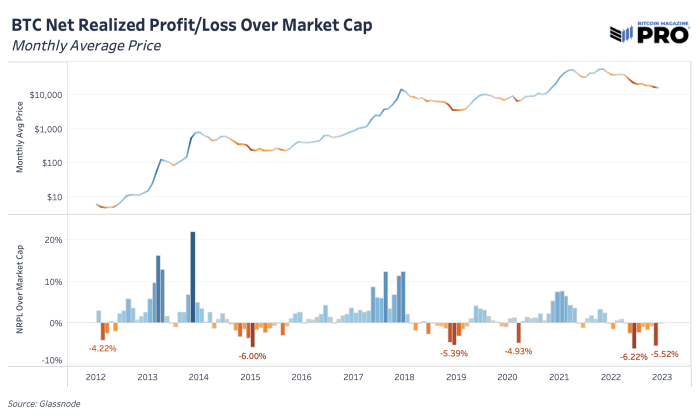

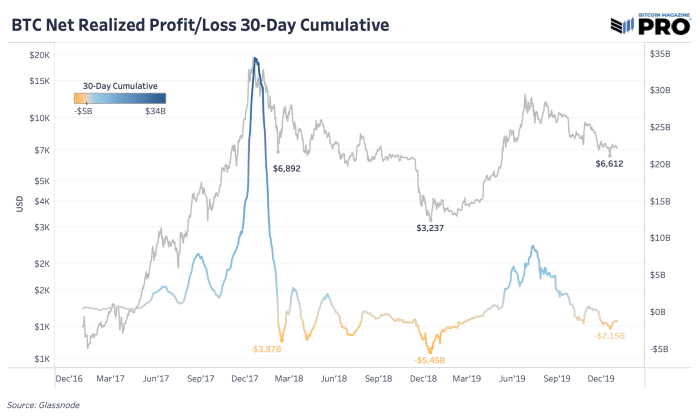

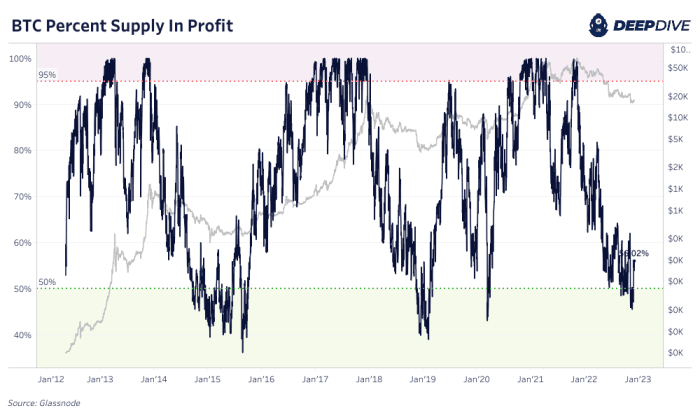

November was a achy month. By looking astatine on-chain realized nett and nonaccomplishment data, we tin spot that this was existent for galore forced-sellers of bitcoin. Before immoderate bitcoin terms bottom, a hallmark motion that you privation to spot is extended periods of forced selling, capitulation and emergence successful realized losses. One mode to presumption this is by looking astatine the sum of realized nett and nonaccomplishment for each period comparative to bitcoin’s full marketplace cap. We saw these bottommost signals successful November 2022, and likewise successful the July 2022 Terra/LUNA crash, March 2020 COVID fearfulness and December 2018 rhythm bottommost capitulation events.

Looking astatine the 2018 cycle, the extremity was marked by excess realized losses, though this was overmuch antithetic with the forced liquidations and cascades of backstage equilibrium expanse leverage and insubstantial bitcoin unwinding that we saw this year.

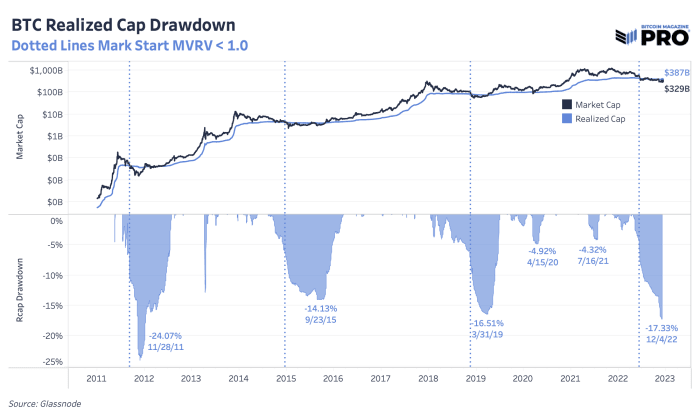

We’ve talked astir the existent drawdown successful bitcoin’s terms and however that compares to erstwhile cycles galore times implicit the past fewer months. Another mode to look astatine cyclical drawdowns is to absorption connected bitcoin’s realized marketplace capitalization — the mean outgo ground of the web which tracks the latest terms wherever each UTXO moved last. With terms being much volatile, realized terms is simply a much unchangeable presumption of bitcoin’s maturation and superior inflows. The realized marketplace capitalization is present down 17.33% which is importantly higher than 2015 and 2018 cycles of 14.13% and 16.51%, respectively.

As for duration, we’re 176 full days into the terms being beneath bitcoin’s realized price. Those aren’t consecutive days arsenic terms tin temporarily spell supra realized price, but terms trends beneath realized terms successful carnivore marketplace periods. For context, trends successful 2018 were short-lived astatine astir 134 days and the trends successful 2014-15 lasted 384 days.

On 1 hand, bitcoin’s realized marketplace capitalization has taken a important deed successful the erstwhile circular of capitulation. That’s a promising bottom-like sign. On the different hand, there’s a lawsuit to beryllium made that terms being beneath realized terms could easy past different six months from humanities cycles and the deficiency of capitulation successful equity markets is inactive a large headwind and concern.

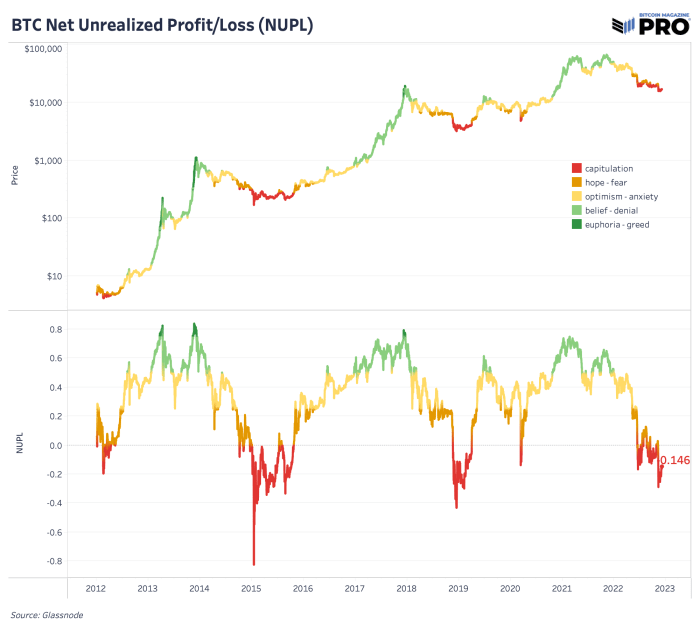

As per the net-unrealized-profit/loss (NUPL) ratio, we are firmly successful the capitulation phase. NUPL tin beryllium calculated by subtracting the realized headdress from marketplace headdress and dividing the effect by the marketplace cap, arsenic described successful this article authored by By Tuur Demeester, Tamás Blummer and Michiel Lescrauwaet.

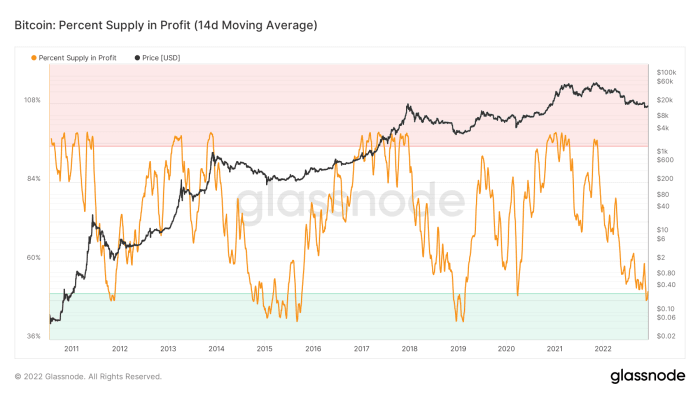

There is nary denying it: For bitcoin-native cycles, we are firmly successful the capitulation phase. Currently, lone 56% of circulating proviso was past moved on-chain successful profit. On a two-week moving mean basis, nether 50% proviso was past moved supra the existent speech rate, which is thing that has lone ever happened successful the depths of erstwhile bear-market lows.

When reasoning of the bitcoin speech rate, the numerator broadside of the equation is historically cheap. The Bitcoin web continues to nutrient a artifact astir each 10 minutes successful an unabated fashion, arsenic hash complaint ticks higher and arsenic the ledger offers an immutable colony furniture for planetary value. The speculation, leverage and fraud of the erstwhile rhythm is washing to enactment and bitcoin continues to speech hands.

Bitcoin is objectively inexpensive comparative to its each clip past and adoption phases. The existent question implicit the contiguous aboriginal is the denominator. We person talked astatine magnitude astir the planetary liquidity rhythm and its existent track. Despite being historically cheap, bitcoin is not immune to a abrupt strengthening successful the dollar due to the fact that thing genuinely is. Exchange rates are comparative and if the dollar is squeezing higher, past everything other volition subsequently autumn — astatine slightest momentarily. As always, presumption sizing and clip penchant is cardinal for all.

As for the catalyst for a surge higher successful the dollar denominator of the bitcoin speech complaint (BTC/USD), determination are 80 trillion imaginable catalysts…

3 years ago

3 years ago

English (US)

English (US)