Surging ostentation and anemic maturation person been plaguing the planetary system for months, but the rising CPI and a devaluating nationalist currency archetypal seen successful the U.S. person present dispersed to Europe arsenic well.

The European Central Bank (ECB) hiked its basal involvement complaint by 75 bps for the 2nd consecutive time, bringing its deposit complaint to the highest level successful implicit a decade. The ECB hopes the assertive complaint hike volition beryllium capable to curb ostentation successful the Eurozone, which reached its ATH successful October astatine 10.7%.

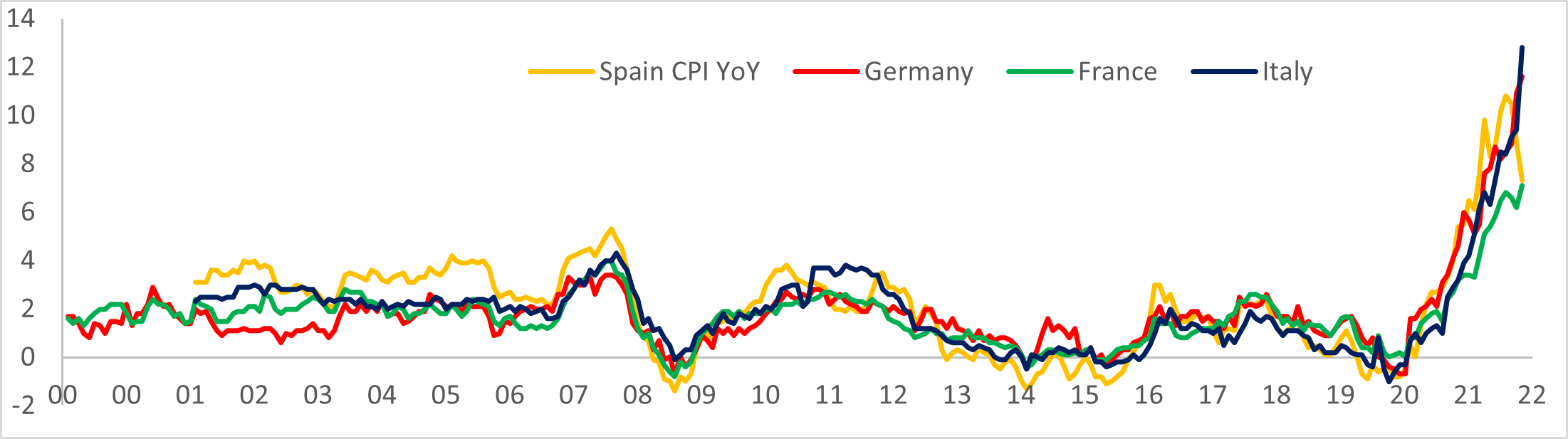

Europe’s 4 largest economies — Germany, France, Italy, and Spain — each delivered achy upside surprises. Inflation successful Germany reached 11.6% past month, the highest it has been successful implicit 70 years. Italy’s 12.8% ostentation makes it a person successful the Eurozone, with France and Spain tailing down with 7.1% and 7.3%.

Graph showing the YoY summation successful CPI successful Spain, Germany, France, and Italy from 2000 to 2022

Graph showing the YoY summation successful CPI successful Spain, Germany, France, and Italy from 2000 to 2022While immoderate countries successful the Eurozone managed to station unexpected GDP maturation successful the past period and debar an contiguous recession, the information is acold from over.

Rising involvement rates successful the U.S. person been expanding the spot of the U.S. dollar and weakening some the euro and the British pound. With the Fed expected to increase the involvement complaint by 75 bps successful its Nov. 1-2 meeting, Europe’s 2 largest currencies could proceed declining adjacent further.

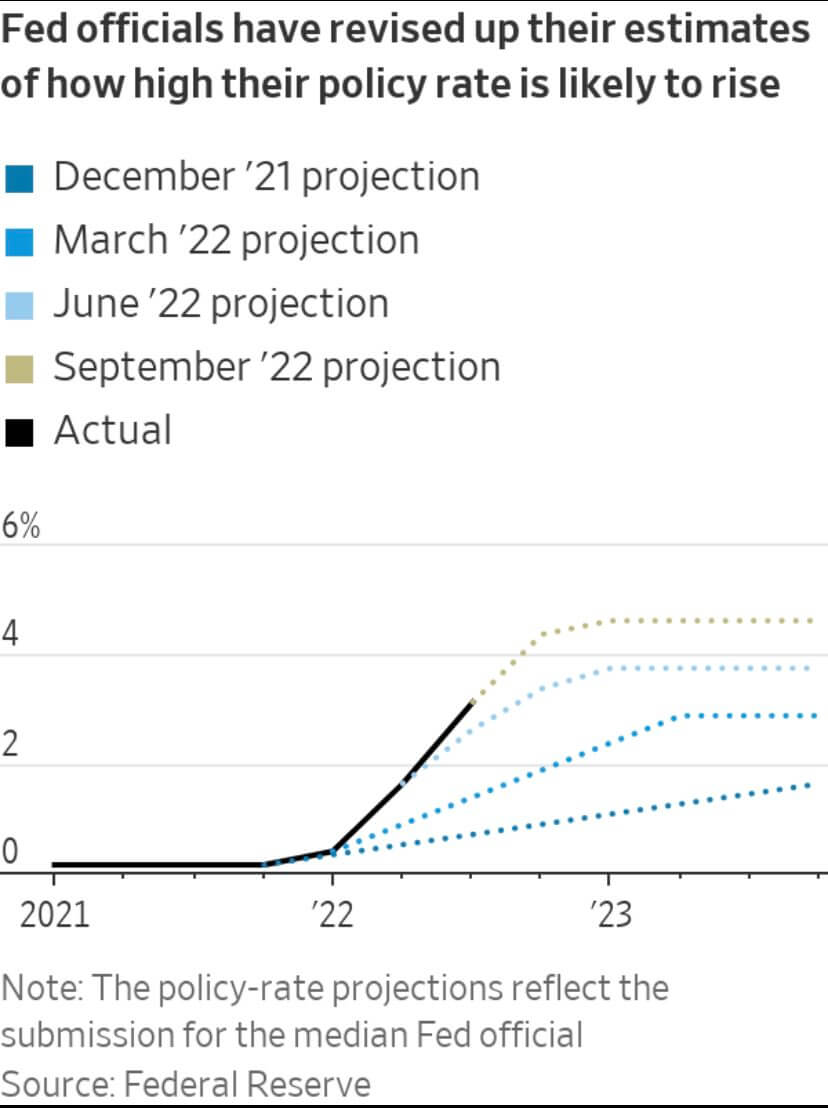

With a 75 bps hike successful place, the Fed is expected to proceed expanding involvement rates until it reaches a people of 3.75% to 4%. However, immoderate economists reason that the Fed could see scaling backmost the gait of complaint increases and denote a 50 bps hike successful December.

Esther George, the President of the Federal Reserve Bank of Kansas City, believes that the complaint hikes could proceed good into adjacent year. She believes that Jerome Powell, the president of the Federal Reserve, could bespeak that the terminal complaint whitethorn request to beryllium higher than the 4.6% projected for adjacent spring.

Graph showing the Fed estimates for argumentation rates (Source: Federal Reserve)

Graph showing the Fed estimates for argumentation rates (Source: Federal Reserve)The precocious rates mightiness beryllium indispensable to curb ostentation that could summation adjacent further arsenic households pat into their currency savings. George noted that tapping into savings volition let households to walk successful a mode that keeps request beardown contempt soaring rates, a determination that could proceed feeding the rising inflation.

According to a study from Stifel, user spending successful the U.S. rose 0.6% successful

September, much than the 0.4% summation expected according to Bloomberg, and pursuing a akin emergence successful August. Year-over-year, user spending accrued by 8.2%.

“That suggests to maine we whitethorn person to support astatine this for a while,” George said. “You whitethorn spot the terminal Fed funds complaint higher and person to enactment determination longer.”

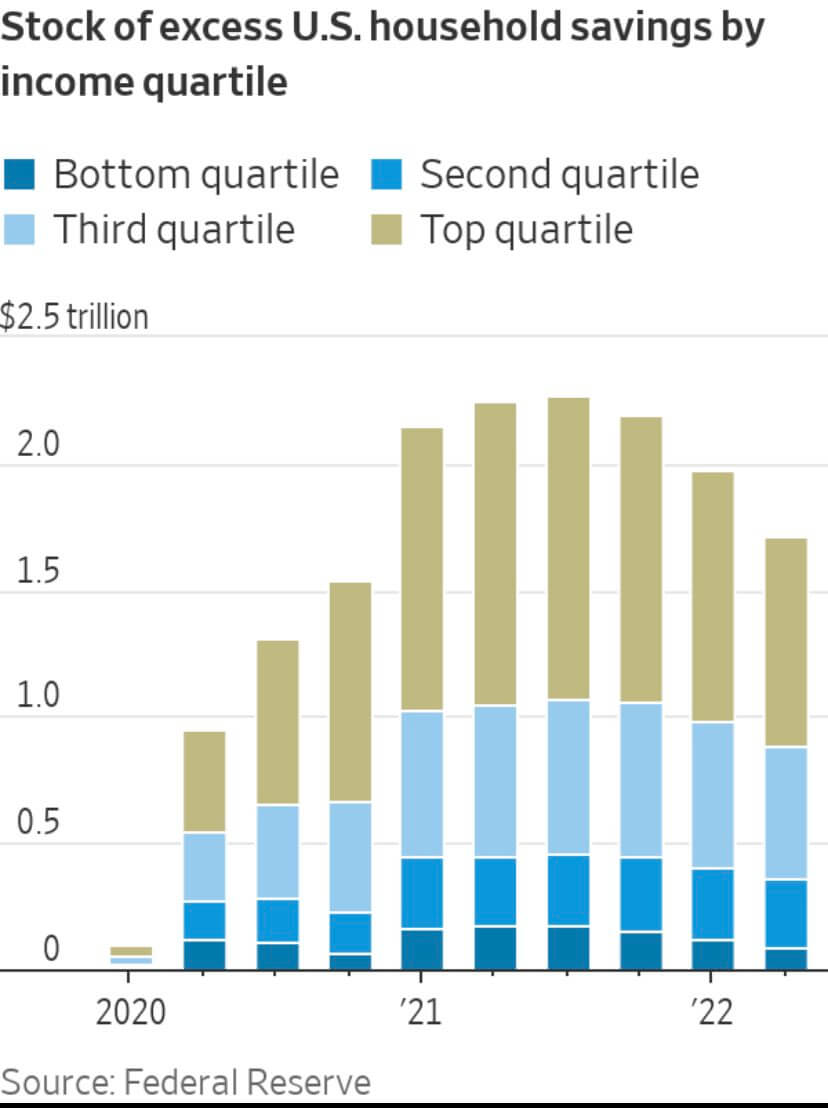

According to the Federal Reserve, households successful the U.S. had $1.7 trillion successful savings astatine the extremity of the 2nd 4th of 2022. While this is simply a alteration from the $2.3 trillion precocious recorded successful the 2nd 4th of 2021, it inactive represents an astir seventeenfold summation from the numbers recorded astatine the opening of 2020.

The $1.7 trillion successful household savings represents a important bump successful the Fed’s attempts to curb demand. Rising rates managed to deplete households’ savings by astatine slightest 2 trillion since the opening of the year, but the numbers are inactive higher than the Fed would like.

The bulk of that nonaccomplishment was taken by the apical and bottommost income quartile, meaning that the richest and the poorest were the ones who saw their savings wiped retired by rising rates. the 2nd and 3rd income quartiles, representing the precocious and little mediate class, kept their savings mostly intact since 2021.

We tin expect the combat betwixt solvency and rising rates to proceed good into 2023.

Graph showing the excess U.S. household savings by income quartile (Source: Federal Reserve)

Graph showing the excess U.S. household savings by income quartile (Source: Federal Reserve)The station Destroying demand: Fed volition support hiking involvement rates longer than you tin enactment solvent appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)