Confidence successful centralized exchanges seems to person reached a caller debased pursuing the FTX fallout. Trading volumes crossed each exchanges person experienced a vertical driblet implicit the weekend, arsenic users unreserved to retreat their tokens from custodial wallets provided by the platforms.

Data analyzed by CryptoSlate showed a drastic driblet successful Bitcoin’s existent trading volume. According to Messari, the existent trading measurement crossed each centralized exchanges dropped to $2.82 cardinal connected Nov. 12. At property clip connected Nov. 14, the volumes recovered to $3.14 billion.

This is simply a crisp driblet from the $13.71 cardinal measurement recorded connected Nov. 8.

Graph showing the existent trading measurement for Bitcoin crossed centralized exchanges (Source: Messari)

Looking astatine idiosyncratic exchanges further confirms this trend.

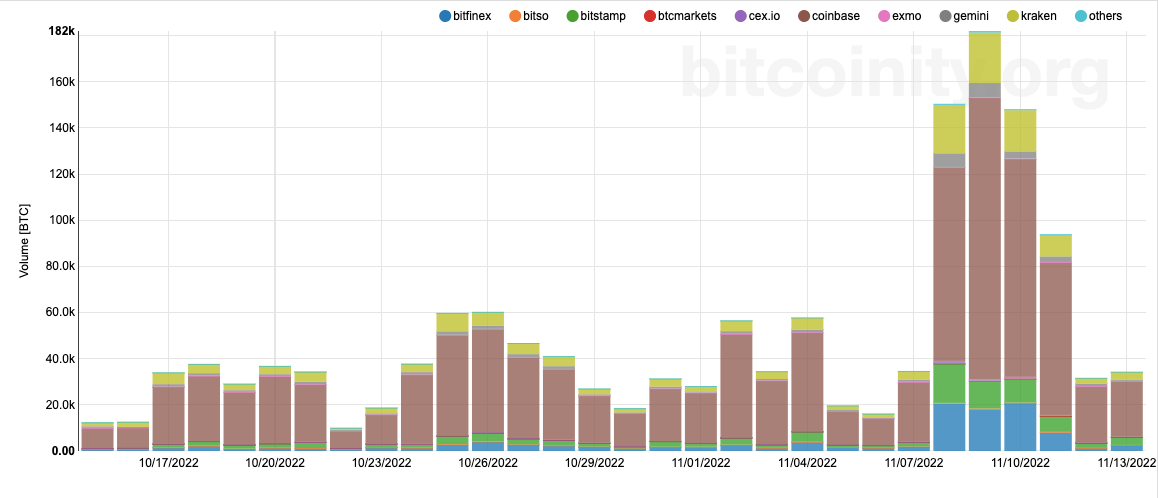

Bitcoin trading volumes crossed 10 ample centralized exchanges, excluding Binance, OKEx, and BitMEX, decreased astir fivefold successful the span of a fewer days, dropping from astir 182,000 BTC per time connected Nov. 9 to astir 38,000 BTC connected Nov. 13.

Chart showing Bitcoin trading measurement crossed assorted centralized exchanges (Source: Bitcoinity.org)

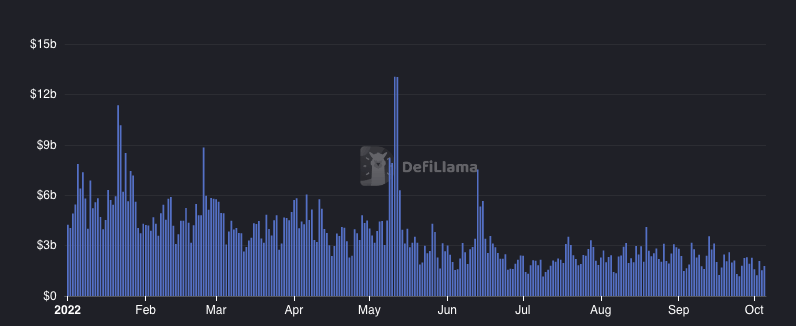

Chart showing Bitcoin trading measurement crossed assorted centralized exchanges (Source: Bitcoinity.org)All of the volumes wiped from centralized exchanges look to person transferred to decentralized ones. DEXs saw a vertical spike successful trading measurement implicit the weekend, reaching astir $12 billion. According to DeFi Llama, trading measurement crossed each decentralized exchanges reached $11.93 cardinal connected Nov. 10, a crisp leap from the $2.92 cardinal recorded connected Nov. 7.

Graph showing the 24-hour trading measurement crossed each decentralized exchanges successful 2022 (Source: Defi Llama)

Graph showing the 24-hour trading measurement crossed each decentralized exchanges successful 2022 (Source: Defi Llama)Out of each the ample DEXs, Curve led the mode seeing its trading measurement summation by 334% successful the span of a week. However, with $1.3 cardinal recorded connected Nov. 12, Uniswap is the person erstwhile it comes to sheer trading volume.

It’s inactive excessively aboriginal to archer what caused the speedy displacement successful volume. The marketplace situation caused by the FTX fallout enactment the information of idiosyncratic funds into question and could person pushed retail traders distant from centralized exchanges. The much transparent and decentralized quality of automated smart-contract-based trading platforms similar Uniswap and Curve could travel arsenic an antidote to the retail marketplace damaged by the FTX fiasco.

Any spikes successful trading volumes connected ample exchanges could beryllium led by organization investors, particularly connected exchanges serving ample endeavor clients similar Coinbase.

The station DEX trading volumes spike arsenic users permission CEXs en masse appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)