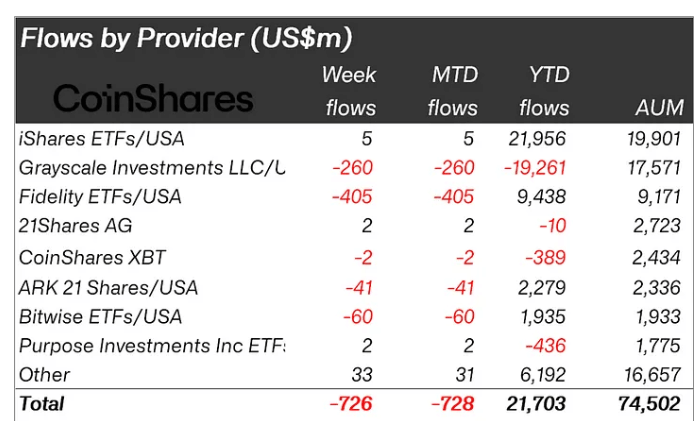

Digital plus concern products saw important outflows totaling $726 million, matching the highest outflow recorded earlier this twelvemonth successful March, according to CoinShares‘ latest report.

James Butterfill, caput of probe astatine CoinShares, attributed this antagonistic sentiment to stronger-than-expected macroeconomic information from the erstwhile week. This accrued the likelihood of a 25-basis constituent involvement complaint hike by the US Federal Reserve.

He added:

“Daily outflows slowed aboriginal successful the week arsenic employment information fell abbreviated of expectations, leaving marketplace opinions connected a imaginable 50bp complaint chopped highly divided. The markets are present awaiting Tuesday’s Consumer Price Index (CP|) ostentation report, with a 50bp chopped much apt if ostentation comes successful beneath expectations.”

US, Bitcoin pb outflows

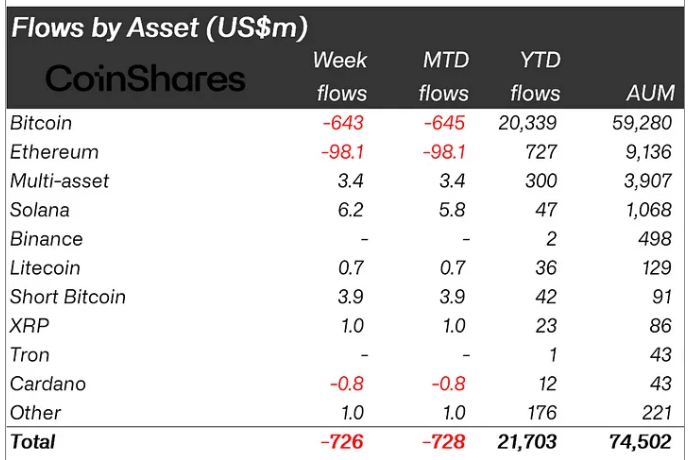

Bitcoin led the outflows, losing $643 million, bringing its monthly outflows to $645 million. Short BTC funds, however, saw insignificant inflows of $3.9 million.

Meanwhile, US Bitcoin exchange-traded funds (ETFs) saw an eight-day outflow streak, causing nett outflows of $721 cardinal successful the country. Fidelity’s FBTC money was liable for astir of this, with $405 cardinal successful outflows past week.

Crypto ETP Flows (Source: CoinShares)

Crypto ETP Flows (Source: CoinShares)It was followed by Grayscale’s GBTC, which saw $280 cardinal successful outflows. Bitwise ETFs completed the apical 3 for past week with losses of astir $60 million.

Canada besides recorded outflows of $28 million. In contrast, Europe had much affirmative sentiment, with Germany and Switzerland seeing inflows of $16.3 cardinal and $3.2 million, respectively.

Altcoins endure contrasting fates.

Ethereum-based concern products recorded $98 cardinal successful nett outflows past week.

This was chiefly owed to Grayscale’s converted ETHE fund, which mislaid $111 cardinal during the period. This meant the minimal inflows into different spot Ethereum ETF products could not offset the important outflows, further fuelling suggestions that determination was nary request for these concern products.

Crypto Assets Weekly Flow. (Source: CoinShares)

Crypto Assets Weekly Flow. (Source: CoinShares)However, Solana-based concern products secured $6.2 cardinal successful nett inflows, the largest among integer plus products.

Other integer assets similar Cardano saw outflows of astir $800,000 contempt completing the archetypal signifier of its highly anticipated Chang Hard Fork. In comparison, Litecoin and XRP products saw cumulative inflows of $1.7 million.

The station Digital assets endure arsenic Bitcoin leads $726 cardinal outflow appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)