The quality betwixt Bitcoin’s realized headdress and marketplace headdress is an underrated indicator of the phases of Bitcoin’s terms cycles. The realized headdress shows Bitcoin’s worth based connected the past terms each coin moved, showing the existent superior invested into the asset.

When the marketplace cap, which reflects the worth of each existing coins based connected the existent spot price, importantly diverges from the realized cap, it shows a displacement successful sentiment. These shifts person historically aligned with phases of either euphoria oregon fear.

A precocious marketplace headdress comparative to the realized headdress shows that investors clasp unrealized gains. While this is an unambiguous motion of a bullish sentiment successful the market, it tin besides precede imaginable overextension. Conversely, erstwhile the marketplace headdress dips beneath the realized cap, it signals wide capitulation and undervaluation of the asset.

The existent discrepancy betwixt Bitcoin’s marketplace headdress and realized headdress reflects the overwhelming bullish sentiment that has dominated the marketplace this month.

Bitcoin’s terms summation was driven by optimism surrounding the US statesmanlike election. On Nov. 5, President Donald Trump’s triumph sparked a rally successful the crypto market, arsenic his upcoming medication is expected to present concrete, Bitcoin-focused policies.

The result of the predetermination created a bullish momentum, with investors gearing up for a overmuch more favorable regulatory environment for crypto. This sentiment drove Bitcoin’s terms to implicit $90,000, establishing a caller ATH.

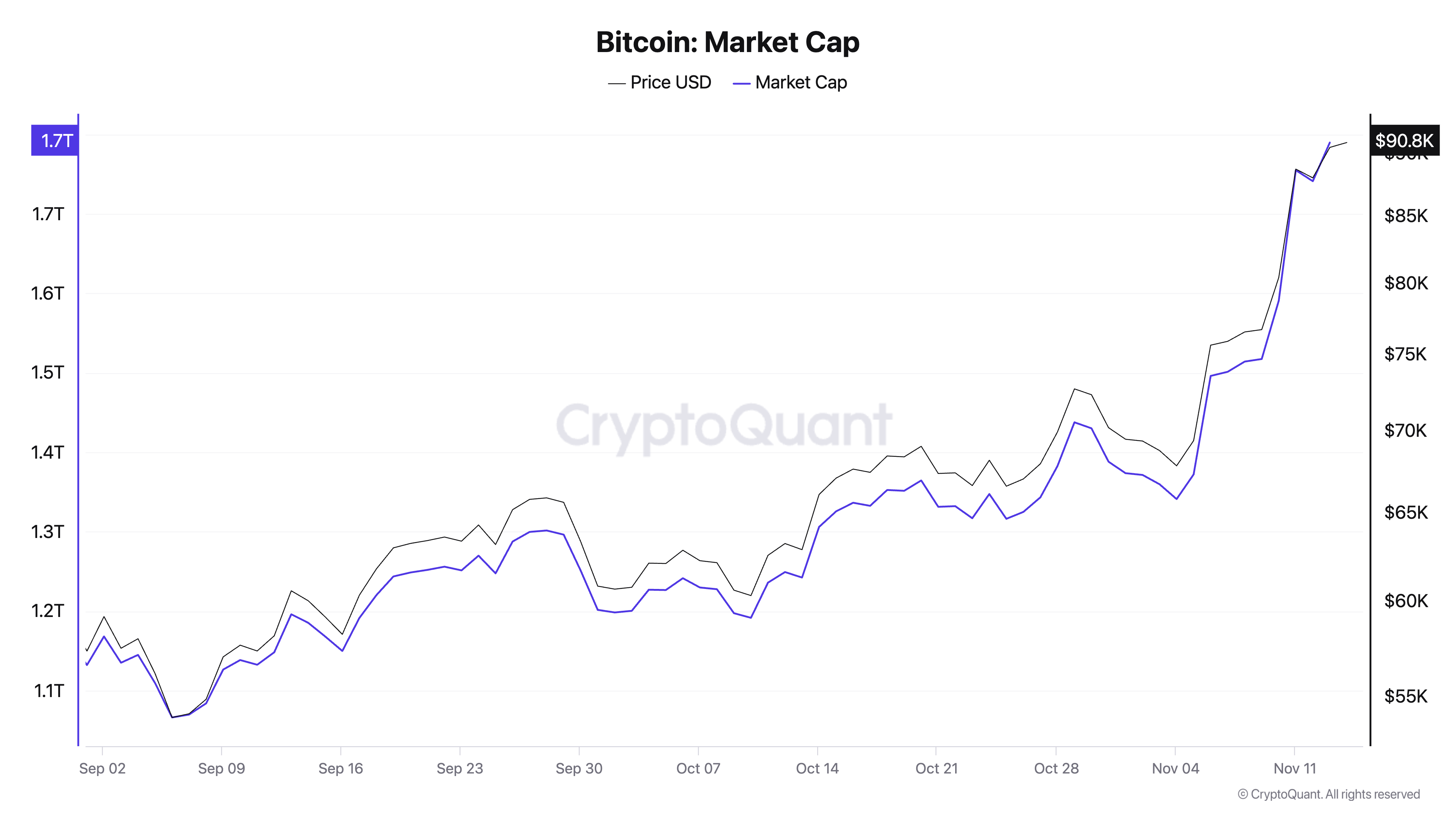

The terms spike was mirrored successful Bitcoin’s marketplace cap, which accrued from $1.132 trillion astatine the commencement of September to $1.789 trillion by mid-November. Most of this summation occurred successful the days pursuing the election, indicating heightened buying enactment and a unreserved of superior into the market.

Graph showing Bitcoin’s marketplace capitalization from Sep. 1 to Nov. 13, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s marketplace capitalization from Sep. 1 to Nov. 13, 2024 (Source: CryptoQuant)While the surge decidedly reflects the market’s enthusiasm and assurance successful Bitcoin’s semipermanent imaginable nether the Trump administration, the terms itself besides apt fueled speculative buying. Such accelerated maturation successful marketplace cap, peculiarly aft a large lawsuit similar a nationalist election, is often a motion of heightened speculation.

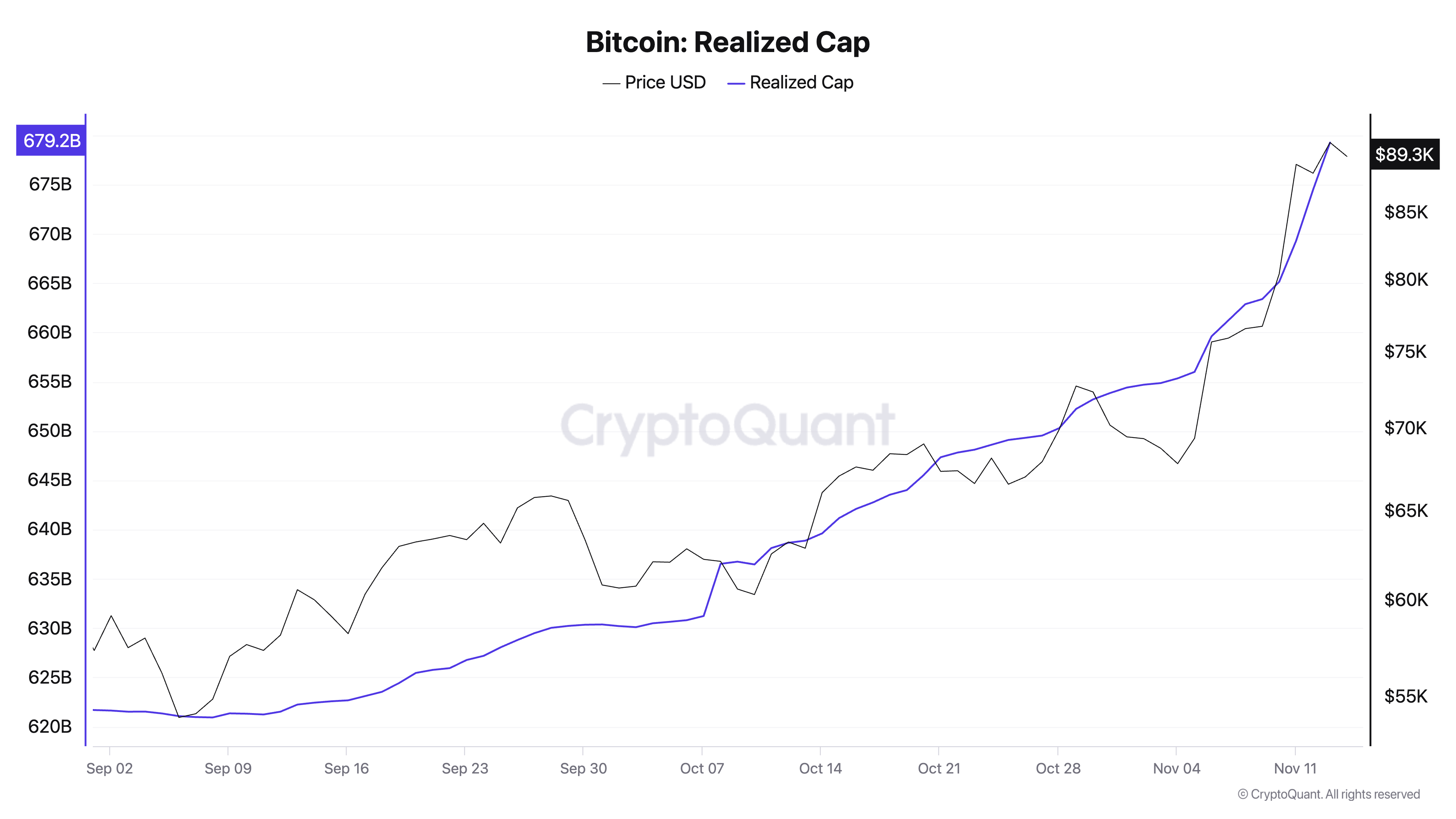

While the marketplace headdress grew significantly, Bitcoin’s realized headdress grew overmuch slower. Moving from $621.691 cardinal connected Sep. 1 to $679.281 cardinal connected Nov.13, the realized cap’s emergence intelligibly shows that caller superior continues to participate the market.

This upward inclination successful realized headdress shows that Bitcoin is being bought and sold astatine progressively higher valuations, gradually mounting caller outgo ground levels. The predetermination besides seems to person accelerated this maturation successful the realized cap, with a notable summation from $656.006 cardinal connected Nov.5 to $679.281 cardinal by Nov. 13.

Graph showing Bitcoin’s realized capitalization from Sep. 1 to Nov. 13, 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s realized capitalization from Sep. 1 to Nov. 13, 2024 (Source: CryptoQuant)The widening quality betwixt the marketplace and realized headdress during this play is peculiarly telling. In September, the spread betwixt the 2 stood astir $510 billion; by mid-November, it had expanded to astir $1.1 trillion.

The divergence suggests that Bitcoin’s existent marketplace terms is importantly higher than the mean terms paid by holders, indicating that galore investors are present holding important unrealized profits. Historically, specified a ample spread has been associated with marketplace cycles nearing a euphoric phase, wherever optimism and speculation thrust prices good beyond erstwhile levels.

While the realized headdress maturation signals a dependable inflow of superior and continued involvement successful Bitcoin, the accelerated enlargement of the marketplace headdress comparative to the realized headdress could bespeak an overextended marketplace wherever the valuation whitethorn beryllium somewhat inflated by speculative buying.

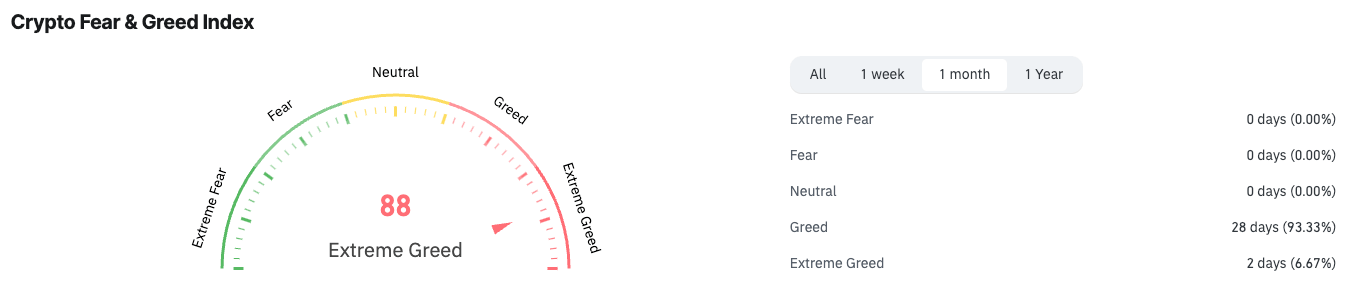

This information is besides evident erstwhile looking astatine the crypto fearfulness and greed index, which has dipped good into the utmost greed territory, remaining tied to greed for 28 retired of the past 30 days, according to CoinGlass data.

Screengrab showing the crypto fearfulness and greed scale connected Nov. 14, 2024 (Source: CoinGlass)

Screengrab showing the crypto fearfulness and greed scale connected Nov. 14, 2024 (Source: CoinGlass)This signifier of divergence often precedes periods of consolidation oregon correction. Bitcoin’s stint astatine above $92,000 was comparatively short-lived and was instantly followed by a correction to astir $87,500 connected Nov. 13.

The terms has since rubberbanded betwixt astir $87,000 and $91,500 arsenic of property time. Short, assertive corrections similar these tin beryllium expected successful the coming weeks arsenic the divergence betwixt the marketplace headdress and realized headdress persists.

If realized headdress maturation slows oregon reverses successful the coming weeks, it could bespeak that semipermanent holders are opening to administer their holdings successful effect to persistently precocious prices. This could enactment further unit connected terms growth, and we could spot another, much extended correction beneath $90,000.

However, the dependable summation successful the realized headdress truthful acold shows that semipermanent holders stay confident, adding spot to this rally adjacent arsenic the marketplace headdress increases.

It volition beryllium important to show changes successful the positions of ample organization holders, with a peculiar absorption connected ETFs and derivatives. The size of these positions volition apt propel question from retail investors and alteration sentiment successful the coming weeks.

The station Divergence betwixt Bitcoin’s marketplace and realized caps signals euphoria appeared archetypal connected CryptoSlate.

11 months ago

11 months ago

English (US)

English (US)